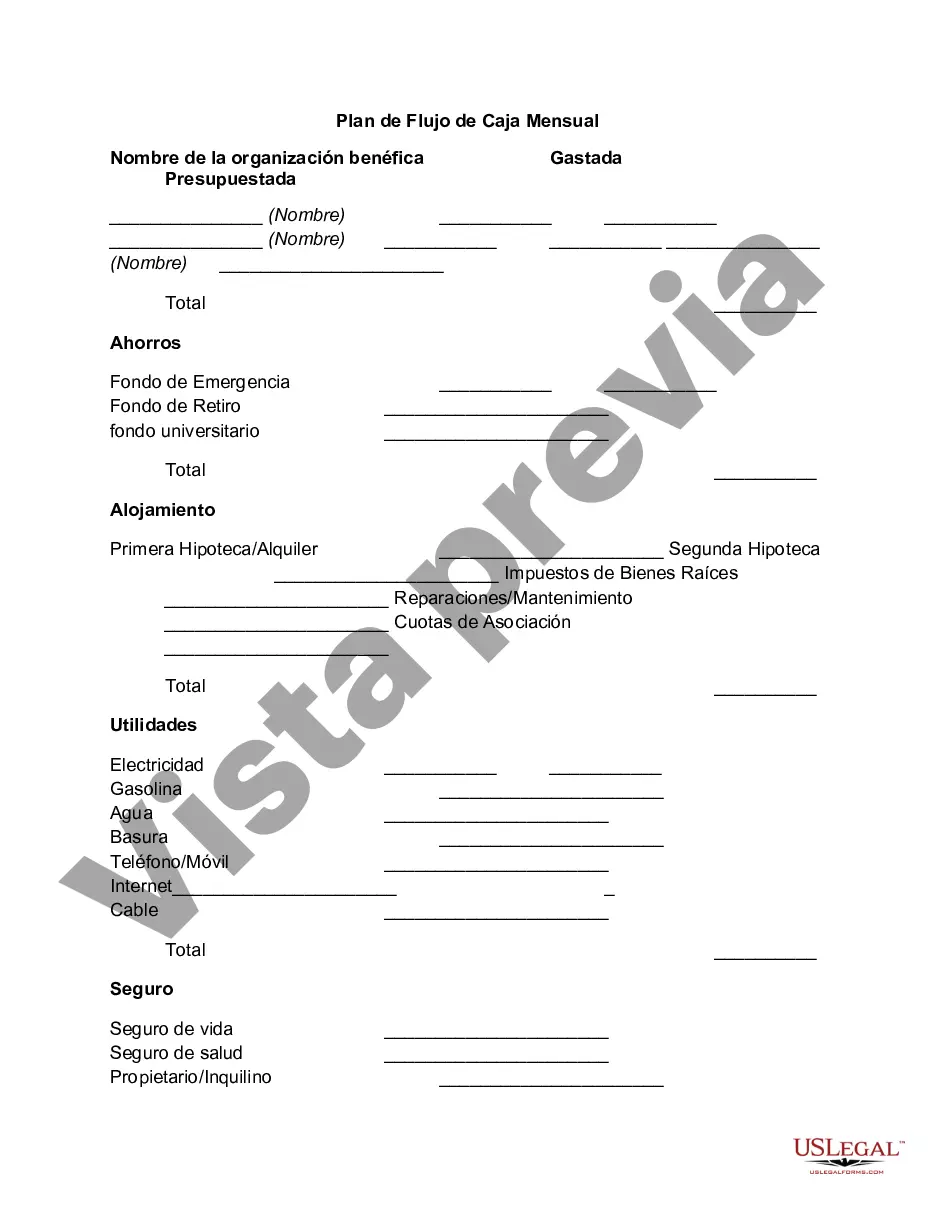

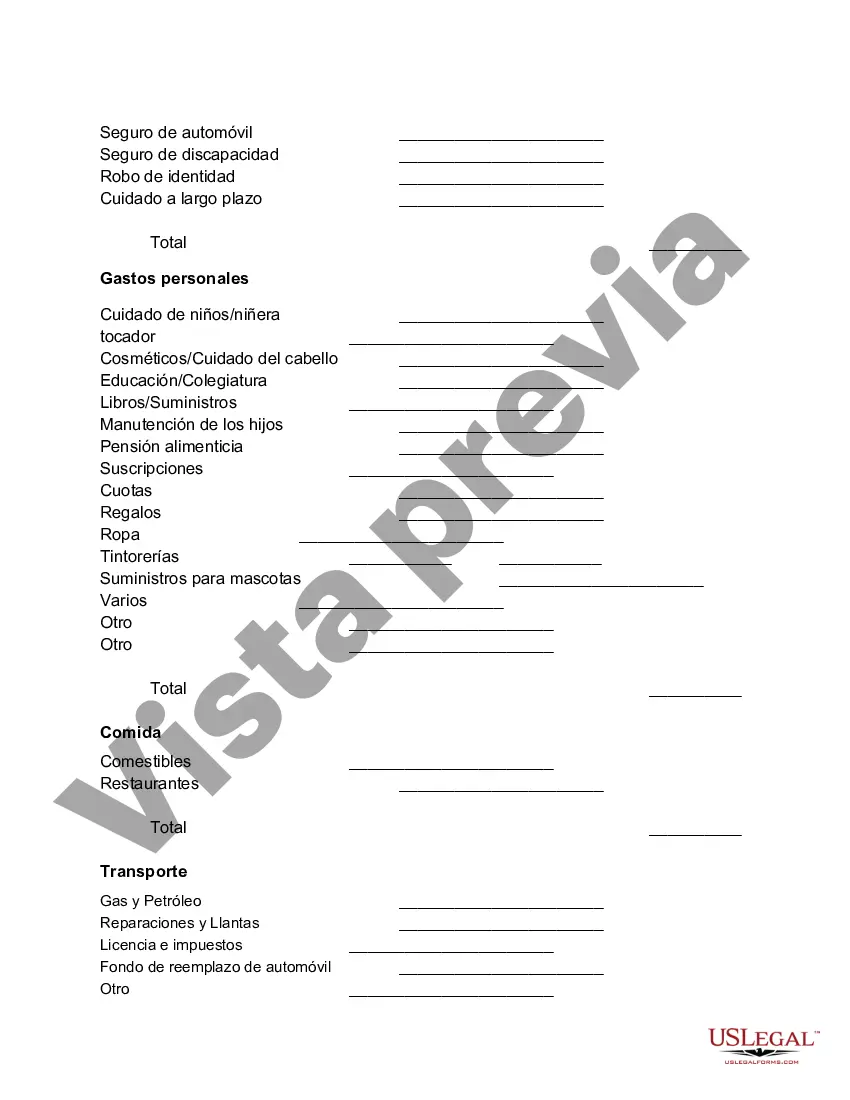

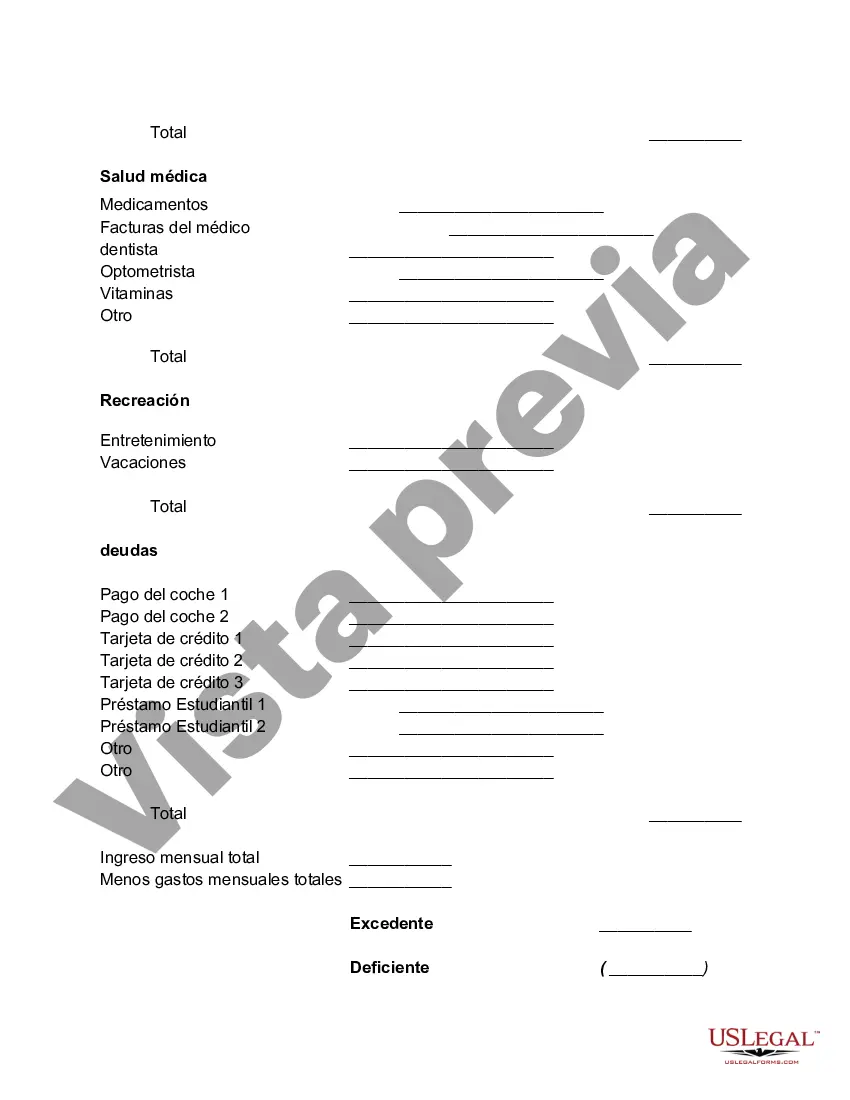

A Sacramento California Monthly Cash Flow Plan is a financial management tool aimed at helping individuals and businesses in Sacramento, California effectively manage their income and expenses on a monthly basis. It provides a detailed breakdown of the incoming and outgoing cash flow, empowering users to allocate their funds wisely and make informed financial decisions. Keywords: Sacramento California, Monthly Cash Flow Plan, financial management, income, expenses, cash flow, allocate funds, financial decisions. Different Types of Sacramento California Monthly Cash Flow Plans: 1. Personal Monthly Cash Flow Plan: This type is tailored to individuals living in Sacramento, California, assisting them in tracking their personal income and expenses. It helps individuals analyze their spending habits, identify areas of savings, and outline a budget that aligns with their financial goals. 2. Business Monthly Cash Flow Plan: Designed specifically for businesses operating in Sacramento, California, this type of cash flow plan provides a comprehensive overview of the company's income and expenditures. It helps businesses streamline their cash flow, reduce costs, and optimize revenue generation. 3. Real Estate Monthly Cash Flow Plan: Real estate investors and property owners in Sacramento, California can benefit from this cash flow plan. It focuses on tracking rental income, mortgage payments, property maintenance costs, and other associated expenses. By carefully managing cash flow in the real estate sector, investors can maximize profits and ensure financial stability. 4. Student Monthly Cash Flow Plan: Geared towards students attending educational institutions in Sacramento, California, this cash flow plan aims to assist them in managing their personal finances efficiently. It helps students keep track of their income from part-time jobs, scholarships, or allowances, and allocate funds for tuition, books, accommodation, transportation, and other living expenses. 5. Retirement Monthly Cash Flow Plan: This type of cash flow plan is designed to help individuals in Sacramento, California plan their finances for retirement. It involves evaluating current income sources, estimating future retirement income, and determining expenses during retirement. With this plan, individuals can make informed decisions about retirement savings, investments, and potential income streams after retirement. The Sacramento California Monthly Cash Flow Plan, regardless of its type, provides a detailed and structured approach to financial management. By utilizing these plans, individuals and businesses can gain better control over their finances, reduce debt, and work towards achieving their financial goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sacramento California Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out Sacramento California Plan De Flujo De Caja Mensual?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a legal professional to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Sacramento Monthly Cash Flow Plan, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case accumulated all in one place. Consequently, if you need the latest version of the Sacramento Monthly Cash Flow Plan, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Sacramento Monthly Cash Flow Plan:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Sacramento Monthly Cash Flow Plan and download it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!