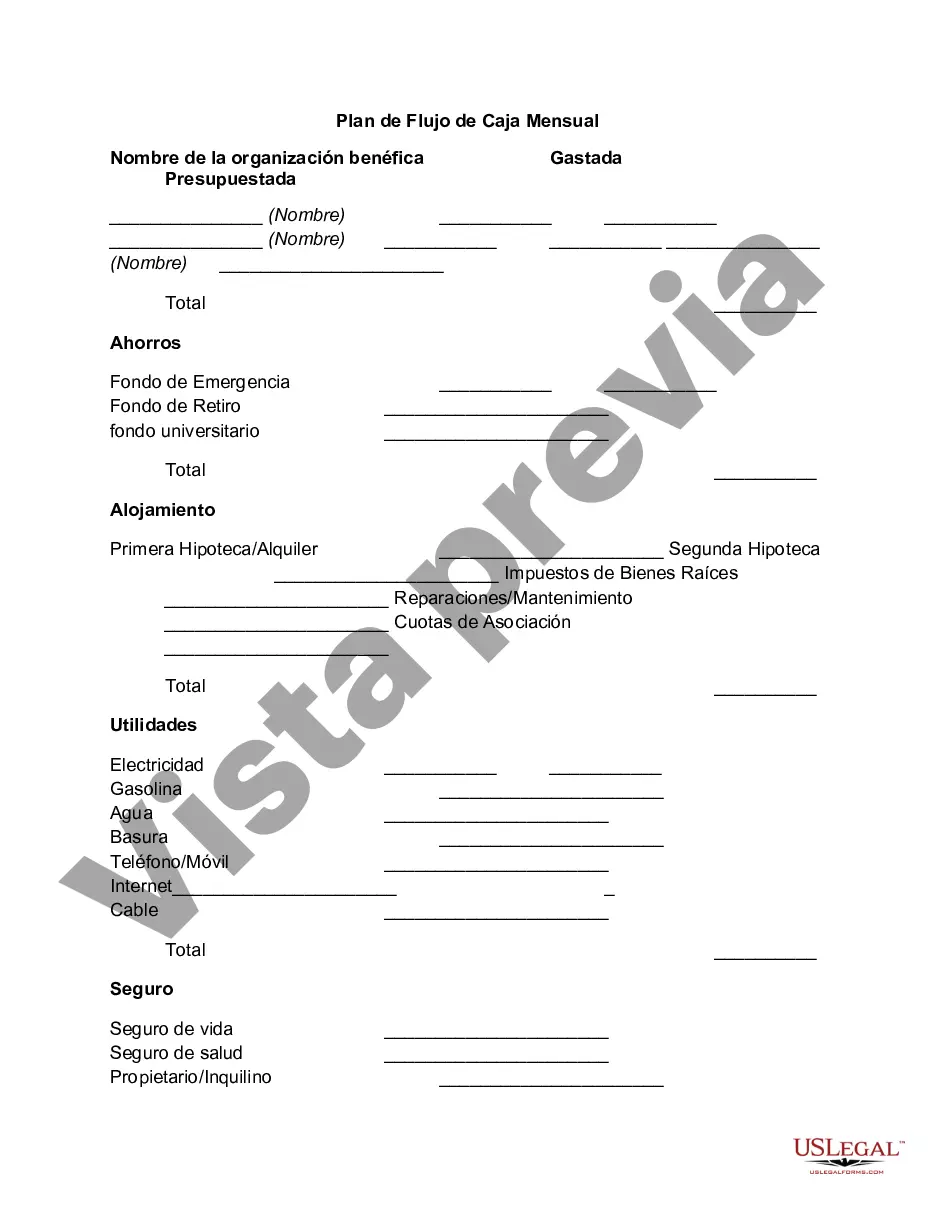

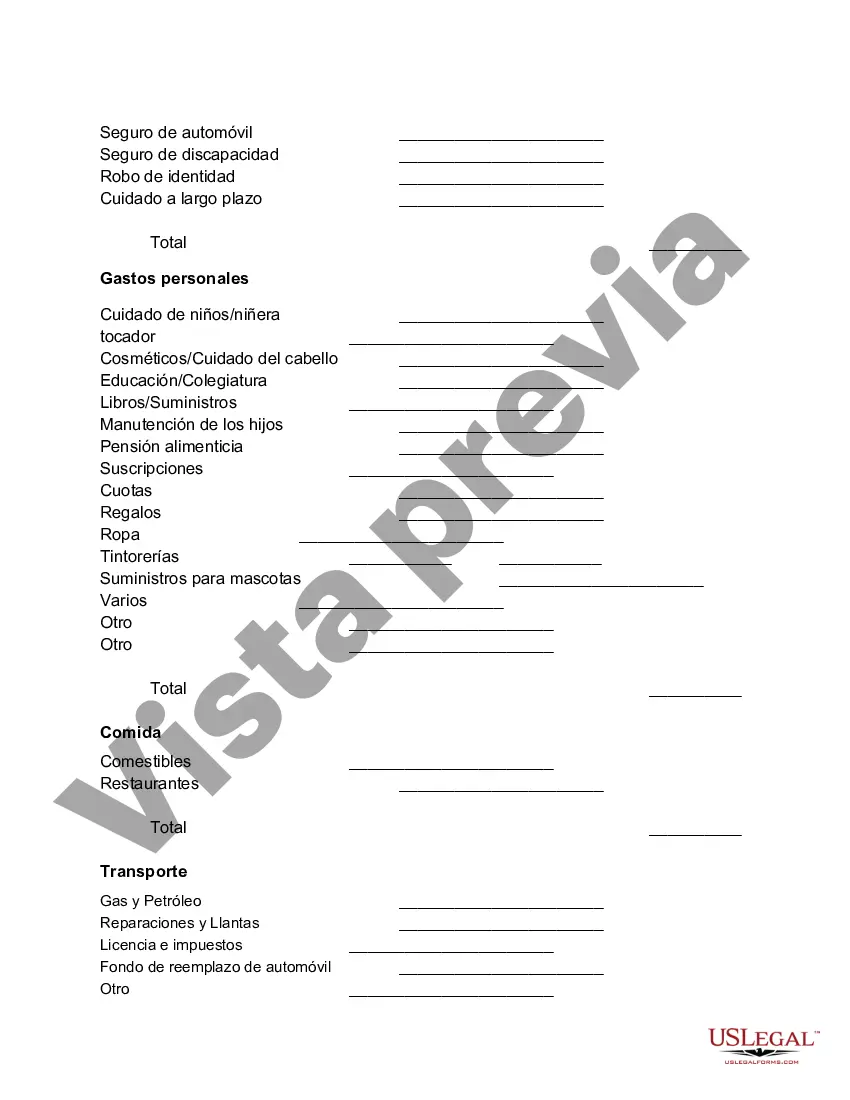

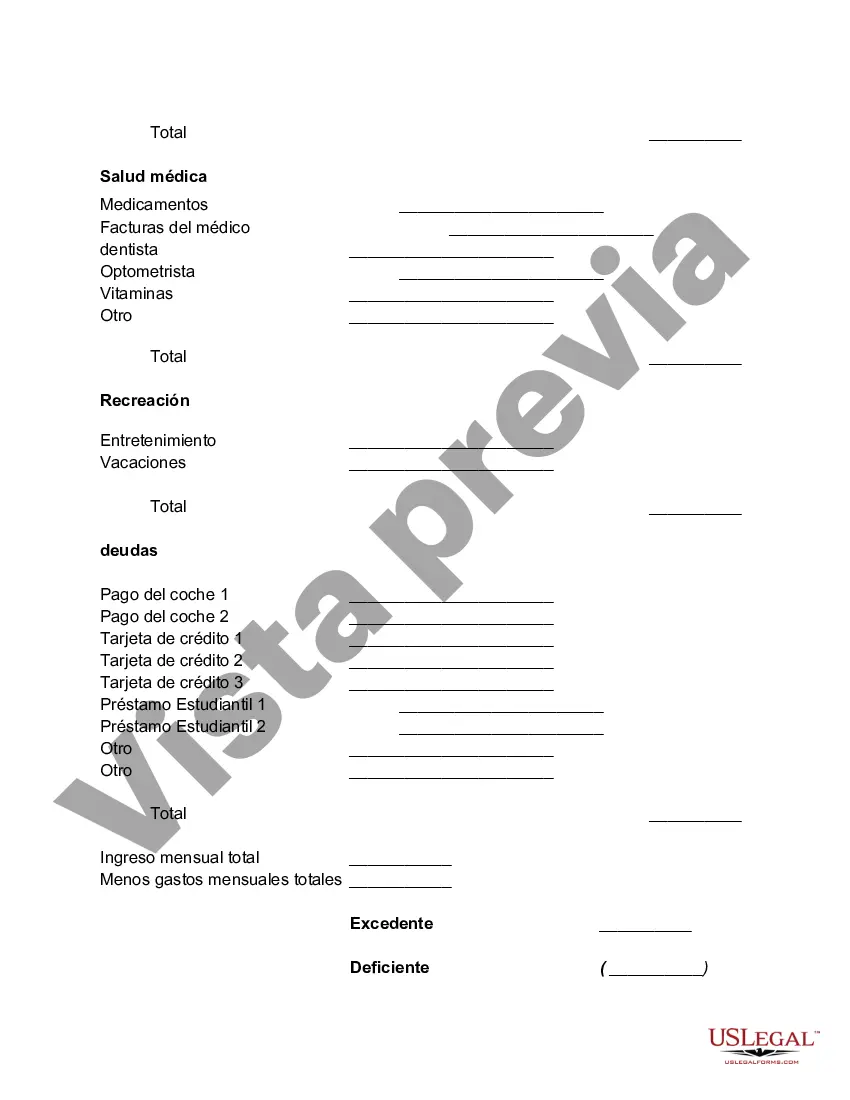

Salt Lake Utah Monthly Cash Flow Plan is a financial management tool designed to help individuals, families, and businesses in the Salt Lake area effectively manage their income and expenses on a monthly basis. It allows users to create a comprehensive plan to allocate their income towards various categories, such as housing, transportation, groceries, debt repayment, savings, and entertainment. This plan enables individuals to track their cash inflow from various sources, including salaries, bonuses, investments, and rental income. By closely monitoring their income and expenses, individuals can make informed decisions regarding their financial goals and identify areas where they can save or reduce spending. The Salt Lake Utah Monthly Cash Flow Plan provides a clear overview of all income sources and categorizes expenses based on their importance, allowing users to prioritize and allocate funds accordingly. By having a well-structured plan in place, users can proactively manage their finances, avoid overspending, and work towards achieving their financial objectives. Different types of Salt Lake Utah Monthly Cash Flow Plans may include variations to cater to specific needs. These variations might include plans tailored for different income levels, such as Low-Income Monthly Cash Flow Plan, Middle-Income Monthly Cash Flow Plan, and High-Income Monthly Cash Flow Plan. Additionally, some plans might target specific demographics, such as Family Monthly Cash Flow Plan or Business Monthly Cash Flow Plan, addressing specific financial challenges faced by these groups. Key features of the Salt Lake Utah Monthly Cash Flow Plan may include: 1. Income Tracking: The plan allows individuals to track and record all sources of income to get an accurate understanding of their total cash inflow. 2. Expense Categorization: Expenses are divided into various categories, allowing users to analyze and prioritize spending based on their financial goals. 3. Savings Allocation: The plan encourages users to allocate a predetermined portion of their income towards savings, ensuring a consistent savings habit. 4. Debt Repayment: The plan helps users outline strategies for paying off existing debts efficiently, minimizing interest payments and accelerating debt-free status. 5. Emergency Fund: This aspect of the plan emphasizes the importance of creating an emergency fund and guides users on how to set aside funds to address unexpected financial challenges. 6. Expense Reduction: Within the plan, users are encouraged to identify areas where expenses can be reduced or eliminated, promoting a more frugal approach to spending. 7. Periodic Review: The Salt Lake Utah Monthly Cash Flow Plan prompts individuals to review and adjust their plan periodically, accommodating changes in income, expenses, or financial goals. Utilizing the Salt Lake Utah Monthly Cash Flow Plan can significantly enhance financial stability and long-term wealth management for residents of the Salt Lake area. Through careful planning, individuals and businesses can effectively allocate their resources, reduce financial stress, and work towards achieving their financial dreams.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out Salt Lake Utah Plan De Flujo De Caja Mensual?

If you need to get a reliable legal document provider to get the Salt Lake Monthly Cash Flow Plan, consider US Legal Forms. Whether you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of supporting materials, and dedicated support make it easy to find and complete various documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply type to look for or browse Salt Lake Monthly Cash Flow Plan, either by a keyword or by the state/county the form is created for. After locating required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Salt Lake Monthly Cash Flow Plan template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is completed. Now you can complete the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes these tasks less expensive and more affordable. Create your first company, organize your advance care planning, create a real estate contract, or complete the Salt Lake Monthly Cash Flow Plan - all from the comfort of your home.

Sign up for US Legal Forms now!