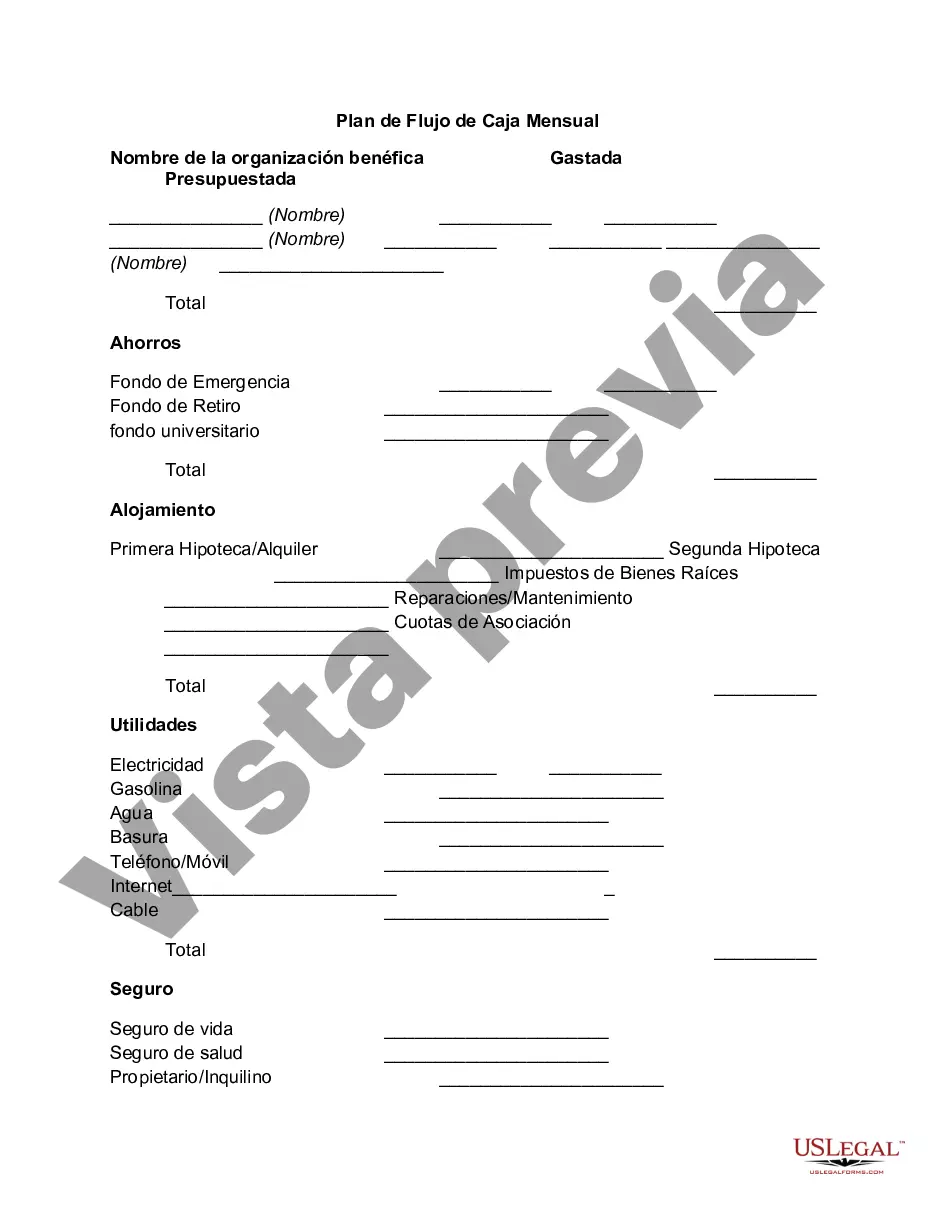

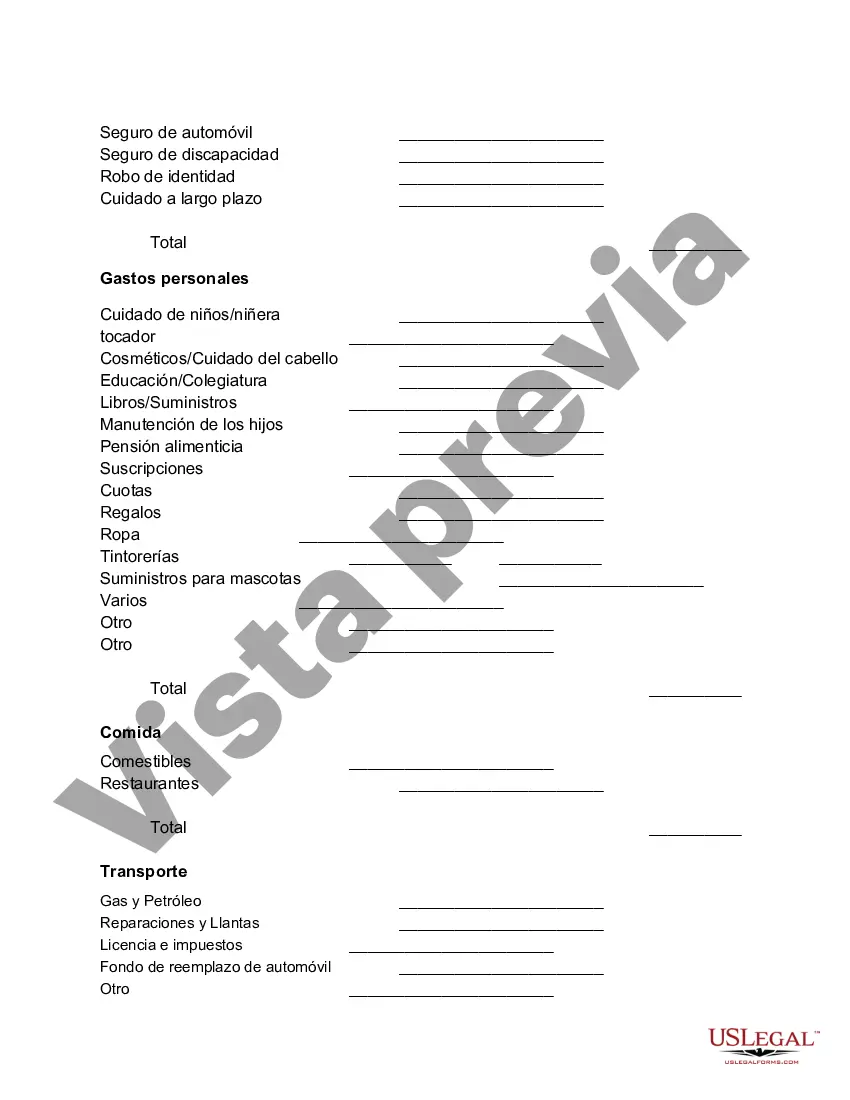

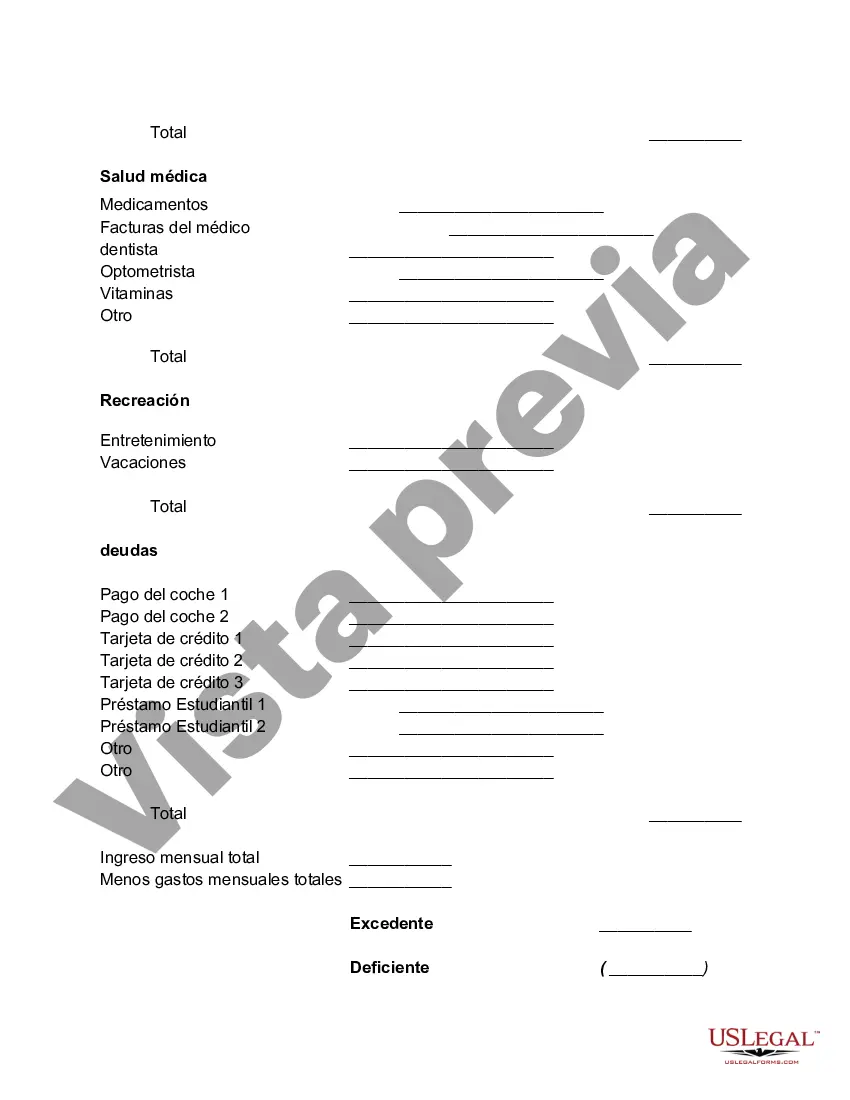

San Bernardino California Monthly Cash Flow Plan is a comprehensive financial management tool designed to help individuals or businesses effectively manage their income, expenses, and savings on a monthly basis. This plan ensures that individuals can wisely allocate their funds to cover essential expenses, save for future needs, pay off debts, and achieve overall financial stability. By following this plan rigorously, individuals can avoid unnecessary debt, unnecessary spending, and track their progress towards their financial goals. Key features of the San Bernardino California Monthly Cash Flow Plan include: 1. Income Tracking: This plan assists users in tracking their total monthly income from various sources such as employment, investments, rental income, and others. Accurate income calculation enables individuals to plan their budget effectively. 2. Expense Categorization: This cash flow plan categorizes expenses into different groups, such as housing, transportation, utilities, groceries, entertainment, healthcare, and others. This breakdown helps individuals understand their spending patterns, identify potential areas for cost-cutting, and make informed decisions regarding their expenditure. 3. Budgeting: San Bernardino California Monthly Cash Flow Plan allows users to set realistic and achievable financial goals by allocating funds to meet essential expenses, savings, debt payments, and investments. It assists in creating a monthly budget that aligns with personal financial goals and aspirations. 4. Debt Management: This plan emphasizes debt reduction strategies by encouraging individuals to allocate a portion of their monthly income towards debt payments. It helps in prioritizing debts based on interest rates and advises on effective debt repayment methods, thereby enabling users to become debt-free faster. 5. Savings and Emergency Fund: The cash flow plan emphasizes the importance of saving a portion of income for future needs and emergencies. By incorporating savings goals into the plan, it ensures that individuals are prepared for unexpected expenses and can achieve long-term financial security. 6. Financial Visualization: Using this monthly cash flow plan, individuals can visualize their financial status through graphs, charts, and reports. These visual representations give an overview of income, expenses, savings, and debt reduction progress, aiding users in tracking their financial performance. Different types of San Bernardino California Monthly Cash Flow Plan include variations tailored to specific individuals or businesses. These may include plans for college students, families, single parents, self-employed individuals, or small businesses. Each tailored plan may focus on unique financial challenges faced by the specific group, providing customized guidance and tips to address their needs. Overall, the San Bernardino California Monthly Cash Flow Plan is an invaluable tool for individuals or businesses seeking to gain control over their finances, plan for the future, and build a solid financial foundation. By following this plan consistently, users can make informed financial decisions, reduce debt, achieve savings goals, and ultimately attain financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Bernardino California Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out San Bernardino California Plan De Flujo De Caja Mensual?

Creating documents, like San Bernardino Monthly Cash Flow Plan, to take care of your legal matters is a challenging and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal issues into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents intended for different cases and life circumstances. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the San Bernardino Monthly Cash Flow Plan form. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly easy! Here’s what you need to do before getting San Bernardino Monthly Cash Flow Plan:

- Make sure that your template is specific to your state/county since the regulations for writing legal documents may vary from one state another.

- Discover more information about the form by previewing it or going through a brief intro. If the San Bernardino Monthly Cash Flow Plan isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin using our website and get the document.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!