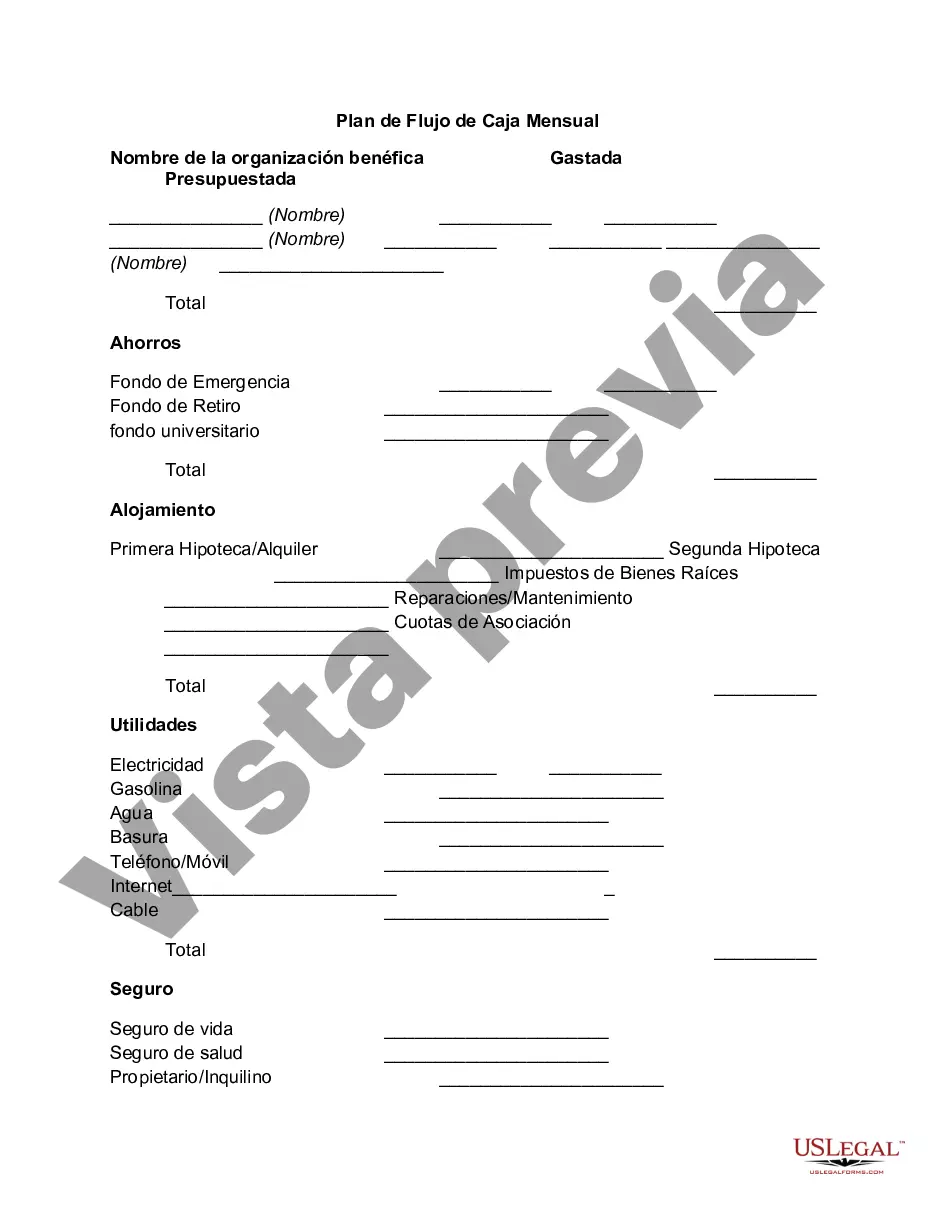

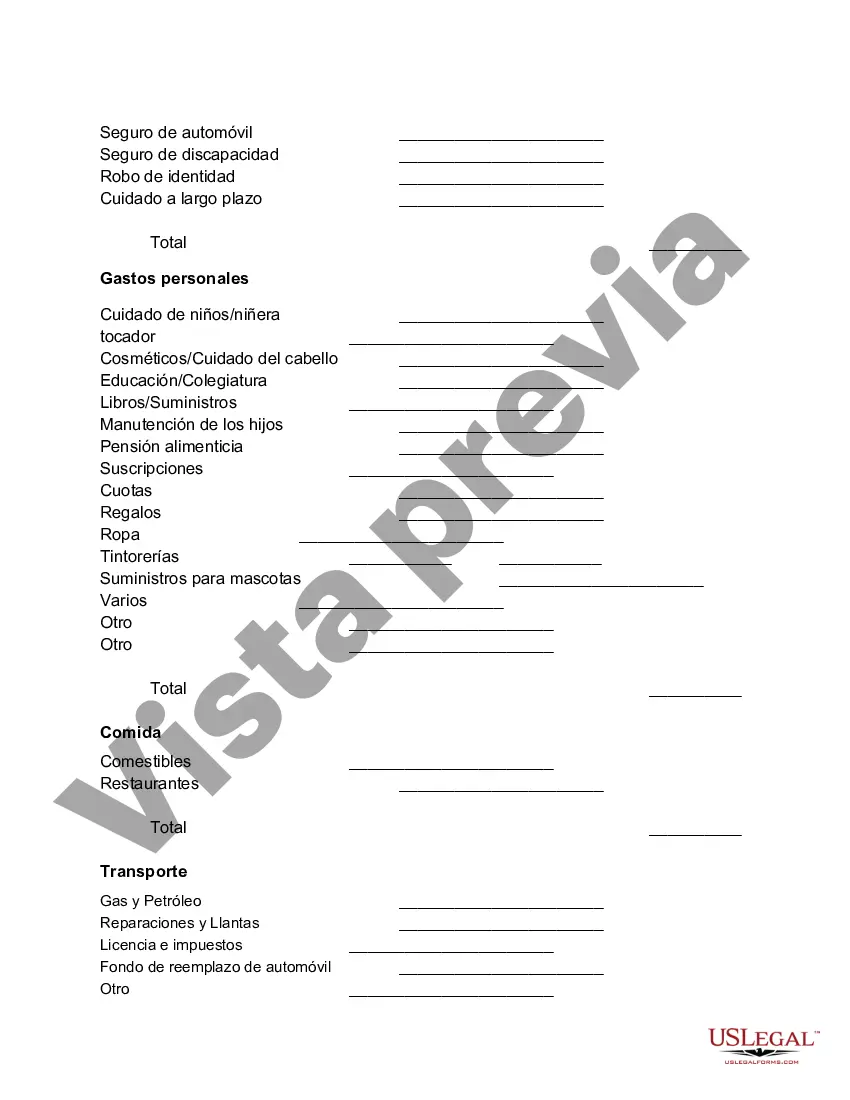

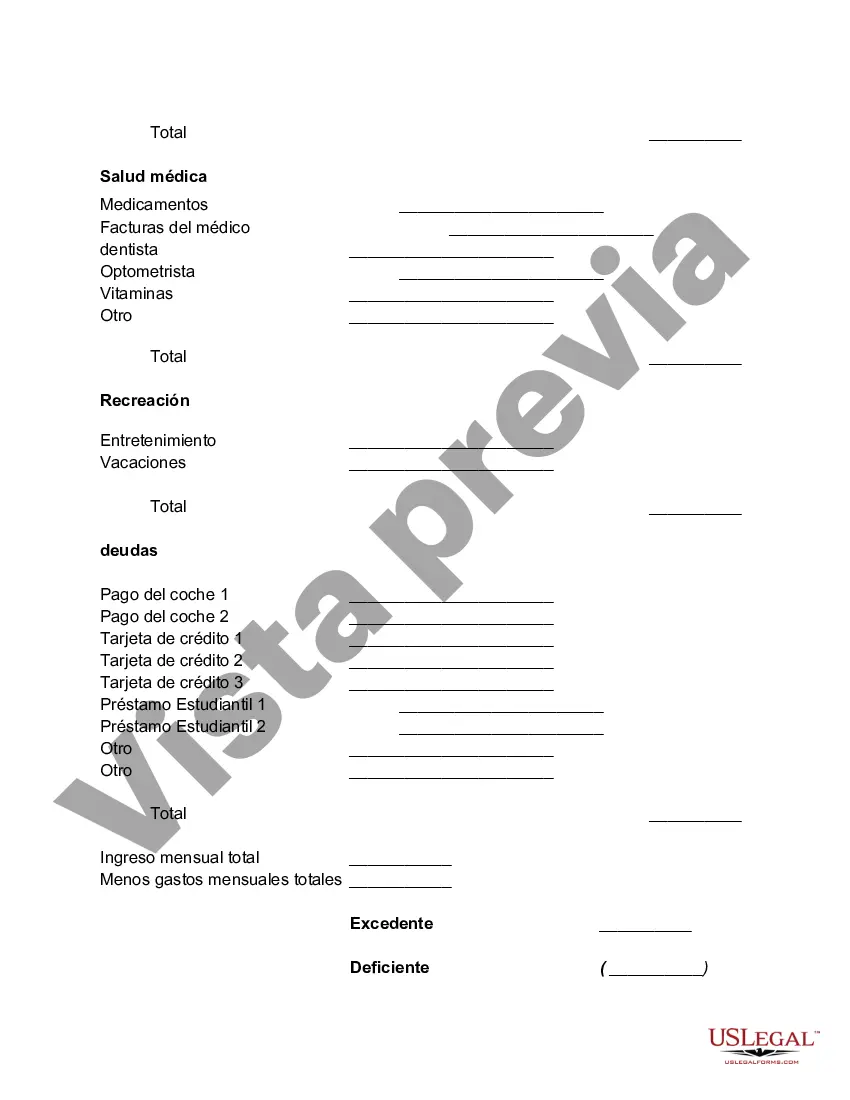

San Diego California Monthly Cash Flow Plan is a financial strategy designed to help individuals and families effectively manage their monthly incomes and expenses in the vibrant city of San Diego, California. This comprehensive plan allows people to track their cash flow, precisely analyze their spending habits, and make informed decisions about savings, investments, and debt management. The San Diego California Monthly Cash Flow Plan assists users in budgeting their finances to ensure they can cover regular expenses such as rent/mortgage payments, utilities, groceries, healthcare, transportation, education, and entertainment. By understanding their monthly cash inflows and outflows, individuals can allocate their funds efficiently and plan for future financial goals. Keywords: San Diego California, Monthly Cash Flow Plan, financial strategy, manage, incomes, expenses, vibrant city, track, analyze, spending habits, informed decisions, savings, investments, debt management, budgeting, regular expenses, rent, mortgage payments, utilities, groceries, healthcare, transportation, education, entertainment, cash inflows, cash outflows, allocate, funds, financial goals. Different types of San Diego California Monthly Cash Flow Plans may include: 1. Basic Monthly Cash Flow Plan: This plan is ideal for individuals who want to have a clear understanding of their monthly income, expenses, and savings. It helps them maintain a balanced budget and make necessary adjustments. 2. Advanced Monthly Cash Flow Plan: This plan is suitable for individuals or families with more complex financial situations. It includes additional elements such as investment tracking, tax planning, and debt reduction strategies. 3. Business Monthly Cash Flow Plan: This plan is specifically designed for entrepreneurs and small business owners in San Diego. It aids in monitoring business cash flow, managing business expenses, tracking revenue, and planning for future growth. 4. Retirement Monthly Cash Flow Plan: This plan focuses on ensuring a stable cash flow during retirement years. It helps individuals estimate and manage retirement income sources, plan for healthcare expenses, and make the most of retirement savings. Keywords: Basic Monthly Cash Flow Plan, Advanced Monthly Cash Flow Plan, Business Monthly Cash Flow Plan, Retirement Monthly Cash Flow Plan, entrepreneurs, small business owners, monitoring, managing, revenue, planning, retirement years, income sources, healthcare expenses, retirement savings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out San Diego California Plan De Flujo De Caja Mensual?

Whether you plan to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like San Diego Monthly Cash Flow Plan is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the San Diego Monthly Cash Flow Plan. Adhere to the instructions below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Monthly Cash Flow Plan in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!