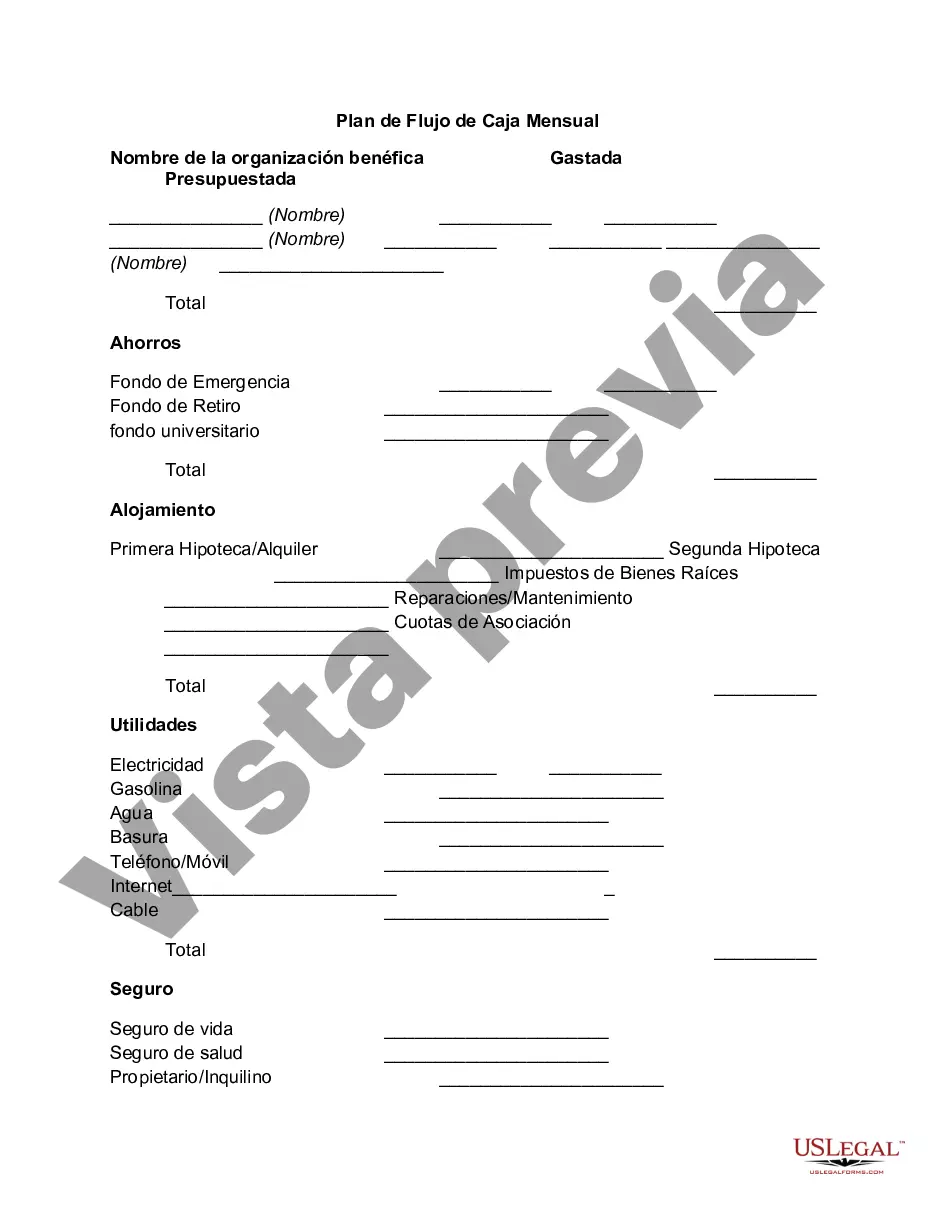

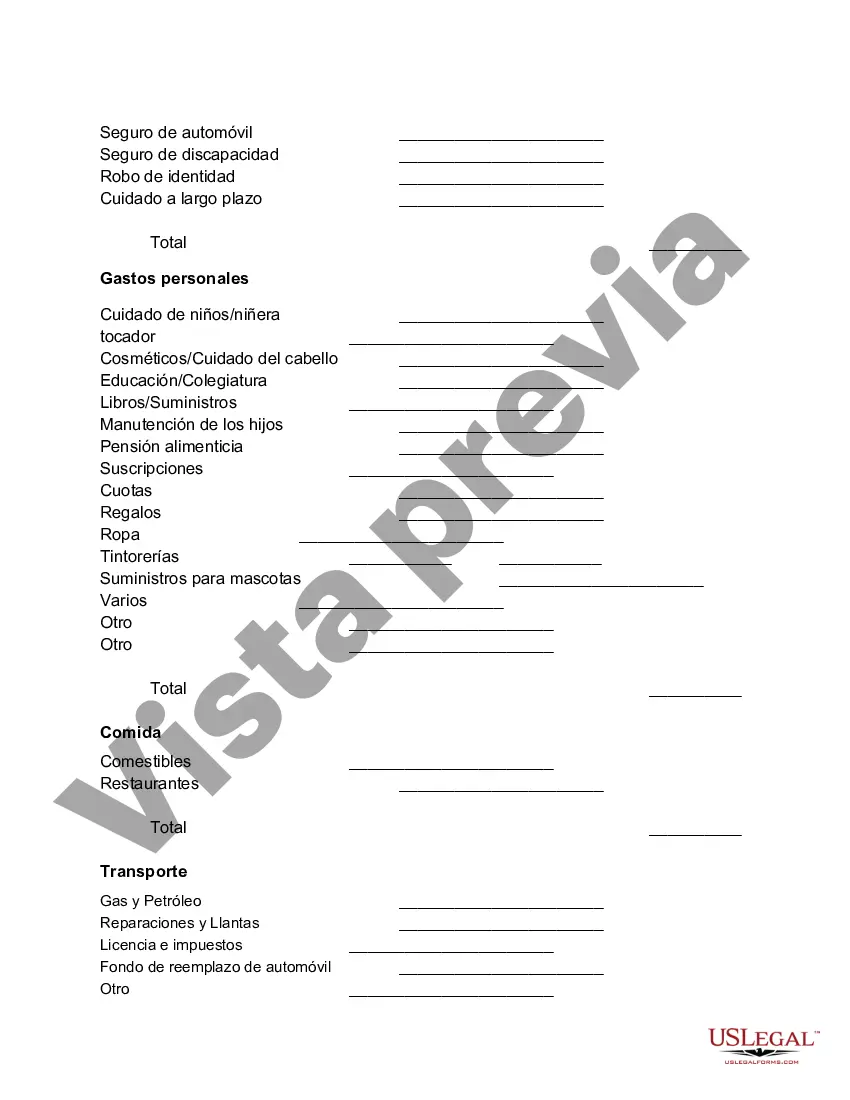

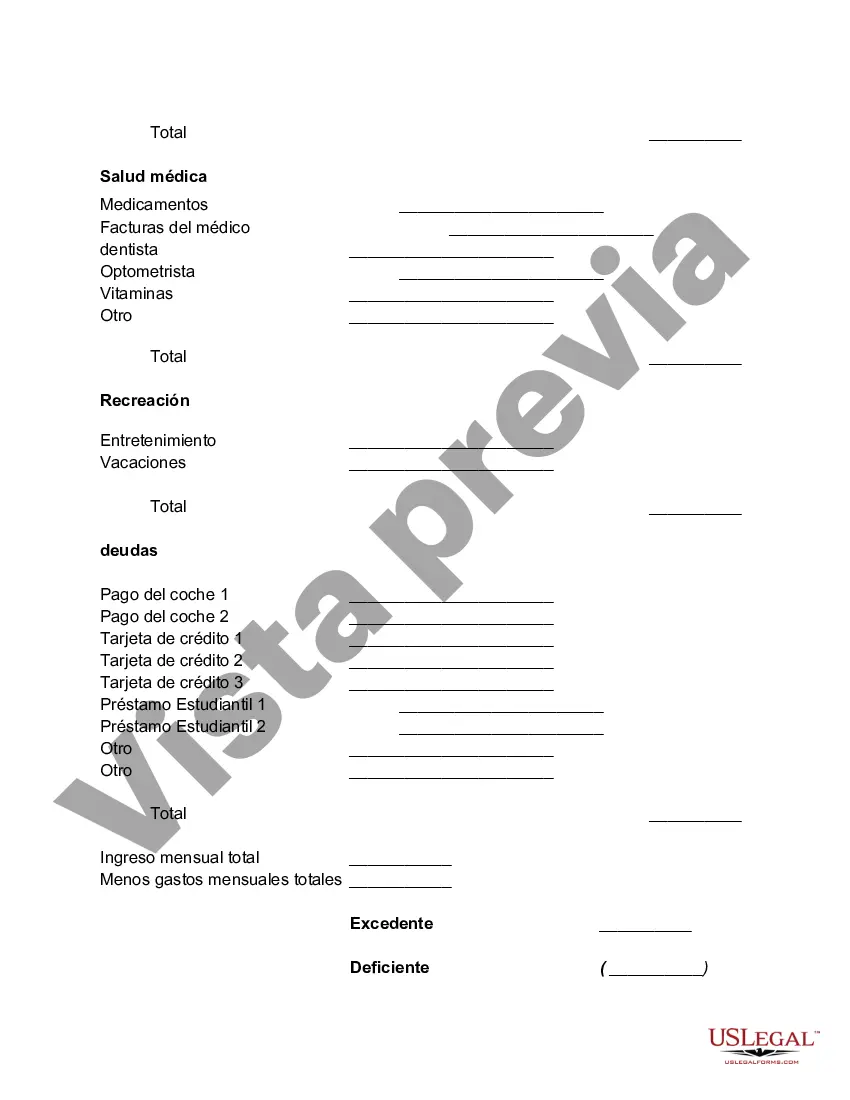

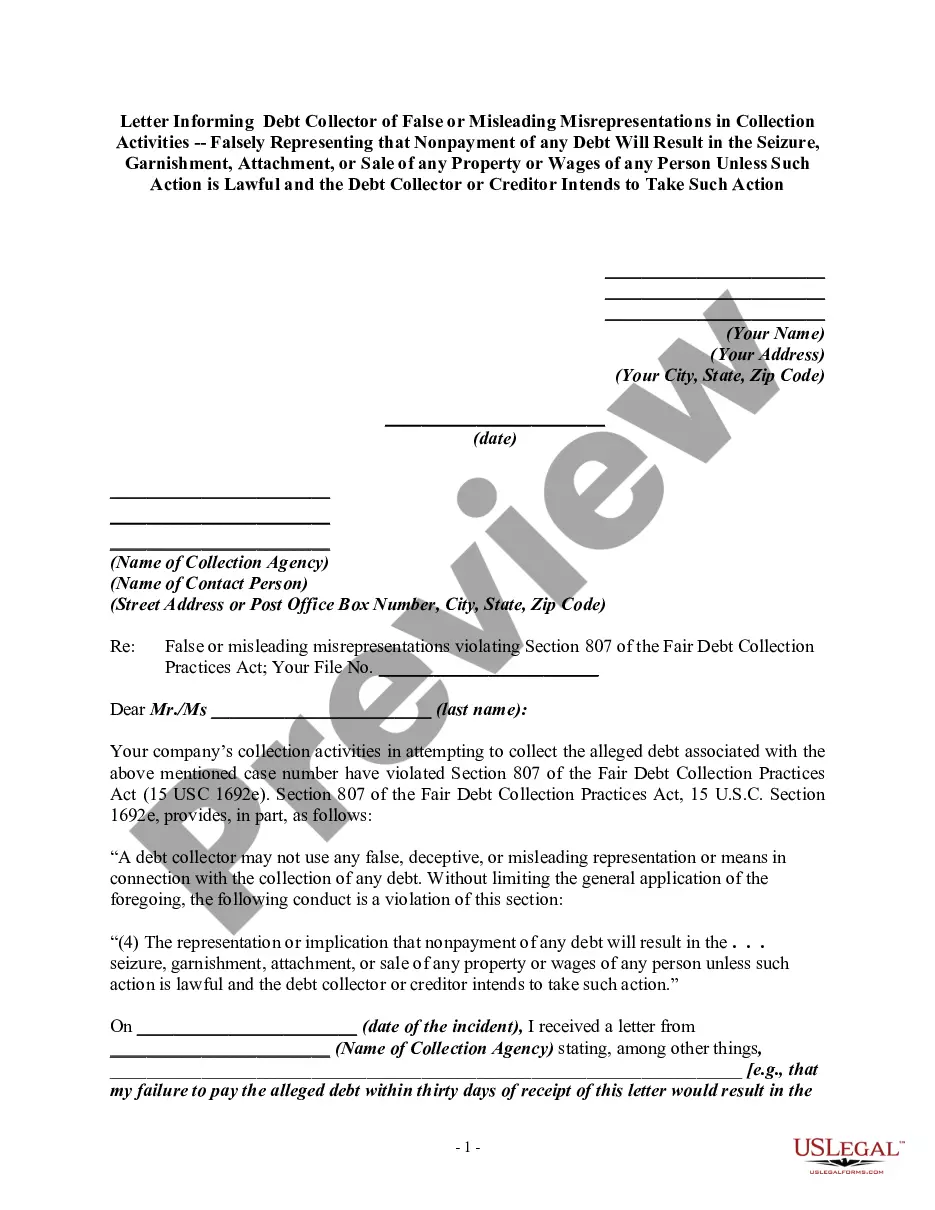

Santa Clara California Monthly Cash Flow Plan is a financial strategy designed to track and manage the inflow and outflow of money on a monthly basis for individuals or businesses residing in Santa Clara, California. It serves as a roadmap to effectively handle income, expenses, savings, and investments to ensure financial stability and achieve financial goals. This cash flow plan begins by categorizing various sources of income, such as salary, investments, rental income, or business profits. It then outlines the estimated monthly expenses, including mortgage or rent payments, utilities, groceries, transportation, healthcare, education, and any other recurring bills or discretionary spending. The Santa Clara California Monthly Cash Flow Plan also emphasizes the importance of setting aside money for both short-term and long-term savings. It may include allocations for emergency funds, vacation savings, retirement accounts, or other investments to build a financially secure future. Furthermore, this plan helps individuals or businesses in Santa Clara, California stay aware of their financial health by regularly updating and reviewing their cash flow statements. It enables them to make informed decisions, identify areas where expenses can be reduced, create a budget, and improve overall financial management. Different types of Santa Clara California Monthly Cash Flow Plans can vary depending on individual or business needs, financial goals, and preferences. Some variations may include: 1. Personal Cash Flow Plan: Primarily for individuals, this plan focuses on managing personal income, expenses, and savings. It addresses personal financial goals like debt payment, building an emergency fund, or saving for specific milestones (e.g., home purchase, education, retirement). 2. Business Cash Flow Plan: Catering to businesses in Santa Clara, this plan involves tracking income, managing operational expenses, payroll, and other business-related financial commitments. It helps maintain a healthy cash flow, identify opportunities for growth, and allocate resources effectively. 3. Real Estate Cash Flow Plan: Tailored for individuals or businesses involved in real estate, this plan emphasizes rental income, property management costs, mortgage expenses, repairs and maintenance, and long-term investment strategies. 4. Retirement Cash Flow Plan: Specifically designed for individuals nearing retirement or already retired, this plan focuses on managing pension payments, investment distributions, healthcare costs, and financial aspects related to the golden years. By implementing a Santa Clara California Monthly Cash Flow Plan, individuals and businesses can gain better control over their financial situations, minimize financial stress, and work towards achieving both short-term and long-term financial goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out Santa Clara California Plan De Flujo De Caja Mensual?

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life scenario, finding a Santa Clara Monthly Cash Flow Plan suiting all local requirements can be tiring, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. In addition to the Santa Clara Monthly Cash Flow Plan, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Experts check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Santa Clara Monthly Cash Flow Plan:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Santa Clara Monthly Cash Flow Plan.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!