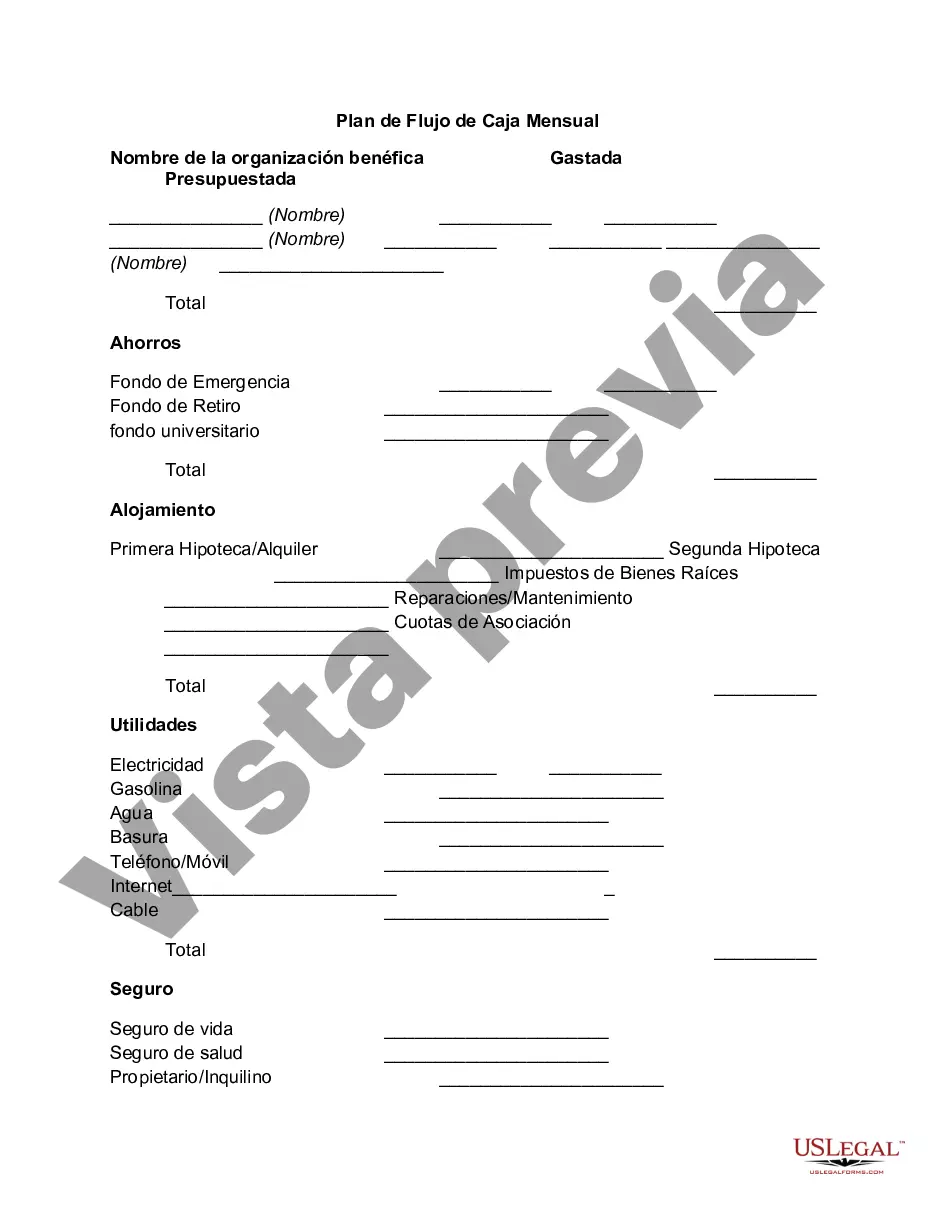

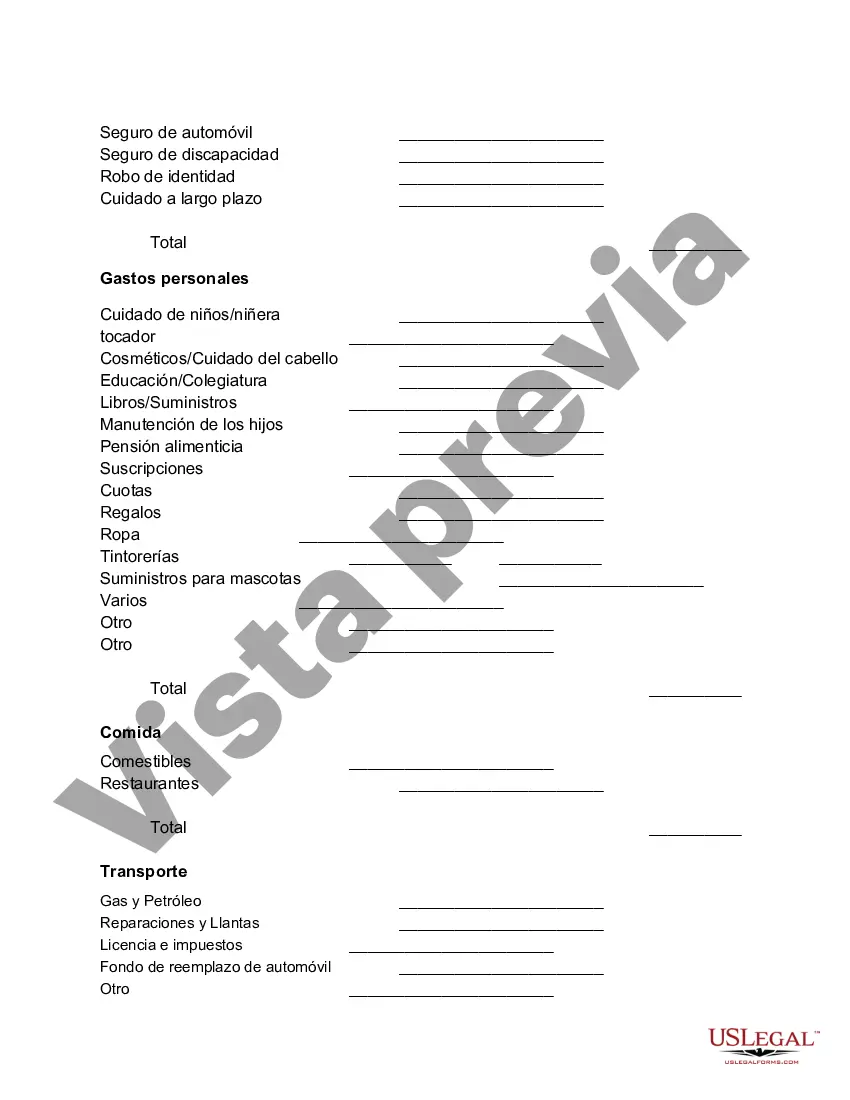

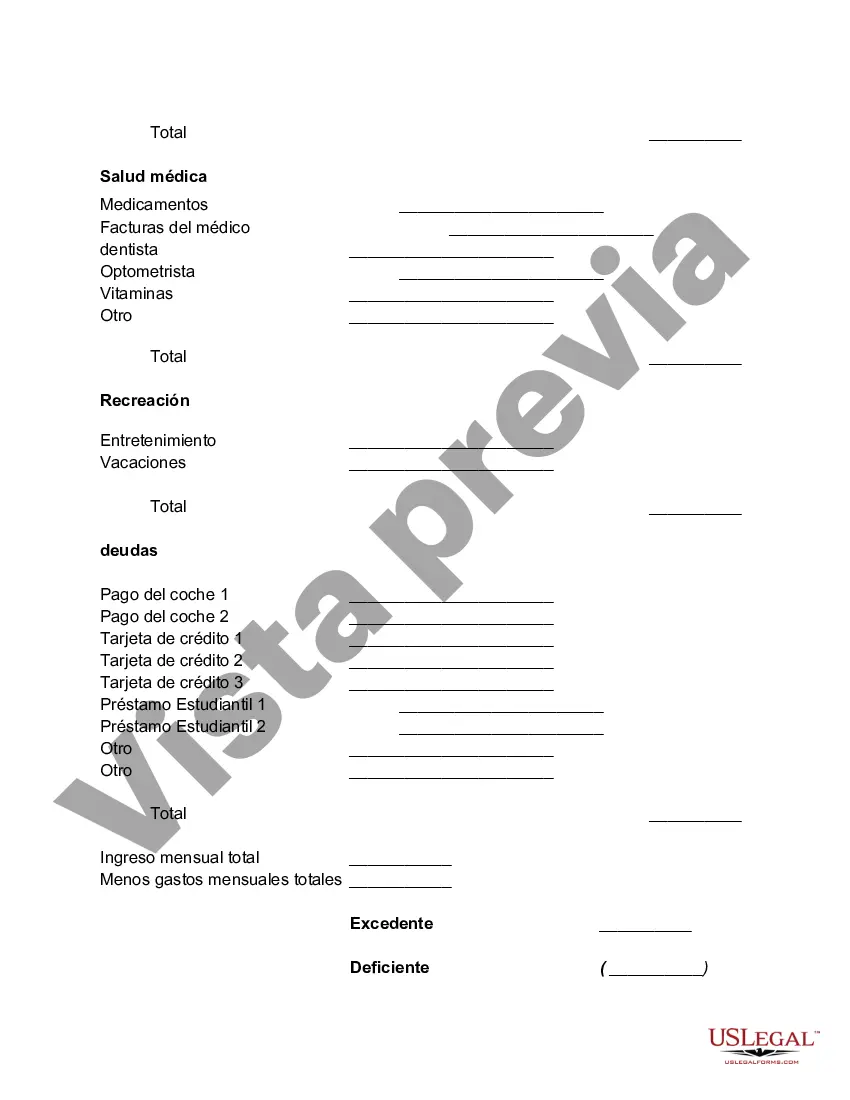

Tarrant Texas Monthly Cash Flow Plan is a financial management tool designed to help individuals and families effectively track and manage their income and expenses on a monthly basis. This plan serves as a comprehensive guideline to allocate funds, prioritize spending, and make informed decisions about financial goals and aspirations. With Tarrant Texas Monthly Cash Flow Plan, users can create a detailed budget that takes into account various income sources, such as salary, investments, and side hustles. The plan allows users to categorize their expenses, which may include housing costs, transportation, groceries, healthcare, education, entertainment, and debt payments. By closely monitoring income and expenses, individuals can identify areas where they can cut back on spending or allocate additional funds to meet their financial objectives. This plan empowers users to stay on top of their finances, avoid overspending, and ensure that they have enough money for both short-term needs and long-term financial goals. Additionally, Tarrant Texas Monthly Cash Flow Plan enables users to address different types of financial scenarios. It provides flexibility for users who may have irregular income or expenses, allowing for adjustments and modifications when necessary. The plan also assists individuals and families in building an emergency fund, paying off debts, and saving for future investments, such as retirement or education. Some key benefits of Tarrant Texas Monthly Cash Flow Plan include: 1. Effective financial management: By utilizing this plan, individuals can gain control over their finances, track their spending habits, and make informed decisions to achieve their financial goals. 2. Debt reduction and elimination: The plan assists users in developing strategies to pay off debts systematically, helping them become debt-free faster. 3. Efficient savings: Tarrant Texas Monthly Cash Flow Plan emphasizes the importance of saving and guides users on how to allocate funds towards short-term and long-term savings goals. 4. Emergency preparedness: The plan encourages users to establish an emergency fund to provide a safety net during unexpected events or financial setbacks. 5. Goal-oriented approach: Users can outline and prioritize financial aspirations, such as purchasing a home, saving for a vacation, or funding a child's education. The plan provides a roadmap and helps users stay on track to achieve these goals. Overall, Tarrant Texas Monthly Cash Flow Plan is a valuable tool for anyone looking to take control of their finances, manage their cash flow effectively, and make informed financial decisions. By implementing this plan, individuals and families can achieve financial stability, reduce debt, build wealth, and create a secure financial future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out Tarrant Texas Plan De Flujo De Caja Mensual?

Draftwing documents, like Tarrant Monthly Cash Flow Plan, to manage your legal affairs is a tough and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms crafted for various scenarios and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Tarrant Monthly Cash Flow Plan template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before downloading Tarrant Monthly Cash Flow Plan:

- Ensure that your template is specific to your state/county since the rules for writing legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Tarrant Monthly Cash Flow Plan isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to start utilizing our service and get the form.

- Everything looks great on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment details.

- Your form is ready to go. You can try and download it.

It’s an easy task to locate and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!