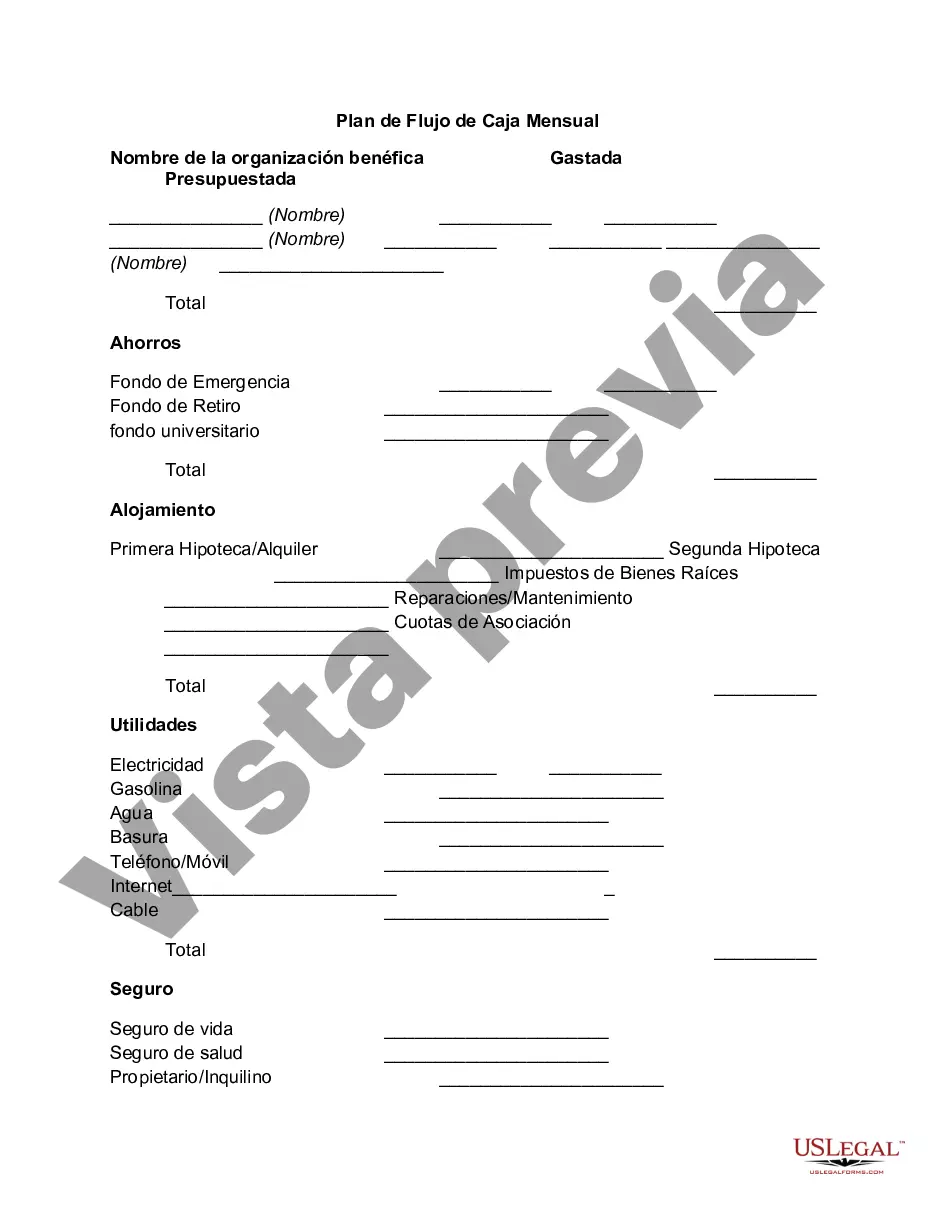

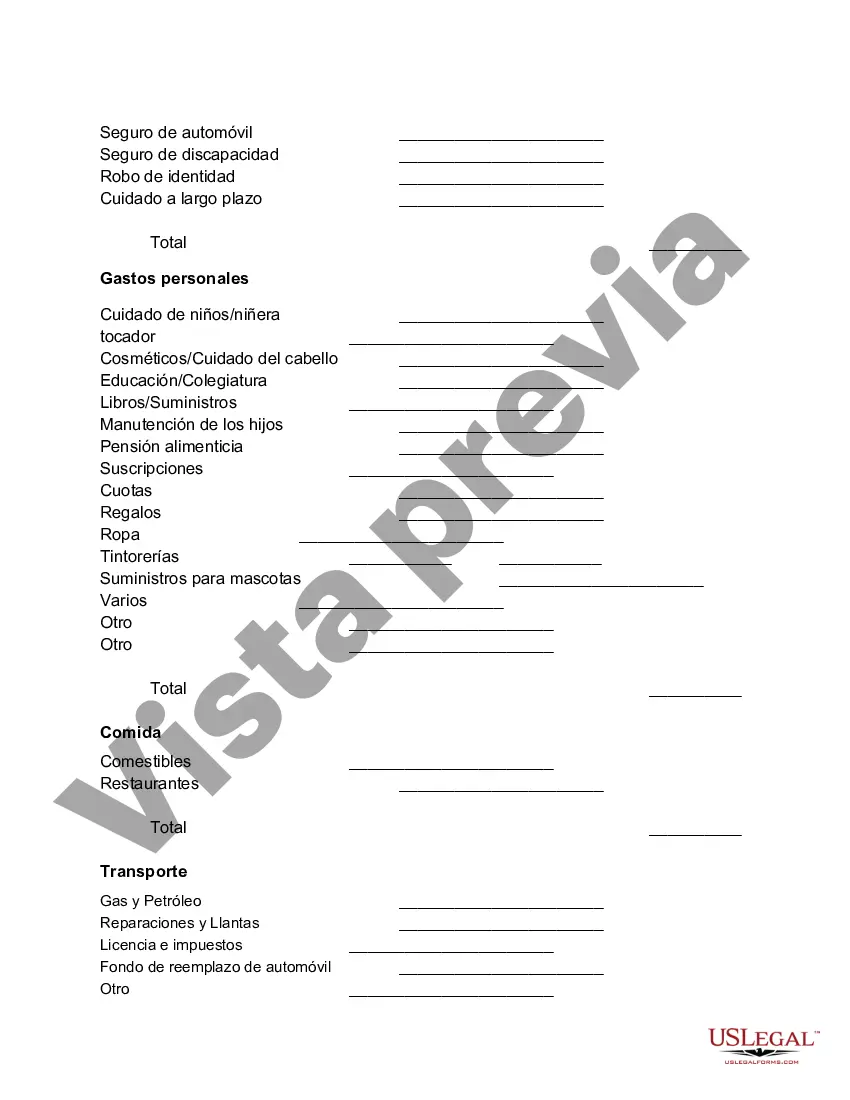

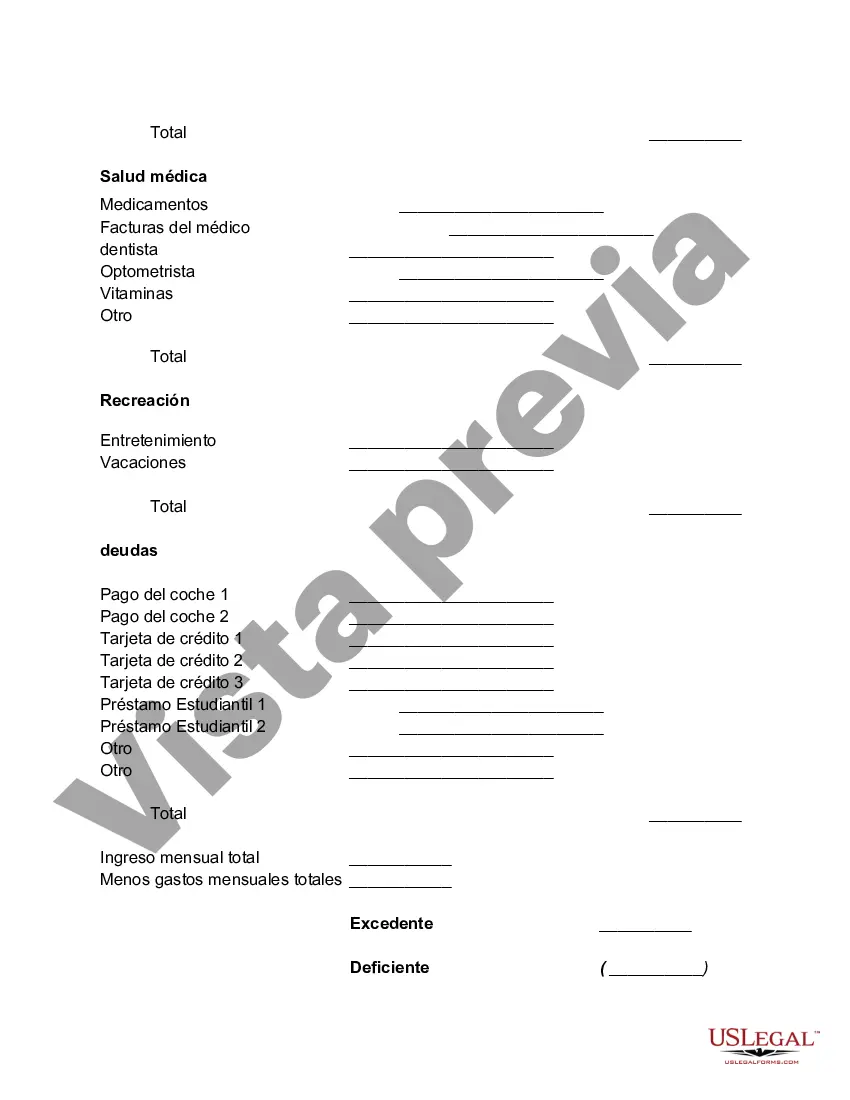

Wake North Carolina Monthly Cash Flow Plan is a budgeting tool designed to help individuals and families in Wake County, North Carolina manage their monthly income and expenses effectively. This comprehensive financial plan aims to provide a structured approach towards tracking, allocating, and optimizing cash flow. The Wake North Carolina Monthly Cash Flow Plan is tailored specifically for residents of Wake County and takes into account the unique economic factors and cost of living in the area. It helps users gain a clear understanding of their financial situation, make informed decisions, and stay on top of their financial goals. By using the Wake North Carolina Monthly Cash Flow Plan, individuals and families can gain control over their spending and saving habits. The plan provides a detailed breakdown of income sources, such as salaries, investments, and government benefits, enabling users to accurately assess their total monthly income. Expenses are categorized under various headings, including housing, transportation, groceries, healthcare, education, entertainment, and debt payments. This categorization helps users identify areas where they can make adjustments to reduce spending and increase savings. Depending on the individual's financial goals, there are different types of Wake North Carolina Monthly Cash Flow Plans available. These variants may include: 1. Basic Monthly Cash Flow Plan: This plan offers a simplified approach to budgeting, suitable for individuals who want to get started with organizing their finances. 2. Advanced Monthly Cash Flow Plan: This plan is more comprehensive and takes into consideration more complex financial situations, such as multiple income streams, investments, and significant debt. 3. Family Monthly Cash Flow Plan: This variant is designed specifically for families living in Wake County, addressing the unique financial needs and expenses associated with raising a family. 4. Retirement Monthly Cash Flow Plan: As people plan for their retirement, this specialized plan helps individuals assess their cash flow during retirement years, taking into account sources such as pensions, social security, and investment returns. The Wake North Carolina Monthly Cash Flow Plan is a powerful tool that empowers individuals and families to take control of their finances, reduce financial stress, and achieve their long-term financial goals. By implementing this proactive approach to budgeting, residents of Wake County can make informed financial decisions and strengthen their overall financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out Wake North Carolina Plan De Flujo De Caja Mensual?

Dealing with legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to draft some of them from the ground up, including Wake Monthly Cash Flow Plan, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various types ranging from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find information resources and guides on the website to make any activities associated with paperwork completion straightforward.

Here's how to locate and download Wake Monthly Cash Flow Plan.

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the legality of some records.

- Check the related document templates or start the search over to find the appropriate document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment method, and purchase Wake Monthly Cash Flow Plan.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Wake Monthly Cash Flow Plan, log in to your account, and download it. Of course, our website can’t take the place of a lawyer entirely. If you need to deal with an exceptionally complicated case, we advise using the services of a lawyer to check your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Become one of them today and get your state-compliant documents effortlessly!