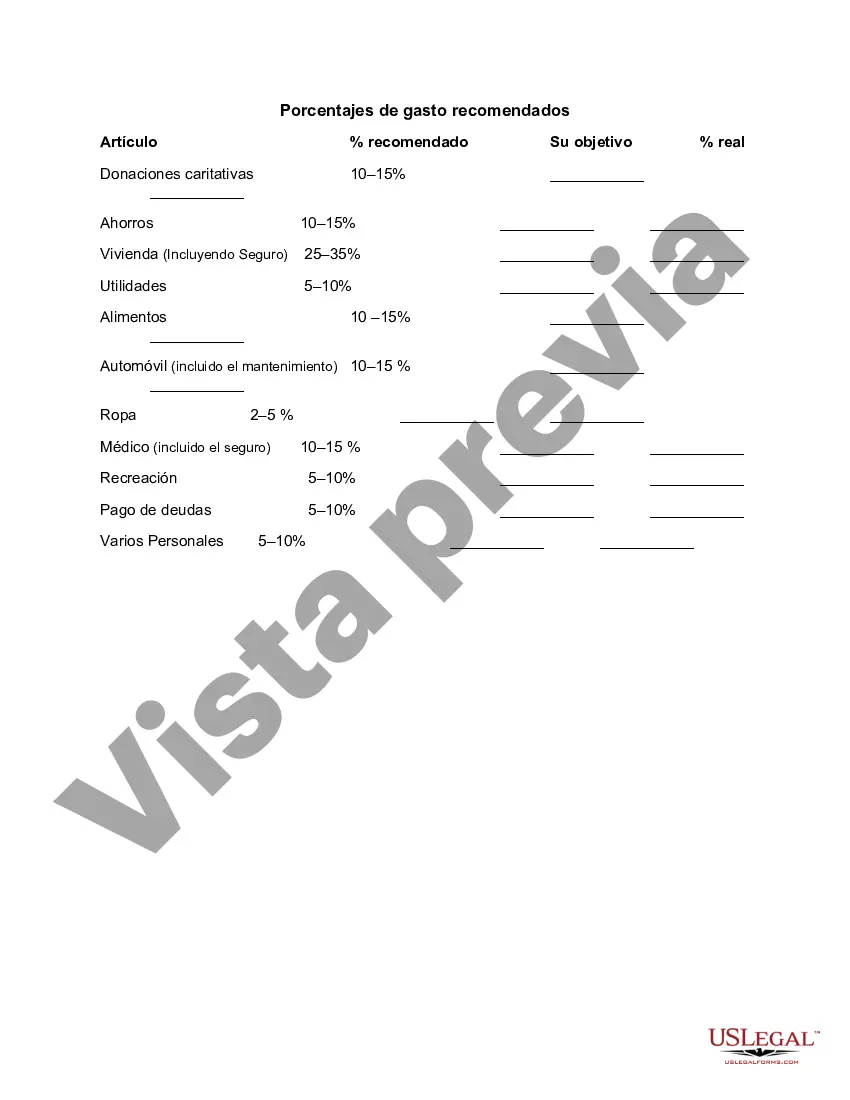

Miami-Dade County, located in southeastern Florida, provides residents with a set of recommended spending percentages to help create a balanced financial plan. These guidelines assist individuals and families in managing their income effectively while ensuring savings, debt reduction, and essential expenses are taken into account. Miami-Dade Florida Recommended Spending Percentages encompass various categories, including housing, transportation, food, healthcare, debt repayment, savings, and discretionary spending. By following these guidelines, individuals can establish a solid financial foundation and achieve their long-term goals. 1. Housing: The Miami-Dade recommended spending percentage for housing typically ranges between 25% and 30% of monthly income. This includes rent or mortgage payments, property taxes, insurance, and utilities. Staying within this range helps maintain affordable housing expenses while leave room for other financial obligations. 2. Transportation: It is suggested to allocate 10-15% of monthly income to transportation expenses, such as car payments, fuel, insurance, maintenance, and public transportation costs. Following this percentage allows individuals to meet their commuting needs without overspending. 3. Food: Miami-Dade recommends dedicating around 10-15% of monthly income to food expenses, including groceries, dining out, and takeout. This range ensures a reasonable allocation for nutritional needs while allowing flexibility for occasional dining experiences. 4. Healthcare: Allocating 5-10% of monthly income to healthcare helps cover insurance premiums, co-payments, medications, and other medical expenses. This percentage safeguards individuals against unforeseen medical costs while maintaining overall well-being. 5. Debt Repayment: For those with outstanding debts, it is suggested to allocate approximately 10-15% of monthly income towards debt repayment, such as credit card balances, loans, or student loans. This allocation ensures regular payments and accelerates debt reduction. 6. Savings: The Miami-Dade recommended spending percentage for savings should aim for at least 10-15% of monthly income. This includes contributions to emergency funds, retirement accounts, and other long-term savings goals. Prioritizing savings facilitates financial security and future planning. 7. Discretionary Spending: It is important to allow some room for enjoyment and entertainment. The recommended spending percentage for discretionary expenses ranges between 10% and 20% of monthly income. This category covers non-essential items, hobbies, vacations, and personal indulgences. By adhering to these Miami-Dade Florida Recommended Spending Percentages, individuals can create a well-rounded financial plan, balancing essential expenses, debt repayment, and savings with discretionary spending. It's important to note that these percentages are general guidelines, and personal circumstances may vary. It is always advisable to adjust these percentages based on individual income, financial goals, and fluctuating priorities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Porcentajes de gasto recomendados - Recommended Spending Percentages

State:

Multi-State

County:

Miami-Dade

Control #:

US-1119BG

Format:

Word

Instant download

Description

What percentage of your income should you spend on what items? This form has some recommendations to consider. The important thing is to come up with realistic percentages.

Miami-Dade County, located in southeastern Florida, provides residents with a set of recommended spending percentages to help create a balanced financial plan. These guidelines assist individuals and families in managing their income effectively while ensuring savings, debt reduction, and essential expenses are taken into account. Miami-Dade Florida Recommended Spending Percentages encompass various categories, including housing, transportation, food, healthcare, debt repayment, savings, and discretionary spending. By following these guidelines, individuals can establish a solid financial foundation and achieve their long-term goals. 1. Housing: The Miami-Dade recommended spending percentage for housing typically ranges between 25% and 30% of monthly income. This includes rent or mortgage payments, property taxes, insurance, and utilities. Staying within this range helps maintain affordable housing expenses while leave room for other financial obligations. 2. Transportation: It is suggested to allocate 10-15% of monthly income to transportation expenses, such as car payments, fuel, insurance, maintenance, and public transportation costs. Following this percentage allows individuals to meet their commuting needs without overspending. 3. Food: Miami-Dade recommends dedicating around 10-15% of monthly income to food expenses, including groceries, dining out, and takeout. This range ensures a reasonable allocation for nutritional needs while allowing flexibility for occasional dining experiences. 4. Healthcare: Allocating 5-10% of monthly income to healthcare helps cover insurance premiums, co-payments, medications, and other medical expenses. This percentage safeguards individuals against unforeseen medical costs while maintaining overall well-being. 5. Debt Repayment: For those with outstanding debts, it is suggested to allocate approximately 10-15% of monthly income towards debt repayment, such as credit card balances, loans, or student loans. This allocation ensures regular payments and accelerates debt reduction. 6. Savings: The Miami-Dade recommended spending percentage for savings should aim for at least 10-15% of monthly income. This includes contributions to emergency funds, retirement accounts, and other long-term savings goals. Prioritizing savings facilitates financial security and future planning. 7. Discretionary Spending: It is important to allow some room for enjoyment and entertainment. The recommended spending percentage for discretionary expenses ranges between 10% and 20% of monthly income. This category covers non-essential items, hobbies, vacations, and personal indulgences. By adhering to these Miami-Dade Florida Recommended Spending Percentages, individuals can create a well-rounded financial plan, balancing essential expenses, debt repayment, and savings with discretionary spending. It's important to note that these percentages are general guidelines, and personal circumstances may vary. It is always advisable to adjust these percentages based on individual income, financial goals, and fluctuating priorities.