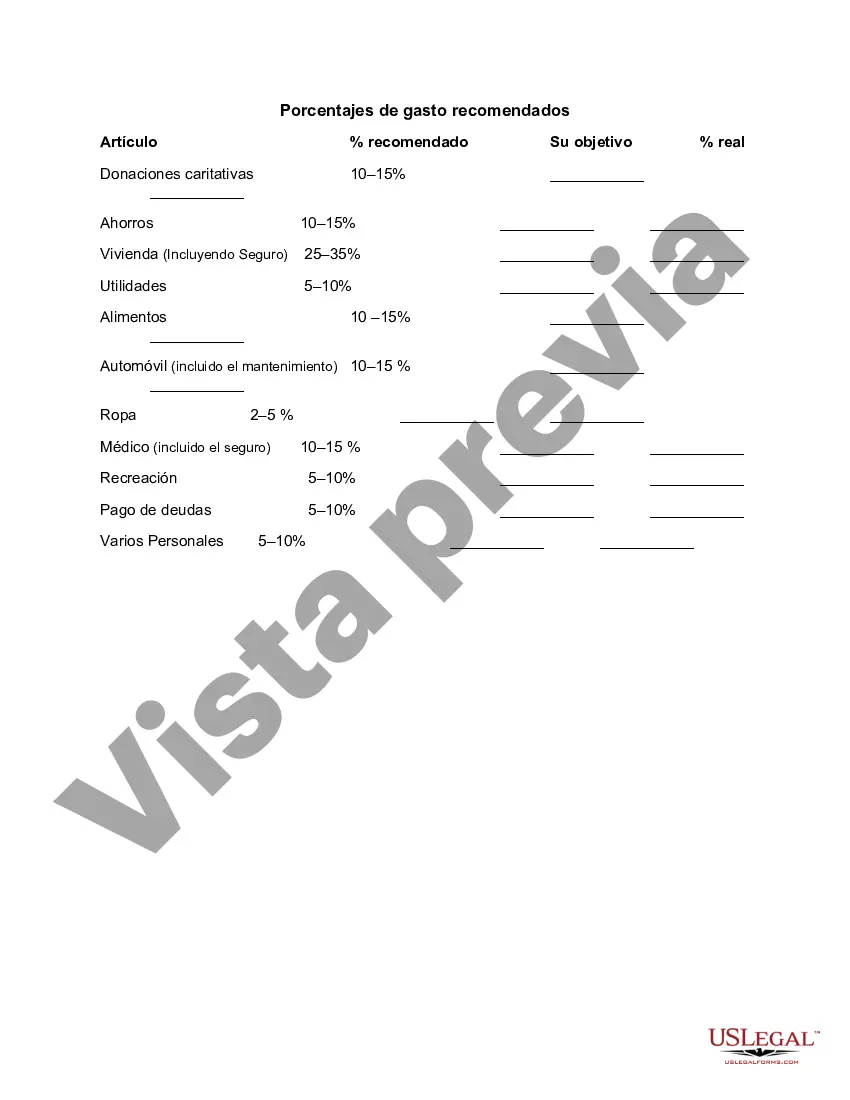

Orange California Recommended Spending Percentages are a set of guidelines that assist residents of Orange, California in managing their personal finances effectively. These spending percentages are based on the average income and cost of living in the region, helping individuals allocate their income into various categories. By following these recommended spending percentages, individuals can maintain a balanced budget, save for the future, and meet their financial goals. 1. Housing: The recommended spending percentage for housing in Orange, California is typically around 30% of one's income. This includes expenses such as rent, mortgage payments, property taxes, and insurance. Allocating an appropriate portion of your income to housing ensures stability and allows for comfortable living arrangements in this vibrant city. 2. Transportation: Transportation expenses in Orange, California should ideally be limited to around 15% of your income. This category includes car payments, fuel costs, insurance premiums, registration fees, and public transportation expenses. By adhering to this recommended percentage, individuals can maintain a reliable mode of transportation without compromising their overall financial health. 3. Debt Repayment: It is recommended that individuals allocate around 10% of their income towards debt repayment. This includes credit card payments, student loan installments, and any other outstanding loan balances. By prioritizing debt repayment within this spending percentage, individuals can gradually eliminate their debts and improve their financial well-being. 4. Savings: Setting aside approximately 20% of your income for savings is crucial for building an emergency fund and planning for the future. This category encompasses contributions to retirement accounts, regular savings accounts, and investments. By adhering to this recommended spending percentage, individuals in Orange, California can safeguard themselves against unexpected expenses and work towards long-term financial stability. 5. Everyday Expenses: Everyday expenses, such as groceries, utilities, entertainment, and other discretionary spending, should ideally be limited to around 25% of one's income. This category allows individuals to enjoy the various amenities and entertainment options available in Orange, California while still maintaining a balanced budget and avoiding unnecessary financial stress. It's important to note that these recommended spending percentages for Orange, California may vary depending on personal circumstances, priorities, and financial goals. Personalizing the percentages based on individual needs and consulting a financial advisor is always recommended ensuring optimal financial management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Porcentajes de gasto recomendados - Recommended Spending Percentages

Description

How to fill out Orange California Porcentajes De Gasto Recomendados?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a lawyer to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Orange Recommended Spending Percentages, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Therefore, if you need the recent version of the Orange Recommended Spending Percentages, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Orange Recommended Spending Percentages:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Orange Recommended Spending Percentages and download it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!