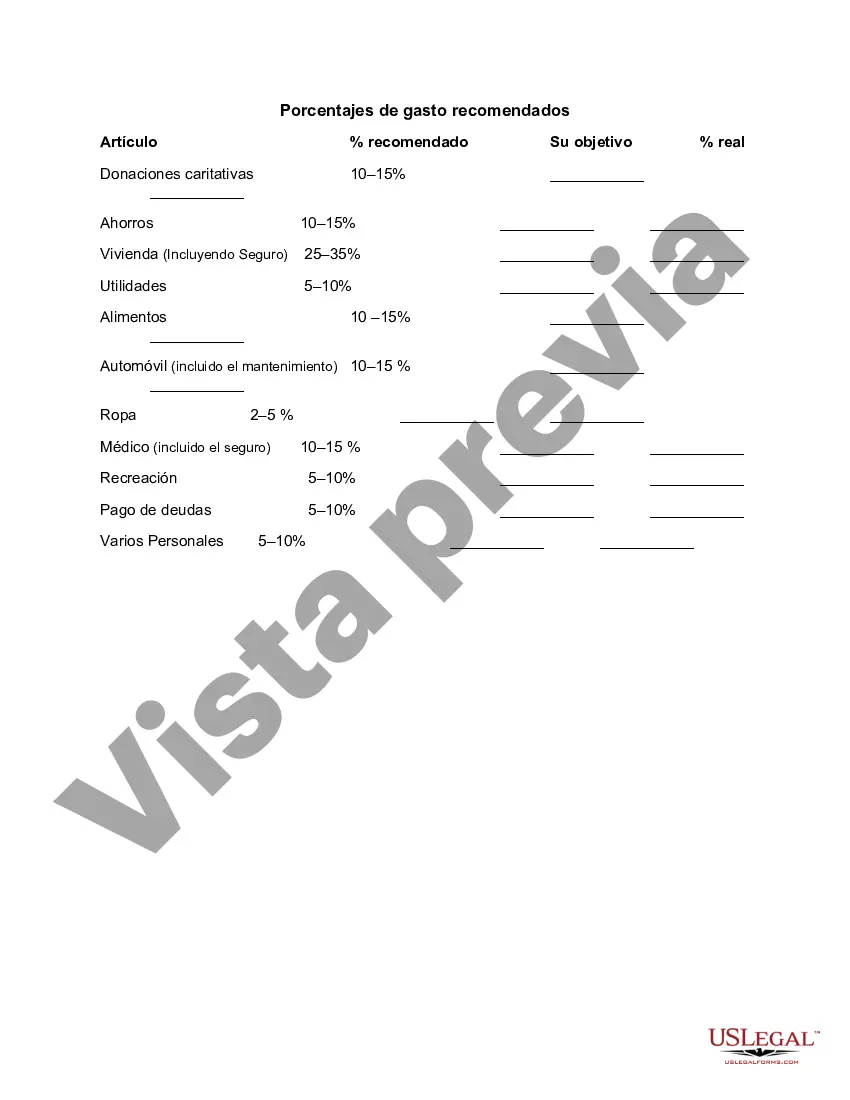

Salt Lake Utah Recommended Spending Percentages: A Detailed Description When it comes to managing your finances effectively in Salt Lake, Utah, it is crucial to allocate your income wisely. To ensure financial stability and a comfortable lifestyle, experts recommend following recommended spending percentages tailored to different categories. By adhering to these guidelines, you can prioritize your expenditures and attain a healthy financial outlook. 1. Housing Expenses: According to the Salt Lake Utah recommended spending percentages, housing expenses should ideally consume around 30% of your monthly income. This includes mortgage or rent payments, homeowner's/renter's insurance, property taxes, and maintenance costs for your residence. Keeping this percentage in mind allows you to strike a balance between living comfortably and saving for other financial goals. 2. Transportation Costs: Transportation costs make up a significant portion of most people's budgets. In Salt Lake, Utah, experts suggest allocating around 15% of your income to transportation expenses. This encompasses vehicle payments, fuel costs, car insurance, maintenance, and public transportation fares. This percentage ensures you can afford reliable transportation while leaving room for other essential financial obligations. 3. Debt Repayment: Paying off debts, such as credit cards, student loans, or personal loans, is crucial to maintain good financial health. Experts recommend that debt repayment should consume approximately 10-15% of your income. By allocating this amount, you can make regular payments and work towards becoming debt-free gradually. 4. Savings and Investments: To build a secure financial future, saving and investing should be prioritized in Salt Lake, Utah as well. Allocating at least 20% of your income towards savings and investments is highly recommended. This includes contributions to retirement accounts, emergency funds, and other long-term savings goals like buying a home or funding education. By putting aside this percentage, you ensure financial security and work towards achieving your future aspirations. 5. Living Expenses: General living expenses, including groceries, utilities, healthcare, personal care, and entertainment, should ideally represent around 20-25% of your income. Allocating this percentage allows you to cover day-to-day necessities without overspending or neglecting other crucial financial aspects. It's important to note that these Salt Lake Utah recommended spending percentages are meant to serve as guidelines and can be adjusted based on your specific financial situation and goals. Prioritize your expenses according to your personal circumstances and consider seeking professional financial advice if necessary. Overall, by following these spending recommendations tailored for Salt Lake, Utah, you can achieve financial stability, save for the future, and enjoy a comfortable lifestyle while staying within your means.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Porcentajes de gasto recomendados - Recommended Spending Percentages

Description

How to fill out Salt Lake Utah Porcentajes De Gasto Recomendados?

Do you need to quickly create a legally-binding Salt Lake Recommended Spending Percentages or probably any other form to handle your own or business affairs? You can go with two options: contact a professional to draft a valid paper for you or create it entirely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you get professionally written legal papers without paying unreasonable prices for legal services.

US Legal Forms offers a rich collection of over 85,000 state-compliant form templates, including Salt Lake Recommended Spending Percentages and form packages. We provide templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary document without extra hassles.

- First and foremost, carefully verify if the Salt Lake Recommended Spending Percentages is adapted to your state's or county's regulations.

- In case the form has a desciption, make sure to check what it's suitable for.

- Start the searching process again if the template isn’t what you were seeking by using the search bar in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Salt Lake Recommended Spending Percentages template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Additionally, the paperwork we offer are reviewed by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!