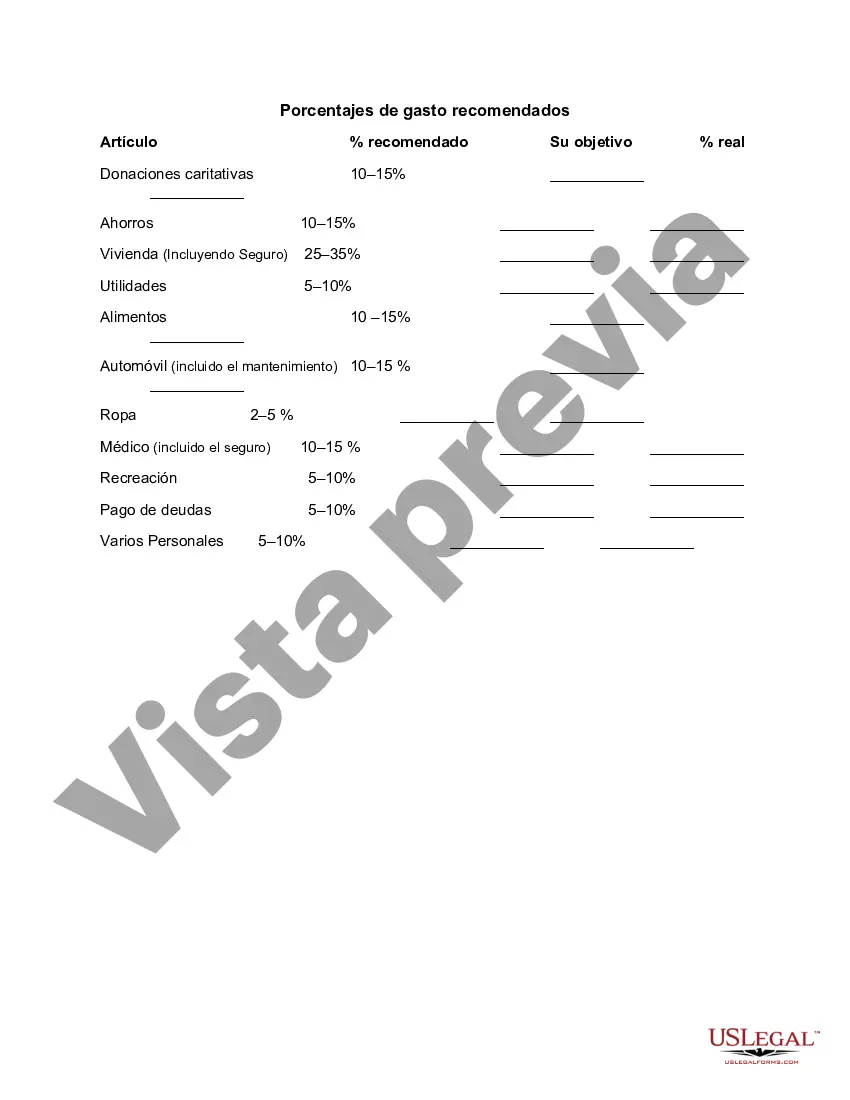

San Jose, California Recommended Spending Percentages: A Comprehensive Guide to Financial Planning In today's fast-paced society, developing sound financial habits and creating a budget are crucial for individuals and families alike. San Jose, California, one of the largest cities in the state, offers a range of recommended spending percentages that can serve as a benchmark for financial planning. Understanding and allocating your income correctly ensures financial stability, helps achieve long-term goals, and allows for a comfortable lifestyle. Let's dive into the various San Jose California recommended spending percentages: 1. Housing Expenses: As housing costs are typically the largest portion of one's budget, financial experts in San Jose recommend allocating around 30% of your income towards housing expenses. This includes rent or mortgage payments, property taxes, insurance, and maintenance costs. 2. Transportation Costs: Transportation is an essential component of daily life, especially in a sprawling city like San Jose. It is advised to allocate approximately 15% of your income towards transportation expenses. This includes car payments, fuel, maintenance, insurance, public transportation fees, and parking. 3. Groceries and Dining Out: Maintaining a balanced and fulfilling diet is important, but it should also align with your overall financial goals. Experts suggest spending around 10-15% of your income on groceries and dining out. By planning meals, utilizing coupons, and cooking at home more often, you can reduce expenses while still enjoying occasional restaurant visits. 4. Healthcare and Insurance: San Jose residents understand that safeguarding health and securing insurance coverage is vital. Allocating around 10-15% of your income to healthcare expenses, including insurance premiums, co-pays, prescriptions, and preventive care, ensures you can address medical needs while protecting your financial well-being. 5. Savings and Investments: Building a robust financial foundation includes setting aside money for emergencies, future goals, and saving for retirement. Experts generally recommend saving 15-20% of your income for these purposes. This might include contributing to an emergency fund, retirement accounts, short-term savings for vacations, or down payments for homes. 6. Debt Repayment: San Jose California residents should also consider allocating a percentage of their income towards debt repayment, especially if managing student loans, credit card debt, or other loans. Experts usually advise spending no more than 15-20% of your income on debt payments, prioritizing higher interest debts first and working towards becoming debt-free. 7. Entertainment and Miscellaneous: While it is essential to prioritize necessities, San Jose offers various recreational activities and events that contribute to an enjoyable lifestyle. Limiting expenses to 5-10% of your income for entertainment and miscellaneous activities like hobbies, movies, concerts, and gym memberships allows for a balanced financial life. Remember, these recommended spending percentages are intended as general guidelines and may vary depending on your individual circumstances and financial goals. Evaluate your personal situation, adjust percentages accordingly, and regularly review your budget to stay on track. By following San Jose California recommended spending percentages, you can better manage your finances, reduce stress, and work towards achieving financial success now and in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Porcentajes de gasto recomendados - Recommended Spending Percentages

Description

How to fill out San Jose California Porcentajes De Gasto Recomendados?

Are you looking to quickly draft a legally-binding San Jose Recommended Spending Percentages or maybe any other form to manage your own or business affairs? You can select one of the two options: hire a legal advisor to write a valid paper for you or create it entirely on your own. The good news is, there's another option - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay sky-high prices for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-specific form templates, including San Jose Recommended Spending Percentages and form packages. We offer documents for a myriad of life circumstances: from divorce papers to real estate document templates. We've been out there for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the needed document without extra troubles.

- First and foremost, double-check if the San Jose Recommended Spending Percentages is adapted to your state's or county's laws.

- In case the form includes a desciption, make sure to check what it's intended for.

- Start the searching process again if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Select the subscription that best fits your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the San Jose Recommended Spending Percentages template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Additionally, the paperwork we provide are reviewed by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!