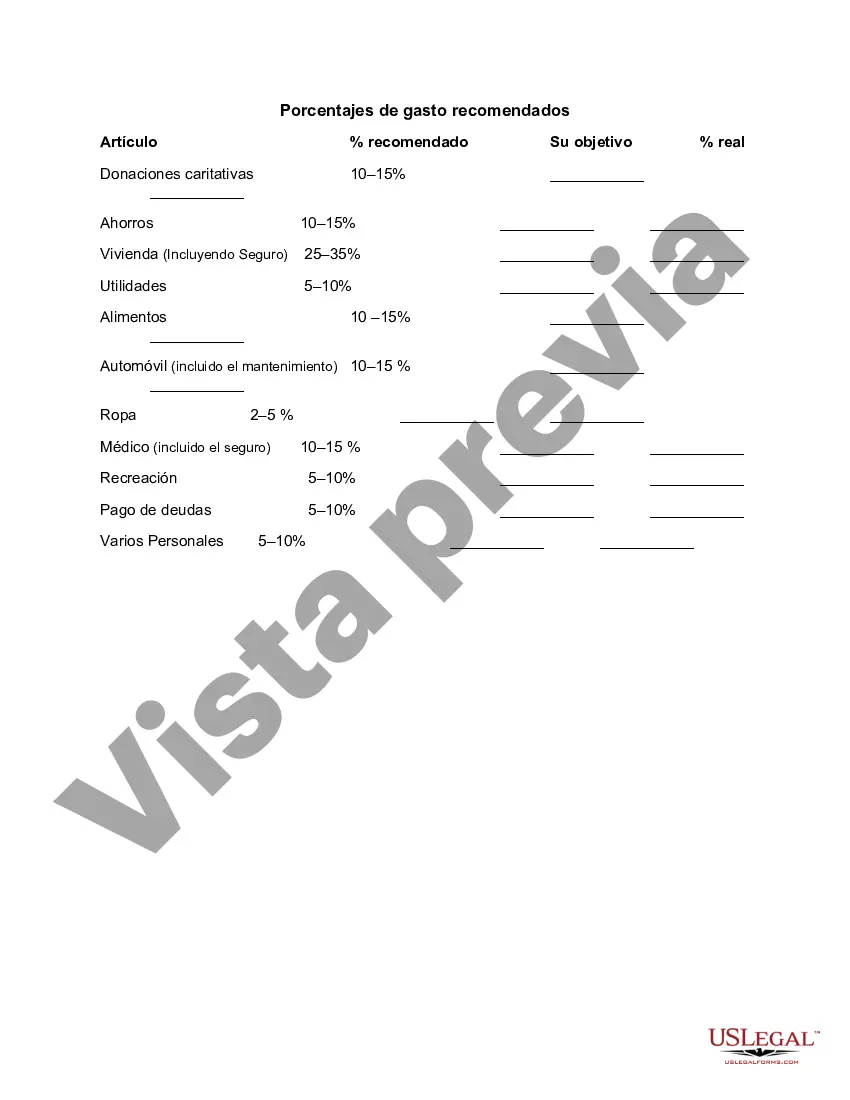

Wayne, Michigan Recommended Spending Percentages: A Comprehensive Guide to Financial Planning In Wayne, Michigan, understanding and adhering to recommended spending percentages is crucial for maintaining financial stability and ensuring a sustainable lifestyle. These spending percentages serve as guidelines to help individuals and households allocate their budget effectively. This detailed description will provide an insightful overview of Wayne, Michigan Recommended Spending Percentages, their importance, and various types that can be considered. 1. Housing: As a significant portion of most budgets, housing expenses generally account for about 30% of income. This category covers expenditures related to mortgage or rent payments, property taxes, homeowner's insurance, and utility bills such as electricity, gas, and water. 2. Transportation: On average, transportation expenses make up around 15-20% of the budget. These include vehicle loan payments, gasoline, car insurance, maintenance, and public transportation costs. Wayne, Michigan is known for its reliable public transportation system, making it an ideal choice for those looking to reduce their transportation expenses. 3. Food and Groceries: Allocating approximately 10-15% of the budget to food and groceries is advisable. This category encompasses expenses related to groceries, dining out, and even occasional take-out meals. Wayne, Michigan offers a wide range of grocery stores and local markets, allowing residents to choose from a variety of affordable options. 4. Healthcare: With rising medical costs, allocating around 5-10% of the budget to healthcare is essential. This includes health insurance premiums, co-pays, prescription medications, and routine medical check-ups. Wayne, Michigan is home to several medical facilities and practitioners, ensuring residents have access to quality healthcare services. 5. Debt Repayment: It is recommended to limit debt repayment to no more than 10-15% of the budget. This category covers student loans, credit card debts, personal loans, or any other outstanding debts. By focusing on debt reduction, individuals in Wayne, Michigan can free up more of their income for savings and investments. 6. Savings and Investments: Allocating a significant portion, around 15-20%, of the budget towards savings and investments is crucial for long-term financial security. This category includes retirement savings, emergency funds, contributions to 401(k) or other retirement plans, and investments such as stocks, bonds, or real estate. It's important to note that these spending percentages are recommended guidelines and can vary based on individual financial situations, goals, and priorities. It is always recommended creating a personalized budget and seek professional financial advice tailored to one's specific needs. By following Wayne, Michigan Recommended Spending Percentages, individuals and households can effectively manage their finances, reduce debt, build savings, and achieve financial goals. It promotes responsible spending and paves the way for a secure financial future in the vibrant community of Wayne, Michigan.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Porcentajes de gasto recomendados - Recommended Spending Percentages

Description

How to fill out Wayne Michigan Porcentajes De Gasto Recomendados?

Drafting paperwork for the business or individual needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create Wayne Recommended Spending Percentages without expert help.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Wayne Recommended Spending Percentages on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, adhere to the step-by-step guide below to obtain the Wayne Recommended Spending Percentages:

- Look through the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a few clicks!