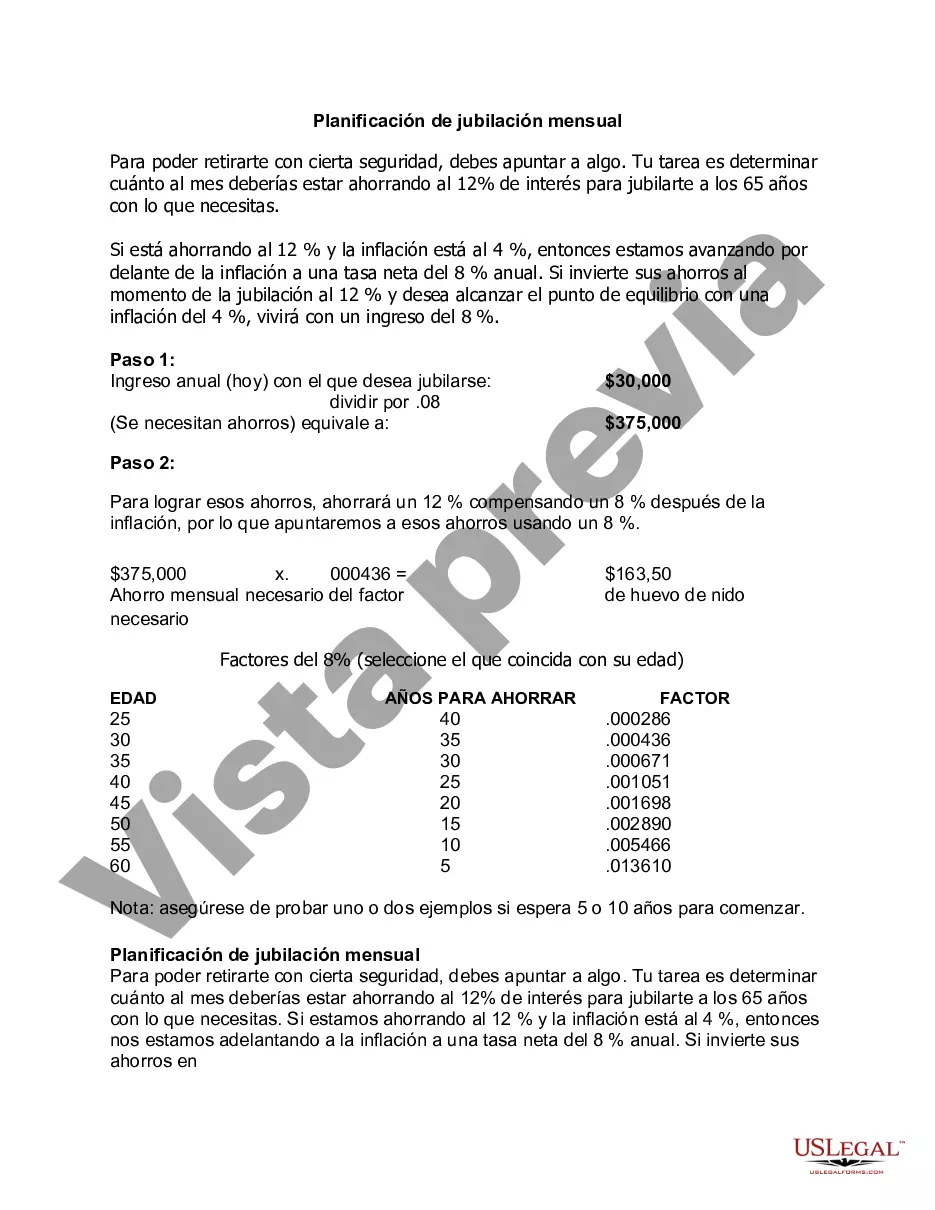

Bexar Texas Monthly Retirement Planning is a comprehensive financial planning service tailored specifically for residents of Bexar County, Texas who are approaching or already enjoying their retirement years. This service provides personalized guidance and strategies to help individuals effectively manage their finances, maximize their retirement income, and achieve their long-term financial goals. Bexar Texas Monthly Retirement Planning offers various types of retirement planning services, each designed to address different aspects of an individual's financial needs during retirement. These include: 1. Retirement Income Planning: This aspect focuses on creating a sustainable and reliable income stream during retirement. It involves assessing current and future income sources, such as pension plans, Social Security benefits, and investment portfolios, to develop a customized strategy that ensures a comfortable retirement lifestyle. 2. Investment Management: Bexar Texas Monthly Retirement Planning also helps retirees optimize their investment portfolios to generate income while managing risk. This may involve adjusting asset allocation, diversifying investments, and monitoring market trends to ensure an appropriate balance between growth and stability. 3. Wealth Preservation: This aspect focuses on strategies to protect and preserve accumulated wealth for future generations or unforeseen circumstances. Estate planning, long-term care insurance, and tax planning are crucial components of this type of planning, ensuring that wealth is transferred efficiently while minimizing tax obligations. 4. Healthcare and Long-Term Care Planning: Bexar Texas Monthly Retirement Planning recognizes the importance of preparing for potential healthcare and long-term care expenses that may arise during retirement. This includes evaluating Medicare options, exploring long-term care insurance policies, and considering strategies to cover medical expenses without depleting retirement savings. 5. Social Security Optimization: Maximizing Social Security benefits is a critical consideration for retirees. Bexar Texas Monthly Retirement Planning provides guidance on when and how to claim Social Security benefits to maximize monthly income and potentially increase lifetime benefits. The underlying principle of Bexar Texas Monthly Retirement Planning is to empower individuals with the knowledge, tools, and strategies needed to make informed financial decisions during the retirement phase. With a focus on personalized attention and comprehensive planning, this service aims to help Bexar County residents achieve a financially secure and fulfilling retirement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Planificación de jubilación mensual - Monthly Retirement Planning

Description

How to fill out Bexar Texas Planificación De Jubilación Mensual?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Bexar Monthly Retirement Planning is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to get the Bexar Monthly Retirement Planning. Adhere to the guide below:

- Make certain the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the file once you find the proper one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Bexar Monthly Retirement Planning in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!