Broward Florida Monthly Retirement Planning refers to the comprehensive financial planning services available to retirees and individuals seeking to plan for their retirement in Broward County, Florida. This service aims to assist individuals in making informed decisions about their future finances, investments, and overall retirement goals. By utilizing Broward Florida Monthly Retirement Planning, individuals can ensure a secure and comfortable retirement lifestyle. The Broward Florida Monthly Retirement Planning services encompass various aspects, including retirement income analysis, tax planning, investment management, estate planning, healthcare planning, Social Security optimization, risk management, and long-term care planning. With a focus on personalized strategies, these services are tailored to meet the unique needs and goals of each individual. Broward Florida Monthly Retirement Planning services offer a range of different types of planning options to address specific retirement planning requirements. Some major types include: 1. Income-based retirement planning: This focuses on creating a sustainable income stream during retirement by analyzing sources such as pensions, Social Security benefits, annuities, and investment portfolios. 2. Tax-efficient retirement planning: This type of planning aims to minimize tax liabilities during retirement by exploring strategies like Roth conversions, tax-efficient investments, and withdrawal strategies. 3. Investment portfolio management: Broward Florida Monthly Retirement Planning services provide expert guidance in managing retirement investments, including asset allocation, diversification, monitoring, and rebalancing, with an emphasis on risk tolerance and long-term growth. 4. Estate planning: This involves creating a comprehensive plan to protect and distribute assets upon death, ensuring an orderly transfer to beneficiaries while minimizing taxes and fees. 5. Long-term care planning: Broward Florida Monthly Retirement Planning includes strategies to fund potential long-term care expenses, such as nursing home care or in-home assistance, through insurance, annuities, or other means. 6. Social Security optimization: This type of planning helps retirees maximize their Social Security benefits by analyzing various claiming strategies and considering factors such as age, marital status, and lifetime income goals. Broward Florida Monthly Retirement Planning empowers individuals to confidently navigate the complexities of retirement finances. By leveraging the expertise and guidance of financial professionals, retirees can achieve financial security and enjoy a fulfilling retirement lifestyle in beautiful Broward County, Florida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Planificación de jubilación mensual - Monthly Retirement Planning

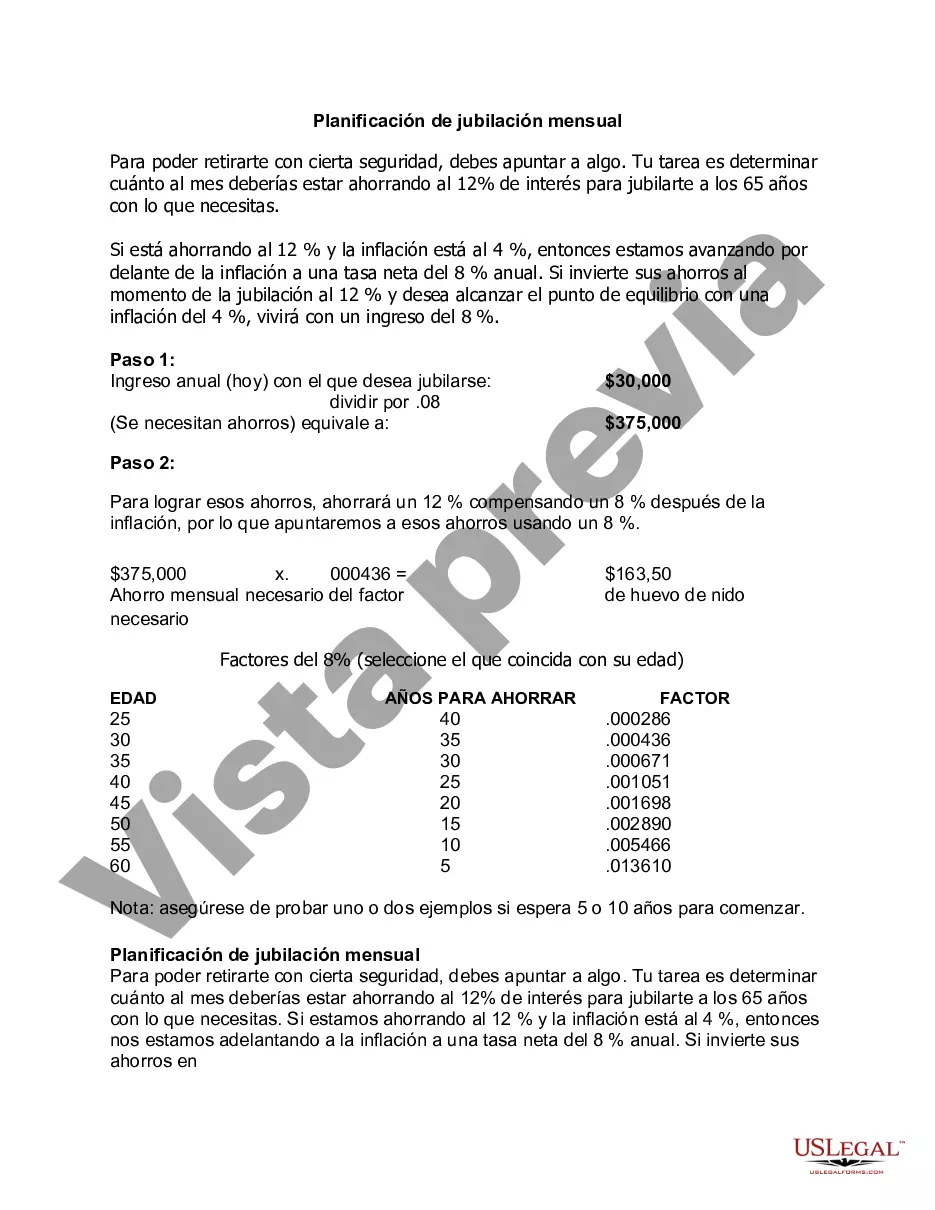

Description

How to fill out Broward Florida Planificación De Jubilación Mensual?

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Broward Monthly Retirement Planning, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different types ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less challenging. You can also find detailed materials and guides on the website to make any tasks associated with paperwork execution simple.

Here's how you can locate and download Broward Monthly Retirement Planning.

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after getting the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Examine the related document templates or start the search over to find the right document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Broward Monthly Retirement Planning.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Broward Monthly Retirement Planning, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney completely. If you have to deal with an extremely complicated case, we recommend getting an attorney to examine your form before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Join them today and get your state-compliant documents effortlessly!