Chicago Illinois Monthly Retirement Planning is a comprehensive financial service provided to individuals for effectively managing their retirement income and investments. This service is specifically designed for the residents of Chicago, Illinois, and caters to their unique retirement planning needs. Chicago is a vibrant city with a diverse population, and its residents have different retirement goals and financial circumstances. Therefore, there are various types of Chicago Illinois Monthly Retirement Planning available to cater to different individuals' needs. Here are some of the major types: 1. Chicago Illinois Monthly Retirement Planning for Baby Boomers: This retirement planning service is tailored for the baby boomer generation, born between 1946 and 1964. It addresses their specific concerns, such as maximizing social security benefits, managing healthcare costs, and creating a sustainable income stream for their retirement years. 2. Chicago Illinois Monthly Retirement Planning for Gen X: This type of retirement planning targets individuals born between 1965 and 1980, known as Generation X. It addresses their unique financial challenges, which may include paying off debts, saving for retirement while supporting children's education, and preparing for potential long-term care expenses. 3. Chicago Illinois Monthly Retirement Planning for Millennials: Millennial retirement planning is aimed at individuals born between 1981 and 1996. It focuses on early financial education, debt repayment strategies, and building a strong foundation for retirement savings. This group may also prioritize ethical and socially responsible investments when planning for their retirement. 4. Chicago Illinois Monthly Retirement Planning for High Net Worth Individuals: This specialized retirement planning service caters to individuals with substantial assets and complex financial situations. It includes strategies for wealth preservation, tax optimization, legacy planning, and philanthropic endeavors. 5. Chicago Illinois Monthly Retirement Planning for Small Business Owners: This retirement planning service is designed for entrepreneurs and small business owners in Chicago. It provides tailored solutions to maximize retirement savings through business entity structures, tax-efficient retirement plans, and business succession strategies. 6. Chicago Illinois Monthly Retirement Planning for Non-Residents: This type of retirement planning caters to individuals who reside in Chicago but may spend significant time in other states or countries due to work or personal reasons. It takes into account potential tax implications, cross-border retirement plans, and coordination between different jurisdictions' regulations. In summary, Chicago Illinois Monthly Retirement Planning encompasses an array of services tailored to different demographics and financial situations. By considering these variations, individuals can align their retirement goals with the appropriate retirement planning strategy.

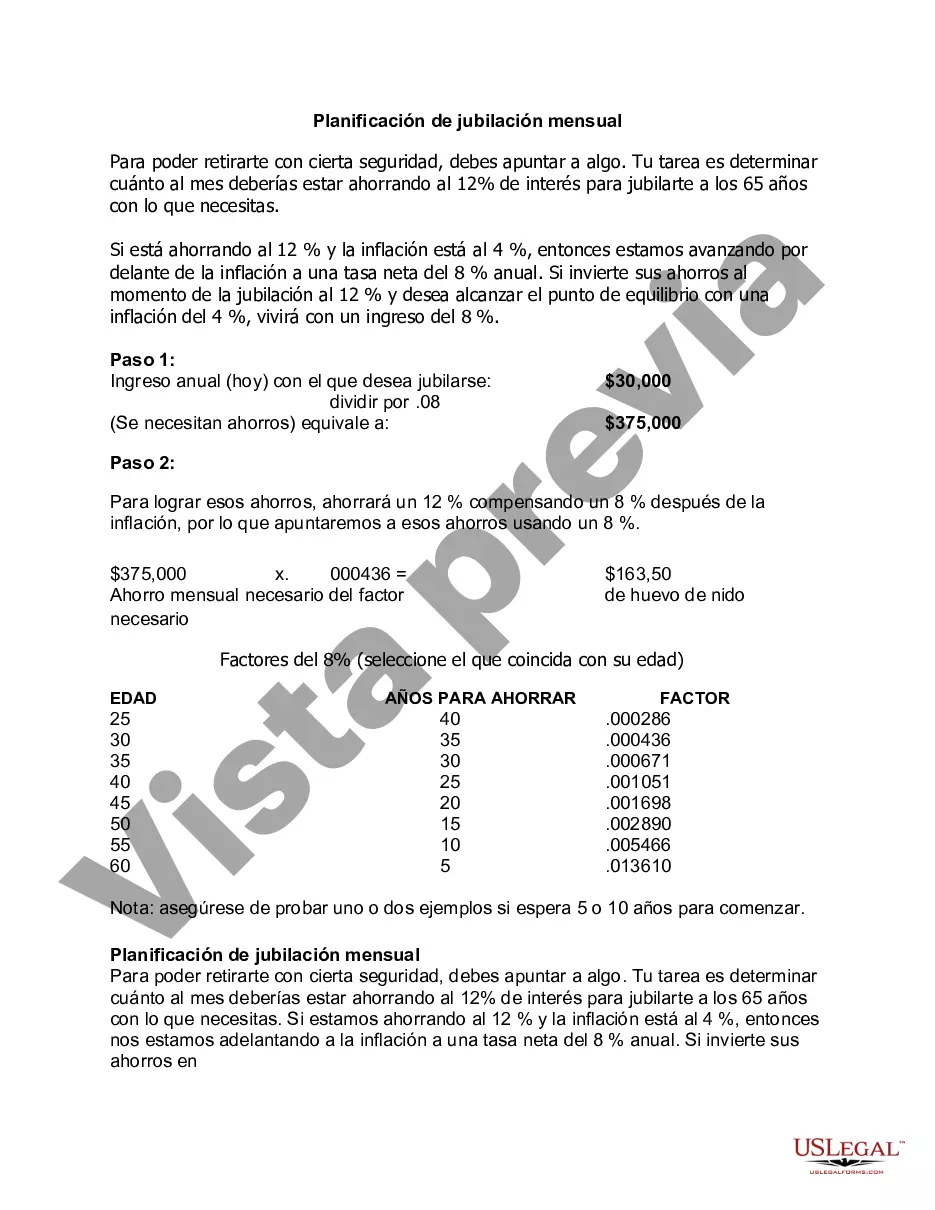

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Planificación de jubilación mensual - Monthly Retirement Planning

Description

How to fill out Chicago Illinois Planificación De Jubilación Mensual?

Draftwing forms, like Chicago Monthly Retirement Planning, to manage your legal affairs is a tough and time-consumming process. A lot of situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can take your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents intended for various cases and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Chicago Monthly Retirement Planning template. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as easy! Here’s what you need to do before getting Chicago Monthly Retirement Planning:

- Make sure that your form is specific to your state/county since the regulations for creating legal papers may differ from one state another.

- Find out more about the form by previewing it or reading a quick description. If the Chicago Monthly Retirement Planning isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin utilizing our website and get the document.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment information.

- Your form is all set. You can try and download it.

It’s an easy task to find and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!