Cook Illinois Monthly Retirement Planning is a comprehensive financial service specifically designed to assist individuals in effectively planning for their retirement. This service aims to provide individuals in Cook County, Illinois with access to expert advice, support, and strategies to ensure a comfortable and secure retirement. With Cook Illinois Monthly Retirement Planning, individuals can expect personalized guidance and tailored approaches to suit their individual financial goals and circumstances. By partnering with experienced retirement planning professionals, individuals gain access to valuable insights and strategies that can help maximize their retirement savings and ensure financial security during their golden years. This retirement planning service covers a wide range of essential aspects to consider when preparing for retirement. It includes a thorough assessment of an individual's current financial standing, including assets, liabilities, and income streams. Additionally, the service analyzes future financial goals, estimated retirement expenses, and long-term care considerations. One of the key aspects of Cook Illinois Monthly Retirement Planning is creating a customized retirement savings plan. This plan takes into account an individual's risk tolerance, time horizon, and investment preferences. It aims to optimize investment returns while managing risks effectively, ensuring a well-diversified portfolio that aligns with the client's retirement goals. Another crucial component of this service is Social Security optimization. The retirement planning professionals help individuals navigate the complexities of the Social Security system to maximize their benefits. They analyze various claiming strategies and provide personalized guidance on how to make the most of Social Security income during retirement. Cook Illinois Monthly Retirement Planning also covers estate planning. Individuals receive guidance on creating wills, trusts, and powers of attorney to protect their assets and ensure a smooth transfer of wealth to future generations. Estate tax planning strategies are explored to minimize potential tax burdens for beneficiaries. Lastly, Cook Illinois Monthly Retirement Planning offers ongoing monitoring and adjustments to the retirement plan. This includes periodic reviews, investment portfolio rebalancing, and adjustments to the retirement savings strategy based on changes in the individual's financial situation or goals. Types of Cook Illinois Monthly Retirement Planning may include: 1. Basic Retirement Planning: This level of service provides individuals with essential retirement planning advice, including goal setting, savings strategies, and an overview of the retirement process. 2. Comprehensive Retirement Planning: This level of service offers a more detailed analysis of an individual's financial situation, incorporating personalized investment strategies, Social Security optimization, and estate planning guidance. 3. Pre-Retirement Planning: This type of retirement planning focuses on individuals who are approaching retirement. It includes a detailed evaluation of retirement income sources, expense projections, and the development of strategies to bridge retirement savings gaps. 4. Post-Retirement Planning: This service is specifically designed for individuals who have already retired. It involves managing retirement income, ensuring long-term financial stability, and adjusting investment portfolios to meet changing lifestyle needs. In conclusion, Cook Illinois Monthly Retirement Planning is a comprehensive and personalized service that provides individuals in Cook County, Illinois, with expert guidance for effective retirement planning. With various types of retirement planning available, individuals can choose a level of service that meets their specific needs and goals.

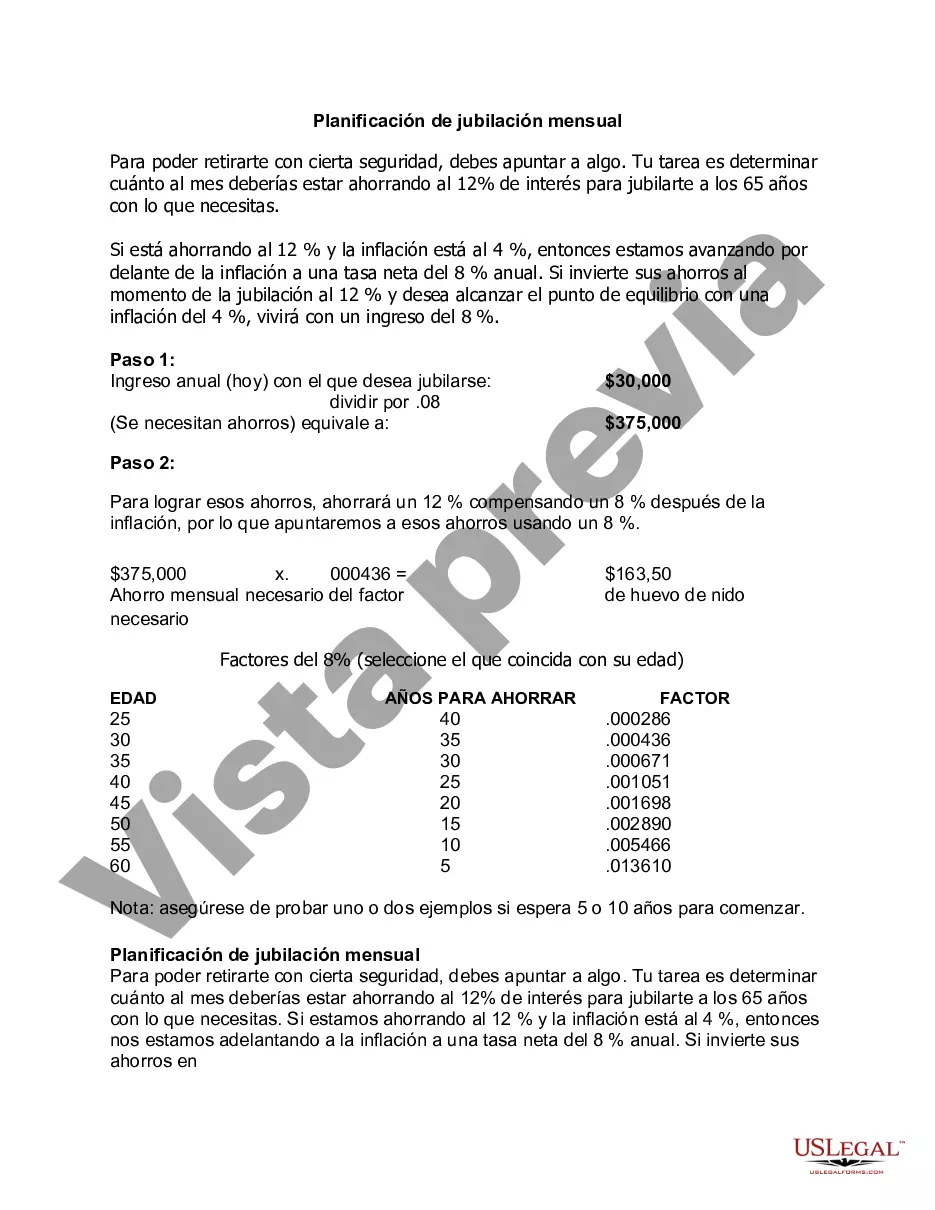

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Planificación de jubilación mensual - Monthly Retirement Planning

Description

How to fill out Cook Illinois Planificación De Jubilación Mensual?

Draftwing documents, like Cook Monthly Retirement Planning, to manage your legal affairs is a difficult and time-consumming process. Many cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can consider your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents created for different cases and life situations. We ensure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Cook Monthly Retirement Planning form. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly easy! Here’s what you need to do before getting Cook Monthly Retirement Planning:

- Make sure that your form is compliant with your state/county since the regulations for creating legal documents may differ from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Cook Monthly Retirement Planning isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to start utilizing our service and get the form.

- Everything looks good on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to find and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!