Hennepin County, Minnesota is a diverse and vibrant area known for its excellent quality of life, making it an ideal location for retirement planning. Hennepin Minnesota Monthly Retirement Planning is a comprehensive financial planning service that caters specifically to individuals and couples who are preparing for their retirement years. It involves evaluating and creating strategies to ensure financial stability and comfortable living during retirement. One type of Hennepin Minnesota Monthly Retirement Planning is focused on investment management. This type of planning aims to grow and protect retirees' assets through various investment options, such as stocks, bonds, mutual funds, and real estate. The goal is to achieve maximum returns while minimizing risks, taking into consideration the retirees' preferences, risk tolerance, and specific retirement goals. Another type is estate planning, which focuses on preserving and managing retirees' wealth for their beneficiaries. This involves creating a plan for the distribution of assets, minimizing taxes, and ensuring that retirees' wishes are fulfilled after their passing. Estate planning also includes setting up trusts, drafting wills, and designating beneficiaries for retirement accounts. Furthermore, Hennepin Minnesota Monthly Retirement Planning encompasses healthcare planning. With rising healthcare costs, it is crucial to plan for potential medical expenses during retirement. This type of planning involves analyzing health insurance options, long-term care insurance, and creating contingency funds for unforeseen medical emergencies. Additionally, social security optimization is an essential aspect of Hennepin Minnesota Monthly Retirement Planning. Retirees need to understand the optimal time to claim social security benefits to maximize their income throughout retirement. This requires careful analysis of factors such as current financial situation, life expectancy, and personal goals. Overall, Hennepin Minnesota Monthly Retirement Planning offers a holistic approach to help retirees achieve their financial dreams and ensure a secure and comfortable retirement. By addressing investment management, estate planning, healthcare planning, and social security optimization, individuals and couples can have peace of mind knowing that their financial future is well-planned and protected.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Planificación de jubilación mensual - Monthly Retirement Planning

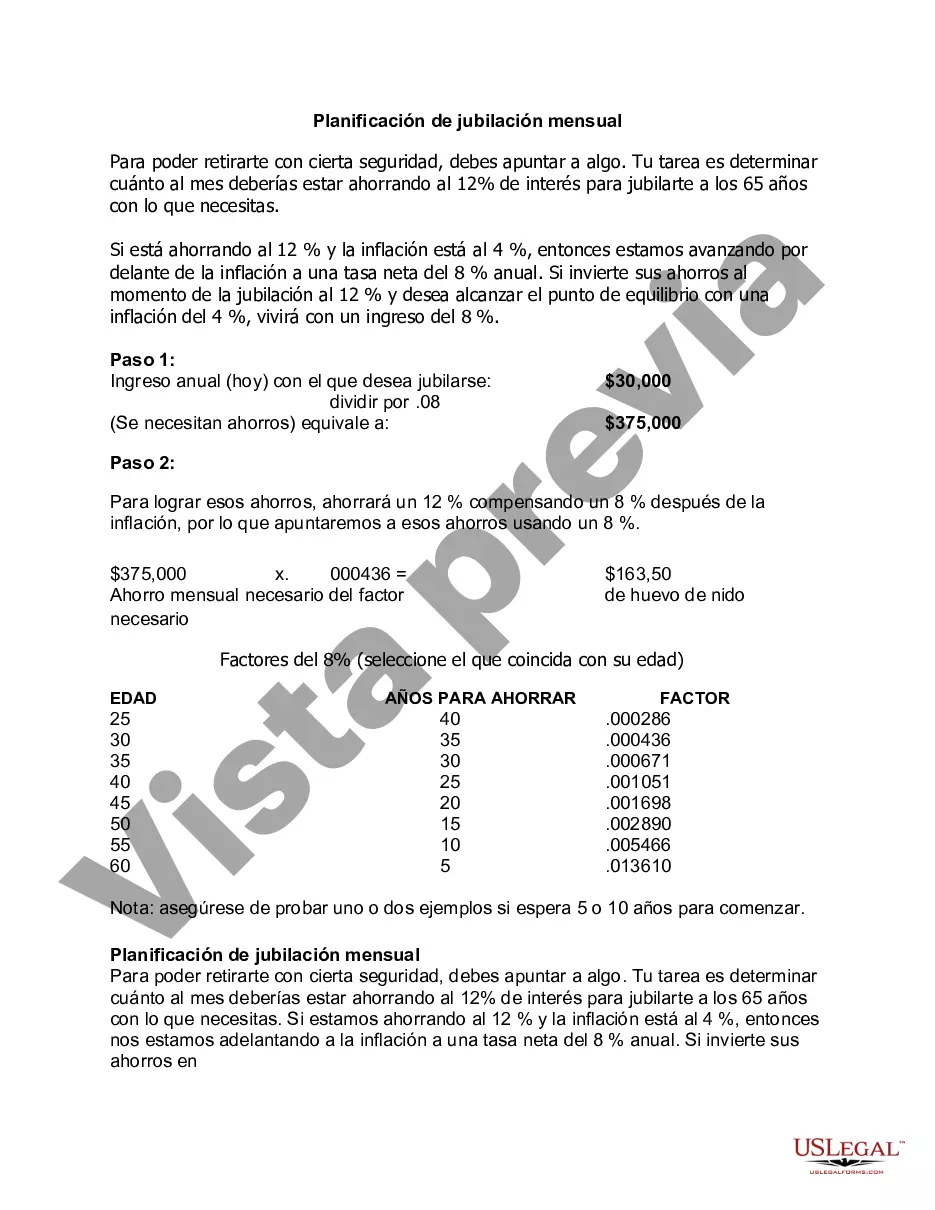

Description

How to fill out Hennepin Minnesota Planificación De Jubilación Mensual?

Preparing papers for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to create Hennepin Monthly Retirement Planning without professional assistance.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Hennepin Monthly Retirement Planning on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Hennepin Monthly Retirement Planning:

- Examine the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any situation with just a couple of clicks!