Houston Texas Monthly Retirement Planning is a comprehensive financial service specifically tailored to assist individuals in planning for a comfortable retirement in the vibrant city of Houston, Texas. With its diverse offerings and strategic planning, this service is designed to meet the unique retirement needs of Houston residents. The primary goal of Houston Texas Monthly Retirement Planning is to ensure financial security and peace of mind for retirees by formulating a personalized retirement plan. This plan takes into consideration various factors such as income, expenses, assets, and goals, all with the aim of maximizing retirement funds and optimizing financial resources. Through Houston Texas Monthly Retirement Planning, individuals have access to a range of services and strategies. One such service is investment planning, where experienced financial advisors analyze market trends, risks, and opportunities to develop an investment portfolio that aligns with the client's retirement objectives. Additionally, retirement income planning is a core aspect of this service, helping retirees determine the most effective strategies for generating a steady stream of income during their golden years. This may involve assessing Social Security benefits, pensions, annuities, or creating a personalized withdrawal plan from retirement accounts. Another critical component of Houston Texas Monthly Retirement Planning is tax planning. Advisors assist clients in understanding tax implications during retirement and guide them in making strategic decisions to minimize tax burdens while maximizing available deductions and credits. Estate planning is also an essential part of Houston Texas Monthly Retirement Planning. This involves creating a detailed plan to protect and distribute assets, ensure healthcare directives are in place, and establish beneficiaries or trusts to safeguard the financial legacy for loved ones. Houston Texas Monthly Retirement Planning is not a one-size-fits-all service. Instead, it offers different types of retirement planning solutions to cater to individual preferences and needs. These may include: 1. Traditional Retirement Planning: This type covers the fundamental aspects of retirement planning, including building retirement savings, creating a realistic budget, and optimizing investment strategies. 2. Early Retirement Planning: Geared towards those who wish to retire before the traditional age, this planning focuses on setting achievable retirement goals, balancing early withdrawals, and maximizing returns to sustain a longer retirement period. 3. Late Retirement Planning: Designed for individuals who plan to retire later in life, this type of retirement planning focuses on accelerated savings, leveraging catch-up contributions, and optimizing investments to prepare for a shorter retirement horizon. 4. Lifestyle Retirement Planning: This planning approach considers clients' desired lifestyle during retirement, aims to maintain or improve their quality of life, and incorporates specialized strategies to align with specific interests or passions. In conclusion, Houston Texas Monthly Retirement Planning is a comprehensive and customizable financial service that offers various retirement planning solutions to ensure a secure and comfortable retirement in Houston, Texas. Through expert strategies and personalized guidance, individuals can optimize their financial resources, minimize tax burdens, and establish a sustainable income stream throughout their golden years.

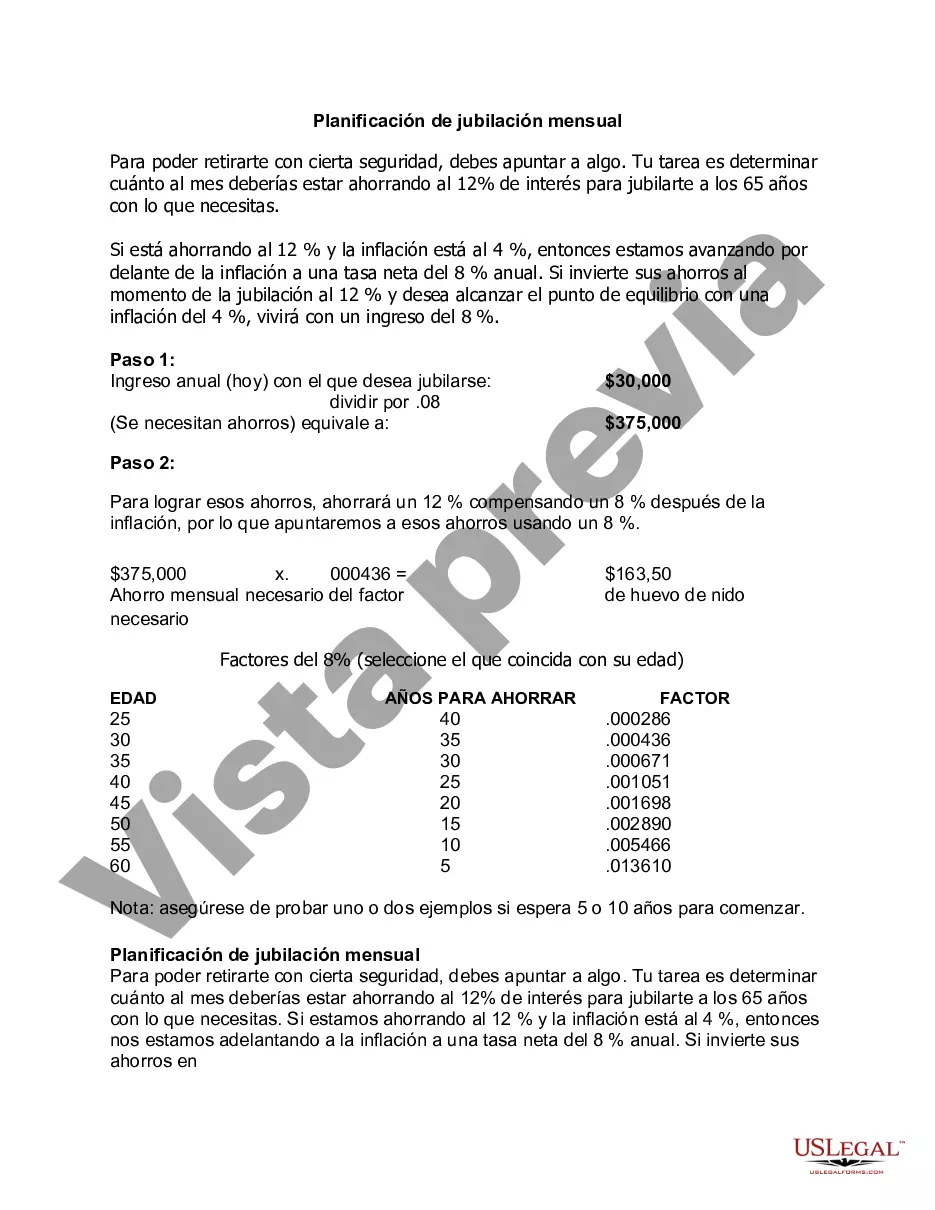

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Planificación de jubilación mensual - Monthly Retirement Planning

Description

How to fill out Houston Texas Planificación De Jubilación Mensual?

Whether you intend to start your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business case. All files are collected by state and area of use, so picking a copy like Houston Monthly Retirement Planning is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Houston Monthly Retirement Planning. Follow the guide below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the right one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Houston Monthly Retirement Planning in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!