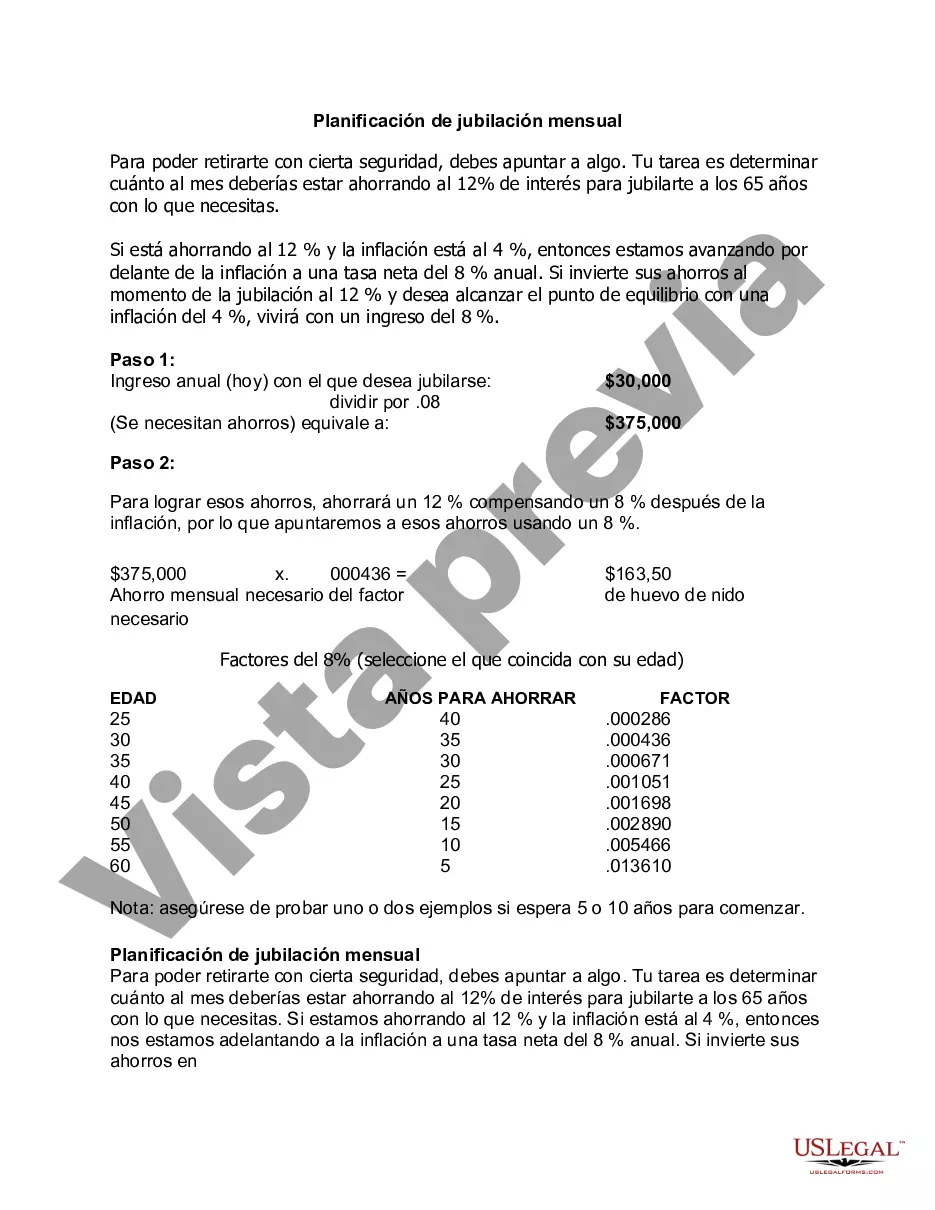

Mecklenburg North Carolina Monthly Retirement Planning is a comprehensive financial service that assists individuals in the region with strategic retirement planning on a monthly basis. Mecklenburg County, located in the Piedmont region of North Carolina, offers a range of retirement planning options tailored to meet the unique needs and goals of retirees. Retirement planning is crucial to ensure a secure and comfortable lifestyle during the golden years. With Mecklenburg North Carolina Monthly Retirement Planning, individuals can benefit from professional guidance, customized strategies, and ongoing support to make informed financial decisions. This service is designed to address various aspects of retirement planning, such as income management, investment portfolio creation, tax considerations, healthcare planning, and estate planning. The retirement planning specialists in Mecklenburg County leverage their expertise and knowledge of the local market to deliver personalized solutions. By understanding clients' financial goals, risk tolerance, and time horizon, they create a tailored plan that aligns with their specific retirement objectives. These professionals utilize various retirement planning tools and techniques to maximize potential returns while minimizing risks. Different types of Mecklenburg North Carolina Monthly Retirement Planning services include: 1. Income Management: This focuses on creating a sustainable income stream during retirement. Experts analyze income sources, such as Social Security benefits, pension plans, and retirement savings, to determine the best strategies for receiving a consistent and reliable income flow. 2. Investment Portfolio Creation: Mecklenburg North Carolina Monthly Retirement Planning experts assist retirees in developing a diversified investment portfolio that aligns with their risk tolerance and financial goals. They consider growth potential, income generation, and risk management to optimize returns and ensure long-term financial security. 3. Tax Considerations: Retirees can benefit from tax planning services, helping them understand tax implications in retirement and finding ways to minimize tax liabilities. Professionals identify potential tax deductions, credits, and investment options that offer tax advantages, aiming to maximize after-tax income during retirement. 4. Healthcare Planning: Mecklenburg North Carolina Monthly Retirement Planning includes guidance on healthcare costs and insurance coverage in retirement. Professionals help retirees understand Medicare, long-term care insurance, and other healthcare options available to protect against unexpected medical expenses. 5. Estate Planning: This service assists retirees in creating a comprehensive estate plan to ensure their assets are protected and distributed according to their wishes. Experts offer advice on wills, trusts, beneficiary designations, and strategies to minimize estate taxes. By opting for Mecklenburg North Carolina Monthly Retirement Planning, individuals gain access to a team of financial experts who collaborate to create a holistic retirement plan. Regular monthly meetings provide the opportunity to review progress, adjust strategies, and stay on track towards achieving retirement goals. With the right guidance and consistent planning, retirees in Mecklenburg County can enjoy a financially secure and fulfilling retirement lifestyle.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Planificación de jubilación mensual - Monthly Retirement Planning

Description

How to fill out Mecklenburg North Carolina Planificación De Jubilación Mensual?

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life situation, finding a Mecklenburg Monthly Retirement Planning meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often expensive. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. In addition to the Mecklenburg Monthly Retirement Planning, here you can get any specific form to run your business or personal affairs, complying with your regional requirements. Specialists check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the file in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Mecklenburg Monthly Retirement Planning:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Mecklenburg Monthly Retirement Planning.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!