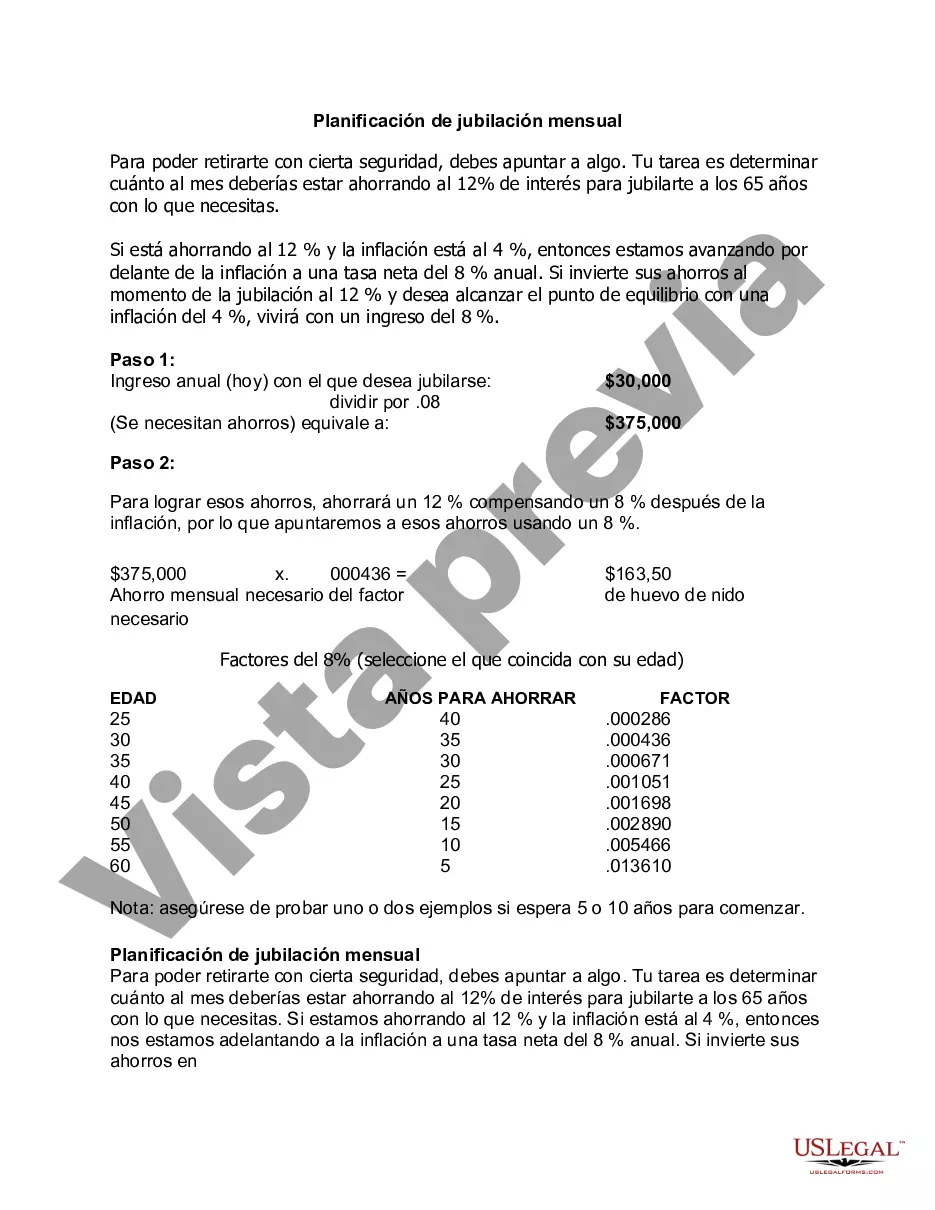

San Diego California Monthly Retirement Planning is a comprehensive financial planning service designed to assist individuals who are preparing for retirement or are already retired in the San Diego area. This service aims to help clients make informed decisions about their financial future and achieve their retirement goals. San Diego California Monthly Retirement Planning covers various aspects of retirement planning, including investment management, tax planning, estate planning, risk management, and income generation. By addressing these key areas, individuals can create a well-rounded retirement plan that takes into account their unique financial situation and goals. One type of San Diego California Monthly Retirement Planning is investment management. This involves analyzing a client's current investments and assets, determining their risk tolerance, and developing an investment strategy that aligns with their retirement goals. The service may include portfolio rebalancing, diversification, and regular performance reviews to ensure that the investments are on track to meet the client's retirement objectives. Another type of San Diego California Monthly Retirement Planning is tax planning. This aspect focuses on optimizing a client's tax situation during retirement by strategically managing their income sources, deductions, and tax credits. The service aims to minimize tax liability while maximizing the client's after-tax income, allowing them to make the most of their retirement savings. Estate planning is another crucial component of San Diego California Monthly Retirement Planning. This involves designing a plan to transfer the client's assets to their desired beneficiaries while minimizing estate taxes and ensuring that the client's wishes are followed. Estate planning may include creating wills, trusts, and powers of attorney, as well as reviewing and updating beneficiary designations. Risk management is essential in retirement planning, and San Diego California Monthly Retirement Planning addresses this aspect too. This involves analyzing a client's insurance coverage, such as life insurance, long-term care insurance, and disability insurance, to protect their assets and ensure their financial security. Regular reviews are conducted to assess whether the client's insurance coverage is adequate for their changing circumstances. Lastly, income generation is a vital consideration in San Diego California Monthly Retirement Planning. The service helps individuals create a sustainable income stream during retirement by strategically withdrawing from various sources such as pensions, Social Security benefits, retirement accounts, and other income-producing assets. The goal is to ensure that clients have a reliable and steady income throughout their retirement years. In summary, San Diego California Monthly Retirement Planning provides a comprehensive approach to retirement planning that covers investment management, tax planning, estate planning, risk management, and income generation. By considering these aspects, individuals can create a solid financial plan that helps them achieve a comfortable and worry-free retirement in San Diego.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Planificación de jubilación mensual - Monthly Retirement Planning

Description

How to fill out San Diego California Planificación De Jubilación Mensual?

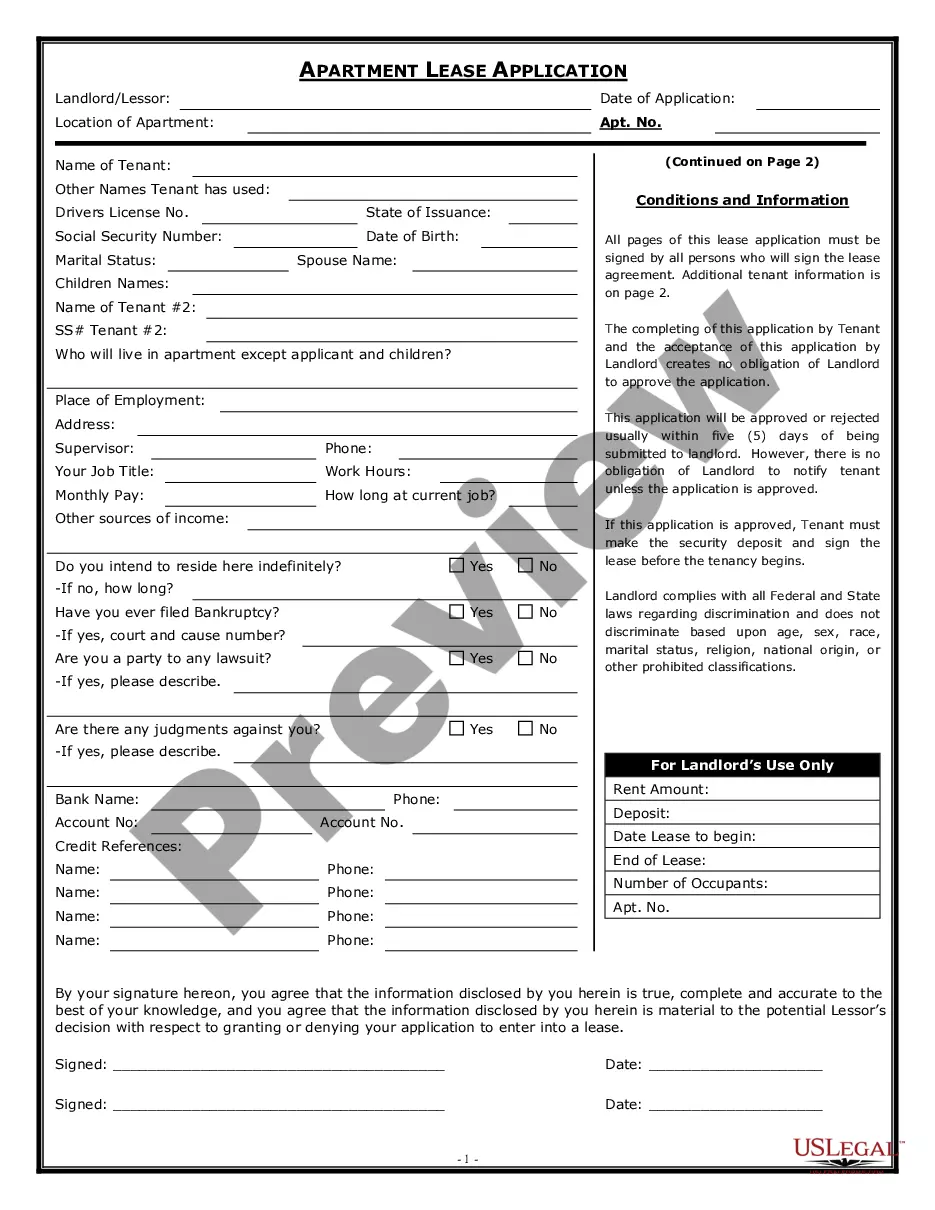

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the San Diego Monthly Retirement Planning, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Therefore, if you need the current version of the San Diego Monthly Retirement Planning, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Diego Monthly Retirement Planning:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your San Diego Monthly Retirement Planning and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!