San Jose California Monthly Retirement Planning is a comprehensive financial service aimed at individuals and couples who are nearing their retirement age and want to ensure a comfortable and worry-free retirement. With San Jose being a vibrant city and the heart of Silicon Valley, it offers a variety of retirement planning options tailored to meet the diverse needs and lifestyles of its residents. San Jose California Monthly Retirement Planning takes into account various factors, such as income, expenses, future goals, assets, and potential risks, to create a personalized retirement plan. This plan helps individuals determine how much money they need to save and invest each month, how to maximize their Social Security benefits, and how to wisely manage their assets to generate income during retirement. There are different types of San Jose California Monthly Retirement Planning to cater to the specific needs of retirees. Some of these include: 1. Investment-focused Retirement Planning: This type of retirement planning focuses on creating an investment portfolio that generates income and allows for growth over time. It considers different investment options, such as stocks, bonds, mutual funds, and real estate, to suit the risk tolerance and financial goals of the retirees. 2. Tax-efficient Retirement Planning: This type of retirement planning concentrates on minimizing tax liabilities during retirement. It explores strategies like Roth IRA conversions, tax-efficient withdrawals, and charitable contributions to optimize retirement income while reducing the tax burden. 3. Healthcare and Long-term Care Retirement Planning: As healthcare costs continue to rise, this type of retirement planning emphasizes budgeting for medical expenses and long-term care needs. It explores options like Medicare, Median policies, long-term care insurance, and Health Savings Accounts (Has) to ensure individuals have adequate coverage and protection. 4. Estate Planning: Estate planning is an integral part of retirement planning. It involves creating wills, trusts, and other legal instruments to manage the transfer of assets, minimize taxes, and leave a financial legacy for loved ones. 5. Social Security Optimization: San Jose California Monthly Retirement Planning also involves maximizing Social Security benefits. It analyzes claiming strategies, factors in retirement age, spousal benefits, and potential working during retirement to help individuals make informed decisions regarding their Social Security benefits. In summary, San Jose California Monthly Retirement Planning provides a tailored approach to retirement planning, considering various factors like investments, taxes, healthcare, estate planning, and Social Security. By carefully evaluating these components, individuals and couples in San Jose can create a robust retirement plan that aligns with their financial goals and ensures a secure and enjoyable retirement.

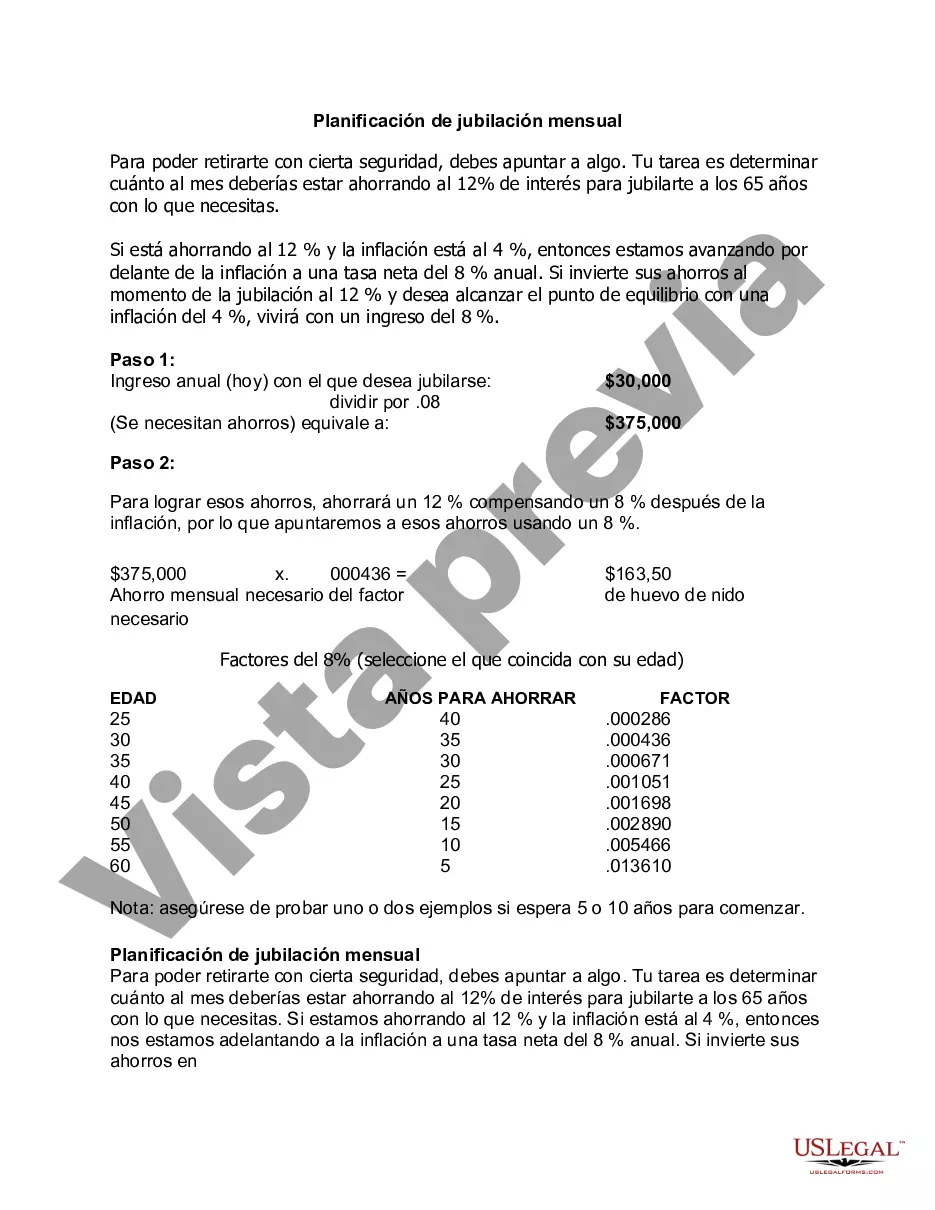

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Planificación de jubilación mensual - Monthly Retirement Planning

Description

How to fill out San Jose California Planificación De Jubilación Mensual?

How much time does it typically take you to draft a legal document? Because every state has its laws and regulations for every life situation, locating a San Jose Monthly Retirement Planning meeting all regional requirements can be stressful, and ordering it from a professional attorney is often costly. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Apart from the San Jose Monthly Retirement Planning, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your San Jose Monthly Retirement Planning:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Jose Monthly Retirement Planning.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!