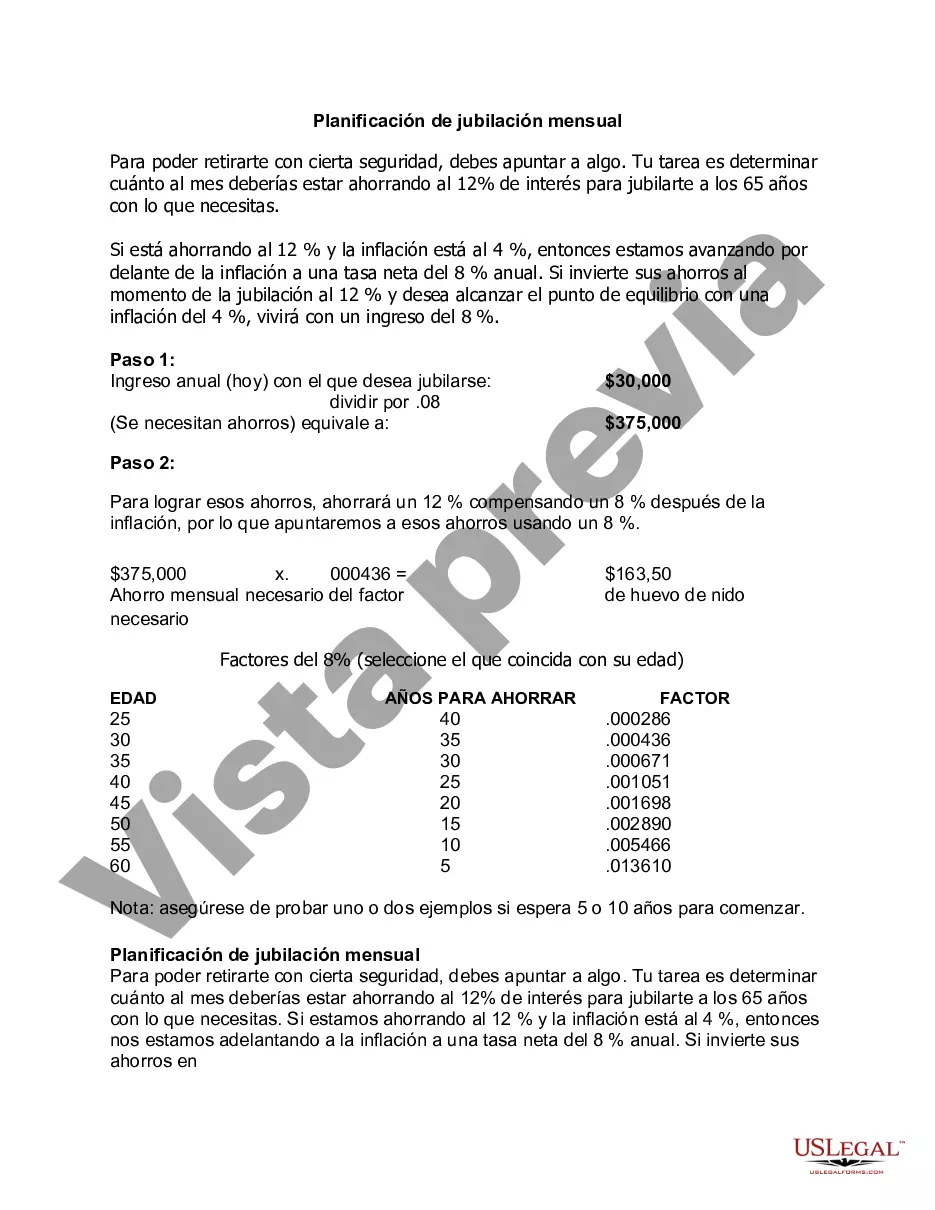

Travis Texas Monthly Retirement Planning is a comprehensive financial service specifically designed to help individuals plan for a comfortable retirement in the Travis County, Texas area. With a focus on long-term financial security, this retirement planning service assists individuals in setting achievable retirement goals, creating personalized financial strategies, and implementing appropriate investment options. At Travis Texas Monthly Retirement Planning, a team of experienced financial advisors work closely with clients to identify their unique retirement needs, considering factors such as desired retirement age, lifestyle expectations, current financial situation, and future income sources. Through an in-depth analysis, they develop a tailored retirement plan that takes into account various aspects including income generation, healthcare costs, tax efficiency, and inflation protection. One of the key features of Travis Texas Monthly Retirement Planning is the emphasis on regular reviews and adjustments. As life circumstances change, retirement goals may evolve as well. The service recognizes the importance of adapting one's financial strategy accordingly. Through periodic check-ins, the financial advisors at Travis Texas Monthly Retirement Planning ensure that the retirement plan remains on track and provide necessary adjustments to accommodate any changes, whether it be alterations to investment allocations or modifications in long-term saving strategies. Travis Texas Monthly Retirement Planning offers different types of retirement planning services based on specific client requirements. These variations may include: 1. Traditional Retirement Planning: This encompasses comprehensive retirement planning services for individuals looking to retire at a standard age while considering factors such as social security benefits, personal savings, and employer-sponsored retirement plans. 2. Early Retirement Planning: Geared towards individuals who aim to retire before the traditional retirement age, this planning service focuses on extensive analysis to build a robust financial plan that incorporates factors such as potential income sources, early withdrawal strategies, and investment growth projections. 3. Tax-efficient Retirement Planning: Designed to optimize tax savings during retirement, this planning service utilizes strategies such as maximizing tax-advantaged accounts, proper timing of withdrawals, and structuring contributions to minimize tax obligations in retirement. 4. Retirement Income Planning: A service specifically focusing on generating a steady income stream during retirement. This planning option incorporates strategies such as annuities, dividend-paying investments, and systematic withdrawal plans, aiming to ensure a constant flow of income to meet retirement expenses. In summary, Travis Texas Monthly Retirement Planning provides personalized retirement planning services in the Travis County region. With various specialized options available, individuals can choose the type of retirement planning that best suits their goals and aspirations. By working closely with experienced financial advisors, clients can feel confident knowing they have a comprehensive financial plan in place to achieve a financially secure retirement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Planificación de jubilación mensual - Monthly Retirement Planning

Description

How to fill out Travis Texas Planificación De Jubilación Mensual?

How much time does it normally take you to create a legal document? Given that every state has its laws and regulations for every life situation, finding a Travis Monthly Retirement Planning suiting all local requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, gathered by states and areas of use. In addition to the Travis Monthly Retirement Planning, here you can find any specific form to run your business or personal deeds, complying with your regional requirements. Experts verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Travis Monthly Retirement Planning:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Travis Monthly Retirement Planning.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!