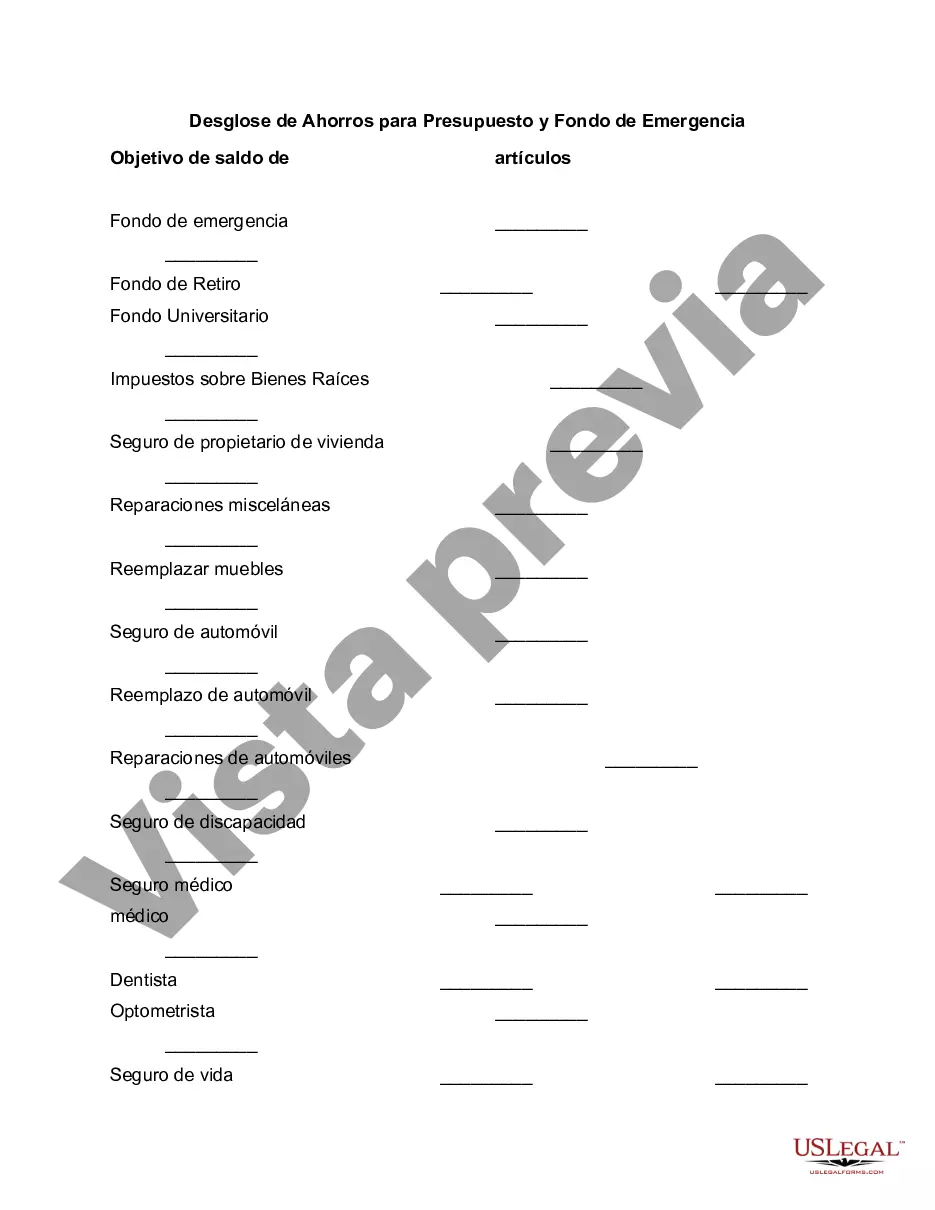

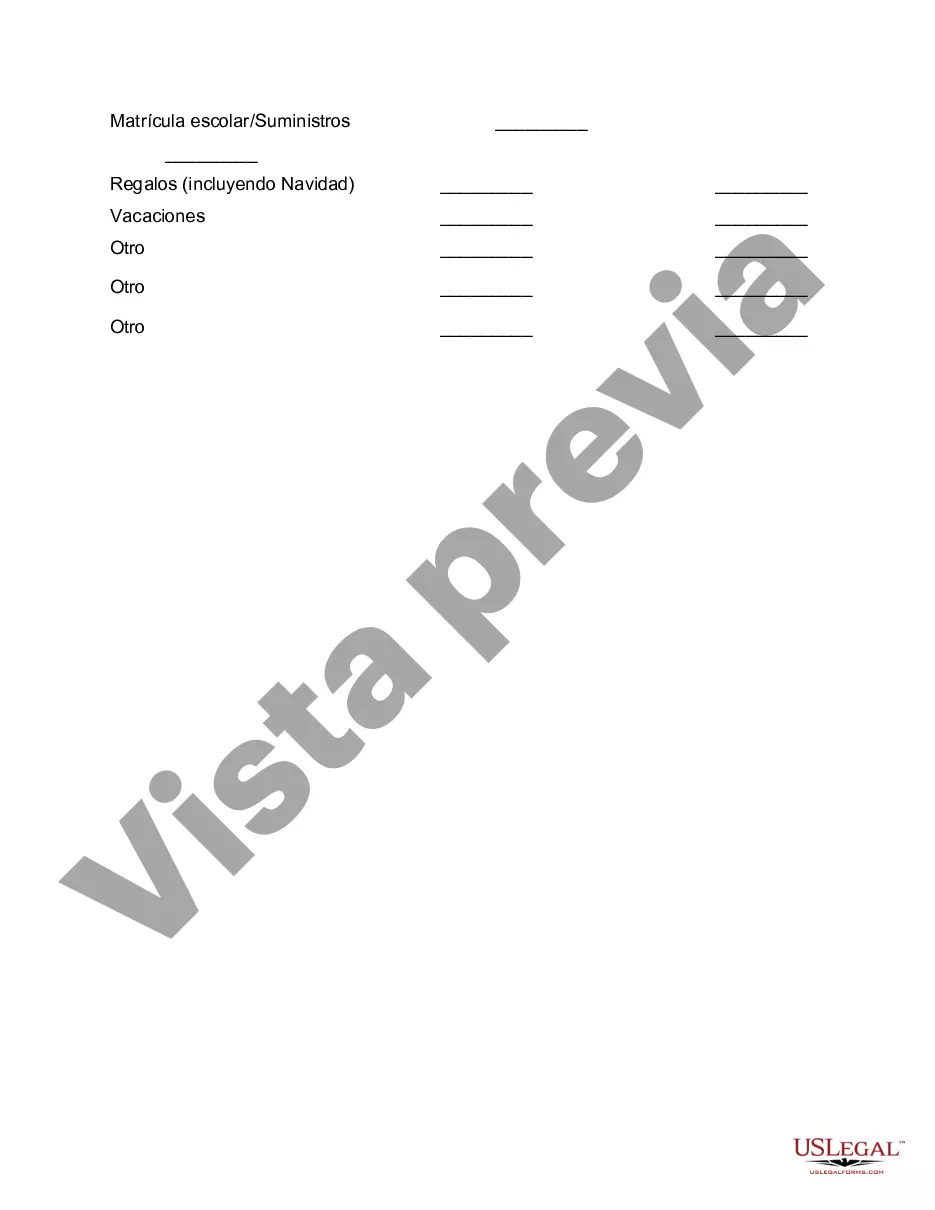

Allegheny Pennsylvania is a county located in the western part of the state. Known for its vibrant culture, historical significance, and natural beauty, Allegheny is home to various cities and towns, including Pittsburgh, the county seat. A breakdown of savings for budget and emergency fund in Allegheny Pennsylvania is crucial for residents to ensure financial stability and be better prepared for unexpected situations. Here's how you can allocate and utilize your savings effectively in this region: 1. Budgeting for Daily Expenses: When creating a budget, it's essential to consider your income, bills, and regular expenditures. Allocate funds for housing, groceries, transportation, utilities, healthcare, entertainment, and other necessary expenses. By tracking and maintaining a comprehensive budget, you can optimize your spending and identify areas where savings can be made. 2. Emergency Fund Allocation: An emergency fund acts as a financial safety net during unexpected events such as medical emergencies, job loss, or sudden home repairs. Experts suggest saving three to six months' worth of living expenses in your emergency fund. Allocate a portion of your savings specifically for this purpose, ensuring you have enough liquidity to cover unforeseen expenses without relying on credit or loans. 3. Establishing Different Types of Savings Accounts: Consider setting up various savings accounts to help organize your funds effectively. You may create separate accounts for short-term goals (vacations or down payments), long-term goals (retirement or education), and emergency funds. This approach allows you to monitor the progress of each goal individually and avoid the temptation of spending money set aside for specific purposes. 4. Automate Savings and Investments: To build savings consistently, automate regular contributions to your savings and investment accounts. This ensures that a fixed amount is deducted automatically from your paycheck or checking account and deposited into your designated savings accounts. Automating savings helps cultivate a disciplined approach to budgeting and emergency fund accumulation. 5. Utilize Tax-Advantaged Accounts: Take advantage of tax-advantaged savings accounts like Individual Retirement Accounts (IRAs) and Health Savings Accounts (Has) available in Allegheny Pennsylvania. IRAs provide tax benefits for retirement savings, while Has assisted in covering qualified medical expenses with pre-tax contributions. Utilizing these accounts allows you to save money while minimizing your tax liability. 6. Seek Professional Financial Advice: Consider consulting a financial advisor or a certified planner to outline a customized budget and savings plan based on your financial goals and circumstances. These professionals are skilled at assessing your needs, advising on investment options, and providing advice on emergency fund allocation. In summary, managing your savings and emergency funds effectively in Allegheny Pennsylvania requires thorough budgeting, allocation for emergencies, creating different savings accounts, automating savings, utilizing tax-advantaged accounts, and seeking professional advice. By taking these steps, you can secure your financial future while enjoying the rich offerings of this beautiful county.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Allegheny Pennsylvania Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

Preparing legal documentation can be difficult. Besides, if you decide to ask an attorney to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Allegheny Breakdown of Savings for Budget and Emergency Fund, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Consequently, if you need the recent version of the Allegheny Breakdown of Savings for Budget and Emergency Fund, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Allegheny Breakdown of Savings for Budget and Emergency Fund:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Allegheny Breakdown of Savings for Budget and Emergency Fund and save it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!