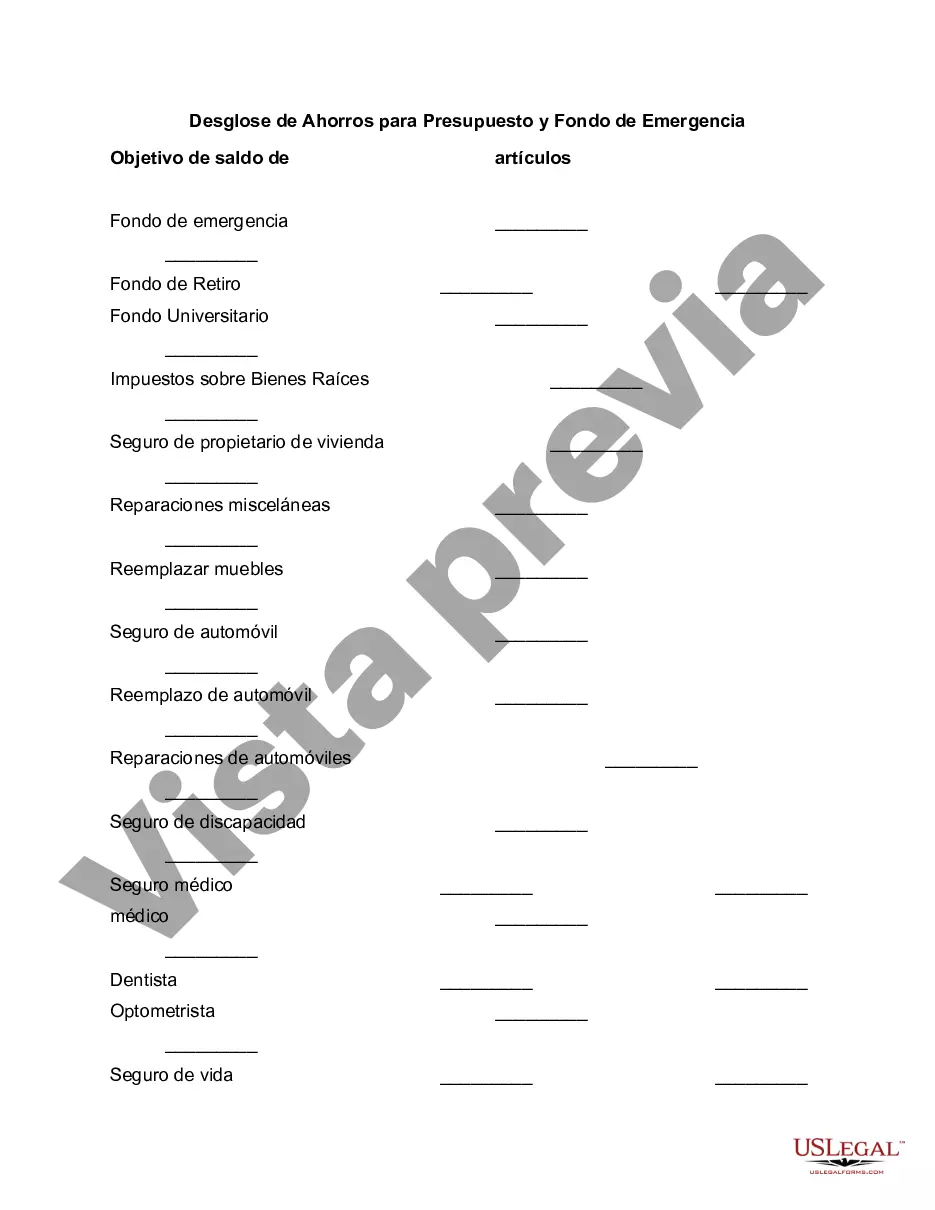

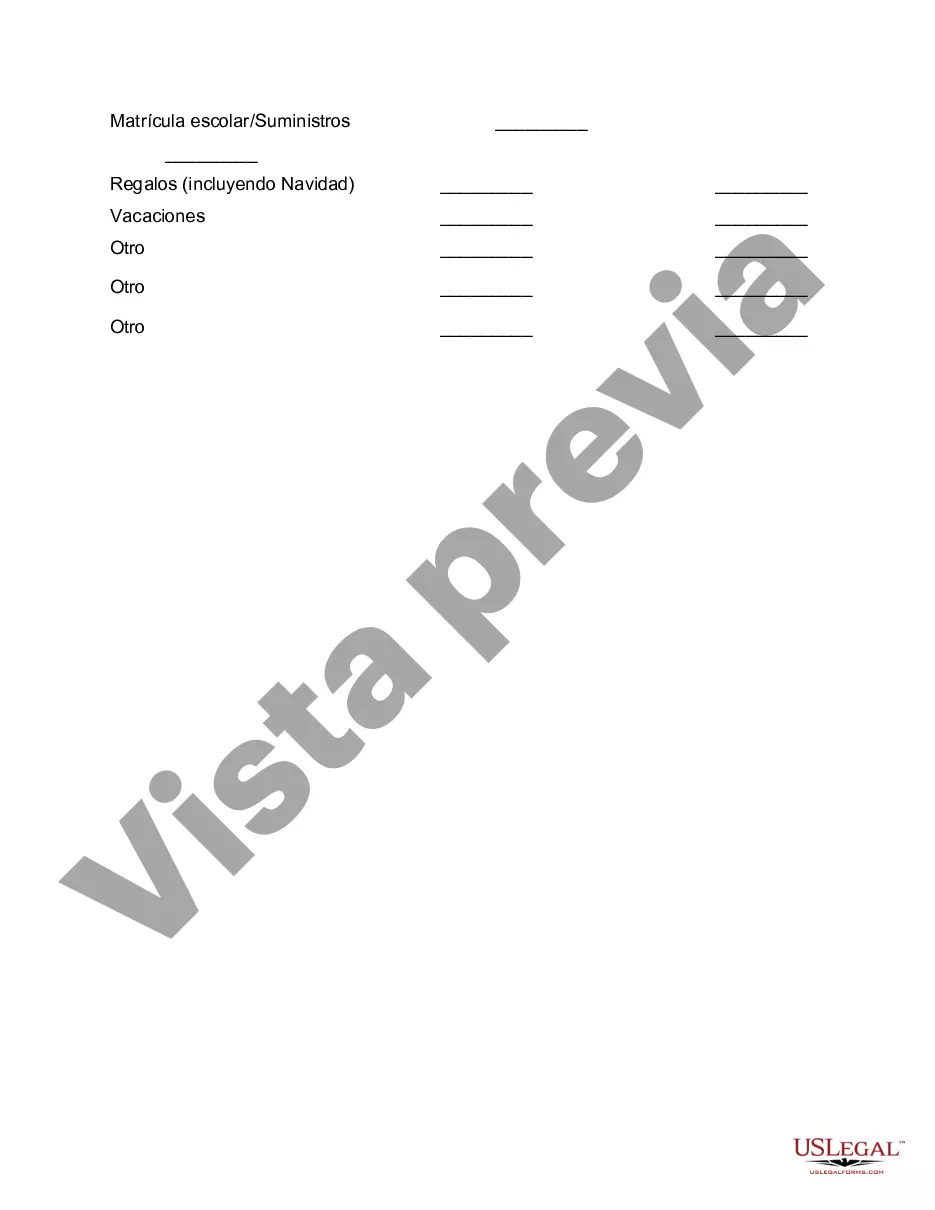

Collin Texas is a bustling county located in the state of Texas, known for its vibrant communities and prosperous economy. When it comes to managing finances, having a breakdown of savings for budgeting and emergency funds is crucial for individuals and families residing in Collin Texas. A breakdown of savings for budget and emergency funds generally consists of various types of savings accounts, each serving a different purpose. Let's explore some of these types below: 1. Personal Budget Savings: This type of savings account involves setting aside a portion of your income specifically for regular monthly expenses. It helps maintain financial stability by covering essential costs such as housing, utilities, groceries, transportation, and healthcare. 2. Emergency Fund: Having an emergency fund is vital to protect yourself from unexpected financial setbacks, such as medical emergencies, home repairs, or job loss. It's recommended to save three to six months' worth of living expenses in a separate account that is easily accessible during challenging times. 3. Retirement Savings: Preparing for retirement is crucial to ensure a comfortable life in the future. Collin Texas residents can consider contributing to retirement accounts like 401(k), Individual Retirement Accounts (IRA), or pension plans. These accounts offer tax advantages, allowing your savings to grow over time. 4. Education Savings: Families in Collin Texas may prioritize saving for their children's education. College savings plans like 529 plans or Cover dell Education Savings Accounts (ESA) can help meet the rising costs of tuition, books, and other educational expenses. 5. Home Down Payment Fund: For individuals looking to purchase a home in Collin Texas, saving for a down payment is crucial. Allocating a portion of your monthly income towards a dedicated down payment fund can help you reach your homeownership goals faster. 6. Travel Fund: Collin Texas residents who value travel and exploration may opt to create a travel fund. These savings account allows you to set aside money specifically for vacations, weekend getaways, or any adventure you've always wanted to embark on. Remember, the key to an effective breakdown of savings for budget and emergency funds is setting realistic savings goals based on your income, expenses, and future plans. Establishing a monthly budget, tracking expenses, and regularly reviewing your financial goals will contribute to successful financial management in Collin Texas, ensuring a more secure and stable financial future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Collin Texas Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

Do you need to quickly create a legally-binding Collin Breakdown of Savings for Budget and Emergency Fund or probably any other document to manage your own or corporate matters? You can select one of the two options: contact a legal advisor to draft a valid paper for you or create it entirely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get neatly written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms provides a rich collection of over 85,000 state-compliant document templates, including Collin Breakdown of Savings for Budget and Emergency Fund and form packages. We provide documents for an array of life circumstances: from divorce papers to real estate documents. We've been on the market for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, double-check if the Collin Breakdown of Savings for Budget and Emergency Fund is tailored to your state's or county's laws.

- In case the document includes a desciption, make sure to check what it's suitable for.

- Start the searching process over if the template isn’t what you were looking for by utilizing the search box in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Collin Breakdown of Savings for Budget and Emergency Fund template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. In addition, the templates we provide are reviewed by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!