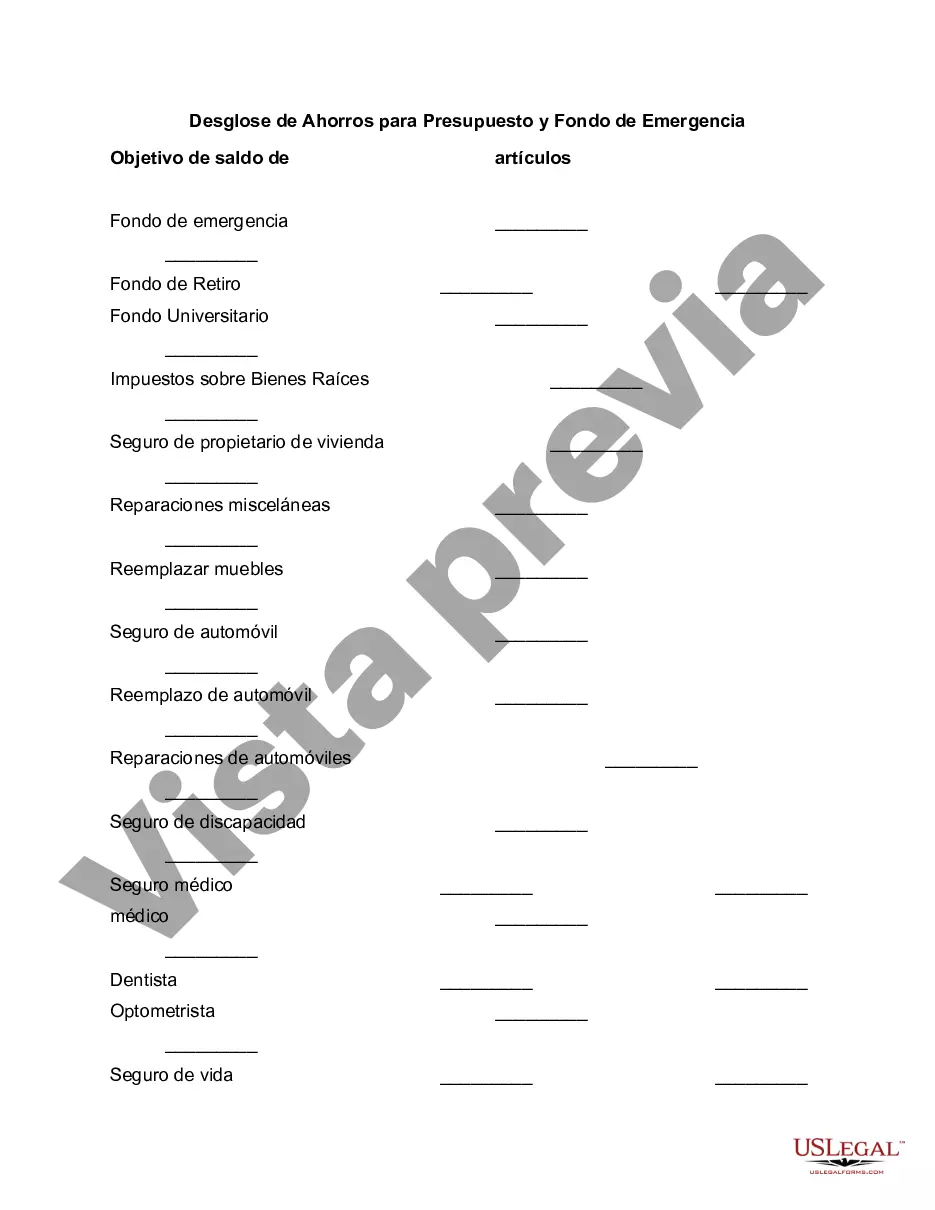

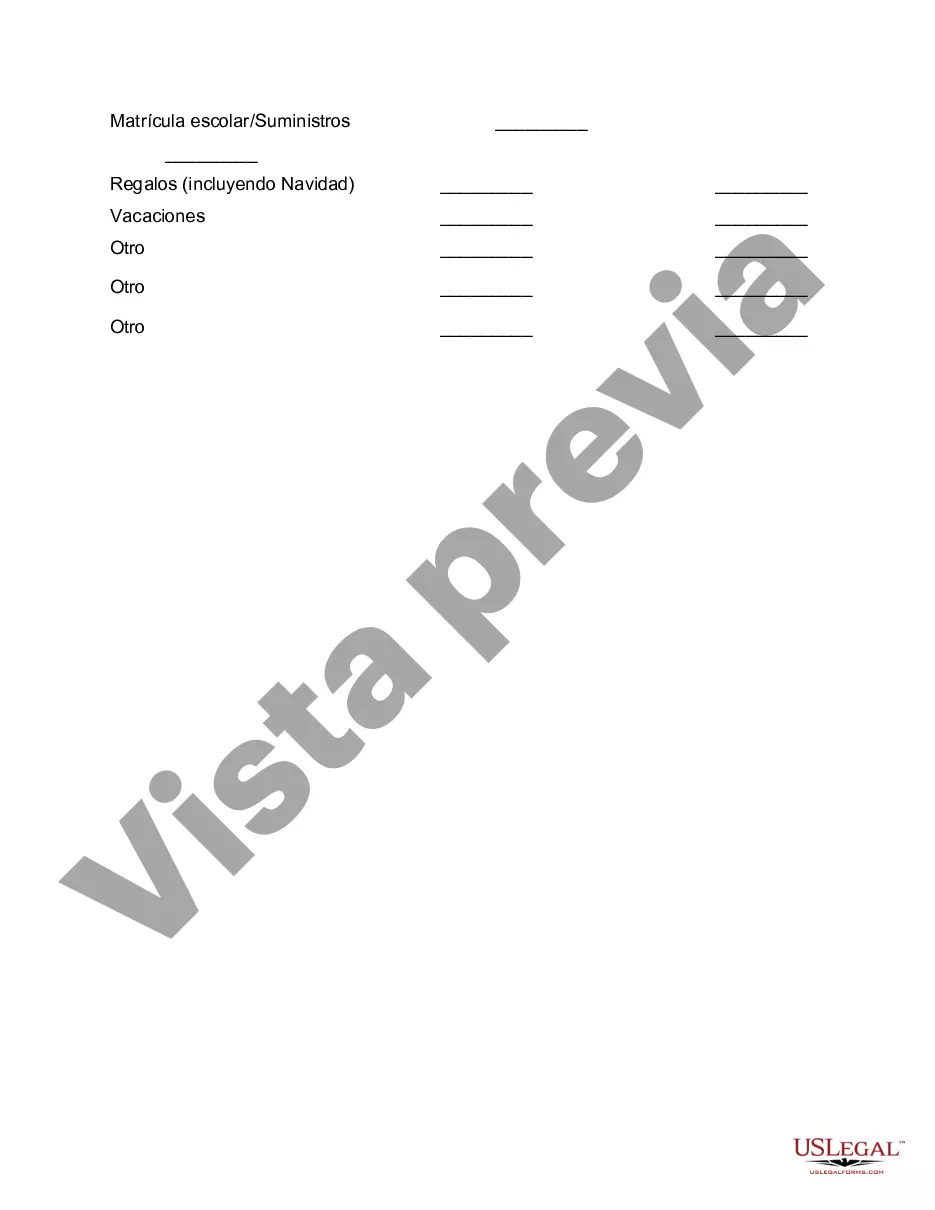

Cook Illinois is a leading transportation provider offering various breakdown savings options for budgeting and emergency funds. They understand the importance of financial planning and have tailored their offerings to cater to different needs. One of the Cook Illinois breakdown savings options is the Budget Fund. This type of savings account allows individuals to set aside a specific amount of money each month to cover basic living expenses, such as rent or mortgage payments, groceries, utilities, and transportation costs. By contributing to this fund regularly, individuals can ensure they have a stable financial base to meet their day-to-day needs without relying on credit or accumulating unnecessary debt. The Budget Fund also helps in creating a realistic budget and providing a sense of control over personal finances. Another breakdown savings option offered by Cook Illinois is the Emergency Fund. This type of savings account is specifically designed to provide a cushion for unexpected expenses or financial emergencies. It is essential to have an emergency fund to cover unforeseen medical bills, car repairs, or job loss, as it helps avoid taking on debt or relying on high-interest loans during difficult circumstances. Cook Illinois understands the importance of building an emergency fund and provides guidance on how much to save and how to allocate these funds wisely. Cook Illinois provides a detailed breakdown of each savings option, helping individuals understand how to set realistic goals and allocate their funds effectively. They offer tools and resources to track progress and make adjustments as needed. Additionally, Cook Illinois offers educational materials and workshops to educate individuals on money management, budgeting, and the importance of having a solid emergency fund. In conclusion, Cook Illinois understands the significance of savings for budgeting and emergency fund purposes. They provide various breakdown savings options, including the Budget Fund and Emergency Fund, to meet the diverse financial needs of its customers. With their expertise and resources, Cook Illinois empowers individuals to take control of their finances, plan for the unexpected, and achieve long-term financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Cook Illinois Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

If you need to get a reliable legal paperwork supplier to obtain the Cook Breakdown of Savings for Budget and Emergency Fund, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can search from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of supporting materials, and dedicated support make it simple to find and execute various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply select to search or browse Cook Breakdown of Savings for Budget and Emergency Fund, either by a keyword or by the state/county the document is intended for. After locating necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Cook Breakdown of Savings for Budget and Emergency Fund template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be immediately available for download once the payment is processed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes these tasks less expensive and more affordable. Set up your first business, arrange your advance care planning, draft a real estate contract, or execute the Cook Breakdown of Savings for Budget and Emergency Fund - all from the comfort of your home.

Join US Legal Forms now!