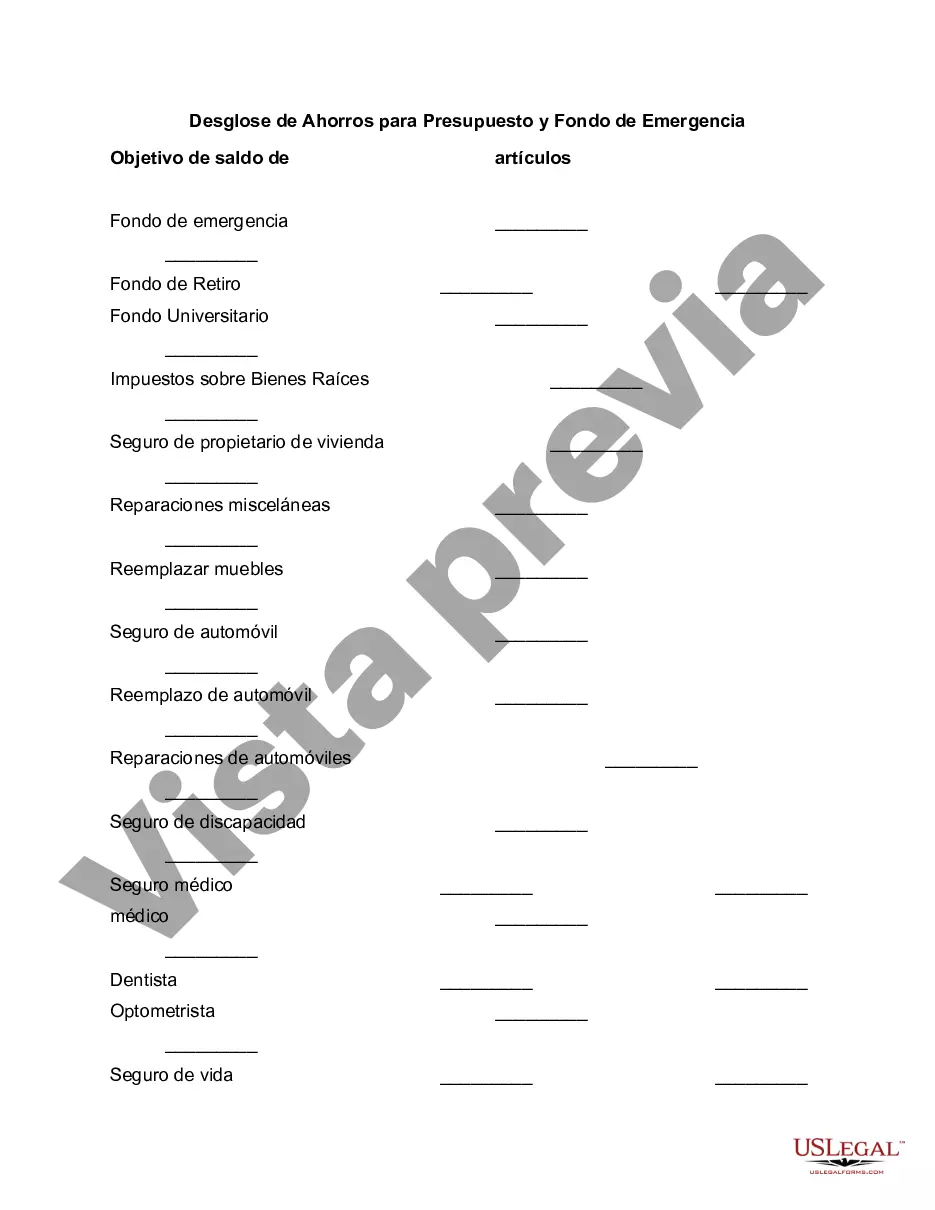

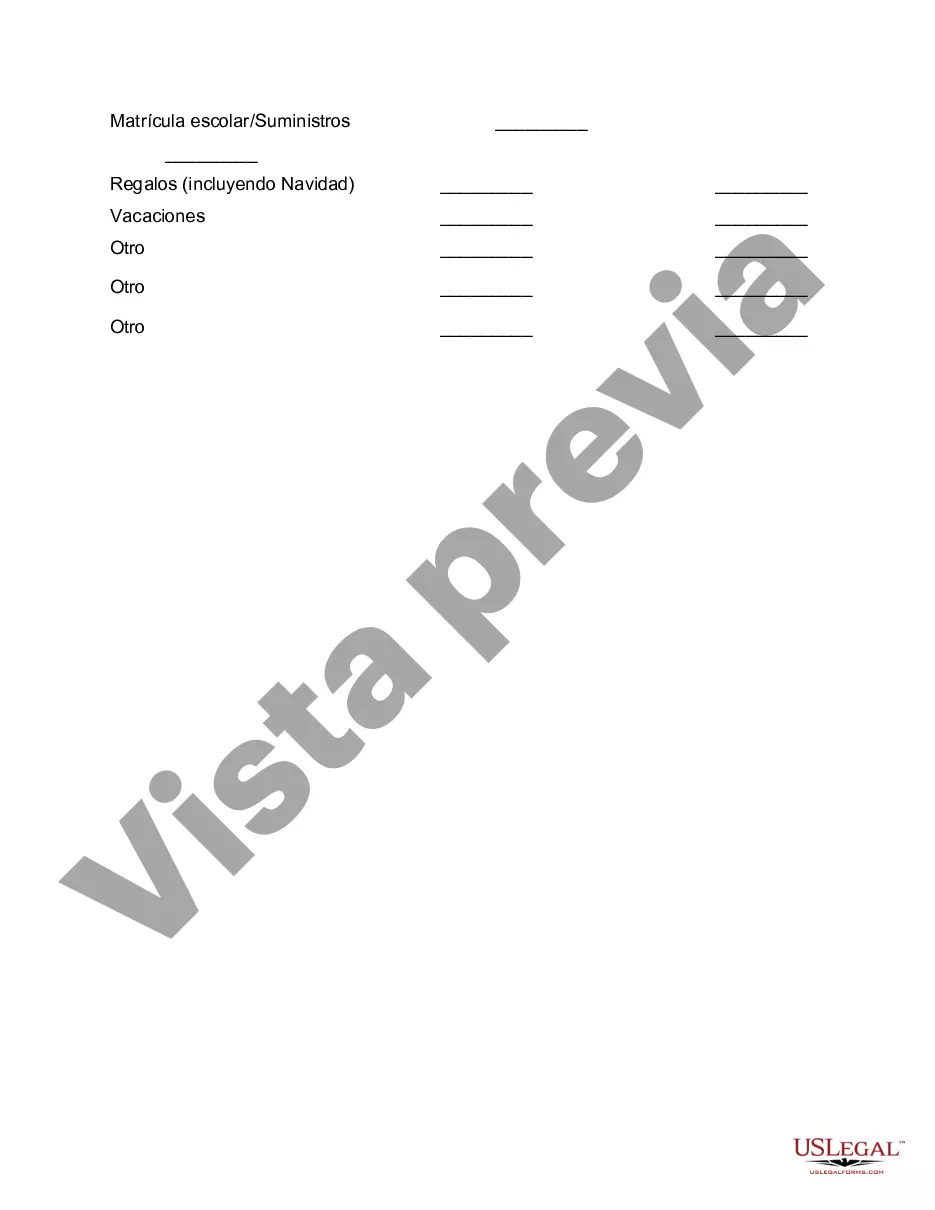

Cuyahoga Ohio is a county located in the northeastern part of the state, and it encompasses a variety of cities and townships such as Cleveland, Parma, Lakewood, and Strongsville. When it comes to financial planning, it is crucial to break down savings for both budgeting and emergency fund purposes. Budget savings in Cuyahoga Ohio refer to setting aside a portion of your income for planned expenses, financial goals, and everyday living costs. By creating a detailed breakdown of your budget, you can better manage your finances and ensure that you are allocating funds appropriately to different categories. This breakdown typically includes expenses like housing (rent/mortgage), utilities, transportation, groceries, healthcare, entertainment, and debt payments. Emergency fund savings, on the other hand, are designed to act as a financial safety net to cover unexpected expenses, emergencies, or income disruptions. It is recommended to save at least three to six months' worth of living expenses in an emergency fund. This fund can help you tackle unexpected medical bills, car repairs, job loss, or any other unforeseen events that may arise. Examples of different types of Cuyahoga Ohio breakdown of savings for budget and emergency fund include: 1. Monthly Budget Categories: This breakdown focuses on allocating funds to different monthly expenses such as housing, transportation, groceries, utilities, entertainment, and savings for future goals. 2. Variable Expenses: In this breakdown, savings are categorized to cover variable expenses that may fluctuate each month, such as entertainment, dining out, travel, and personal care. 3. Essential vs. Non-essential Expenses: This breakdown helps prioritize savings by differentiating between essential expenses like housing, utilities, and groceries, and non-essential expenses like entertainment or dining out. 4. Emergency Fund Tiers: This type of breakdown divides the emergency fund into different tiers or levels. For instance, saving one month's worth of expenses as a starter emergency fund, and gradually building up to three to six months' worth of expenses for a fully-funded emergency fund. 5. Specific Goal Savings: Another breakdown approach is saving for specific financial goals, such as a down payment for a home, a new car, higher education, or retirement. This breakdown ensures that savings are allocated towards achieving specific targets. In summary, when it comes to financial planning in Cuyahoga Ohio, breaking down savings for both budgeting and emergency fund purposes helps individuals effectively manage their finances, allocate funds wisely, and be prepared for unexpected expenses or income disruptions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Cuyahoga Ohio Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

Whether you plan to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business case. All files are collected by state and area of use, so opting for a copy like Cuyahoga Breakdown of Savings for Budget and Emergency Fund is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to obtain the Cuyahoga Breakdown of Savings for Budget and Emergency Fund. Follow the instructions below:

- Make certain the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Cuyahoga Breakdown of Savings for Budget and Emergency Fund in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!