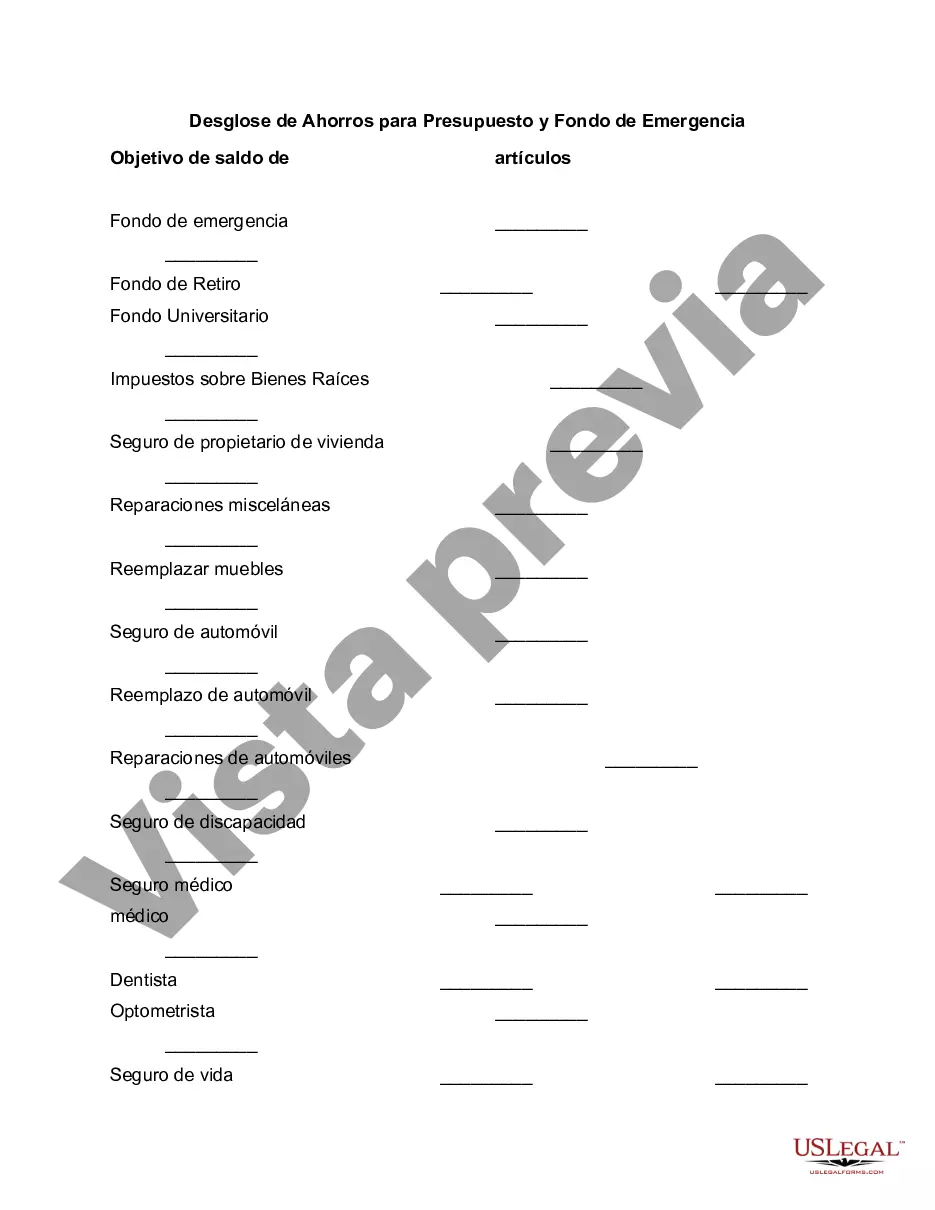

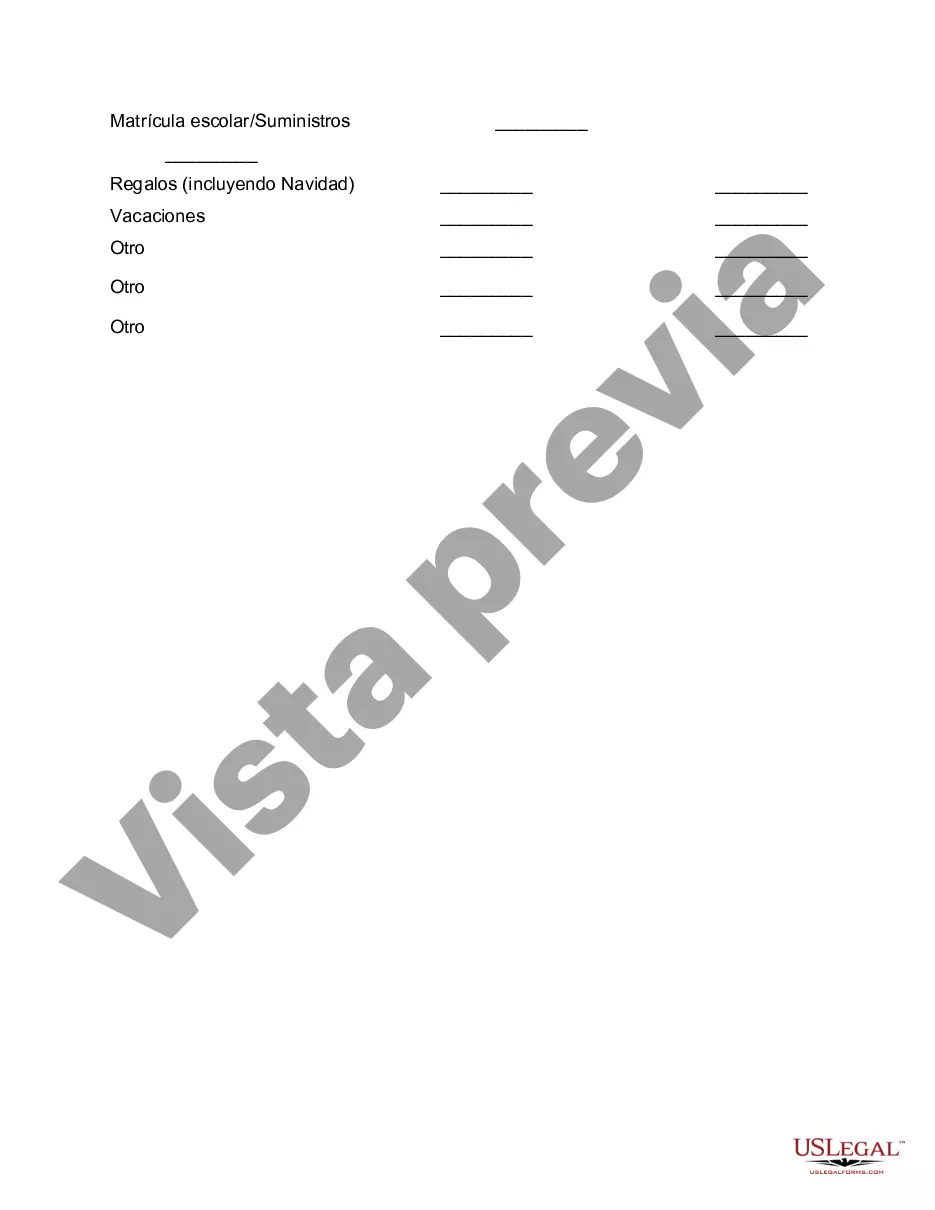

Fulton Georgia is one of the 159 counties in the state of Georgia, located in the north-central part of the state. It is the most populous county in Georgia and includes the city of Atlanta as its county seat. Fulton County is known for its diverse population, thriving economy, and rich cultural heritage, offering residents and visitors a wide range of opportunities and attractions. When it comes to budgeting and establishing an emergency fund in Fulton Georgia, it is essential to have a detailed breakdown of your savings plan. By allocating your funds strategically, you can effectively manage your finances and be better prepared for unexpected emergencies. Here is a breakdown of savings for both budget and emergency funds, along with some different types: 1. Budget Savings: a. Housing: Allocate a significant portion of your savings towards housing, including rent or mortgage payments, property taxes, and homeowners' association fees. b. Transportation: Consider setting aside money for regular vehicle maintenance, fuel expenses, insurance premiums, and potential repairs. c. Utilities: Save a portion of your income to cover monthly bills such as electricity, water, gas, waste disposal, internet, and phone services. d. Groceries and Food: Set a budget for grocery shopping and dining out expenses, ensuring that you can comfortably cover your nutritional needs. e. Health and Wellness: Save for healthcare costs, including insurance premiums, doctor visits, medications, and any potential medical emergencies. f. Education and Childcare: If applicable, allocate funds towards education expenses, such as tuition, books, and supplies, or childcare costs for parents. 2. Emergency Fund Savings: a. Job Loss: Save an emergency fund that covers at least three to six months of essential expenses, including housing, utilities, transportation, and food, in case of job loss or loss of income. b. Medical Emergencies: Set aside funds to cover potential medical emergencies, including deductibles, co-payments, and unexpected medical treatments or surgeries. c. Home Repairs: Allocate savings to handle unexpected home repairs, such as plumbing issues, roof repairs, or major appliance breakdowns. d. Car Repairs: Save for unforeseen vehicle repairs or accidents that may require significant financial support. e. Natural Disasters: In Georgia, particularly in Fulton County, where severe weather events like hurricanes or tornadoes occasionally occur, allocate savings to cover emergency supplies, evacuation costs, or potential damages to property. By following a comprehensive savings breakdown for both budget and emergency funds in Fulton Georgia, individuals and families can maintain financial stability and be better prepared for any unforeseen circumstances. It is essential to regularly review and adjust your savings plan based on your changing financial situation and priorities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Fulton Georgia Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

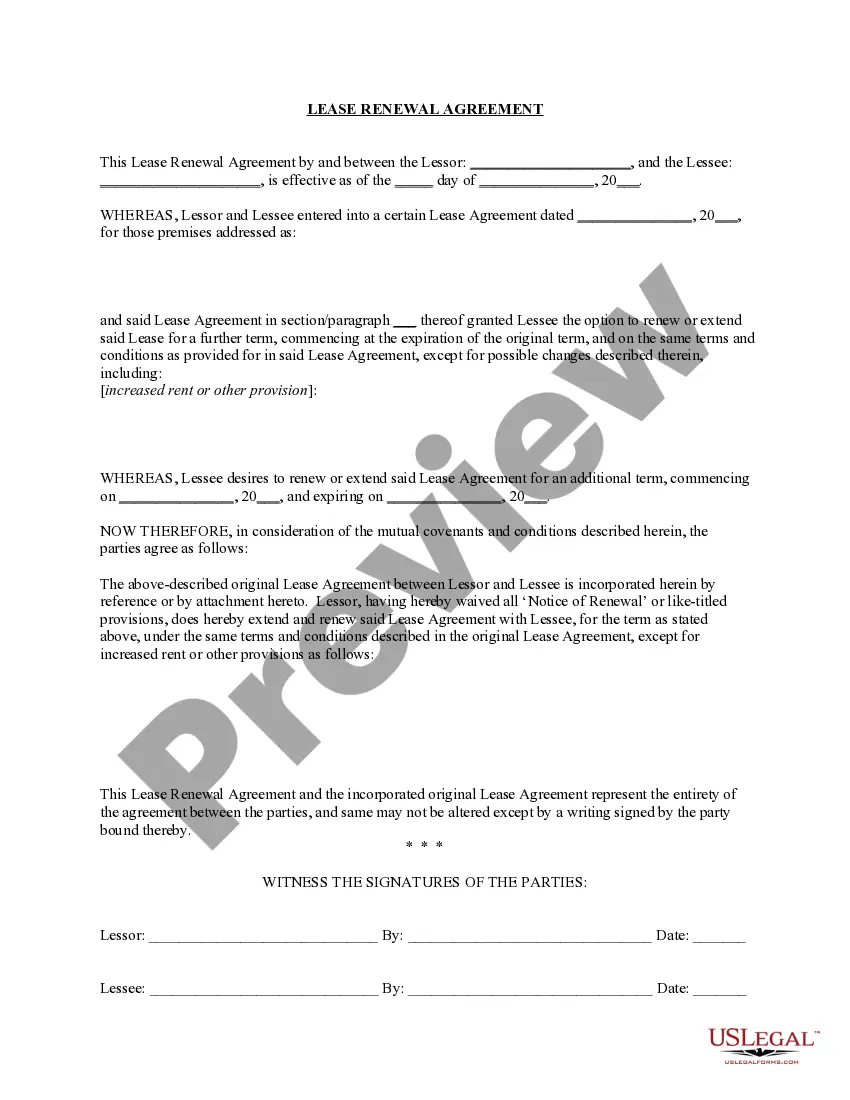

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including Fulton Breakdown of Savings for Budget and Emergency Fund, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various categories varying from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find detailed resources and tutorials on the website to make any tasks related to document execution simple.

Here's how to find and download Fulton Breakdown of Savings for Budget and Emergency Fund.

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after getting the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the validity of some documents.

- Check the similar forms or start the search over to locate the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Fulton Breakdown of Savings for Budget and Emergency Fund.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Fulton Breakdown of Savings for Budget and Emergency Fund, log in to your account, and download it. Needless to say, our platform can’t replace an attorney completely. If you need to deal with an exceptionally challenging case, we advise getting a lawyer to check your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Join them today and get your state-specific paperwork with ease!