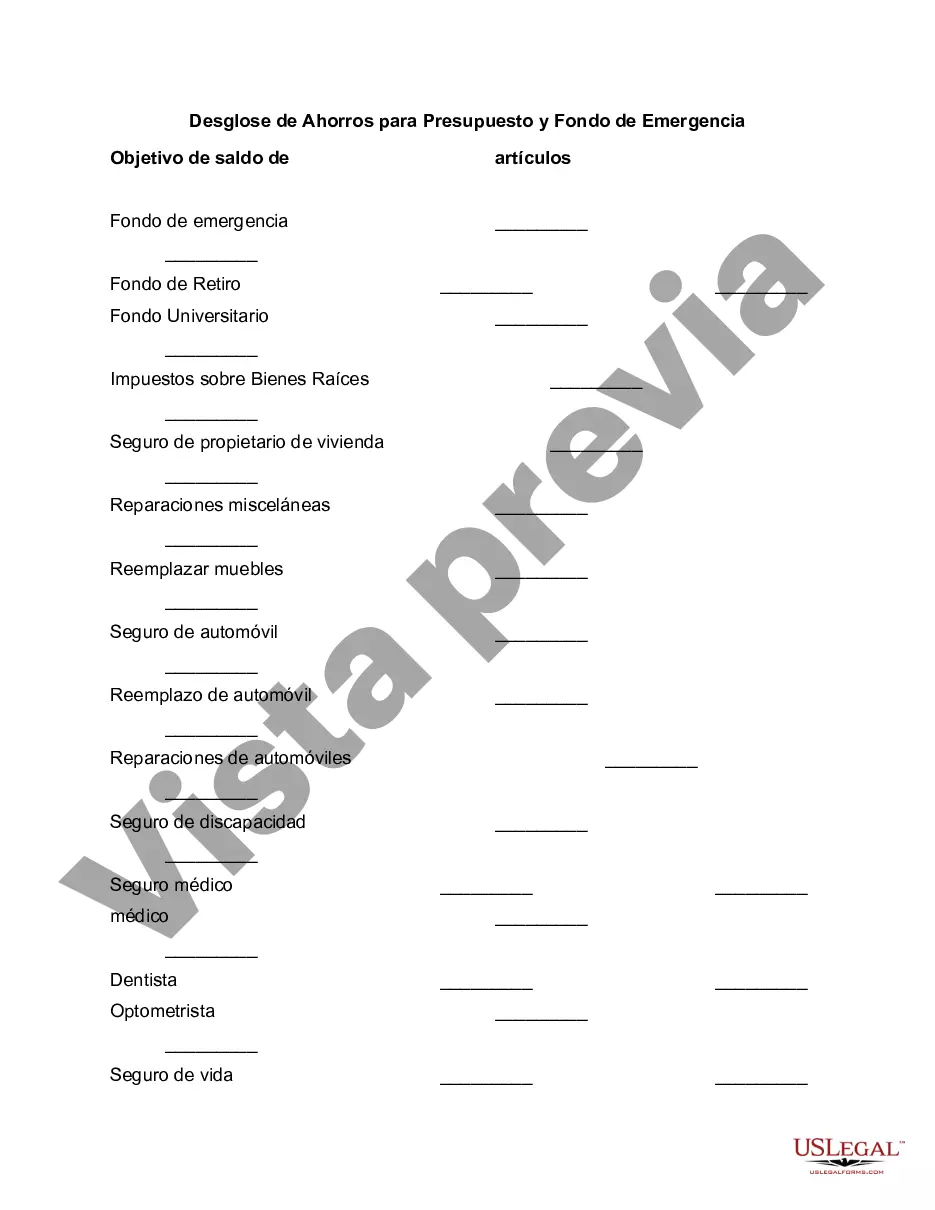

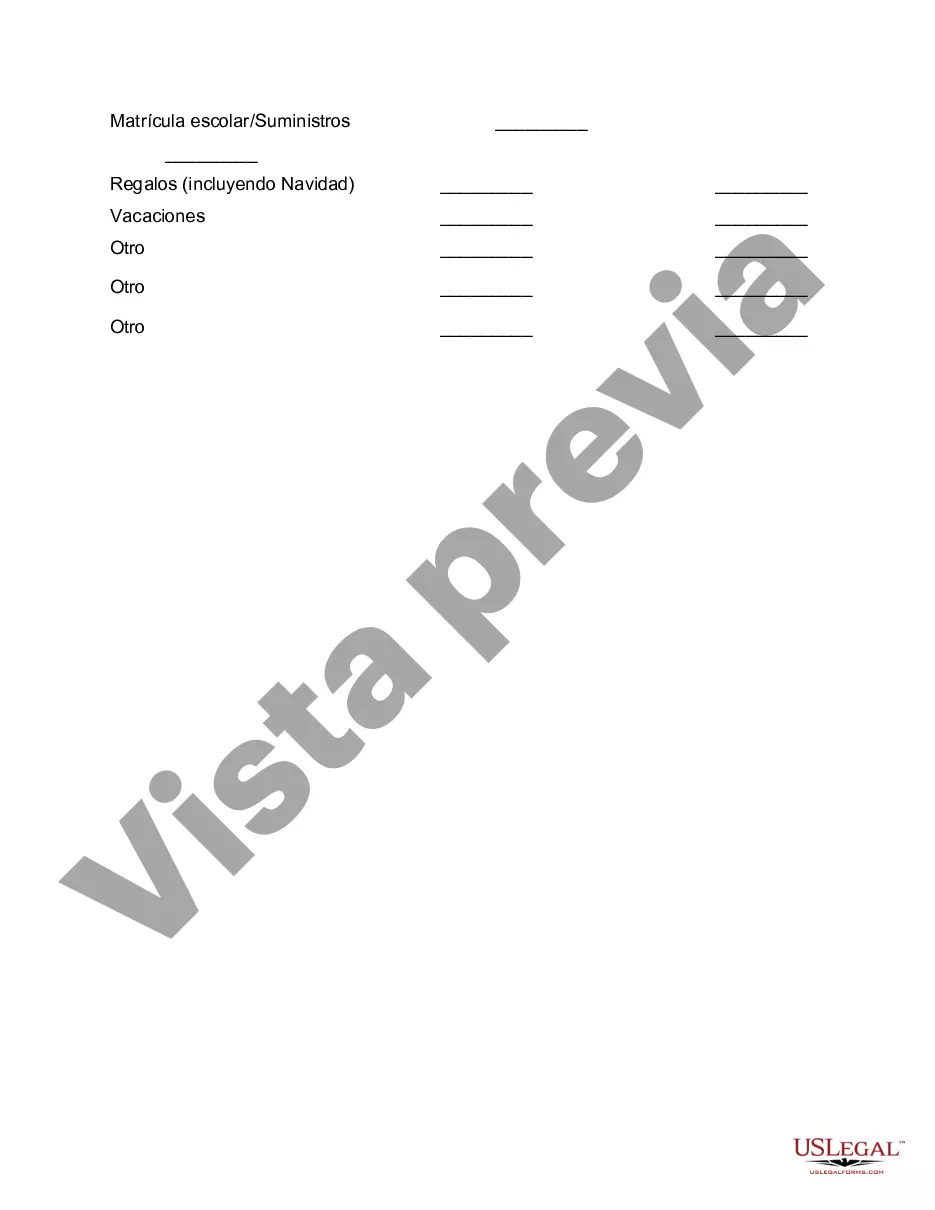

Hennepin County, located in Minnesota, is one of the largest and most populous counties in the state. As such, having a solid financial plan is crucial for residents in Hennepin to handle their expenses effectively and be prepared for unexpected emergencies. One essential aspect of financial planning is establishing a savings account for both budgeting and emergency purposes. In this article, we will delve into the breakdown of savings for budget and emergency funds specific to Hennepin County, discussing different types and strategies. 1. Hennepin County Budgeting Savings: — Monthly Expense Allocation: When residents create a budget, they should allocate a specific portion of their income towards various monthly expenses such as rent/mortgage, groceries, transportation, utilities, insurance, and more. — Leisure and Entertainment: It is essential to set aside money for leisure activities, including dining out, travel, hobbies, and entertainment, to ensure a balanced lifestyle. — Healthcare and Insurance: Allocating funds for health insurance premiums, deductibles, copay, and emergency medical expenses can safeguard individuals and families from unforeseen medical costs. — Education and Personal Development: Saving for educational pursuits and personal development workshops, courses, or conferences can expand knowledge and skills, leading to personal growth. 2. Hennepin County Emergency Fund Savings: — Job Loss or Income Reduction: Building an emergency fund to cover living expenses during a period of unemployment or reduced income is crucial. Experts often suggest having at least three to six months' worth of living expenses saved. — Medical Emergencies: Unforeseen medical emergencies can be financially burdensome. Having sufficient savings can help cover medical bills, prescription costs, or the need for temporary disability assistance. — Home Repairs or Damage: From unexpected appliance breakdowns to structural repairs, setting aside money for home-related emergencies can prevent financial strain when repairs are needed. — Car Repairs or Accidents: Maintaining an emergency fund to cover car repairs or potential accidents can prevent incurring debt or the need for costly loans. — Natural Disasters: Hennepin County experiences extreme weather conditions, including blizzards, storms, or flooding. Saving for emergencies like temporary relocation, essential supplies, or repairs after such events is essential. In summary, Hennepin County residents should consider different types of savings to effectively manage their finances. Budgeting savings should be allocated towards monthly expenses, leisure activities, healthcare, and personal development. Emergency fund savings should focus on potential job loss, medical emergencies, home or car repairs, and natural disasters. By planning and saving accordingly, individuals and families can achieve financial stability, peace of mind, and the ability to handle unexpected events.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Hennepin Minnesota Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Hennepin Breakdown of Savings for Budget and Emergency Fund, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Hennepin Breakdown of Savings for Budget and Emergency Fund from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Hennepin Breakdown of Savings for Budget and Emergency Fund:

- Take a look at the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!