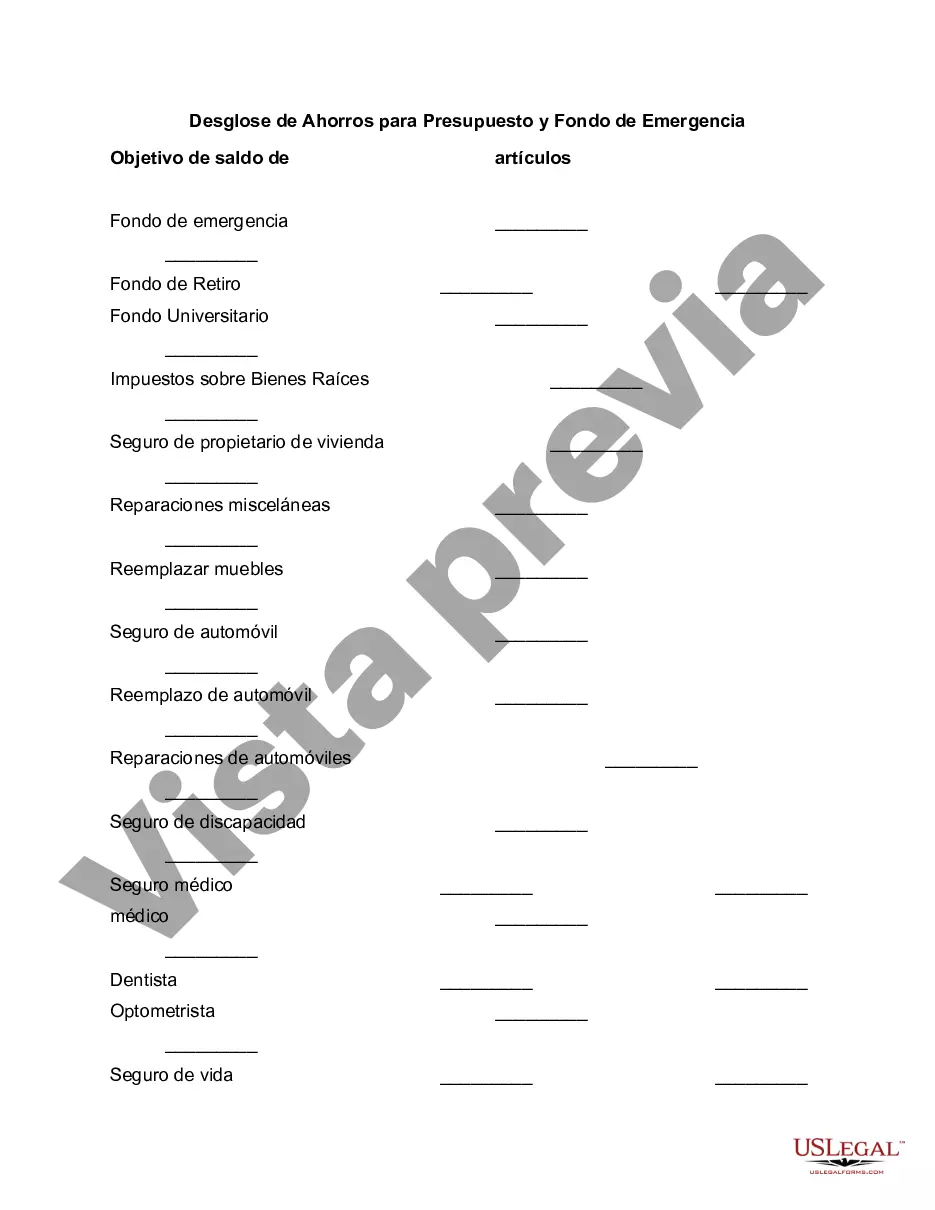

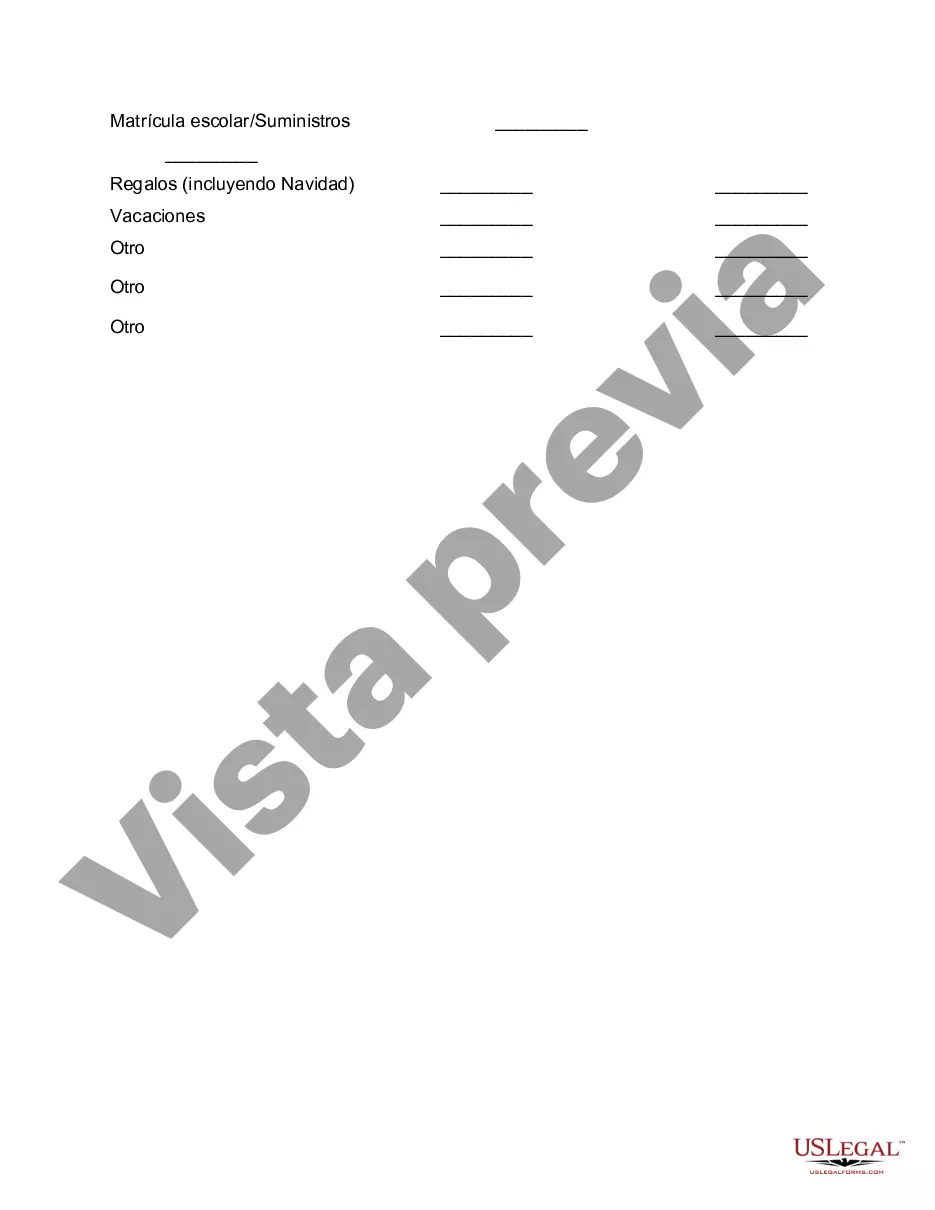

Los Angeles, California, is a vibrant and diverse city located on the southern coast of the United States. It is renowned for its stunning beaches, bustling entertainment industry, and cultural landmarks. Despite its allure, living in Los Angeles can be financially challenging. Therefore, it is crucial to have a breakdown of savings for both a budget and an emergency fund to navigate this bustling metropolis. The first type of savings breakdown is for a budget. Establishing a budget is essential to ensure your expenses align with your income and financial goals. This breakdown involves assigning specific amounts to various categories, such as housing, transportation, groceries, dining out, entertainment, and healthcare. By carefully allocating funds to each category, you can plan and manage your expenditures effectively, ultimately ensuring financial stability. Housing expenses typically account for a significant portion of one's budget in Los Angeles. With a high cost of living, finding affordable accommodation can be a challenge. Rent or mortgage payments should ideally be limited to no more than 30% of your income, allowing you to allocate enough funds for other essential expenses. Transportation is another crucial category when it comes to budgeting in Los Angeles. With widespread traffic congestion, owning a vehicle might necessitate allocating funds for car payments, insurance, fuel, and maintenance. Additionally, considering public transportation options like buses or trains can save money on commuting expenses. Groceries, dining out, and entertainment are categories where expenses should be carefully managed. By creating a detailed breakdown of your food-related expenditures, you can plan healthier and cost-effective meals. Limiting dining out and opting for homemade meals can significantly impact your savings. When it comes to entertainment, Los Angeles offers both free and paid options. Allocating a specific amount for recreational activities such as movies, concerts, or visiting amusement parks helps you enjoy the city's offerings while staying within budget limits. Healthcare is an important consideration, and allocating funds to health insurance premiums, co-payments, and prescriptions is essential. Accessing affordable healthcare providers within your insurance network can help you save on medical expenses. In addition to budgeting, an emergency fund breakdown is vital for unexpected situations, such as job loss, medical emergencies, or car repairs. Experts suggest having three to six months' worth of living expenses saved up for an emergency fund. This fund should cover essential expenses like housing, utilities, transportation, and groceries. By setting aside a specific percentage of your income each month, you can gradually build this financial safety net. To sum up, Los Angeles, California, requires a detailed breakdown of savings for budget and emergency funds to thrive in this dynamic city. By allocating funds to various categories such as housing, transportation, groceries, dining out, entertainment, and healthcare, you can effectively manage your finances. Simultaneously, establishing an emergency fund ensures financial security in unexpected situations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Los Angeles California Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

Drafting papers for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Los Angeles Breakdown of Savings for Budget and Emergency Fund without professional assistance.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Los Angeles Breakdown of Savings for Budget and Emergency Fund on your own, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Los Angeles Breakdown of Savings for Budget and Emergency Fund:

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any situation with just a couple of clicks!