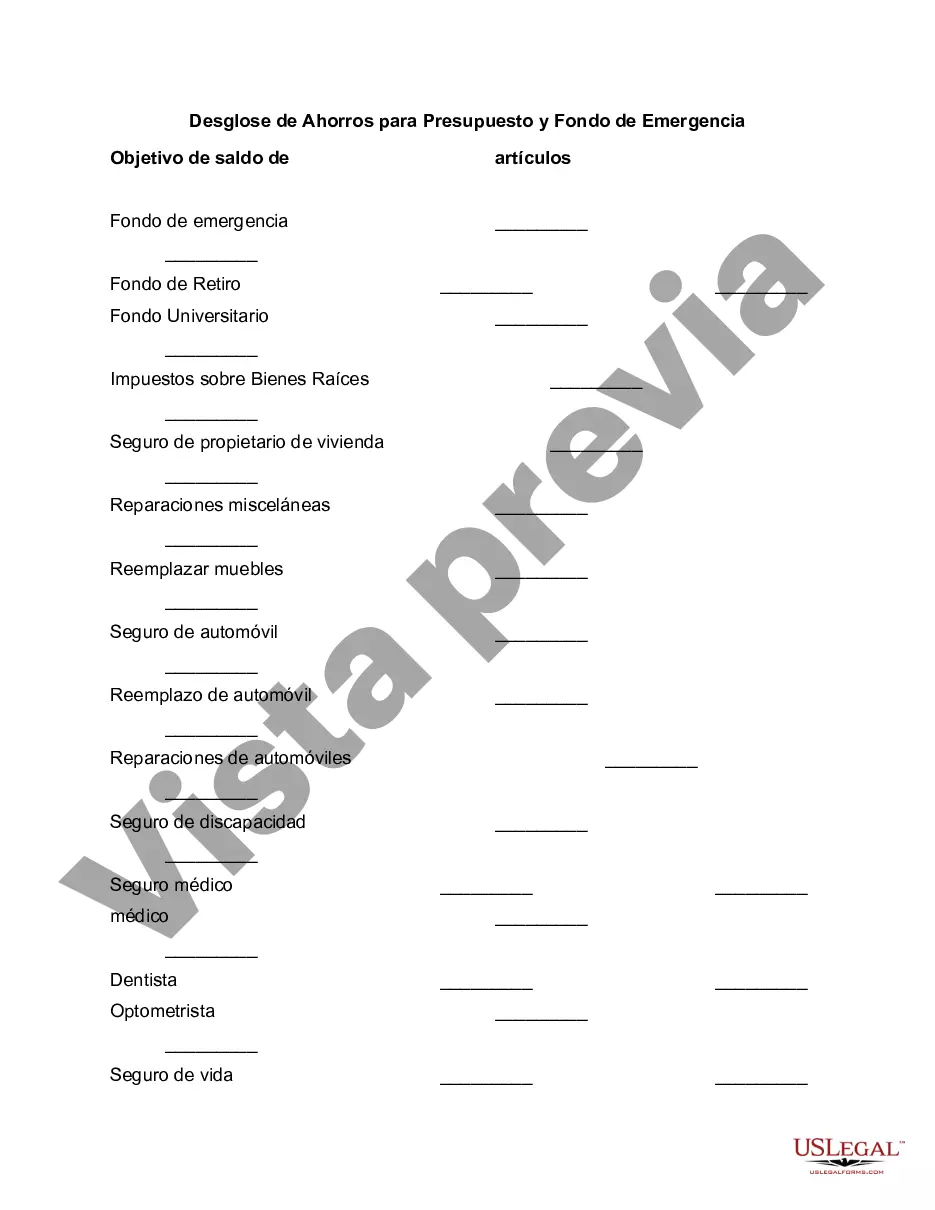

Maricopa, Arizona is a vibrant city located in Pinal County, known for its picturesque landscape and rapidly growing population. Boasting a charming small-town feel while offering modern amenities, Maricopa attracts both families and individuals looking for a peaceful suburban lifestyle within proximity to the bustling Phoenix metropolitan area. When it comes to managing finances, having a breakdown of savings for both budget and emergency fund is crucial to ensure financial stability in Maricopa, Arizona. Here we will explore the different types of savings, detailing their importance and strategies to build and maintain them. 1. Emergency Fund: An emergency fund is an essential component of any solid financial plan, particularly when residing in Maricopa, Arizona. This fund acts as a safety net to cover unexpected expenses such as medical emergencies, car repairs, and home repairs. It provides a sense of security and prevents individuals from going into debt during challenging times. Experts recommend having at least three to six months' worth of living expenses saved in an easily accessible account. By prioritizing saving a portion of each paycheck, individuals can gradually build their emergency fund. 2. Budget Savings: Budget savings refer to the money set aside from one's income specifically for planned expenses, future goals, or investments. It involves budgeting and allocating a certain percentage of income towards different categories, such as housing, transportation, groceries, and entertainment, ensuring that all expenses are covered while leaving room for saving. In Maricopa, Arizona, where the cost of living is relatively affordable compared to neighboring cities, individuals can focus on saving for short-term goals, vacations, or even a down payment for a home. 3. Retirement Savings: Maricopa, Arizona also offers wonderful retirement opportunities, making retirement savings a critical aspect of financial planning. Individuals can contribute to retirement accounts such as 401(k), individual retirement accounts (IRAs), or employer-sponsored plans. By consistently investing in retirement funds, residents can secure a comfortable and financially independent future. 4. Homeownership Savings: For individuals interested in homeownership, saving for a down payment is crucial, and in Maricopa, Arizona, homeownership is often more affordable than renting. By diligently saving a portion of their income, potential buyers can accumulate the necessary funds for a down payment, closing costs, and other homeownership expenses. 5. Education Fund: Maricopa, Arizona is home to excellent educational institutions, and saving for future educational expenses is vital for individuals with children or those planning to pursue higher education themselves. Establishing an education fund, such as a 529 plan, allows individuals to save and invest specifically for educational purposes, easing the burden of student loans. In conclusion, having a comprehensive breakdown of savings is integral for financial success in Maricopa, Arizona. Building an emergency fund, budget savings, retirement savings, homeownership savings, and education funds are key pillars to consider when planning for a secure financial future. By prioritizing financial stability and diligently saving in these areas, residents can enjoy the benefits of a thriving community while ensuring their financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Maricopa Arizona Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

Draftwing documents, like Maricopa Breakdown of Savings for Budget and Emergency Fund, to take care of your legal affairs is a tough and time-consumming process. A lot of situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can consider your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents crafted for a variety of scenarios and life circumstances. We ensure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Maricopa Breakdown of Savings for Budget and Emergency Fund template. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly straightforward! Here’s what you need to do before downloading Maricopa Breakdown of Savings for Budget and Emergency Fund:

- Make sure that your form is specific to your state/county since the rules for creating legal papers may differ from one state another.

- Learn more about the form by previewing it or going through a brief intro. If the Maricopa Breakdown of Savings for Budget and Emergency Fund isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin utilizing our website and get the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!