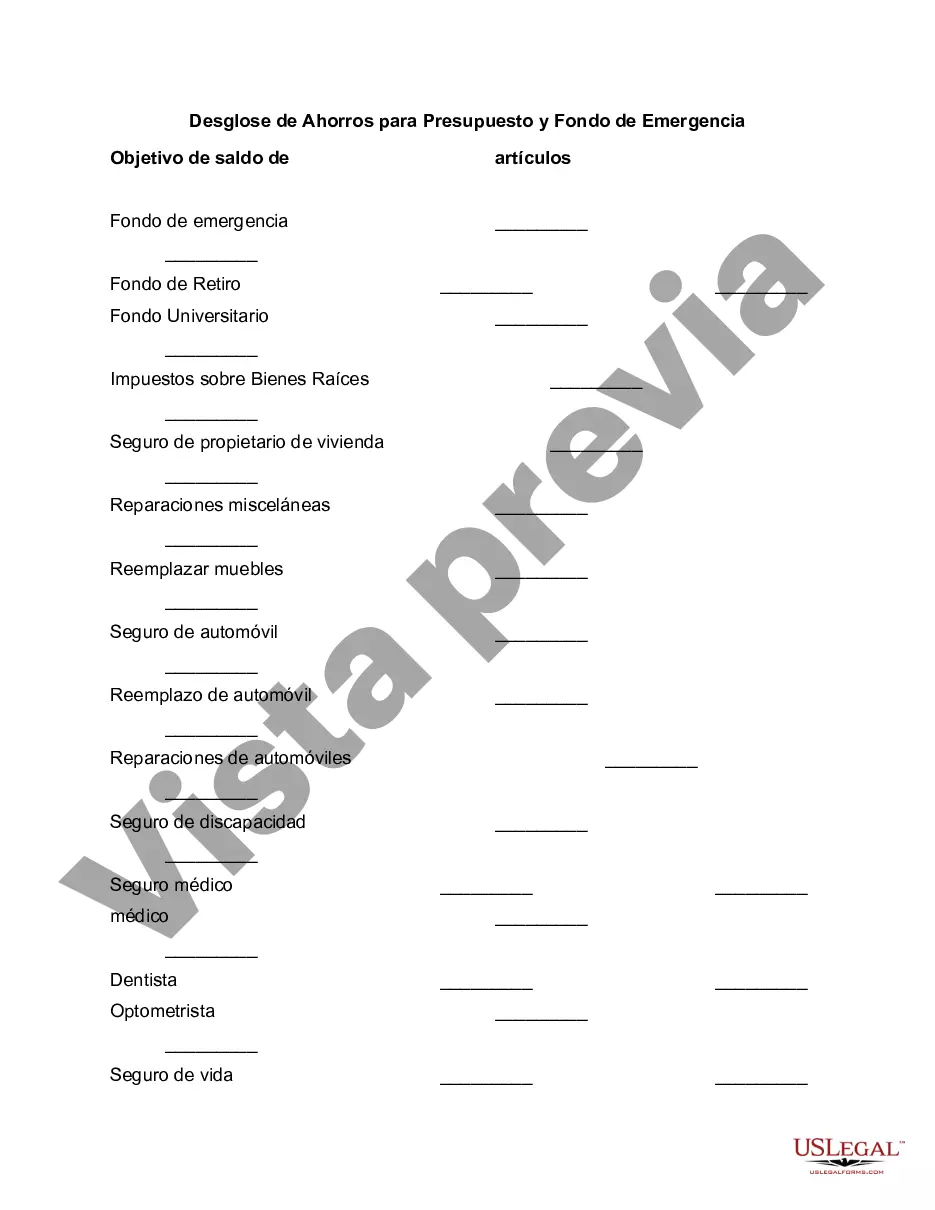

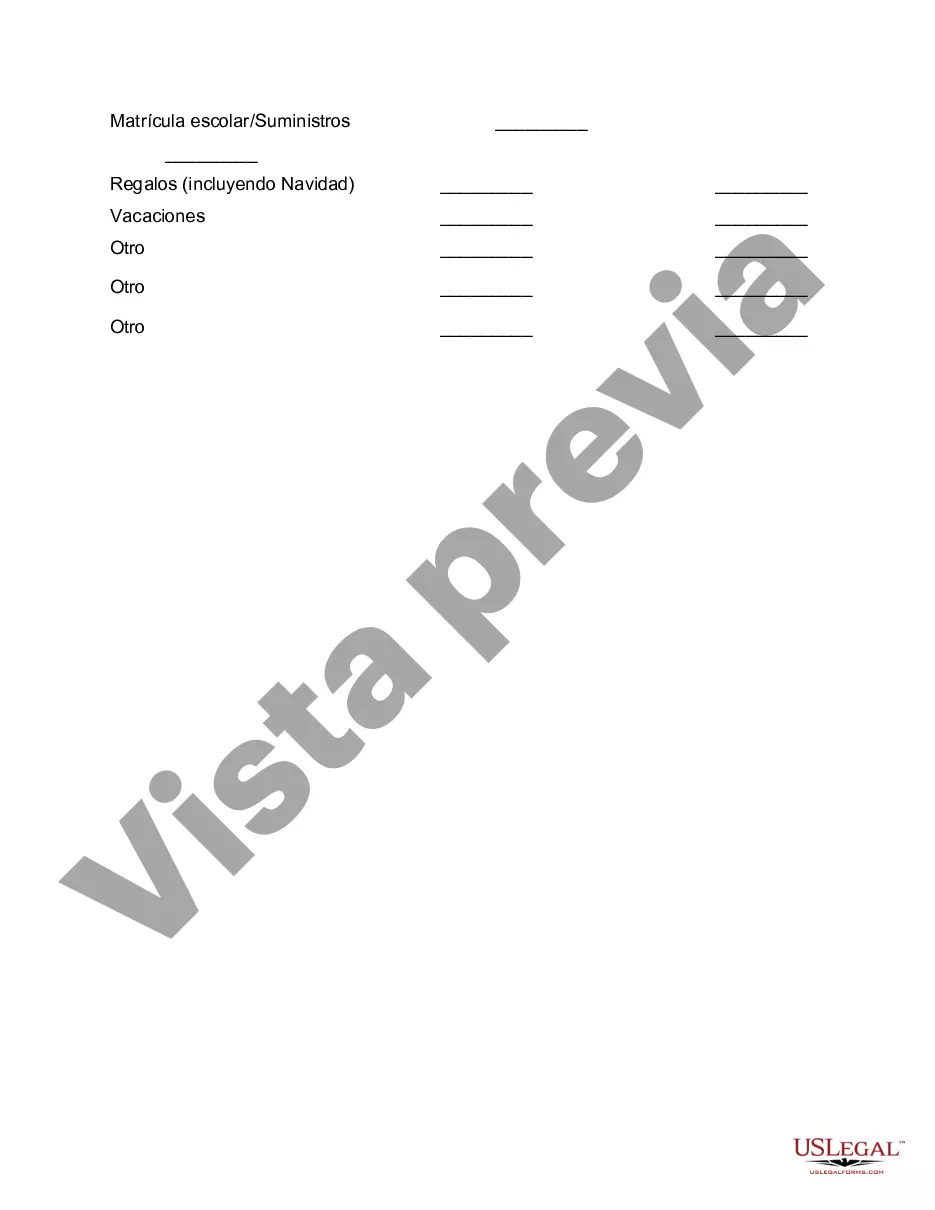

Mecklenburg County, located in the state of North Carolina, offers individuals and families various options for saving and creating a financial safety net. This breakdown will provide an in-depth description of the different types of savings accounts and funds designed for budgeting and emergency purposes in Mecklenburg County, NC. 1. Mecklenburg County Budget Savings: The county government encourages residents to maintain a budget savings account to effectively manage their finances. This type of savings account aims to cover planned expenses, such as annual property taxes, vehicle repairs, or regular home maintenance. By allocating a portion of their income to a budget savings account, individuals can avoid accruing debt or dipping into emergency funds to cover expected expenses. 2. Emergency Fund: An emergency fund serves as a safety net for unexpected financial crises, such as medical emergencies, job loss, or major unexpected repairs. Mecklenburg County residents are advised to maintain an emergency fund equivalent to at least three to six months of living expenses. This fund acts as a financial cushion, providing peace of mind and helping individuals avoid taking on debt or relying on high-interest loans during challenging times. 3. Retirement Savings: While not explicitly targeted towards emergency expenses, saving for retirement can indirectly contribute to an individual's financial security and preparedness. Mecklenburg County residents are encouraged to take advantage of retirement savings options such as employer-based plans like 401(k) or individual retirement accounts (IRAs). By regularly contributing to these accounts, individuals can build long-term savings and potentially access emergency funds through certain hardship withdrawal options. 4. College Savings: For families with children, saving for future education expenses is crucial. Mecklenburg County residents can make use of various college savings plans, such as 529 plans or Cover dell Education Savings Accounts. These accounts offer tax advantages and allow funds to grow over time to cover tuition, books, and other education-related expenses. While not specifically designed for emergencies, having college savings can provide families with additional financial flexibility in times of need. 5. Health Savings Accounts (Has): Has been tax-advantaged accounts that individuals can use to save for qualified medical expenses. Mecklenburg County residents who have high-deductible health insurance plans can contribute to an HSA and take advantage of tax deductions. Although primarily associated with healthcare expenses, Has can serve as an emergency fund for medical emergencies or unexpected healthcare costs that may not be fully covered by insurance. In summary, Mecklenburg County, North Carolina, offers individuals various opportunities to save and prepare for both expected and unexpected expenses. Residents can benefit from budget savings accounts for planned expenses, emergency funds for unforeseen events, retirement savings for long-term security, college savings options for future education expenses, and health savings accounts for qualified medical costs. By strategically utilizing these savings options, Mecklenburg County residents can enhance their financial stability, preparedness, and overall peace of mind.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Mecklenburg North Carolina Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

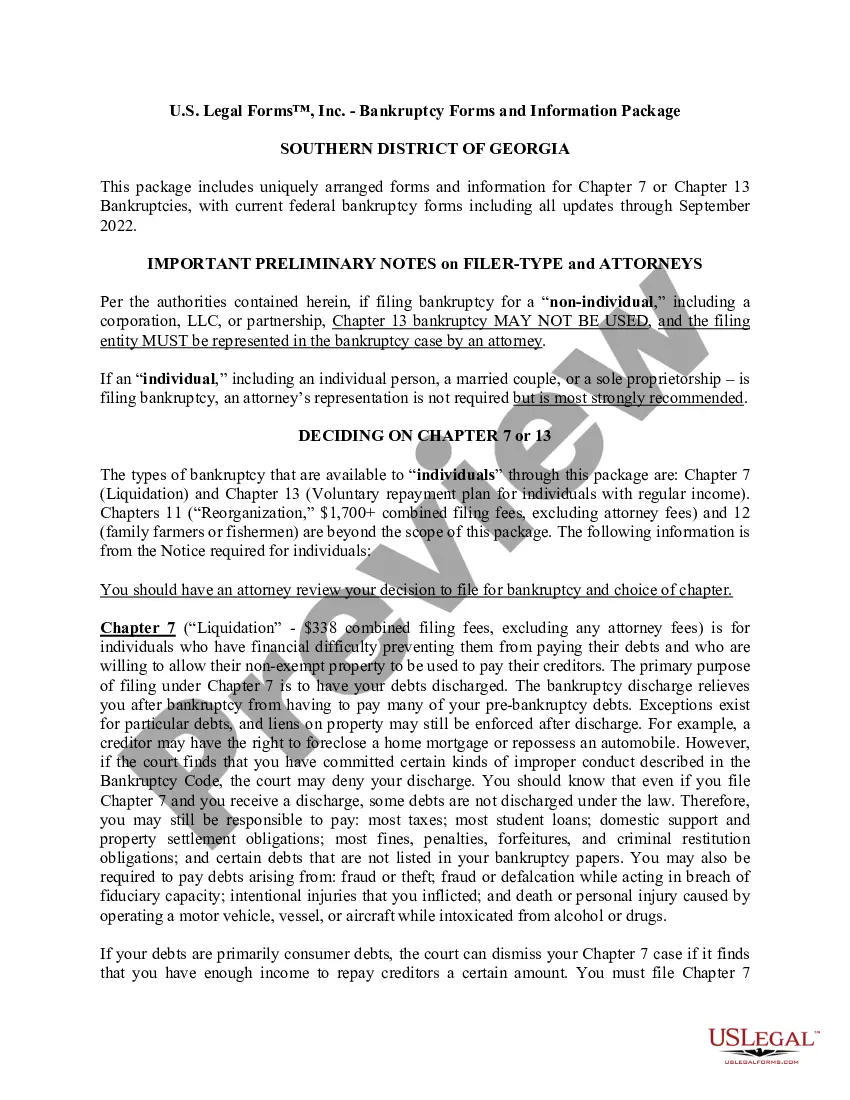

How much time does it typically take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, locating a Mecklenburg Breakdown of Savings for Budget and Emergency Fund suiting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. Apart from the Mecklenburg Breakdown of Savings for Budget and Emergency Fund, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Specialists check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can pick the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Mecklenburg Breakdown of Savings for Budget and Emergency Fund:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Mecklenburg Breakdown of Savings for Budget and Emergency Fund.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!