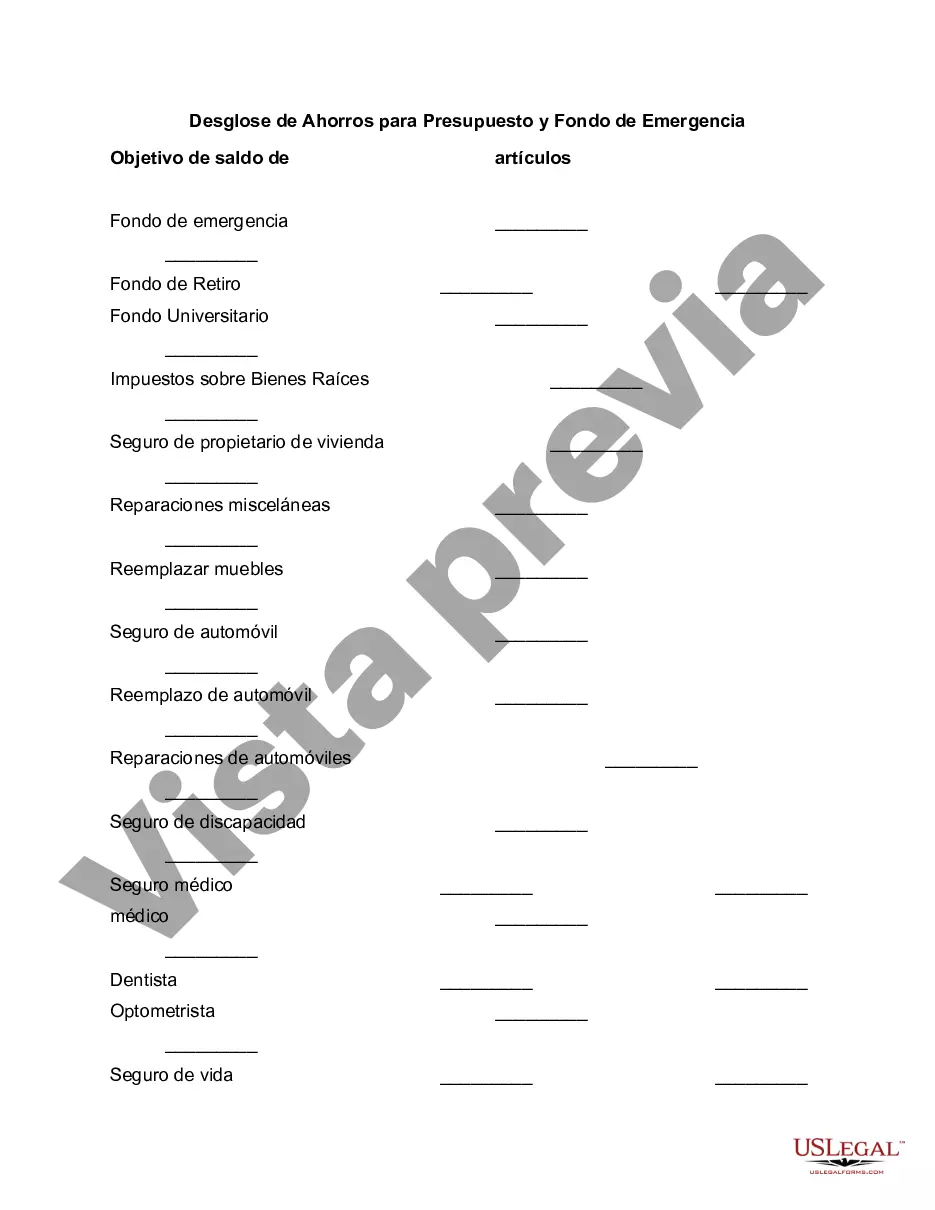

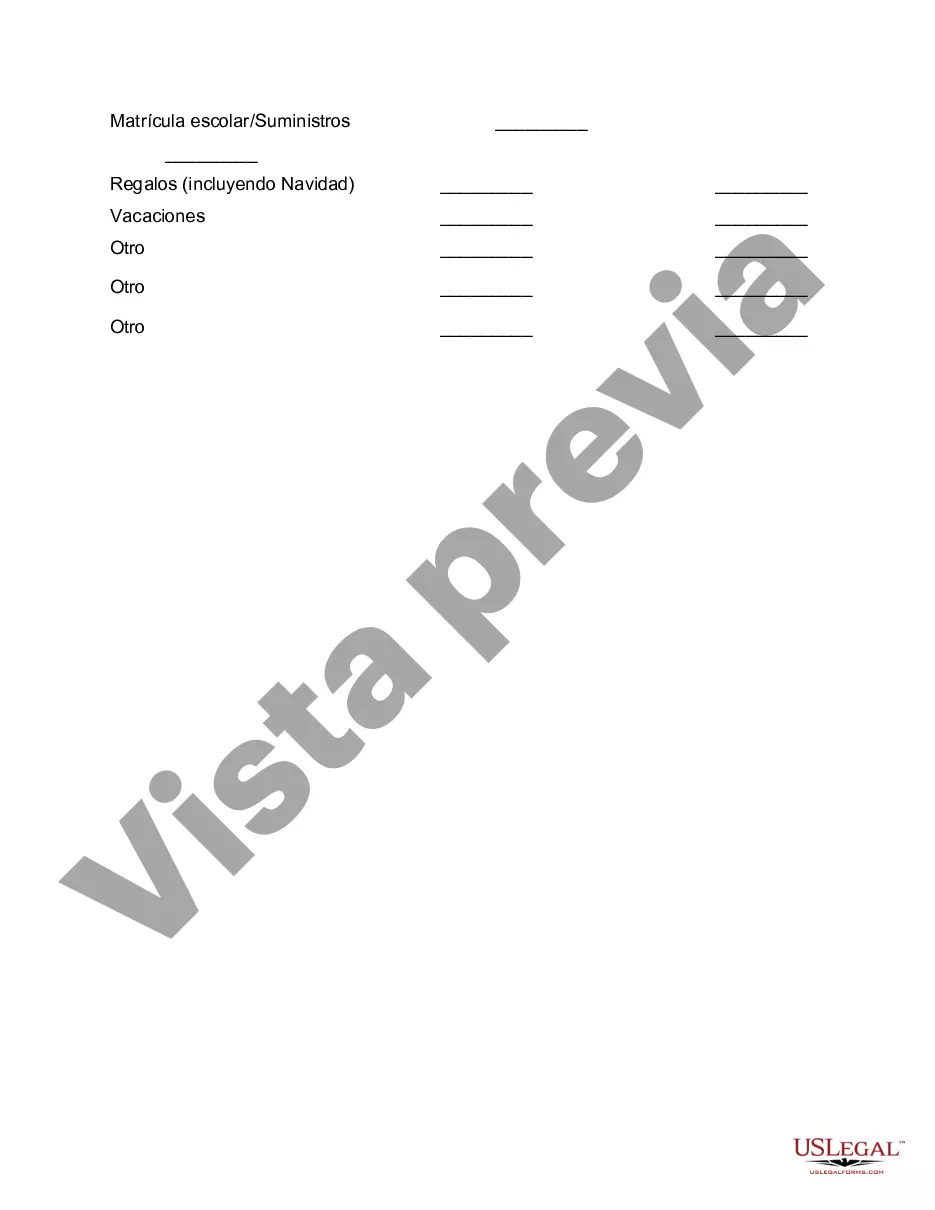

Phoenix Arizona is the bustling capital city of Arizona and is known for its warm climate, vibrant culture, and stunning desert landscapes. It offers a diverse range of activities, attractions, and amenities that make it an appealing place to live or visit. When creating a breakdown of savings for your budget and emergency fund in Phoenix Arizona, it is vital to consider various factors specific to the region. These factors include housing costs, transportation expenses, healthcare, recreational activities, and potential emergency situations unique to this area. 1. Housing Costs: Housing is a significant expense when living in Phoenix Arizona. Detailing the average rent or mortgage costs for different types of accommodation, such as apartments, condos, or single-family homes, can help you determine a realistic saving target. 2. Transportation Expenses: With its sprawling urban area, having a reliable mode of transportation is essential in Phoenix. Calculating a percentage of your budget for fuel, car insurance, and maintenance can enable you to plan your savings adequately. 3. Healthcare: Identifying the cost of healthcare services and insurance premiums in Phoenix Arizona will be crucial. Mentioning the average costs of medical consultations, prescription medications, and health insurance plans can help individuals plan for potential emergencies. 4. Recreational Activities: Phoenix offers a wide range of recreational activities, such as hiking, golfing, and visiting museums and galleries. Consider including a portion of your budget for leisure activities and entertainment, ensuring a balanced financial plan. 5. Emergency Fund: Building an emergency fund is vital to prepare for unexpected events like natural disasters, medical emergencies, or sudden job loss. Specify an amount or percentage of your income that you should save each month for emergencies, and stress the importance of maintaining a separate fund solely for unexpected expenses. By incorporating relevant keywords related to Phoenix Arizona, you can optimize the content for search engines. Some suitable keywords include Phoenix Arizona budgeting, Phoenix emergency fund breakdown, savings plan in Phoenix, budgeting for housing in Phoenix, calculating transportation costs in Phoenix, healthcare expenses in Phoenix, and emergency preparedness in Phoenix Arizona. There are no specific types of breakdowns for savings for budget and emergency funds in Phoenix Arizona, as the content will largely depend on individual needs and circumstances. However, by addressing the various aspects mentioned above, you can create a comprehensive guide that caters to individuals living or planning to live in Phoenix Arizona.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Phoenix Arizona Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a legal professional to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Phoenix Breakdown of Savings for Budget and Emergency Fund, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Consequently, if you need the current version of the Phoenix Breakdown of Savings for Budget and Emergency Fund, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Phoenix Breakdown of Savings for Budget and Emergency Fund:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Phoenix Breakdown of Savings for Budget and Emergency Fund and download it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!