Queens, New York: A Guide to Budgeting and Building an Emergency Fund Introduction: Queens, New York, located in the heart of the bustling city, is known for its cultural diversity, vibrant neighborhoods, and exciting opportunities. As an individual residing in Queens, it is essential to manage your finances wisely. This comprehensive guide will provide a detailed breakdown of savings for both budgeting and building an emergency fund, ensuring you are prepared for unexpected expenses and future financial stability. 1. Budgeting in Queens, New York: Budgeting is a fundamental component of financial management, allowing you to allocate your income effectively and track your expenses. In Queens, where the cost of living may vary depending on the neighborhood, creating a realistic and personalized budget is crucial. Here's a breakdown of essential savings categories: a. Housing: Rent or mortgage payments make up a significant portion of monthly expenses in Queens. Allocate a reasonable percentage of your income towards housing while considering factors like utilities, maintenance, and insurance. b. Transportation: Given the city's extensive public transportation system, it's essential to budget for subway or bus fares, ride-sharing services, or car-related expenses like fuel, parking, and insurance. c. Food and Groceries: Queens is a food lover's paradise, offering a wide range of cuisines and dining options. Allocate a reasonable amount towards groceries and dining out, considering both home-cooked meals and occasional indulgences in the borough's diverse culinary scene. d. Utilities: Include expenses for electricity, water, internet, and cable services in your budget. Prices may vary depending on the size of your household and usage. e. Entertainment and Recreation: Queens boasts a plethora of recreational activities, cultural events, and parks. Dedicate a portion of your budget to entertainment, such as movie tickets, museum visits, fitness memberships, or outdoor activities. f. Miscellaneous Expenses: Account for miscellaneous costs like healthcare, personal care products, clothing, gifts, and unexpected expenses. 2. Building an Emergency Fund in Queens, New York: An emergency fund provides a safety net during unexpected financial crises. It's crucial to set aside funds for unforeseen circumstances such as job loss, medical emergencies, or home repairs. Consider the following strategies: a. Determine your Emergency Fund Goal: Financial experts recommend saving three to six months' worth of living expenses in your emergency fund. Assess your monthly spending and set a realistic savings target. b. Automate Savings: Set up automatic transfers from your checking account to a dedicated emergency savings account. This helps ensure consistent savings growth without the temptation to spend. c. Minimize Unnecessary Expenses: Review your budget to identify areas where you can cut back and redirect savings towards building your emergency fund. This might include reducing dining out expenses, eliminating subscription services, or renegotiating utility bills. d. Explore Savings Vehicles: Consider utilizing high-yield savings accounts, certificates of deposit (CDs), or money market accounts to maximize the growth potential of your emergency fund. e. Regularly Reassess and Adjust: Periodically review and adjust your emergency fund savings goals based on changing circumstances, such as increased expenses, career changes, or new financial responsibilities. Different Types of Queens New York Breakdown of Savings for Budget and Emergency Fund: While the breakdown of savings for budgeting and emergency funds remains consistent for individuals across Queens, the specific cost considerations may differ based on the neighborhood or specific circumstances. Some neighborhoods within Queens might have higher housing costs, requiring a greater allocation towards rent or mortgage payments. Additionally, factors such as family size, transportation needs, and entertainment preferences can contribute to slight variations in the breakdown of savings. Conclusion: Managing your finances effectively in Queens, New York, encompasses proper budgeting and building an emergency fund. Analyzing your expenses, setting financial goals, and diligently saving will help ensure you have a stable financial foundation. By employing the strategies outlined in this guide, you can navigate the vibrant city of Queens while securing your financial well-being.

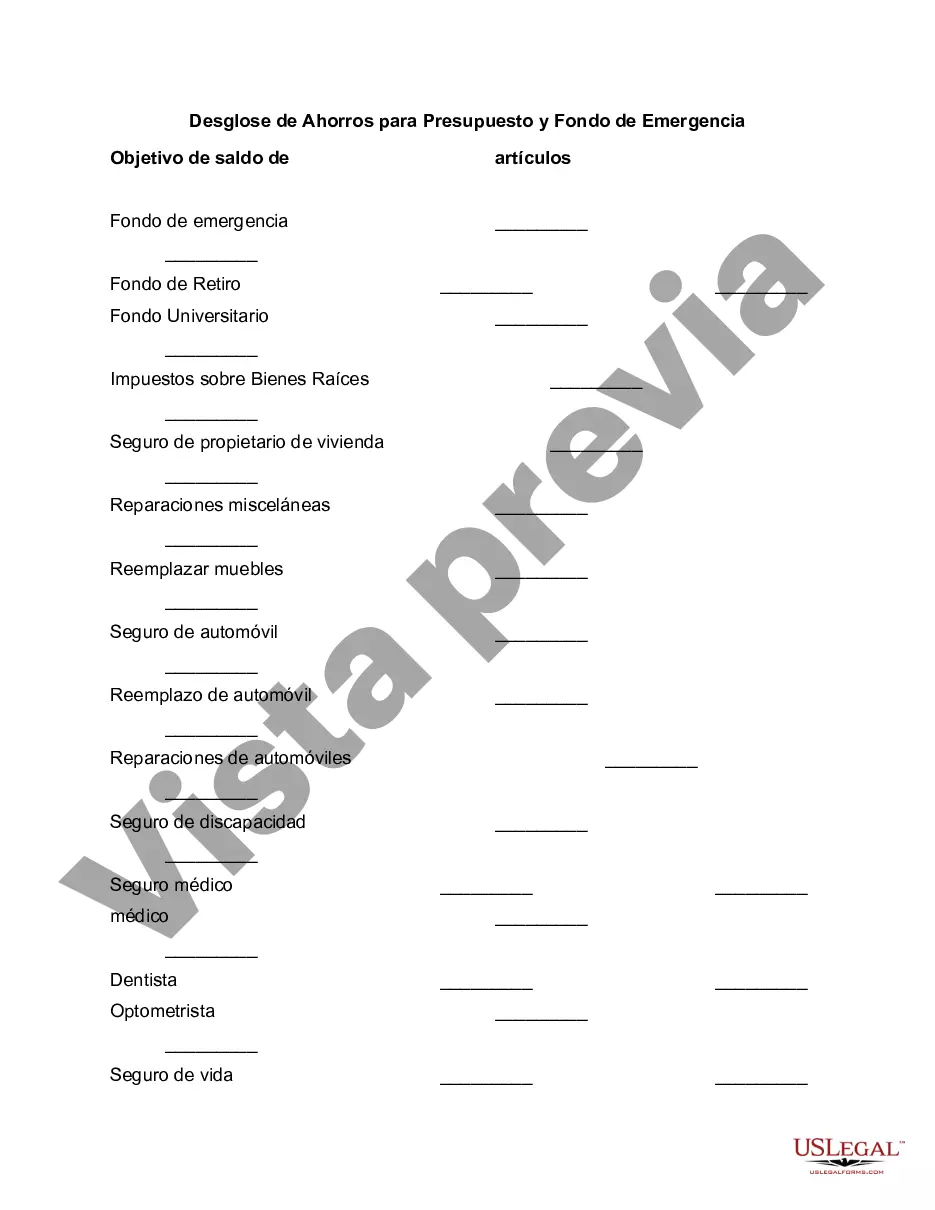

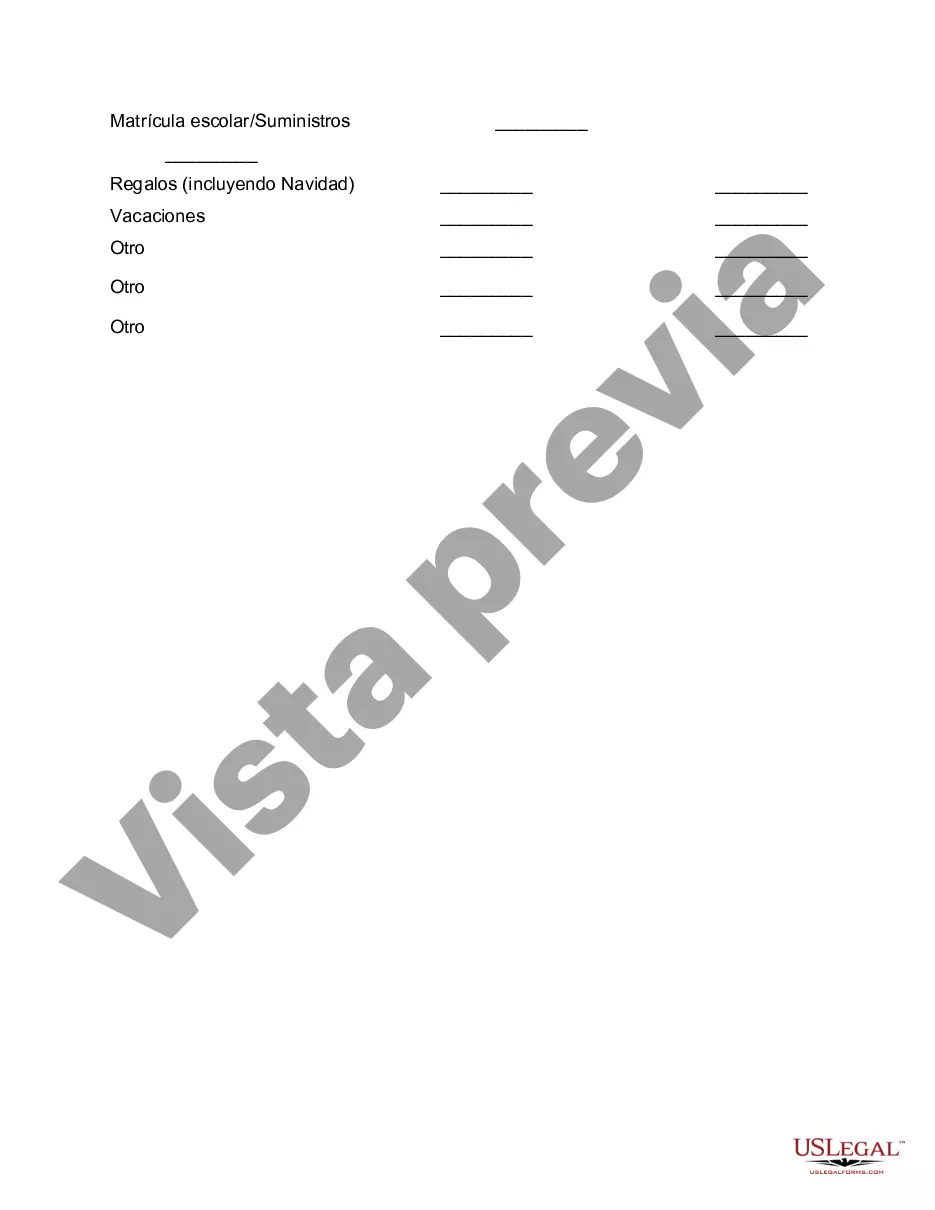

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Queens New York Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

Draftwing paperwork, like Queens Breakdown of Savings for Budget and Emergency Fund, to manage your legal affairs is a challenging and time-consumming task. Many situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can consider your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms crafted for various cases and life situations. We make sure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Queens Breakdown of Savings for Budget and Emergency Fund template. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as easy! Here’s what you need to do before downloading Queens Breakdown of Savings for Budget and Emergency Fund:

- Ensure that your form is compliant with your state/county since the rules for creating legal paperwork may vary from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the Queens Breakdown of Savings for Budget and Emergency Fund isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin utilizing our website and get the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is all set. You can go ahead and download it.

It’s easy to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!