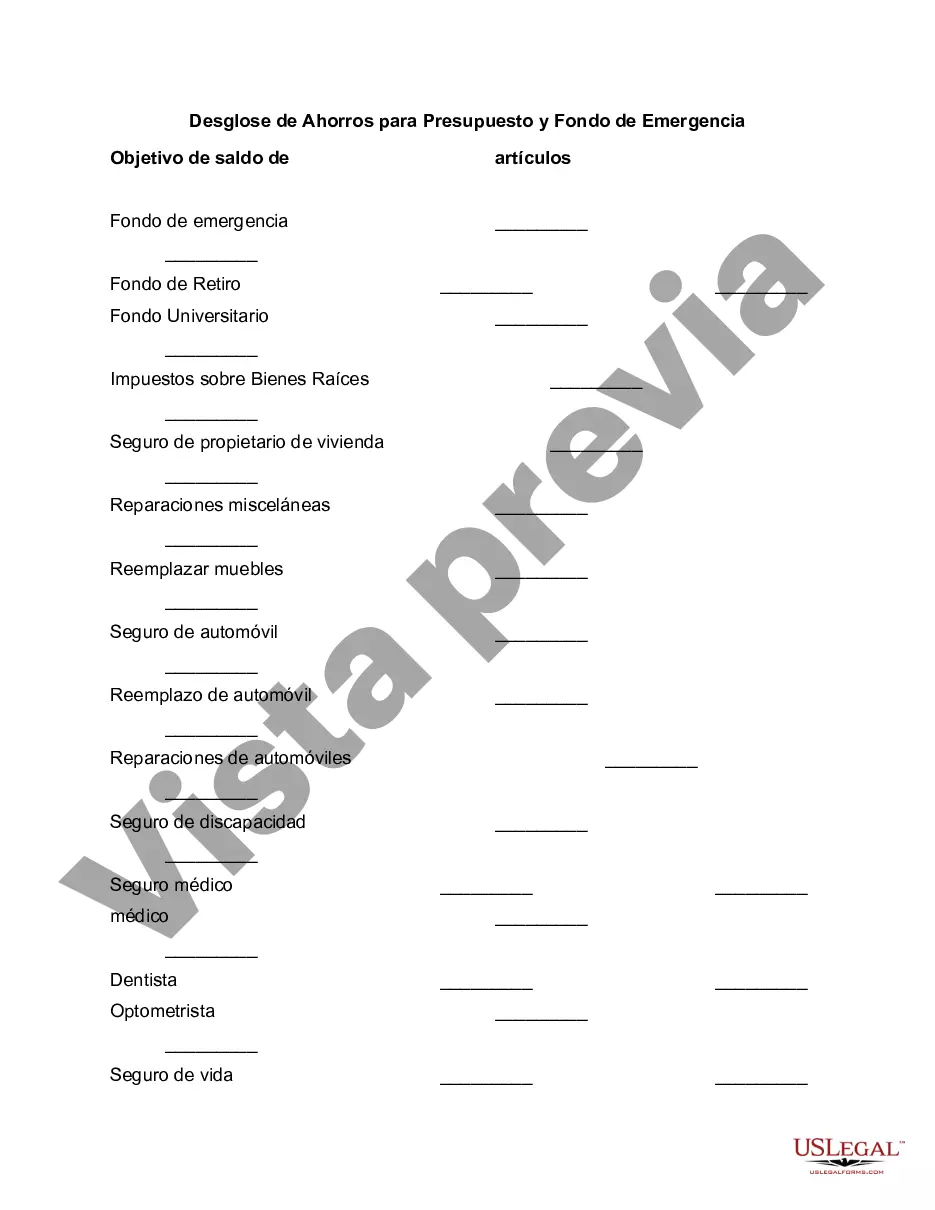

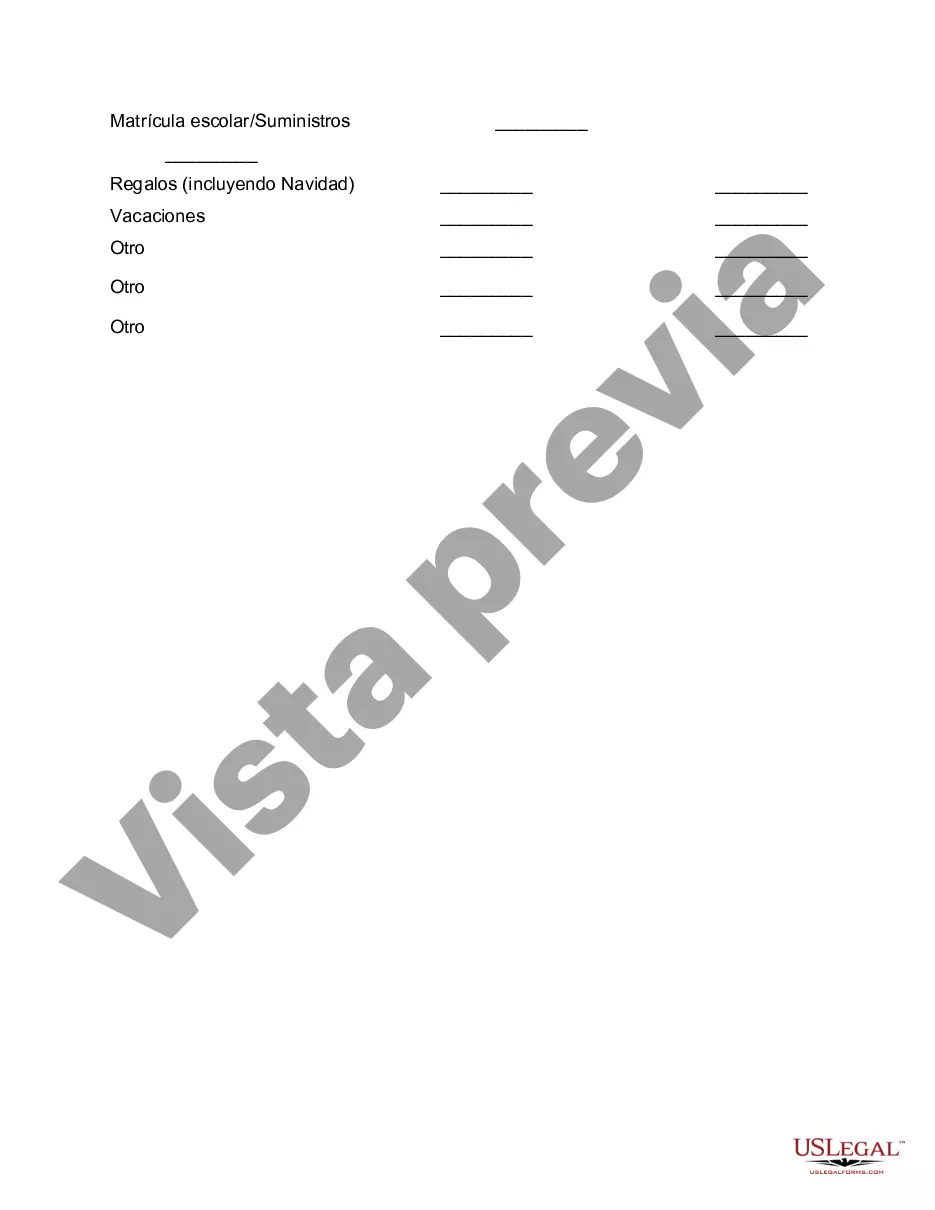

Salt Lake City, Utah, is the capital and largest city in the state of Utah. It is known for its stunning natural surroundings, including the nearby Great Salt Lake and the majestic Wasatch Mountains. In addition to its natural beauty, Salt Lake City offers a bustling downtown area with a thriving arts and cultural scene, as well as a strong economy. When it comes to managing finances in Salt Lake City, having a breakdown of savings for both budget and emergency funds is crucial. By understanding the different types of savings accounts and their purposes, individuals can better prepare for unexpected expenses and achieve their financial goals. Here is a detailed description of what Salt Lake Utah breakdown of savings for budget and emergency fund entails: 1. Budget Savings: — Regular Savings Account: This is a basic savings account where individuals can deposit and withdraw funds as needed. It is an ideal account for short-term savings and easily accessible funds. — High-Yield Savings Account: These accounts offer higher interest rates compared to regular savings accounts, allowing individuals to grow their savings faster. They are great for mid-term savings goals, such as a down payment on a house or a dream vacation. — Certificate of Deposit (CD): A CD is a type of savings account that offers a fixed interest rate for a specific period. It requires a deposit with a promise not to withdraw for a predetermined length of time. This is an excellent option for long-term savings goals, as the funds cannot be accessed until the CD matures, typically ranging from a few months to several years. 2. Emergency Fund Savings: — Dedicated Emergency Savings Account: It is crucial to have a separate account specifically designated for emergency funds. This ensures that unexpected expenses, such as medical bills or car repairs, can be covered without derailing the budget. A savings account with easy access, like a regular savings account, is a suitable option for emergency funds. — Money Market Account: A money market account combines features of both savings and checking accounts, offering higher interest rates while providing limited check-writing abilities. These accounts often require a higher minimum balance but offer added flexibility for emergency situations. — Rainy Day Fund: This is a personal emergency fund kept at home, usually in cash, for immediate access during emergencies when electronic transactions may not be possible. It is only recommended for small amounts and should be kept in a secured place. In Salt Lake City, individuals should strive to balance their budget savings with emergency fund savings, focusing on both short-term and long-term financial goals. By adopting a comprehensive savings strategy and utilizing various types of savings accounts, individuals can ensure financial stability and peace of mind in any situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Salt Lake Utah Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

If you need to find a trustworthy legal form supplier to get the Salt Lake Breakdown of Savings for Budget and Emergency Fund, consider US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can browse from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of learning materials, and dedicated support team make it simple to find and execute different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply select to look for or browse Salt Lake Breakdown of Savings for Budget and Emergency Fund, either by a keyword or by the state/county the form is created for. After finding the necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Salt Lake Breakdown of Savings for Budget and Emergency Fund template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription option. The template will be immediately available for download once the payment is completed. Now you can execute the form.

Handling your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes these tasks less expensive and more affordable. Create your first business, organize your advance care planning, draft a real estate contract, or complete the Salt Lake Breakdown of Savings for Budget and Emergency Fund - all from the convenience of your sofa.

Sign up for US Legal Forms now!