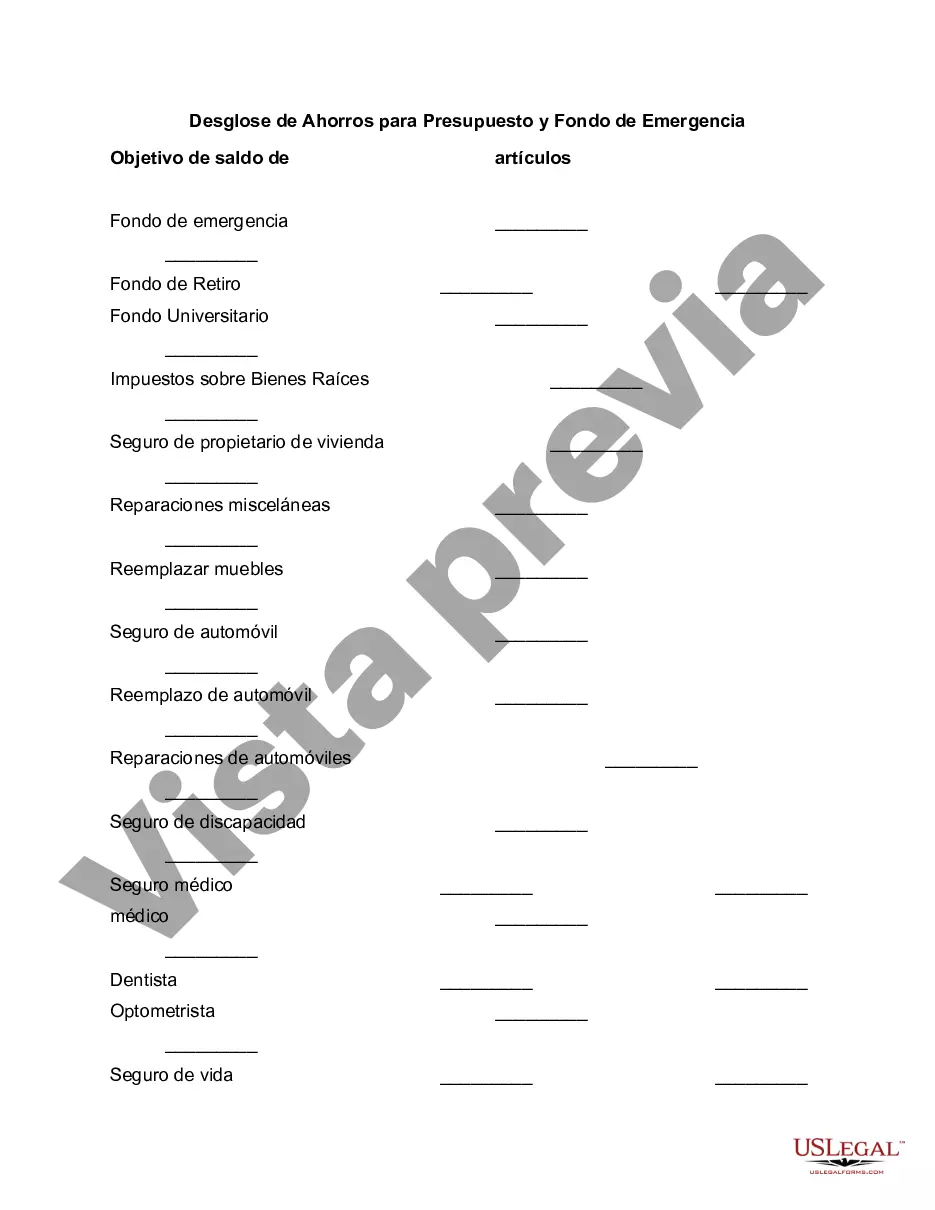

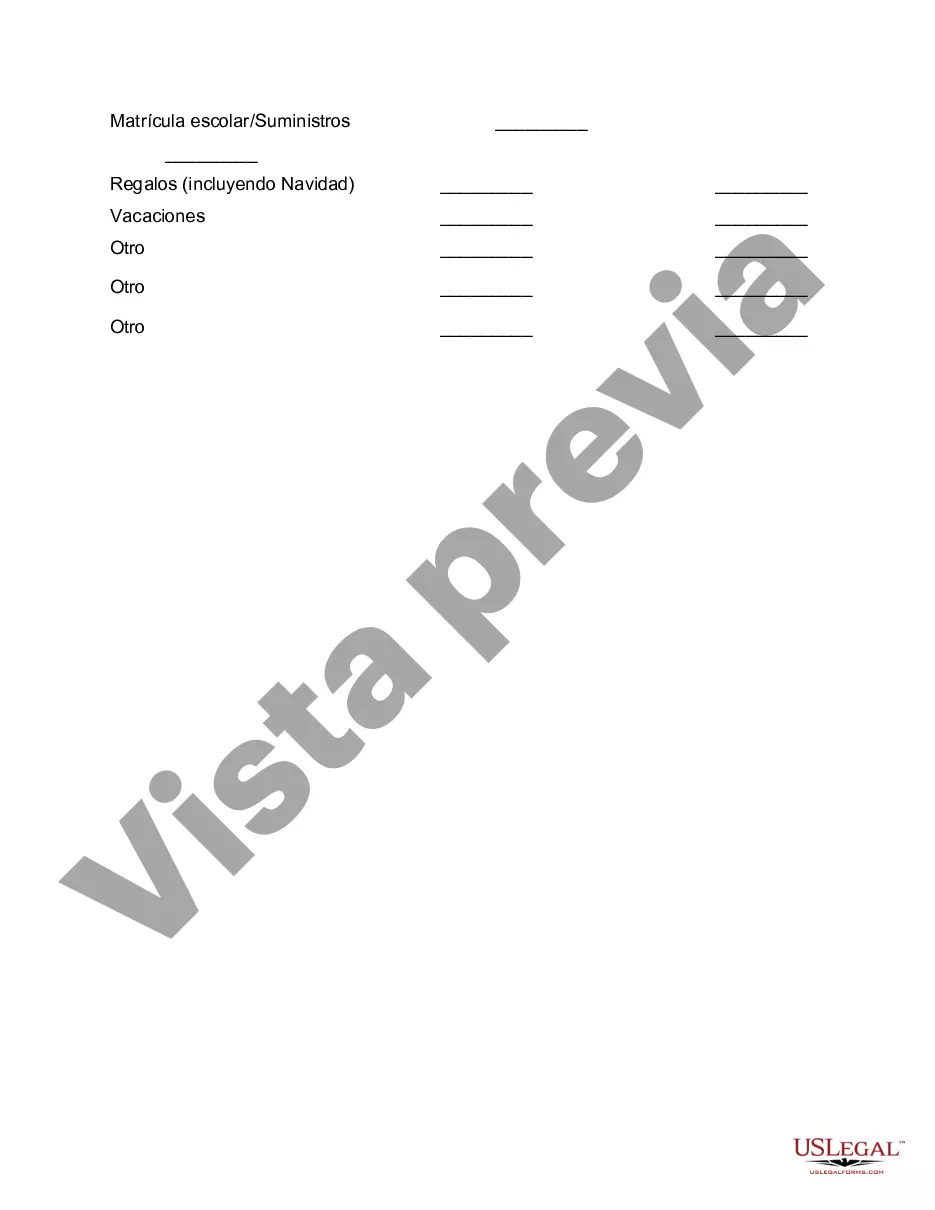

San Jose, California is a vibrant city located in the heart of Silicon Valley. Known for its tech industry, diverse culture, and beautiful landscapes, San Jose offers a range of opportunities for residents and visitors alike. When it comes to managing finances, understanding the breakdown of savings for budget and emergency funds is essential. Budgeting plays a crucial role in ensuring financial stability and achieving long-term goals. By allocating funds for different expenses, individuals can effectively manage their income and expenditures. In San Jose, residents typically consider the following categories when creating a budget: 1. Housing: San Jose's real estate market can be quite competitive, with high rental and housing costs. Allocating a significant portion of the budget towards rent or mortgage payments is common for many residents. 2. Transportation: Public transportation options such as buses, light rail, and Caltrain are widely available in San Jose. However, individuals may also need to budget for car-related expenses, including gas, insurance, and maintenance. 3. Groceries and Dining: San Jose offers a diverse culinary scene, from local food trucks to high-end restaurants. Including a budget for groceries and dining out is important to maintain a healthy and well-balanced lifestyle. 4. Utilities: San Jose has a Mediterranean climate, resulting in moderate temperatures throughout the year. Budgeting for utilities like electricity, water, and internet services is essential for maintaining a comfortable living environment. 5. Health and Wellness: Prioritizing health by allocating funds for gym memberships, healthcare, and wellness activities is common in San Jose. Many residents enjoy outdoor activities like hiking and biking. 6. Entertainment and Recreation: San Jose boasts numerous entertainment options, including museums, theaters, sports events, and outdoor parks. Budgeting for leisure activities allows individuals to enjoy the city's offerings without overspending. While budgeting sets the foundation for financial stability, it is equally important to establish an emergency fund. An emergency fund serves as a safety net during unexpected situations, such as job loss, medical emergencies, or major home repairs. Typically, financial advisors recommend aiming for three to six months' worth of living expenses in an emergency fund. When it comes to different types of San Jose California Breakdown of Savings for Budget and Emergency Fund, it mainly depends on individual financial circumstances and goals. Some individuals may have specific savings accounts for various purposes, such as: 1. General Savings: This account can be used for short-term goals like vacations, home upgrades, or purchasing a new vehicle. It allows individuals to save for specific non-emergency expenses. 2. Retirement Savings: Saving for retirement is crucial for long-term financial security. Setting aside a portion of income in retirement accounts like a 401(k) or an Individual Retirement Account (IRA) can help individuals prepare for their golden years. 3. Education Savings: If individuals have children, they may consider saving for their educational expenses. Establishing dedicated education savings accounts, such as 529 plans, can help cover future college costs. In summary, San Jose, California, offers numerous opportunities for individuals to manage their finances, set budgets, and establish emergency funds. Allocating funds towards essential expenses such as housing, transportation, groceries, and utilities, while also saving for emergencies and long-term goals, is crucial for a secure financial future. By understanding the breakdown of savings and planning accordingly, residents of San Jose can navigate their finances with confidence.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out San Jose California Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

Whether you intend to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like San Jose Breakdown of Savings for Budget and Emergency Fund is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several additional steps to obtain the San Jose Breakdown of Savings for Budget and Emergency Fund. Follow the guidelines below:

- Make sure the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the proper one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Jose Breakdown of Savings for Budget and Emergency Fund in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

¿Te has planteado para que sirve un plan de ahorro? Se trata de un producto financiero cuya funcion es ayudarte a planificar una estrategia en el ahorro personal, evitando los riesgos de otros modelos de inversion. Ademas, propicia que puedas ir creando una bolsa de ahorro constante en los anos venideros.

20 anos: el trabajador tiene que haber ahorrado un 25% de su salario anual actual. 30 anos: se debe tener ahorrado el 100% de su salario anual actual. 35 anos: ahorrado el doble del sueldo anual actual. 40 anos: el triple del sueldo anual actual.

¿Cuanto deberia ahorrar? Si bien la magnitud de su fondo de emergencia variara dependiendo de su estilo de vida, los costos mensuales, las vias de ingresos y los dependientes, la regla basica consiste en apartar por lo menos el valor de tres a seis meses de gastos.

Ideas para crear un fondo de emergencia Calcula tus gastos mensuales. Haz una lista de todos tus gastos mensuales regulares: costos de vivienda, alimentos, servicios publicos, pagos de deudas, transporte y todo lo demas que "debes pagar".Decide cuanto ahorrar para tu fondo.Determina un plazo.Abre una cuenta.

Consejos practicos para ayudar a ahorrar a los mas pequenos de la casa: Ganarse la paga.Ensenarles a ahorrar para conseguir cosas que le gustan es un incentivo (aunque con limites, claro).Ensenarles a hacer lista de la compra.Dejar que se equivoquen.Marcaros metas familiares conjuntas.

Se recomienda que el fondo de emergencias debe ser equivalente a cuatro (4) meses de nuestros gastos mensuales vitales. Esto significa que podamos vivir al menos durante cuatro meses sin ingresos.

El plan de ahorro es un ejercicio sencillo que te ayudara a determinar cuanto dinero necesitas para lograr tu meta y en cuanto tiempo podras alcanzarla. Este es un ejemplo sencillo de un plan de ahorro de Juan Perez, que servira de modelo para que completes el tuyo: ¿Cual es la meta de ahorro?

La primera pregunta que deberemos contestar para planificar nuestro ahorro es que tenemos y como gastamos. Basicamente, se trata de hacer un diagnostico de nuestra economia para conocer nuestro patrimonio y nuestra capacidad de ahorro. Tambien podremos identificar que areas tienen un margen para la mejora.

Fija metas y considera los siguientes consejos: Los planes de ahorro deben tener un objetivo. Comienza con metas pequenas y a corto plazo. Despues, establece objetivos mayores con plazos mas amplios. Define el monto que se requiere reunir como parte de cada meta. Calcula el tiempo que te vas a tardar en alcanzarla.

Cuenta de banco o cooperativa de credito Si tiene una cuenta en algun banco o cooperativa de credito, generalmente considerada como la opcion mas segura para tener su dinero, podria ser una buena idea contar una cuenta especificamente para guardar y mantener estos fondos.