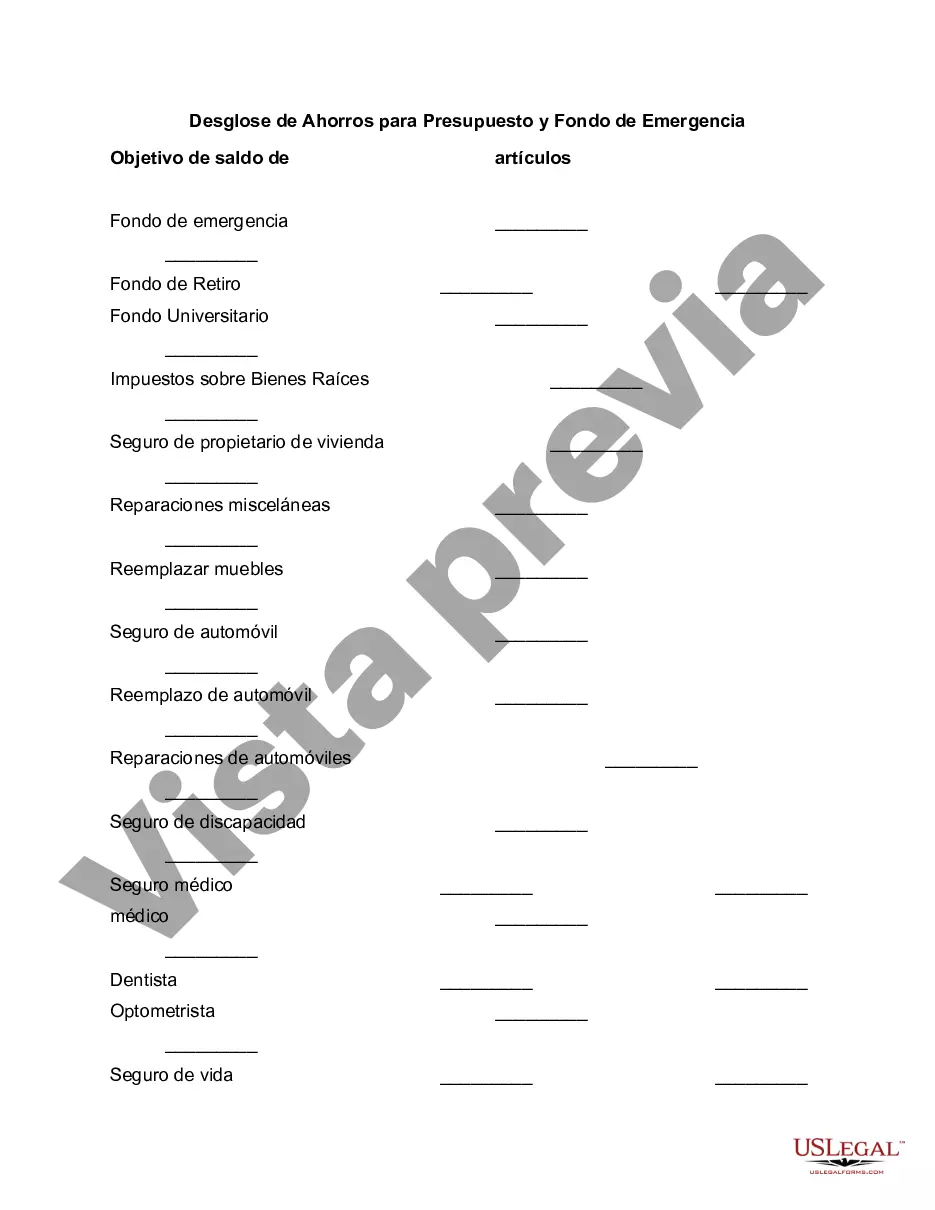

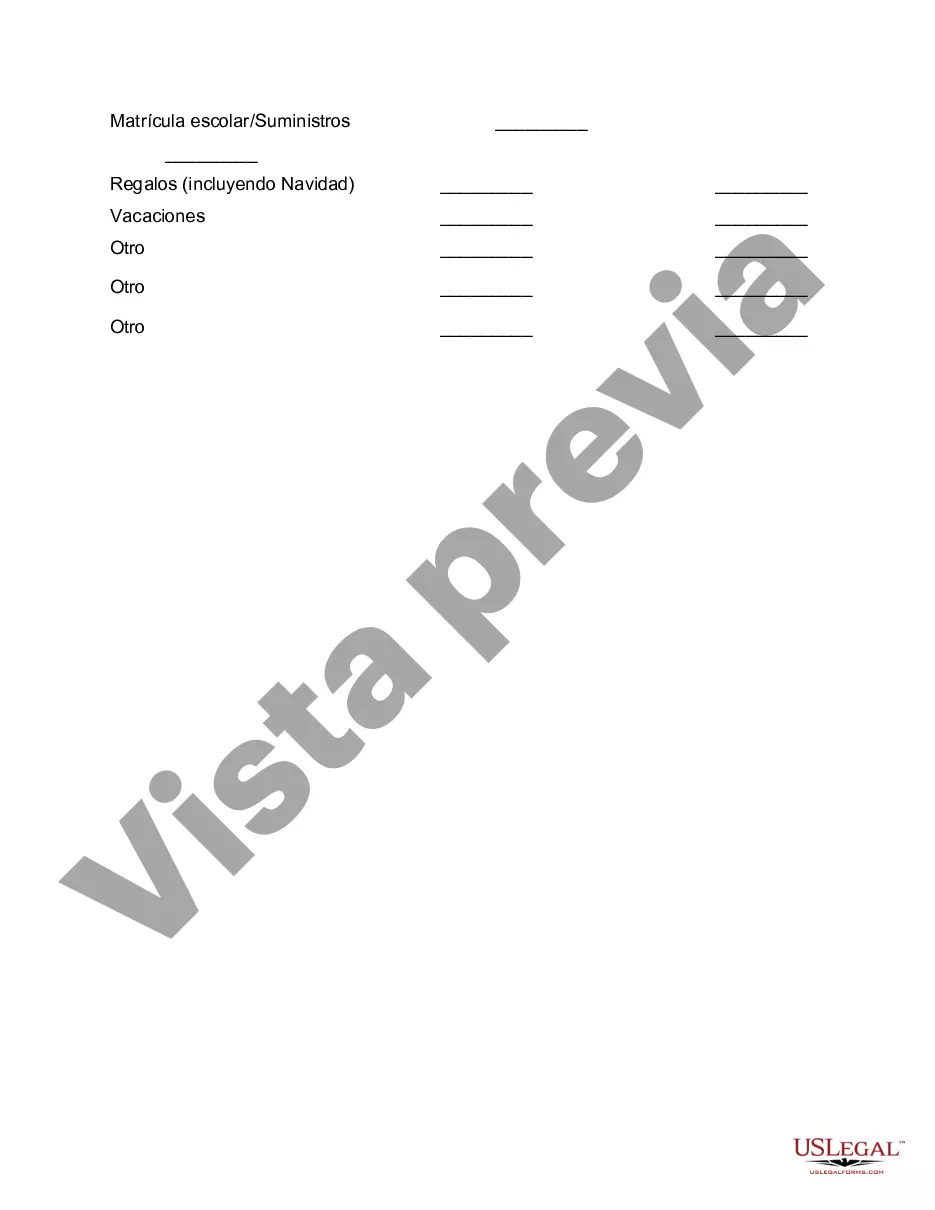

Tarrant Texas Breakdown of Savings for Budget and Emergency Fund: A Comprehensive Guide In order to maintain financial stability and face unexpected expenses, it is crucial to have a well-structured savings plan. For residents of Tarrant, Texas, understanding the breakdown of savings for both budgeting and emergency funds can serve as a valuable resource in securing your financial future. This detailed description will shed light on the different components and types of savings in Tarrant, Texas, and provide insight into creating an effective budget and emergency fund. 1. Budgeting Savings: Budgeting savings refer to the portion of your income that is set aside to cover regular expenses and planned goals. It serves as a protective buffer against unforeseen circumstances and ensures a steady financial plan. The breakdown of budgeting savings can include the following key areas: a) Essential Expenses: These include housing payments, utilities, transportation costs, food, and healthcare. Allocating a significant portion of your monthly income to cover these expenses is essential for maintaining a stable budget. b) Discretionary Expenses: This category comprises non-essential spending such as entertainment, dining out, shopping, and hobbies. By setting a specific budget for discretionary expenses, you can effectively manage your finances and avoid overspending. c) Debt Repayment: Allocating funds towards paying off debts is paramount. This includes credit card debt, student loans, and personal loans. Prioritizing debt repayment helps reduce interest charges and ensures long-term financial freedom. d) Saving for Future Goals: Whether it's buying a house, funding your child's education, or planning for retirement, setting money aside regularly ensures you make progress towards these aspirations. Establishing specific savings goals and contributing consistently will help you achieve them. 2. Emergency Fund Savings: An emergency fund acts as a financial safety net, designed to cover unexpected expenses or income disruptions. It provides peace of mind, mitigates financial stress, and safeguards against unforeseen events. The breakdown of emergency fund savings includes: a) Basic Emergency Fund: This initially involves setting aside three to six months' worth of living expenses. It serves as protection in the event of temporary job loss, medical emergencies, or unexpected home repairs. b) Major Life Event Fund: Planning for significant life events like purchasing a vehicle, funding a wedding, or covering childbirth expenses requires additional savings. Setting up a separate fund for these purposes ensures you are financially prepared for the milestones ahead. c) Insurance Deductibles: Ensuring you have enough savings to cover insurance deductibles, such as car insurance or homeowner's insurance, is vital. This avoids potential financial hardship in the event of an accident or property damage. d) Miscellaneous Contingency Fund: Unforeseen situations such as sudden pet care expenses, emergency travel, or family emergencies may arise. A miscellaneous contingency fund provides financial flexibility to account for such unexpected occurrences. By considering these various savings categories within Tarrant, Texas, residents can have a well-rounded understanding of how to break down their savings for successful budgeting and emergency fund purposes. Remember, regularly reviewing and adjusting your budget, as well as consistently contributing to both budgeting and emergency funds, are essential to maintaining financial stability. Prioritize financial planning today to secure a more prosperous future in Tarrant, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Tarrant Texas Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal documentation that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any individual or business objective utilized in your county, including the Tarrant Breakdown of Savings for Budget and Emergency Fund.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Tarrant Breakdown of Savings for Budget and Emergency Fund will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to obtain the Tarrant Breakdown of Savings for Budget and Emergency Fund:

- Ensure you have opened the right page with your local form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Tarrant Breakdown of Savings for Budget and Emergency Fund on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!