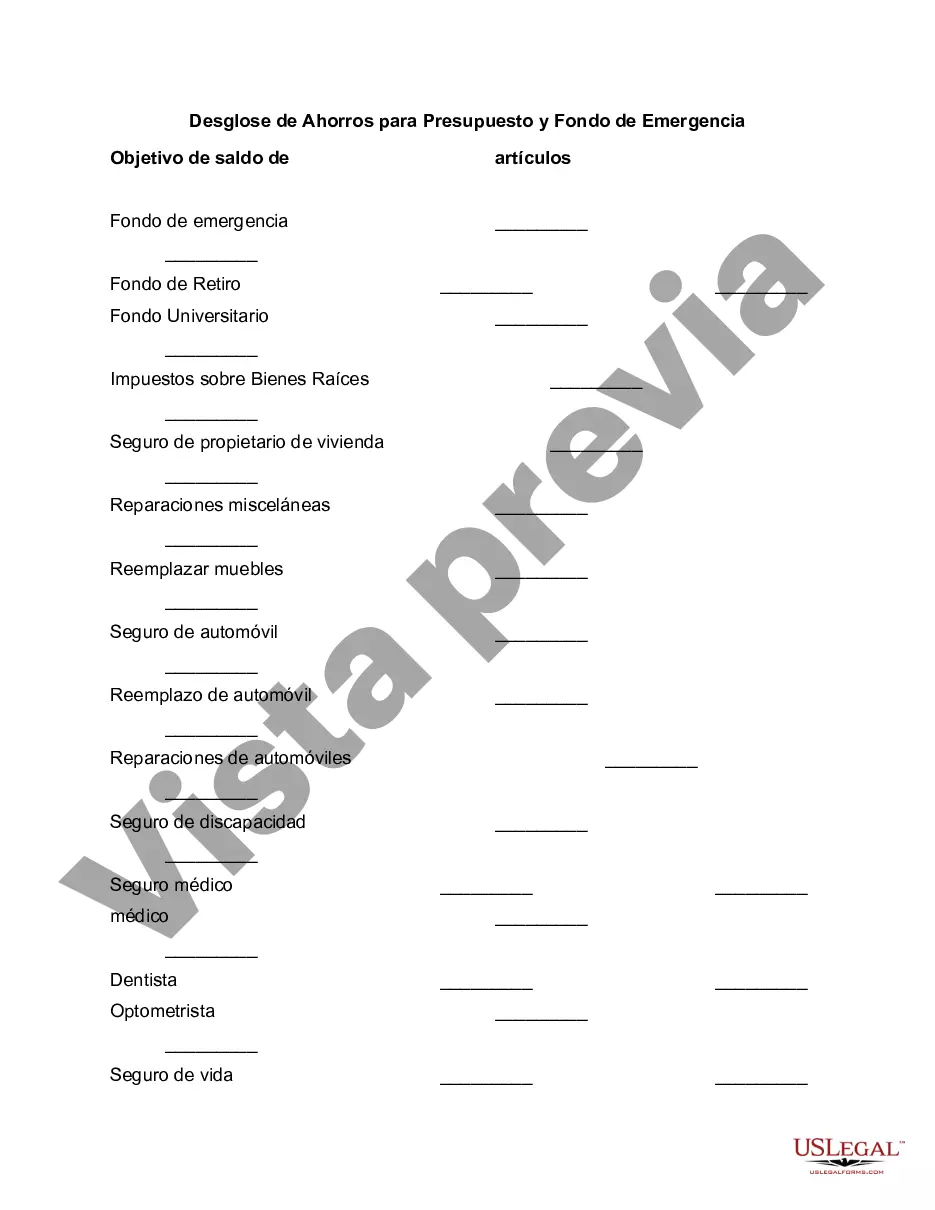

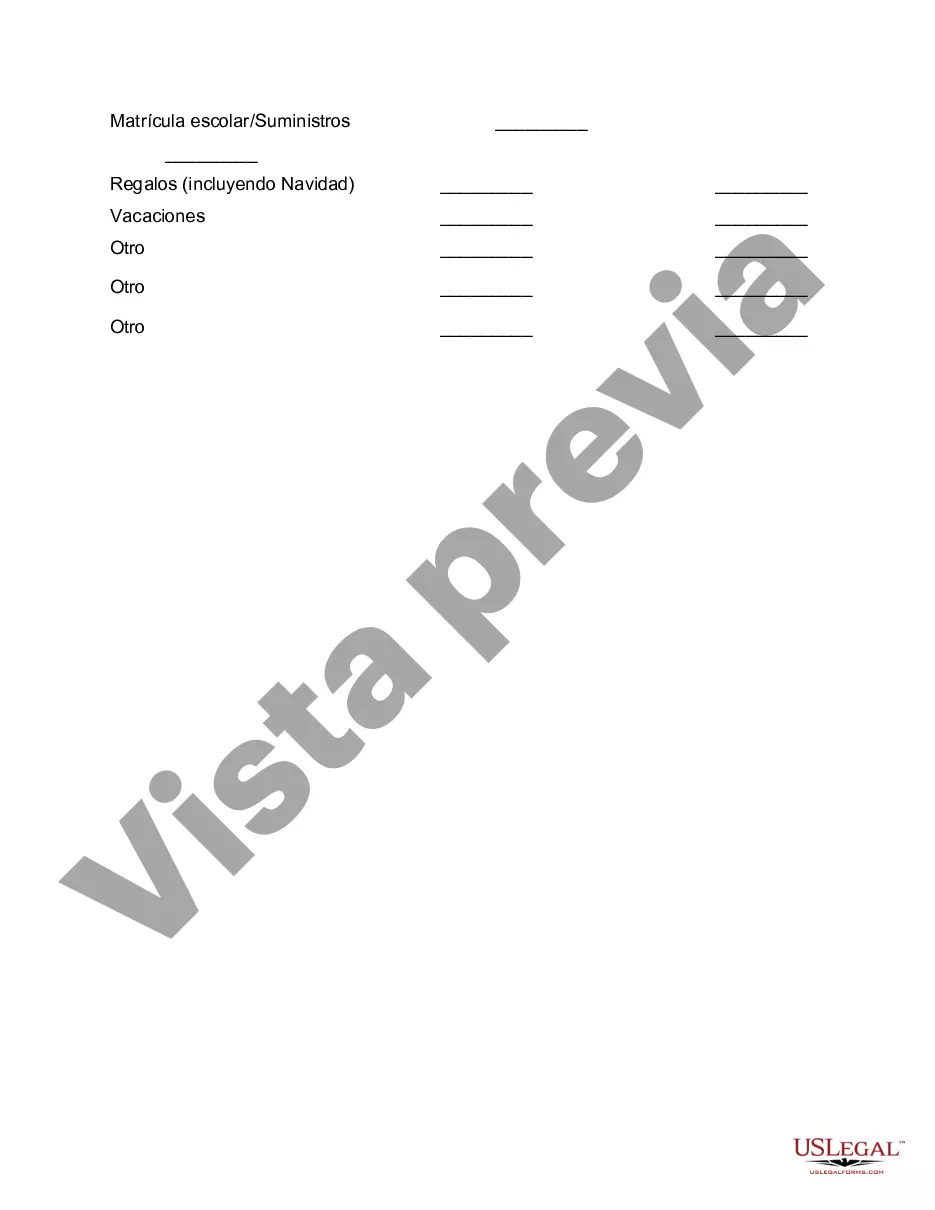

Wake North Carolina is a beautiful city located in the heart of North Carolina. Known for its vibrant arts scene, historical landmarks, and bustling downtown area, Wake North Carolina offers residents and visitors a diverse range of experiences. When it comes to financial planning, Wake North Carolina offers numerous options for budgeting and building an emergency fund. In this article, we will explore the different types of savings breakdowns available to individuals and families in Wake North Carolina. 1. Budgeting Savings: Budgeting is essential for managing your finances effectively. Wake North Carolina provides various strategies to break down your savings for budgeting purposes. Some key keywords to consider in this section are: — Monthly budgeting: Allocate a specific amount from your income each month to cover essential expenses such as rent/mortgage, utilities, groceries, transportation, and healthcare. Keywords to include are "monthly budgeting," "allocating funds," and "essential expenses." — Discretionary spending: Determine a reasonable amount for non-essential expenses, including dining out, entertainment, travel, and shopping. Keywords to emphasize here are "discretionary spending," "non-essential expenses," and "entertainment budget." — Savings goals: Set specific savings goals like buying a home, having an emergency fund, or planning for retirement. Keywords to include are "savings goals," "long-term financial planning," and "retirement savings." 2. Emergency Fund Savings: Building an emergency fund helps prepare for unexpected financial setbacks. Wake North Carolina offers different breakdowns for emergency fund savings. Some relevant keywords to include are: — Establishing an emergency fund: Begin by setting aside a specific percentage of your income to be solely dedicated to emergencies. Keywords to emphasize here are "emergency fund," "setting aside income," and "financial safety net." — Three to six-month rule: Aim to save three to six months' worth of living expenses in case of job loss or other unforeseen circumstances. Keywords to include are "living expenses," "job loss preparedness," and "emergency savings rule." — High-yield savings accounts: Consider opening a high-yield savings account with a local bank or credit union to maximize the growth of your emergency fund. Keywords to emphasize here are "high-yield savings account," "savings growth," and "local banking options." In Wake North Carolina, there are different types of savings breakdowns for budgeting and emergency funds, including monthly budgeting, discretionary spending, savings goals, establishing an emergency fund, the three to six-month rule, and high-yield savings accounts. By understanding and implementing these strategies, individuals and families can develop a sound financial plan that provides both security and peace of mind in the Wake North Carolina area.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Wake North Carolina Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

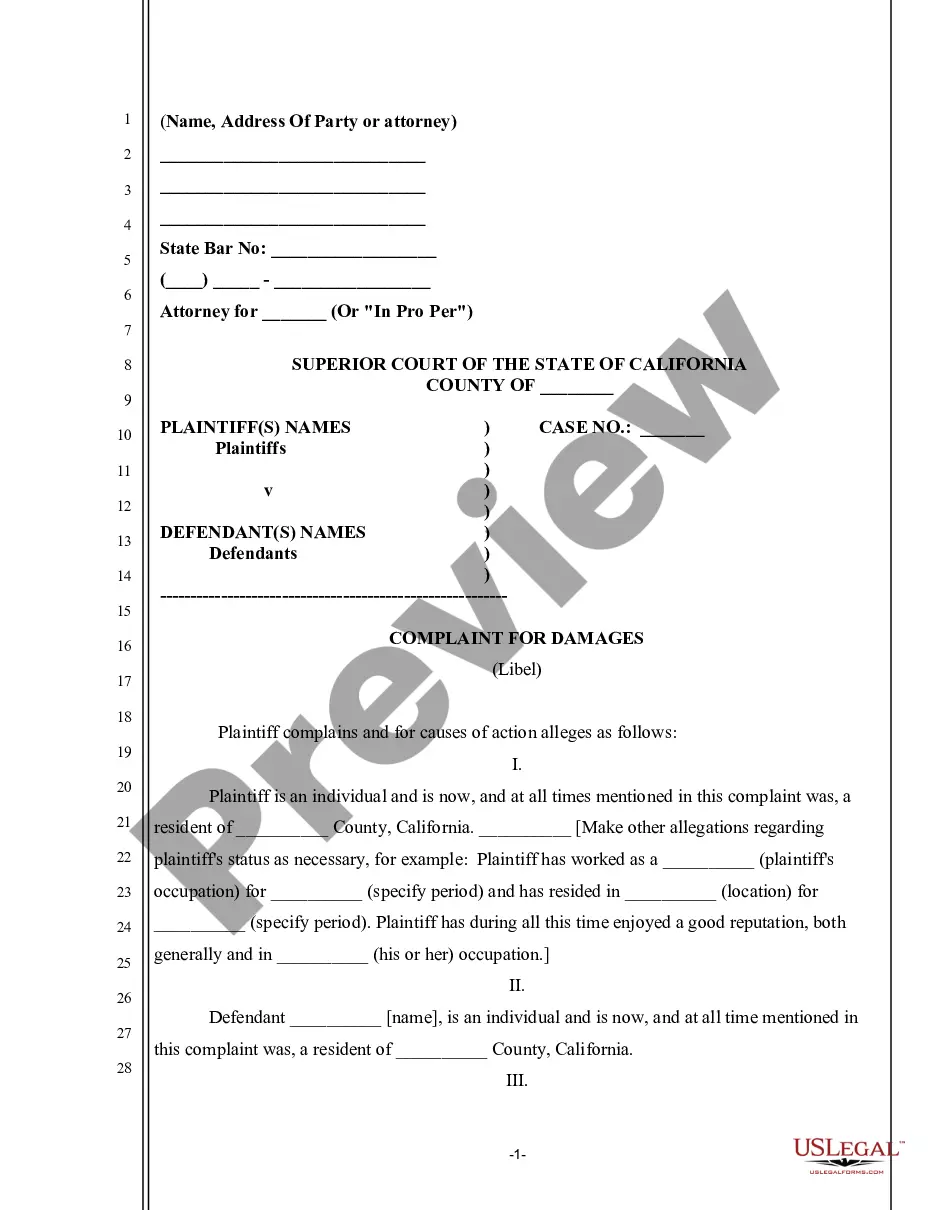

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Wake Breakdown of Savings for Budget and Emergency Fund, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Wake Breakdown of Savings for Budget and Emergency Fund from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Wake Breakdown of Savings for Budget and Emergency Fund:

- Examine the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

El fondo de emergencia debe cubrir entre tres y seis meses de gastos normales. Para calcularlo, se deben de tener en cuenta los gastos fijos y gastos variables. La cantidad obtenida seria el fondo que debe ahorrarse pero teniendo en cuenta un factor psicologico: la tolerancia al riesgo de cada uno.

Para crear un fondo de inversion se exigen varios requisitos: Un patrimonio minimo de 3 millones de euros. Contar con un minimo de 100 participes, que son las personas que invierten en el fondo. Designar una sociedad gestora. Designar un depositario.

¿Como funciona la regla 50 30 20? Dedica el 50 % de tu dinero a las necesidades. Destina el 30 % de tu dinero a los caprichos. Destina el 20 % de tu dinero a tus ahorros. Calcula tus ingresos netos. Clasifica los gastos del ultimo mes. Evalua y ajusta tus gastos para adaptarlos a la regla 50 30 20.

Un fondo de emergencia es una reserva de efectivo que se guarda para atender gastos no planeados o emergencias financieras. Algunos ejemplos comunes de estos gastos son reparaciones al coche o a su vivienda, facturas medicas o la perdida de ingresos.

La primera pregunta que deberemos contestar para planificar nuestro ahorro es que tenemos y como gastamos. Basicamente, se trata de hacer un diagnostico de nuestra economia para conocer nuestro patrimonio y nuestra capacidad de ahorro. Tambien podremos identificar que areas tienen un margen para la mejora.

¿Te has planteado para que sirve un plan de ahorro? Se trata de un producto financiero cuya funcion es ayudarte a planificar una estrategia en el ahorro personal, evitando los riesgos de otros modelos de inversion. Ademas, propicia que puedas ir creando una bolsa de ahorro constante en los anos venideros.

Consejos practicos para ayudar a ahorrar a los mas pequenos de la casa: Ganarse la paga.Ensenarles a ahorrar para conseguir cosas que le gustan es un incentivo (aunque con limites, claro).Ensenarles a hacer lista de la compra.Dejar que se equivoquen.Marcaros metas familiares conjuntas.

El plan de ahorro es un ejercicio sencillo que te ayudara a determinar cuanto dinero necesitas para lograr tu meta y en cuanto tiempo podras alcanzarla. Este es un ejemplo sencillo de un plan de ahorro de Juan Perez, que servira de modelo para que completes el tuyo: ¿Cual es la meta de ahorro?

Fija metas y considera los siguientes consejos: Los planes de ahorro deben tener un objetivo. Comienza con metas pequenas y a corto plazo. Despues, establece objetivos mayores con plazos mas amplios. Define el monto que se requiere reunir como parte de cada meta. Calcula el tiempo que te vas a tardar en alcanzarla.

Solo debes dividir el dinero del fondo entre la cantidad que ahorres cada mes. A modo de ejemplo, vamos a hacer numeros. Imaginemos que cuentas con unos ingresos de 1000 euros al mes y unos gastos fijos irrenunciables de 800 euros. En este caso la cuantia del fondo de emergencia sera de 4.800 euros.