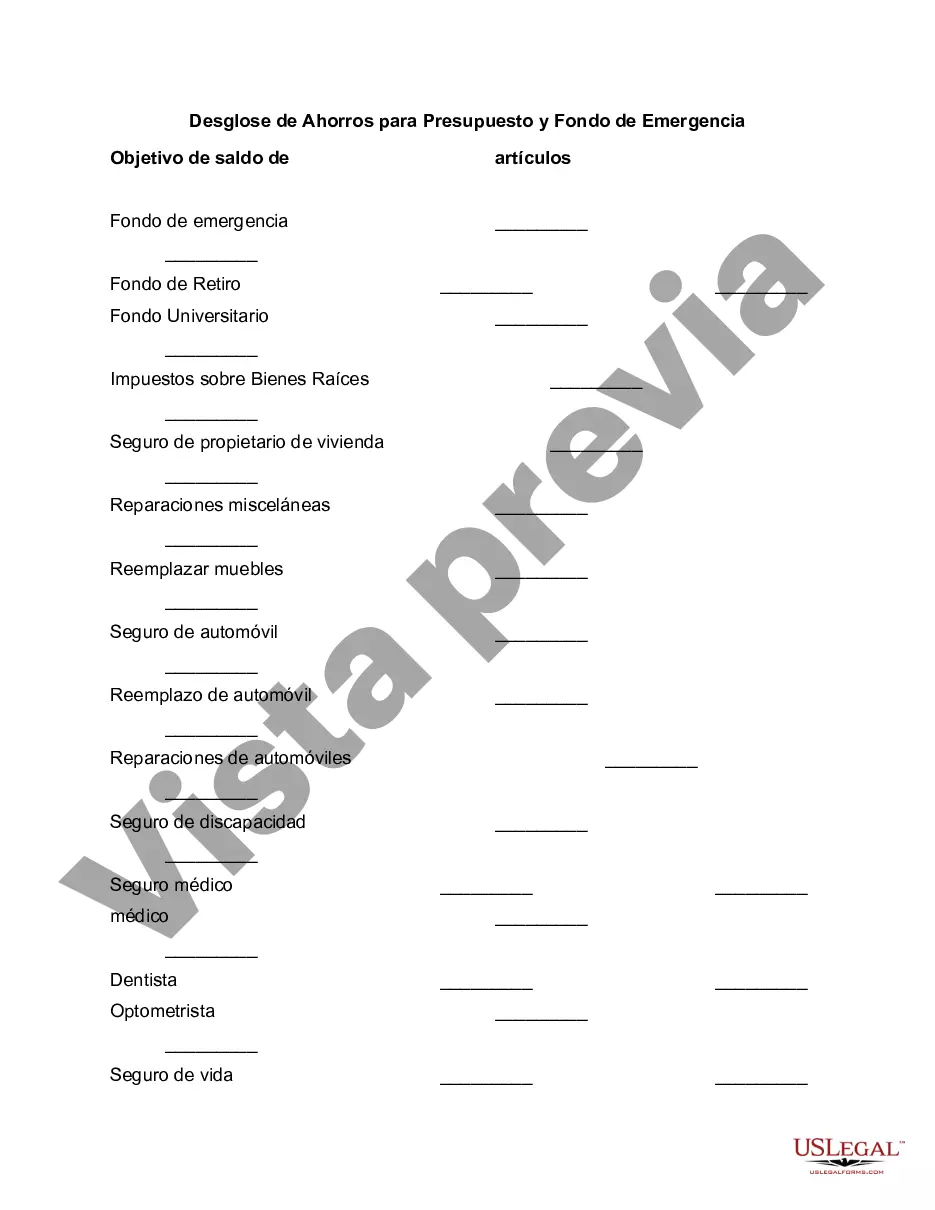

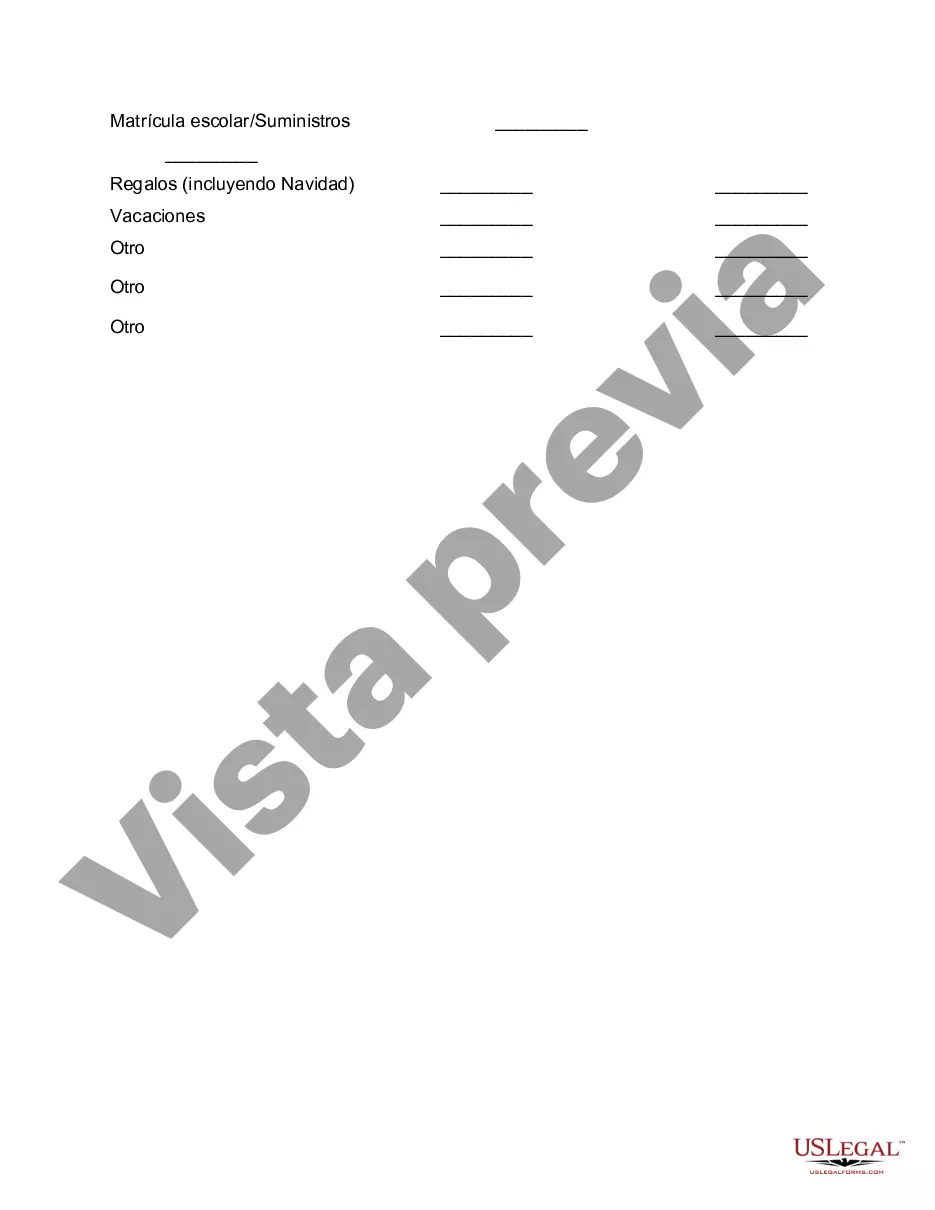

Wayne Michigan Breakdown of Savings for Budget and Emergency Fund: A Comprehensive Guide Introduction: Managing finances and preparing for unexpected events are crucial components of achieving financial stability. In Wayne, Michigan, understanding the breakdown of savings for both budget and emergency funds becomes vital to ensure a secure financial future. This article will provide a detailed description of different types of savings, their importance, and how residents of Wayne, Michigan can allocate their finances accordingly. 1. Budget Savings: Budget savings refer to funds set aside for planned expenses and financial goals. It involves strict financial planning and disciplined saving habits. Here are some key types of budget savings to consider: a. Short-Term Savings: Short-term savings primarily focus on saving money for immediate financial goals, typically within a year. This could include saving for a vacation, upgrading gadgets, or covering necessary home repairs. b. Long-Term Savings: Long-term savings involve setting aside funds for major life events and future objectives, such as retirement, purchasing a home, or funding your child's education. These savings require long-term commitment, often spanning several years or decades. c. Specific Savings Categories: It is beneficial to allocate savings to specific categories such as healthcare, transportation, and entertainment. This ensures effective planning, prevents overspending, and helps maintain a balanced budget. 2. Emergency Fund: An emergency fund acts as a financial safety net during unexpected events or emergencies. It provides a sense of security and prevents individuals from falling into debt or major financial strains. Consider the following types of emergency savings: a. Basic Emergency Fund: A basic emergency fund includes enough savings to cover 3-6 months' worth of living expenses. This sum should be readily accessible and easily liquidated when needed most, such as during job loss, medical emergencies, or any unforeseen crises. b. Enhanced Emergency Fund: An enhanced emergency fund accounts for a more extended period of financial stability, generally beyond six months. Residents of Wayne, Michigan may opt for this type of fund based on personal circumstances, job stability, or extra comfort during uncertain economic times. c. Specialized Emergency Fund: Some emergencies may require specialized savings, such as a medical emergency fund or car repair fund. These funds cater to specific needs that may arise due to personal situations or specific living conditions. Conclusion: Understanding the breakdown of savings for both budget and emergency funds is essential for individuals residing in Wayne, Michigan. By strategically allocating funds to different savings categories and establishing a robust emergency fund, residents can achieve financial stability, tackle unexpected expenses, and work towards achieving their long-term financial goals. Remember, the types of savings mentioned above are not exhaustive, but they provide a solid foundation for planning your financial future in Wayne, Michigan.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Desglose de Ahorros para Presupuesto y Fondo de Emergencia - Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Wayne Michigan Desglose De Ahorros Para Presupuesto Y Fondo De Emergencia?

How much time does it usually take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, locating a Wayne Breakdown of Savings for Budget and Emergency Fund meeting all regional requirements can be stressful, and ordering it from a professional attorney is often costly. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. Aside from the Wayne Breakdown of Savings for Budget and Emergency Fund, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Experts check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can retain the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Wayne Breakdown of Savings for Budget and Emergency Fund:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Wayne Breakdown of Savings for Budget and Emergency Fund.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!