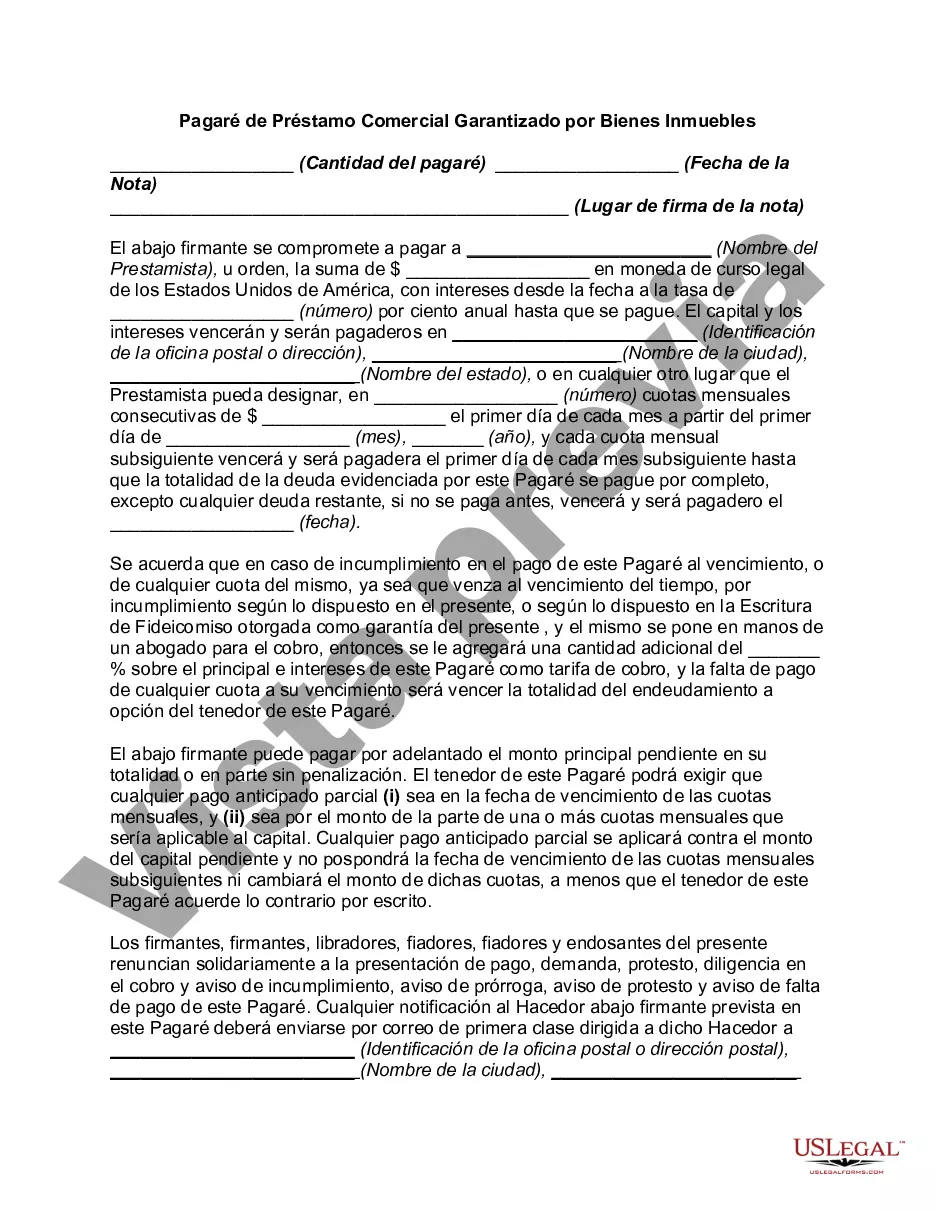

Allegheny Pennsylvania Promissory Note for Commercial Loan Secured by Real Property is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Allegheny County, Pennsylvania. This type of promissory note is specifically designed for commercial loans that are secured by real property, such as a commercial building, office space, or industrial facility. Key points to include in the description: — Purpose: The Allegheny Pennsylvania Promissory Note for Commercial Loan Secured by Real Property serves as a legally binding contract between the lender and borrower, defining the terms of the loan agreement and the obligations of both parties involved. — Loan Amount: This promissory note clearly states the amount of the loan taken by the borrower from the lender. — Interest Rate: It outlines the interest rate at which the borrowed amount will accrue interest, usually expressed as an annual percentage. — Repayment Terms: The promissory note specifies the repayment terms, including the frequency and duration of payments, whether these are fixed or variable, along with any grace periods, late payment penalties, or prepayment provisions. — Collateral: Since the loan is secured by real property, the promissory note will describe the specific property or properties being offered as collateral to secure the loan. — Default and Remedies: It outlines the consequences of default by the borrower, such as late payment or breach of any other terms, and the remedies available to the lender in such situations, which may include foreclosure on the secured property. — Signatories: The promissory note must be signed by both the lender and borrower to validate the agreement. Different types of Allegheny Pennsylvania Promissory Note for Commercial Loan Secured by Real Property might include variations to the terms based on factors such as loan duration, interest rate structure (fixed or adjustable), and payment schedules (monthly, quarterly, annually). Additional relevant keywords for this topic could be: — Legadocumentationio— - Loan agreement - Commercial loan — SecureLOAoa— - Real estate - Lender - Borrower — Loan term— - Loan repayment - Interest rate — Collatera— - Default - Foreclosure - Signatures — Obligation— - Loan duration

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pagare De Prestamo - Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out Allegheny Pennsylvania Pagaré De Préstamo Comercial Garantizado Por Bienes Inmuebles?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Allegheny Promissory Note for Commercial Loan Secured by Real Property, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in various types ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less challenging. You can also find detailed materials and guides on the website to make any tasks associated with paperwork completion straightforward.

Here's how to locate and download Allegheny Promissory Note for Commercial Loan Secured by Real Property.

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Examine the related document templates or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment method, and purchase Allegheny Promissory Note for Commercial Loan Secured by Real Property.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Allegheny Promissory Note for Commercial Loan Secured by Real Property, log in to your account, and download it. Needless to say, our website can’t replace a lawyer entirely. If you need to cope with an extremely difficult case, we advise getting a lawyer to check your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Join them today and get your state-specific paperwork with ease!