The Bronx, New York Promissory Note for Commercial Loan Secured by Real Property is a legally binding document that outlines the terms and conditions of a loan granted to a borrower in the Bronx, specifically for commercial purposes. This Promissory Note serves as evidence of the borrower's commitment to repay the loan amount, along with any accrued interest, within the agreed-upon time frame. In the Bronx, there are several types of Promissory Notes available for commercial loans secured by real property, designed to meet the varying needs of borrowers and lenders. Some common types include: 1. Fixed-Rate Promissory Note: This type of Promissory Note allows the borrower to repay the loan in regular installments, with a fixed interest rate applied throughout the loan term. It provides stability and predictability to both parties involved. 2. Variable-Rate Promissory Note: Unlike a fixed-rate Promissory Note, a variable-rate Promissory Note offers an interest rate that fluctuates based on a specified index, such as the prime rate. This type of Note exposes the borrower to interest rate changes, potentially resulting in varying repayment amounts over time. 3. Balloon Promissory Note: A Balloon Promissory Note requires the borrower to make regular payments for a certain period, typically with lower installments. However, at the end of the loan term, there is a large final payment, known as the balloon payment, which must be paid in full. This type of Note is suitable for borrowers who anticipate a substantial influx of funds or refinancing options before the balloon payment due date. 4. Secured Promissory Note: This Promissory Note is tied to real property assets, such as land, buildings, or machinery. The borrower pledges these assets as collateral to secure the loan, providing the lender with assurance that they can recoup the loan amount in case of default. This type of Note is ideal for lenders seeking additional security for their investment. In summary, the Bronx, New York Promissory Note for Commercial Loan Secured by Real Property is a legal document that establishes the terms and conditions of a loan. It is crucial for both borrowers and lenders to carefully review and understand the specific type of Promissory Note they are entering into, ensuring it aligns with their financial objectives and risk tolerance.

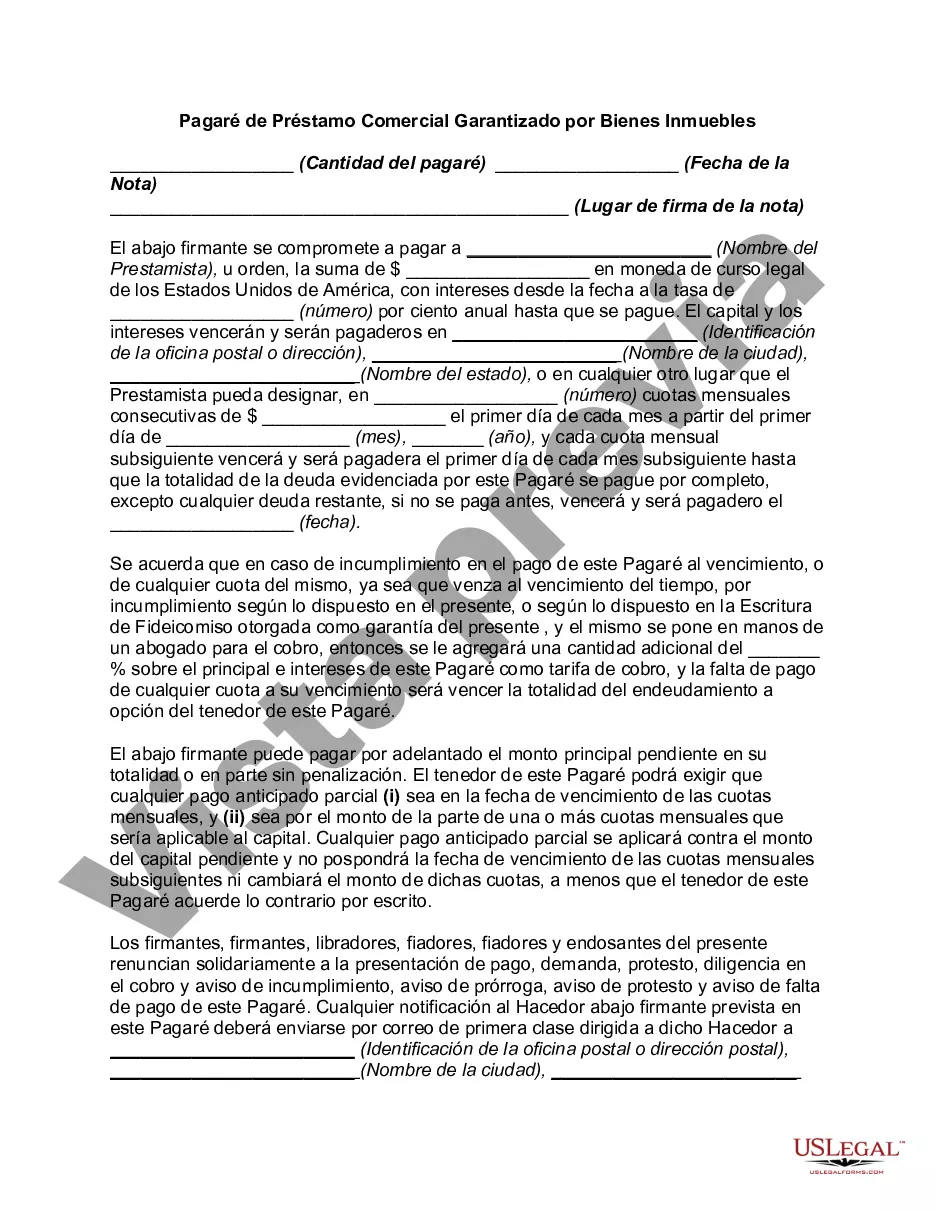

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pagare De Prestamo - Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out Bronx New York Pagaré De Préstamo Comercial Garantizado Por Bienes Inmuebles?

Whether you plan to open your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business case. All files are collected by state and area of use, so opting for a copy like Bronx Promissory Note for Commercial Loan Secured by Real Property is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to get the Bronx Promissory Note for Commercial Loan Secured by Real Property. Follow the guide below:

- Make sure the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Bronx Promissory Note for Commercial Loan Secured by Real Property in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!