The Contra Costa California Promissory Note for Commercial Loan Secured by Real Property is a legal document that outlines an agreement between a lender and a borrower for a commercial loan. This note serves as evidence of the borrower's promise to repay the loan amount along with any accrued interest within a specified period. In Contra Costa County, California, there are different types of promissory notes specifically designed for commercial loans secured by real property: 1. Fixed-Rate Promissory Note: This type of promissory note entails a fixed interest rate that remains unchanged throughout the loan term. Borrowers and lenders prefer this option as it offers predictability and stability in loan payments. 2. Adjustable-Rate Promissory Note: Also known as an ARM, this note allows the interest rate to fluctuate based on a predetermined index. The interest rate adjustments typically occur at regular intervals, providing the potential for lower payments initially and potentially higher payments in the future. 3. Balloon Promissory Note: A balloon note involves the repayment of interest and principal in fixed monthly installments for a specific period; however, a balloon payment is due at the end of the term. This option is often used when a borrower expects to have substantial funds available to make the balloon payment or intends to sell or refinance the property prior to the due date. 4. Interest-Only Promissory Note: This type of note allows the borrower to make interest-only payments for a specified period, typically ranging from a few months to several years. Subsequently, the borrower must begin making payments towards the principal as well as the interest. 5. Demand Promissory Note: A demand note grants the lender the right to request full repayment of the loan amount at any time without providing a specific due date. This type of note is often utilized in short-term loans and lines of credit. 6. Non-Recourse Promissory Note: A non-recourse note limits the lender's ability to collect on the loan to the property securing the loan. In the event of borrower default, the lender's only recourse is the property itself, and they cannot pursue the borrower's personal assets. These Contra Costa California Promissory Notes for Commercial Loan Secured by Real Property provide legal protection to both the borrower and the lender, ensuring that the terms and conditions of the loan are understood and adhered to. It is crucial for all parties involved in a commercial loan transaction to carefully review and understand the contents of the promissory note before signing to avoid any potential disputes or issues in the future.

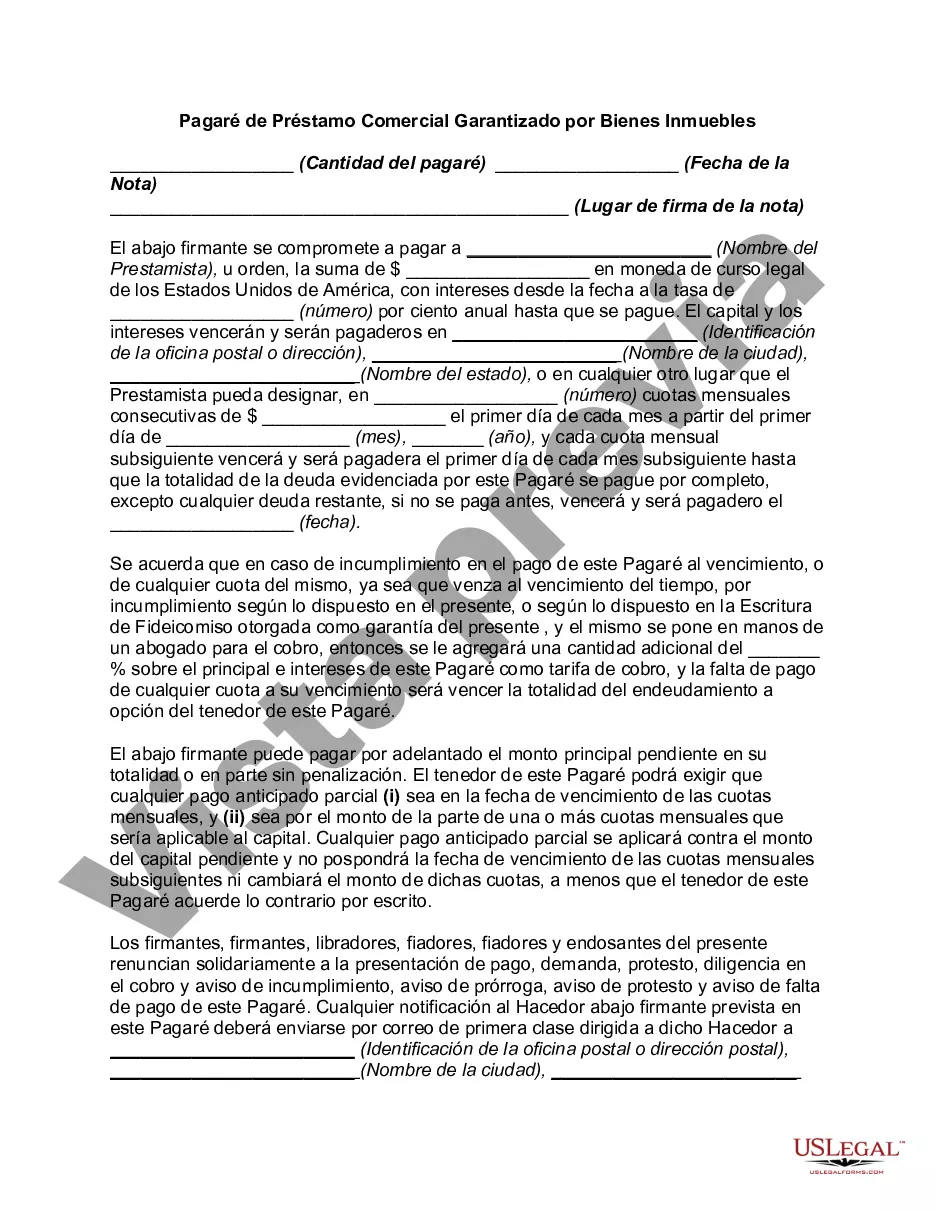

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Pagaré de Préstamo Comercial Garantizado por Bienes Inmuebles - Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out Contra Costa California Pagaré De Préstamo Comercial Garantizado Por Bienes Inmuebles?

If you need to get a reliable legal paperwork provider to find the Contra Costa Promissory Note for Commercial Loan Secured by Real Property, consider US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can search from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of supporting resources, and dedicated support make it easy to find and complete various documents.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply select to search or browse Contra Costa Promissory Note for Commercial Loan Secured by Real Property, either by a keyword or by the state/county the form is intended for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Contra Costa Promissory Note for Commercial Loan Secured by Real Property template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and select a subscription option. The template will be instantly available for download as soon as the payment is completed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes these tasks less expensive and more reasonably priced. Set up your first business, organize your advance care planning, create a real estate agreement, or execute the Contra Costa Promissory Note for Commercial Loan Secured by Real Property - all from the comfort of your sofa.

Join US Legal Forms now!