The Cuyahoga Ohio Promissory Note for Commercial Loan Secured by Real Property is a legally binding document that outlines the terms and conditions of a commercial loan secured by real property in Cuyahoga County, Ohio. This promissory note serves as an agreement between the borrower and the lender, establishing the obligations and rights of both parties involved in the commercial loan transaction. In Cuyahoga County, Ohio, there are several types of Promissory Notes for Commercial Loans Secured by Real Property that cater to different financial needs and situations. These variations include: 1. Fixed-Rate Promissory Note: This type of promissory note establishes a fixed interest rate for the entire duration of the loan, providing the borrower with clarity and predictability in terms of monthly payments. 2. Adjustable-Rate Promissory Note: Unlike the fixed-rate promissory note, an adjustable-rate promissory note allows for changes in the interest rate over time. The interest rate adjustments are typically tied to an index, such as the prime rate or the LIBOR rate. 3. Balloon Payment Promissory Note: This type of promissory note involves smaller regular payments over a specified period, with a larger "balloon" payment due at the end of the term. Borrowers may choose this option if they anticipate having sufficient funds to cover the balloon payment by the time it becomes due. 4. Interest-Only Promissory Note: With an interest-only promissory note, the borrower is only required to make interest payments during a specified period, typically for the first few years. Once the interest-only period ends, the borrower must begin repaying both the principal amount and interest. 5. Non-recourse Promissory Note: This type of promissory note limits the lender's ability to seek repayment beyond the collateral property in case of loan default. It protects borrowers from personal liability, meaning the lender cannot go after the borrower's personal assets or income for repayment. Regardless of the specific type of Cuyahoga Ohio Promissory Note for Commercial Loan Secured by Real Property, it is crucial for borrowers and lenders to carefully review and understand the terms and conditions outlined in the document before signing. Seeking legal advice when drafting or entering into such agreements is highly recommended ensuring compliance with local laws and protection of both parties' interests.

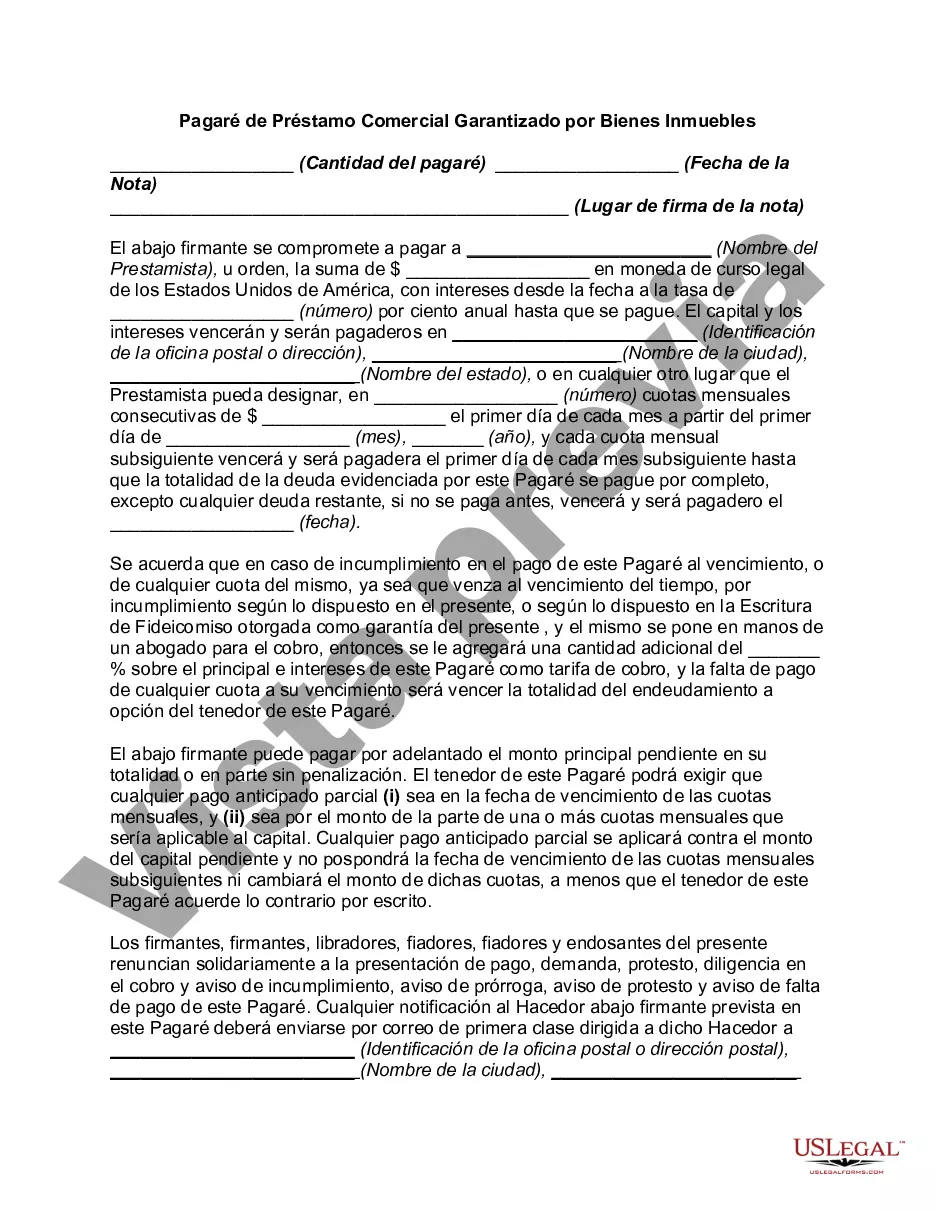

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Pagaré de Préstamo Comercial Garantizado por Bienes Inmuebles - Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out Cuyahoga Ohio Pagaré De Préstamo Comercial Garantizado Por Bienes Inmuebles?

Creating documents, like Cuyahoga Promissory Note for Commercial Loan Secured by Real Property, to manage your legal affairs is a tough and time-consumming process. Many situations require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can acquire your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents crafted for a variety of cases and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Cuyahoga Promissory Note for Commercial Loan Secured by Real Property form. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before getting Cuyahoga Promissory Note for Commercial Loan Secured by Real Property:

- Ensure that your form is specific to your state/county since the regulations for creating legal paperwork may vary from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Cuyahoga Promissory Note for Commercial Loan Secured by Real Property isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start utilizing our website and download the document.

- Everything looks great on your side? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is all set. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!