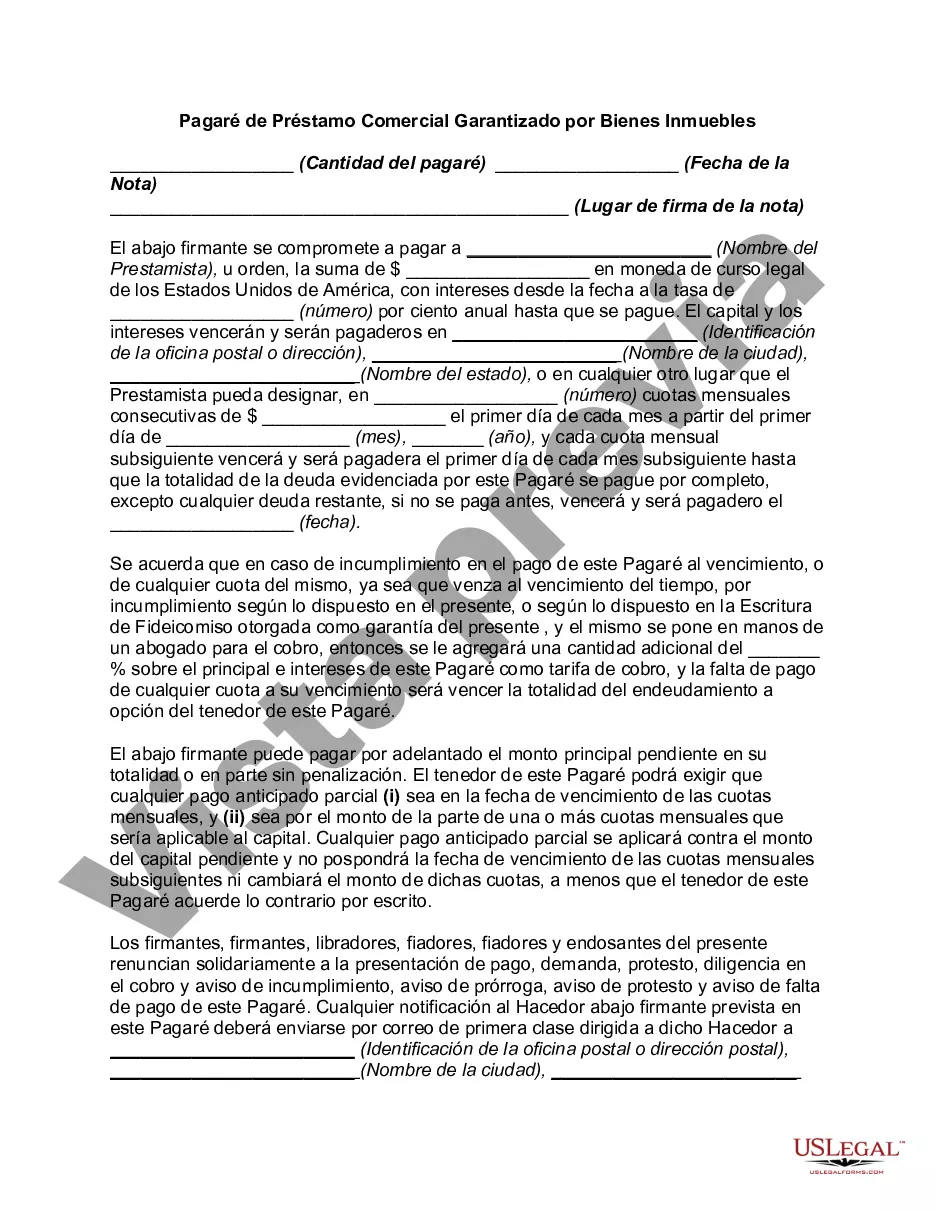

A Hillsborough Florida Promissory Note for Commercial Loan Secured by Real Property is a legal document that outlines the terms and conditions of a commercial loan secured by real estate in Hillsborough County, Florida. This promissory note serves as a written agreement between a lender and a borrower, establishing the borrower's promise to repay the loan amount with interest within a specified period. The Hillsborough Florida Promissory Note for Commercial Loan Secured by Real Property is an essential part of the lending process, providing clarity on the obligations and rights of both parties involved. It contains crucial components such as the loan amount, interest rate, repayment terms, late payment penalties, and the legal description of the real property being used as collateral. Depending on the specific needs and circumstances, there may be various types of Hillsborough Florida Promissory Notes for Commercial Loans Secured by Real Property. These may include: 1. Fixed-Rate Promissory Note: This type of promissory note specifies a fixed interest rate throughout the loan term, ensuring consistent payments for the borrower. 2. Adjustable-Rate Promissory Note (ARM): An ARM promissory note establishes an interest rate that may fluctuate over time according to market conditions, potentially affecting the borrower's monthly payments. 3. Balloon Payment Promissory Note: This promissory note structure allows borrowers to make lower monthly payments throughout the loan term, with a large lump sum (balloon payment) due at the end. 4. Construction Loan Promissory Note: Specifically designed for financing construction projects, this type of promissory note incorporates provisions related to progress payments and stages of completion. 5. Bridge Loan Promissory Note: A bridge loan promissory note serves as temporary financing until permanent funding is available, often used to overcome short-term financial gaps. When preparing a Hillsborough Florida Promissory Note for Commercial Loan Secured by Real Property, it is crucial to consult with legal professionals specializing in real estate and contract law. Accuracy and thoroughness in documenting the terms of the loan are essential to protect the rights and interests of both parties involved in the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Pagaré de Préstamo Comercial Garantizado por Bienes Inmuebles - Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out Hillsborough Florida Pagaré De Préstamo Comercial Garantizado Por Bienes Inmuebles?

Creating forms, like Hillsborough Promissory Note for Commercial Loan Secured by Real Property, to manage your legal matters is a challenging and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task not really affordable. However, you can get your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents crafted for a variety of cases and life situations. We ensure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Hillsborough Promissory Note for Commercial Loan Secured by Real Property form. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before getting Hillsborough Promissory Note for Commercial Loan Secured by Real Property:

- Ensure that your form is compliant with your state/county since the regulations for creating legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Hillsborough Promissory Note for Commercial Loan Secured by Real Property isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to begin utilizing our website and get the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment information.

- Your template is all set. You can try and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!