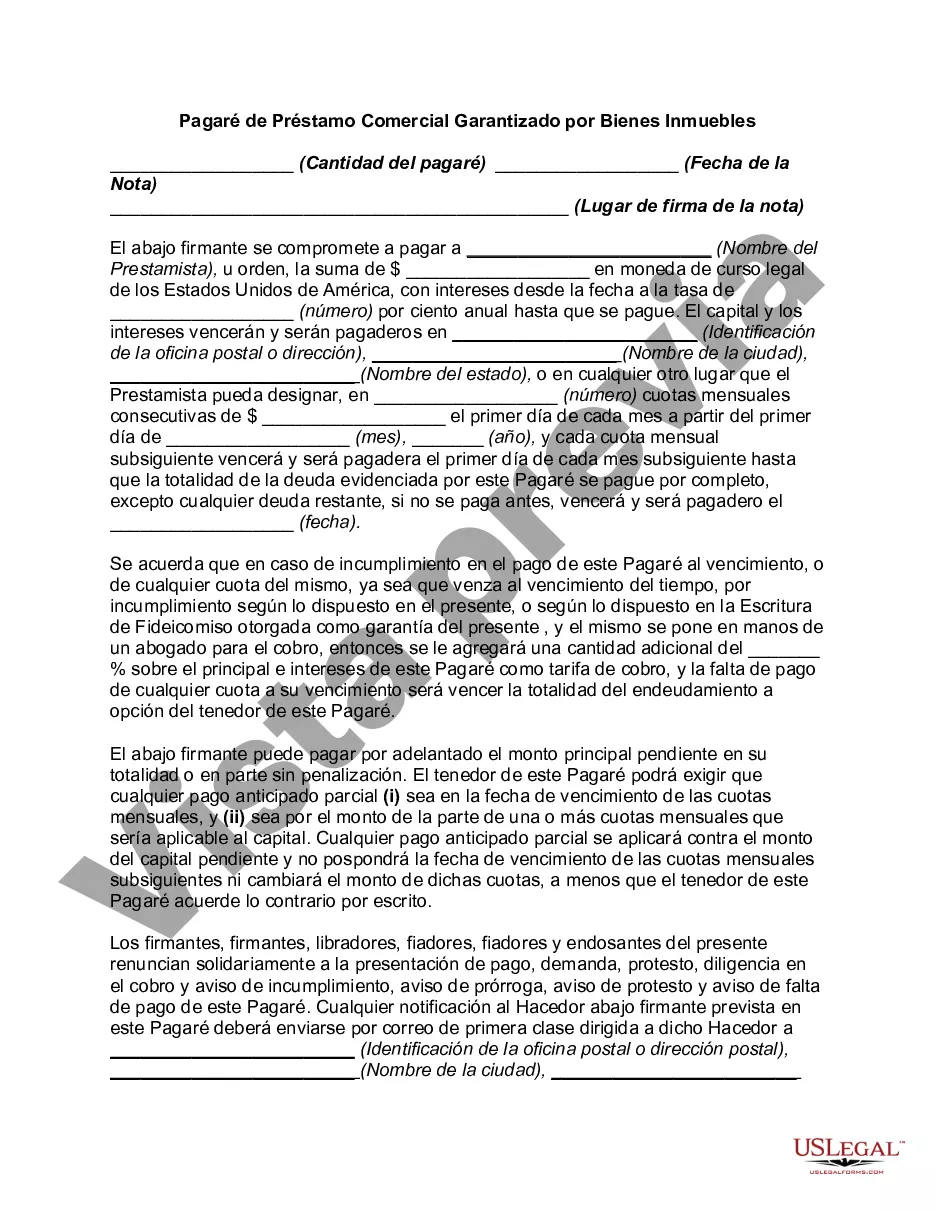

Miami-Dade Florida Promissory Note for Commercial Loan Secured by Real Property is a legal document outlining the terms and conditions of a commercial loan given by a lender to a borrower. This type of promissory note is specific to the Miami-Dade County area in Florida and is designed to ensure that both parties involved are protected when it comes to the loan transaction and the use of real property as collateral. This Promissory Note serves as a written agreement between the borrower and lender, clearly stating the amount borrowed, the interest rate, repayment terms, and the rights and obligations of each party. The note also includes provisions regarding default, late payment penalties, and the steps to be taken in case of non-payment, foreclosure, or dispute resolution. The Miami-Dade Florida Promissory Note for Commercial Loan Secured by Real Property may have different variations depending on the specific circumstances of the loan. Some variations include: 1. Fixed-Rate Promissory Note: This type of promissory note establishes a fixed interest rate that remains constant throughout the loan term. Both the borrower and lender agree on a specific interest rate at the time of loan origination, which does not fluctuate with market conditions. 2. Adjustable-Rate Promissory Note: This variant allows for an adjustable interest rate that may change periodically based on market conditions. The note specifies the factors that will be used to determine the interest rate adjustment, such as the prime rate or the London Interbank Offered Rate (LIBOR). 3. Balloon Promissory Note: In some cases, the lender and borrower may agree to structure the loan with smaller monthly payments over a certain period, usually 5 or 10 years, followed by a large final payment called a balloon payment. This Promissory Note clearly outlines this payment structure and the terms of the balloon payment. 4. Interest-Only Promissory Note: This type of promissory note allows the borrower to make monthly payments consisting only of the interest accrued on the loan amount. The principal amount is not reduced during the interest-only period, and repayment of the principal is typically due at a later date. Regardless of the specific type of Promissory Note, it is important for both the lender and borrower to seek legal advice and conduct thorough due diligence before entering into any commercial loan transaction. This ensures that both parties understand and agree to the terms and conditions set forth in the note and helps to avoid potential legal issues or conflicts in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Pagaré de Préstamo Comercial Garantizado por Bienes Inmuebles - Promissory Note for Commercial Loan Secured by Real Property

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-1166BG

Format:

Word

Instant download

Description

A promissory note is a written promise to pay a debt. It is an unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

Miami-Dade Florida Promissory Note for Commercial Loan Secured by Real Property is a legal document outlining the terms and conditions of a commercial loan given by a lender to a borrower. This type of promissory note is specific to the Miami-Dade County area in Florida and is designed to ensure that both parties involved are protected when it comes to the loan transaction and the use of real property as collateral. This Promissory Note serves as a written agreement between the borrower and lender, clearly stating the amount borrowed, the interest rate, repayment terms, and the rights and obligations of each party. The note also includes provisions regarding default, late payment penalties, and the steps to be taken in case of non-payment, foreclosure, or dispute resolution. The Miami-Dade Florida Promissory Note for Commercial Loan Secured by Real Property may have different variations depending on the specific circumstances of the loan. Some variations include: 1. Fixed-Rate Promissory Note: This type of promissory note establishes a fixed interest rate that remains constant throughout the loan term. Both the borrower and lender agree on a specific interest rate at the time of loan origination, which does not fluctuate with market conditions. 2. Adjustable-Rate Promissory Note: This variant allows for an adjustable interest rate that may change periodically based on market conditions. The note specifies the factors that will be used to determine the interest rate adjustment, such as the prime rate or the London Interbank Offered Rate (LIBOR). 3. Balloon Promissory Note: In some cases, the lender and borrower may agree to structure the loan with smaller monthly payments over a certain period, usually 5 or 10 years, followed by a large final payment called a balloon payment. This Promissory Note clearly outlines this payment structure and the terms of the balloon payment. 4. Interest-Only Promissory Note: This type of promissory note allows the borrower to make monthly payments consisting only of the interest accrued on the loan amount. The principal amount is not reduced during the interest-only period, and repayment of the principal is typically due at a later date. Regardless of the specific type of Promissory Note, it is important for both the lender and borrower to seek legal advice and conduct thorough due diligence before entering into any commercial loan transaction. This ensures that both parties understand and agree to the terms and conditions set forth in the note and helps to avoid potential legal issues or conflicts in the future.

Free preview