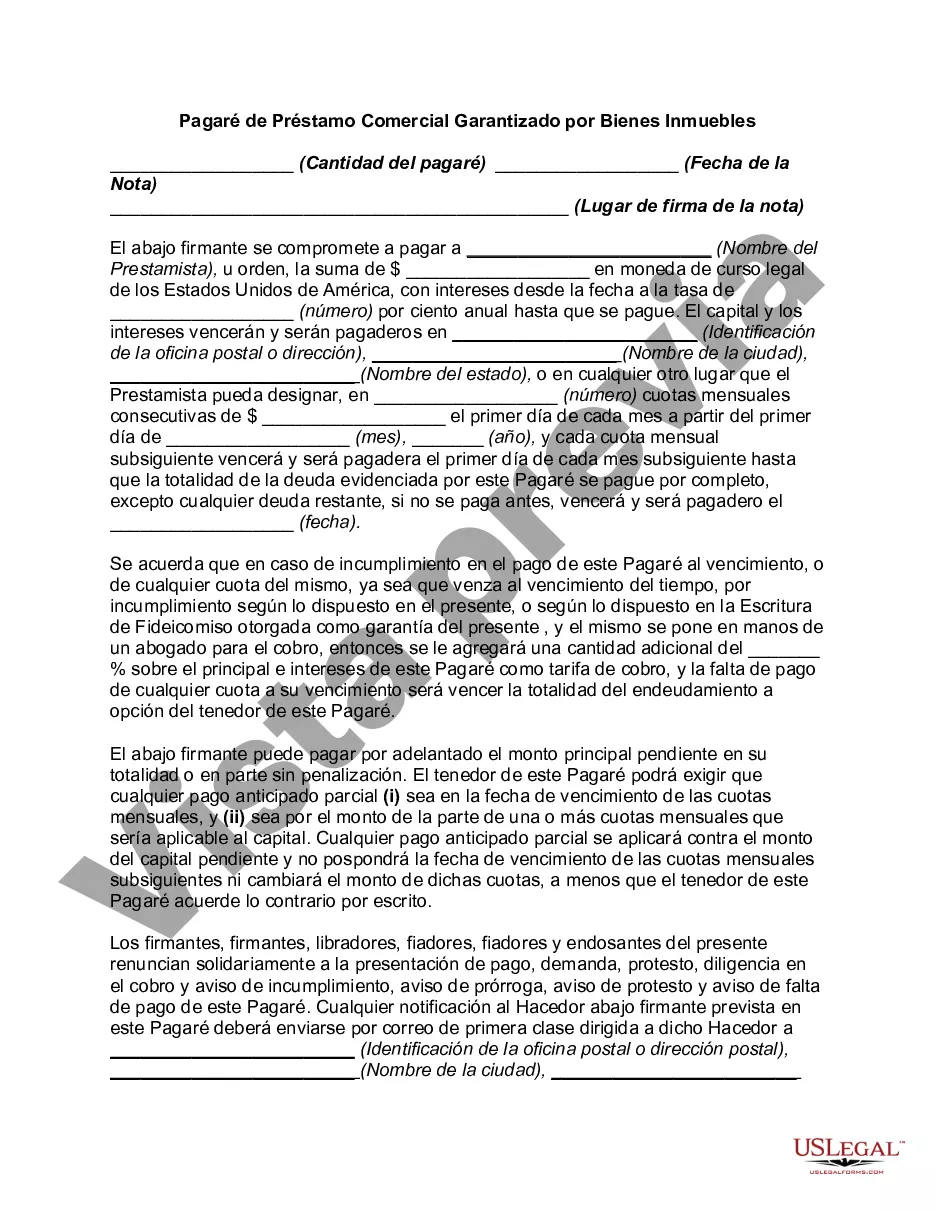

The Nassau New York Promissory Note for Commercial Loan Secured by Real Property is a legal document that outlines the terms and conditions of a commercial loan secured by real estate in the county of Nassau, New York. This note serves as evidence of the borrower's obligation to repay the loan and specifies the rights and responsibilities of both the borrower and the lender. It acts as a binding contract between the parties involved and is essential for ensuring a smooth loan transaction. The promissory note includes various sections that detail the specifics of the loan agreement. These sections may include: 1. Parties: This section identifies the lender and the borrower involved in the loan transaction. It includes their names, addresses, and contact information. 2. Loan Amount: This section outlines the principal amount of the loan that the borrower is obligated to repay. It may also include information about any interest or fees associated with the loan. 3. Repayment Terms: This section describes the repayment schedule, including the frequency of payments and the due dates. It may also specify the method of payment and any penalties for late or missed payments. 4. Interest Rate: This section states the interest rate applicable to the loan. It may be fixed or variable, depending on the terms agreed upon by the parties. 5. Security: As the loan is secured by real property, this section outlines the details of the property being used as collateral. It includes the property address, legal description, value, and any additional terms or conditions related to the property's use as security. 6. Default and Remedies: This section explains the consequences of defaulting on the loan and the remedies available to the lender. It may include provisions for foreclosure, the appointment of a receiver, or other legal actions to recover the outstanding debt. It is important to note that there may be variations of the Nassau New York Promissory Note for Commercial Loan Secured by Real Property, depending on specific requirements or preferences. For example, there could be different versions for loans with fixed or adjustable interest rates, loans with different repayment terms, or loans involving different types of real property (commercial buildings, vacant land, etc.). Adhering to the requirements and terms of the Nassau New York Promissory Note for Commercial Loan Secured by Real Property is crucial for both borrowers and lenders to establish clear expectations and protect their interests throughout the loan process. Seeking legal advice and guidance when drafting or signing such a note is highly recommended ensuring compliance with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Pagaré de Préstamo Comercial Garantizado por Bienes Inmuebles - Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out Nassau New York Pagaré De Préstamo Comercial Garantizado Por Bienes Inmuebles?

If you need to find a trustworthy legal document supplier to obtain the Nassau Promissory Note for Commercial Loan Secured by Real Property, consider US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can search from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of learning materials, and dedicated support team make it easy to find and execute various documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to look for or browse Nassau Promissory Note for Commercial Loan Secured by Real Property, either by a keyword or by the state/county the form is created for. After locating required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Nassau Promissory Note for Commercial Loan Secured by Real Property template and check the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Register an account and select a subscription plan. The template will be instantly available for download as soon as the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less costly and more reasonably priced. Set up your first business, organize your advance care planning, create a real estate contract, or complete the Nassau Promissory Note for Commercial Loan Secured by Real Property - all from the comfort of your sofa.

Join US Legal Forms now!