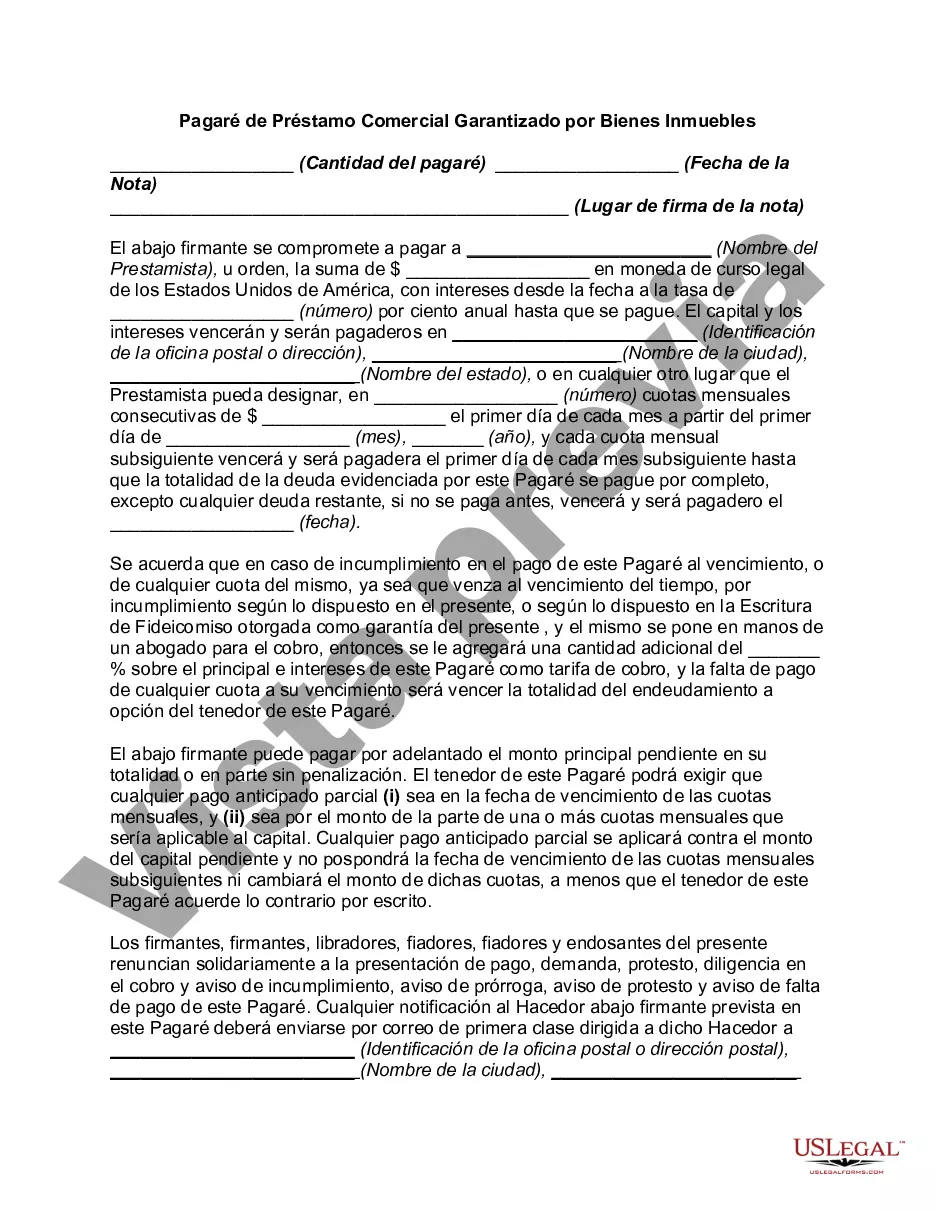

Keywords: San Antonio Texas, promissory note, commercial loan, real property, secured, types A San Antonio Texas Promissory Note for a Commercial Loan secured by Real Property is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower for commercial purposes. The promissory note serves as evidence of the borrower's promise to repay the loan amount, along with any applicable interest, within a specified period. This type of promissory note is specifically designed for commercial loans secured by real property, meaning that the borrower pledges their property as collateral to the lender. If the borrower fails to repay the loan as agreed, the lender has the right to seize and sell the commercial property to recover the outstanding debt. Several types of San Antonio Texas Promissory Notes for Commercial Loans Secured by Real Property exist, including: 1. Fixed-Rate Promissory Note: This type of promissory note specifies a fixed interest rate throughout the loan term, ensuring predictable monthly payments. Borrowers opting for stability often choose this type. 2. Adjustable-Rate Promissory Note: With an adjustable-rate note, the interest rate fluctuates based on a predetermined index or market rate, such as the prime rate. The monthly payment can change periodically, either increasing or decreasing. 3. Balloon Promissory Note: A balloon note includes periodic payments that may be lower compared to traditional loans, but a large lump sum payment, known as a balloon payment, is due at the end of the loan term. This option is suitable for borrowers anticipating significant income or fund availability before the final payment. 4. Interest-Only Promissory Note: This type of note allows the borrower to pay only the interest charges for a specific period, typically at the beginning of the loan term. Principal repayment commences at a later date, allowing borrowers to focus on other financial commitments temporarily. It is crucial for both lenders and borrowers to carefully review and understand the terms presented in the San Antonio Texas Promissory Note for a Commercial Loan Secured by Real Property. Seeking legal counsel during the drafting and signing process is highly recommended ensuring compliance with local regulations and adequate protection for all involved parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Pagaré de Préstamo Comercial Garantizado por Bienes Inmuebles - Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out San Antonio Texas Pagaré De Préstamo Comercial Garantizado Por Bienes Inmuebles?

If you need to get a reliable legal form supplier to get the San Antonio Promissory Note for Commercial Loan Secured by Real Property, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can browse from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of learning resources, and dedicated support team make it simple to locate and complete different papers.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply type to search or browse San Antonio Promissory Note for Commercial Loan Secured by Real Property, either by a keyword or by the state/county the form is intended for. After locating necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the San Antonio Promissory Note for Commercial Loan Secured by Real Property template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be instantly ready for download once the payment is processed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes these tasks less expensive and more reasonably priced. Create your first business, organize your advance care planning, create a real estate agreement, or execute the San Antonio Promissory Note for Commercial Loan Secured by Real Property - all from the comfort of your home.

Join US Legal Forms now!