Title: Exploring the Chicago Illinois Assignment of Contract as Security for Loan Introduction: The Chicago Illinois Assignment of Contract as Security for Loan pertains to a legal arrangement in which a contract or agreement is assigned as collateral for a loan. This practice enables lenders to secure repayment by utilizing the rights and interests of a contract in case of default by the borrower. In Chicago, Illinois, various types of Assignment of Contract as Security for Loan exist to cater to different circumstances, including the following: 1. Real Estate Assignment of Contract as Security for Loan: This type of assignment is commonly used when a borrower pledges a real estate contract as collateral for a loan. Lenders may have the right to foreclose the property in case of default, allowing them to recover their investment. 2. Business Assignment of Contract as Security for Loan: In Chicago, businesses may utilize this type of assignment to secure loans. Contracts related to business assets, such as intellectual property rights, accounts receivable, or client contracts, can be assigned to guarantee repayment. 3. Equipment Assignment of Contract as Security for Loan: In some cases, borrowers may assign contracts related to equipment, machinery, or vehicles as security for loans. This allows lenders to possess or sell the equipment if the borrower fails to meet their loan obligations. Key Aspects of Chicago Illinois Assignment of Contract as Security for Loan: — Legal Considerations: The assignment process must comply with the laws of Chicago, Illinois. It requires formal documentation, including a written agreement between the parties involved. — Consent from All Parties: All parties who are affected by the assignment, including the original parties to the contract, must consent to the assignment. — Rights and Obligations: The assignee (lender) assumes the rights and obligations of the original party to the contract, which can include rights to payments, legal actions, or performance. — Notice to Counterparties: Counterparties to the assigned contract should be notified about the assignment. Only after proper notification can the assignee enforce their rights against the counterparty. Benefits of Chicago Illinois Assignment of Contract as Security for Loan: 1. Enhanced Borrowing Capacity: The Assignment of Contract as Security for Loan allows borrowers to offer additional collateral, potentially increasing their borrowing capacity. 2. Lower Interest Rates: By providing an additional layer of security, borrowers may negotiate lower interest rates with lenders. 3. Access to Funding: The assignment option gives borrowers access to funds that might otherwise be difficult to obtain or require more stringent financial requirements. 4. Flexible Repayment Terms: Lenders may be more willing to offer flexible repayment terms when a contract is assigned as security, as it helps mitigate their risk. Conclusion: The Chicago Illinois Assignment of Contract as Security for Loan provides a valuable mechanism for securing loans. Whether it's related to real estate, business assets, or equipment, assigning contracts as collateral offers benefits to both borrowers and lenders. However, it is essential to comply with legal requirements and ensure that all parties involved are informed about the assignment.

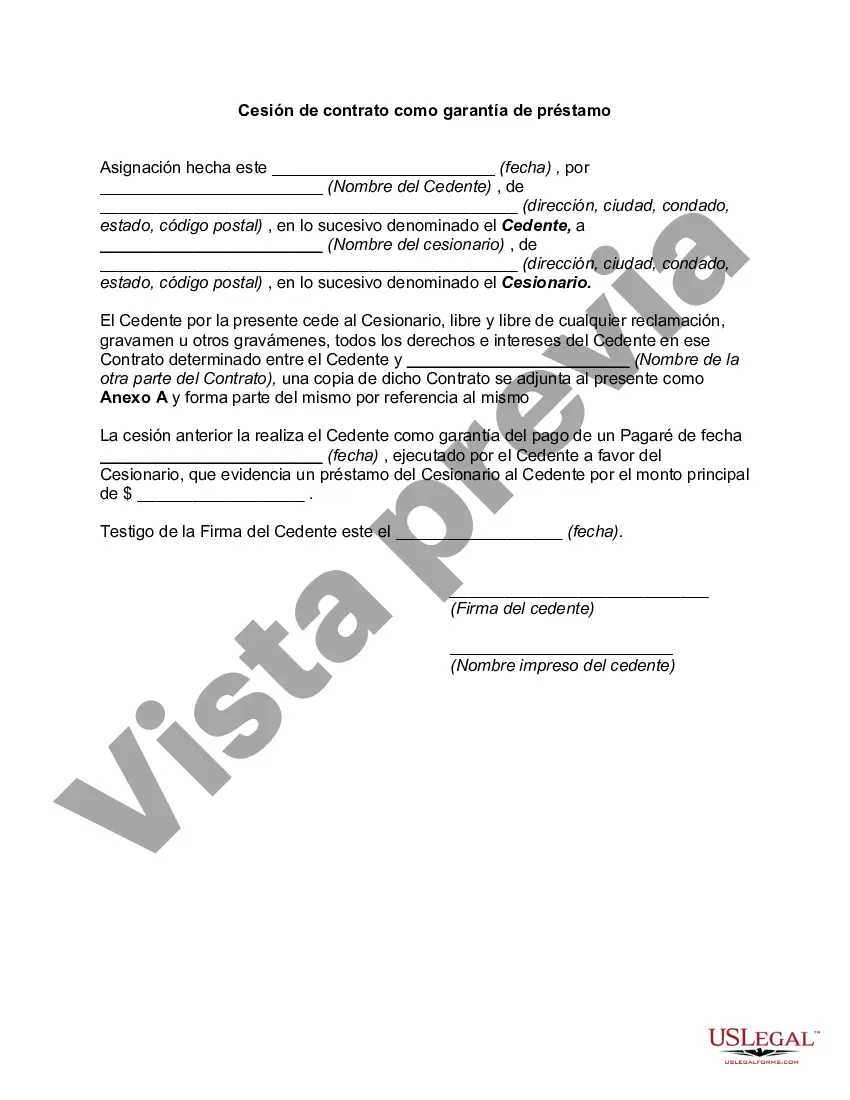

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Cesión de contrato como garantía de préstamo - Assignment of Contract as Security for Loan

Description

How to fill out Chicago Illinois Cesión De Contrato Como Garantía De Préstamo?

Are you looking to quickly create a legally-binding Chicago Assignment of Contract as Security for Loan or maybe any other form to handle your own or business affairs? You can select one of the two options: contact a legal advisor to draft a legal paper for you or create it entirely on your own. Luckily, there's another option - US Legal Forms. It will help you get neatly written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-specific form templates, including Chicago Assignment of Contract as Security for Loan and form packages. We offer templates for a myriad of use cases: from divorce papers to real estate document templates. We've been out there for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra troubles.

- First and foremost, double-check if the Chicago Assignment of Contract as Security for Loan is adapted to your state's or county's laws.

- In case the document comes with a desciption, make sure to verify what it's intended for.

- Start the searching process over if the document isn’t what you were seeking by using the search box in the header.

- Select the plan that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Chicago Assignment of Contract as Security for Loan template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Moreover, the templates we offer are updated by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!