Title: Contra Costa California Assignment of Contract as Security for Loan: Understanding the Basics Introduction: In Contra Costa, California, an Assignment of Contract as Security for Loan serves as a legally binding agreement between a lender and a borrower. This arrangement allows the borrower to provide their contractual rights as collateral for a loan. This article aims to provide a detailed description of the Contra Costa California Assignment of Contract as Security for Loan, highlighting its importance, benefits, and potential variations. 1. Definition and Purpose: The Contra Costa California Assignment of Contract as Security for Loan is a written agreement wherein a borrower assigns their contract rights to a lender as collateral for a loan. The contract can pertain to various agreements such as land or property leases, purchase contracts, rental agreements, or any other legally binding document. 2. Key Features and Benefits: Lateralizationon: By assigning their contract rights, borrowers provide additional security for the loan, increasing the lender's confidence in extending credit. — Risk Reduction: Lenders minimize risk by having a legal claim to the assigned contract rights. In case of default, they can exercise their rights by assuming the contract and accessing its benefits. — Flexibility: This agreement allows borrowers to utilize their existing contracts to demonstrate creditworthiness without having to pledge personal assets, making it an attractive option for both parties. 3. Types of Contra Costa California Assignment of Contract as Security for Loan: a. Real Estate Assignment of Contract: This type involves using a real estate contract, such as a purchase agreement or lease, as security for a loan provided for property-related purposes. b. Business Assignment of Contract: Used when businesses assign contracts related to leases, sales agreements, vendor agreements, or any other contract that adds value to the business as collateral. c. Personal Property Assignment of Contract: This variation includes contracts related to personal property, such as vehicle leases, equipment rentals, or licensing agreements. 4. Legal Considerations: — Written Agreement: To be enforceable, the Assignment of Contract as Security for Loan must be in writing and signed by both parties. — Consent: The assignor (borrower) should obtain consent from the counterparty involved in the original contract before assigning its rights as collateral. — Notifying Parties: Usually, all parties involved in the original contract need to be aware of the assignment for it to be effective. Conclusion: The Contra Costa California Assignment of Contract as Security for Loan is a powerful tool facilitating borrowing and lending arrangements. It allows borrowers to leverage their existing contractual rights to secure financing while providing lenders with an additional layer of security. Whether it involves real estate, business, or personal property contracts, this assignment showcases the flexibility and benefits of lateralization in loan agreements.

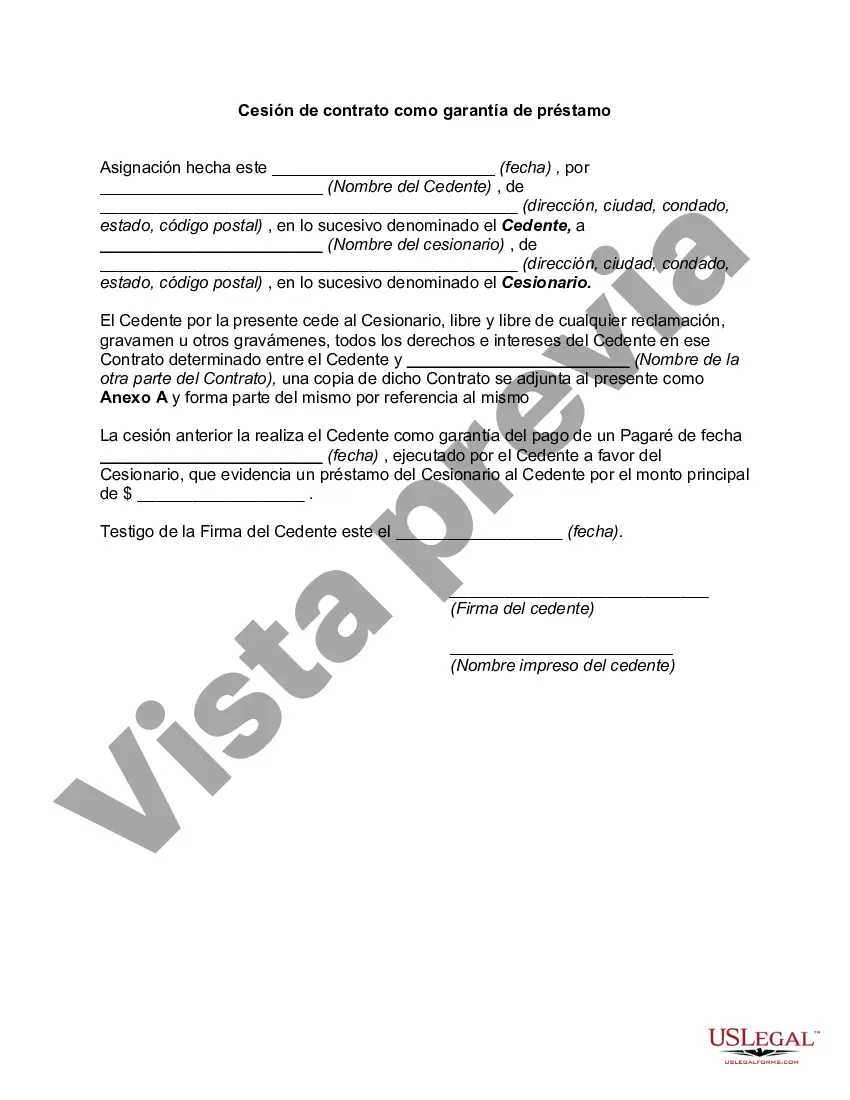

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Cesión de contrato como garantía de préstamo - Assignment of Contract as Security for Loan

Description

How to fill out Contra Costa California Cesión De Contrato Como Garantía De Préstamo?

Preparing paperwork for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate Contra Costa Assignment of Contract as Security for Loan without professional help.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Contra Costa Assignment of Contract as Security for Loan on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Contra Costa Assignment of Contract as Security for Loan:

- Look through the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that suits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any use case with just a couple of clicks!