Fairfax, Virginia Assignment of Contract as Security for Loan: A Comprehensive Overview Introduction: Fairfax, Virginia, known for its rich history and thriving economy, offers diverse opportunities for businesses and individuals alike. In this vibrant city, the Assignment of Contract as Security for Loan plays a crucial role in facilitating financial transactions. This article provides a detailed description of what Fairfax, Virginia Assignment of Contract as Security for Loan entails, highlighting its significance and potential variations. Overview: The Assignment of Contract as Security for Loan is a legal agreement rooted in contract law that allows lenders to secure a loan by obtaining the rights and benefits associated with an existing contract. In Fairfax, Virginia, this arrangement is frequently employed to mitigate risk and ensure repayment for lenders on a wide range of financial transactions. Key Concepts and Process: 1. Parties involved: The Assignment of Contract as Security for Loan involves three primary parties: a. Lender: The entity providing the loan. b. Borrower: The individual or company receiving the loan. c. Obliged: The original party involved in the contract assigned as security. 2. Basic steps: a. Identification: The specific contract must be identified, ensuring it meets certain criteria (e.g., enforceability, clarity, and legality) suitable for assignment. b. Assignment agreement: A legally binding agreement is drawn up, clearly outlining the terms of assignment, rights, obligations, and potential remedies between the parties involved. c. Notice to obliged: The obliged of the original contract is notified of the assignment, with clear instructions on how to make future payments to the lender. Advantages: The Fairfax, Virginia Assignment of Contract as Security for Loan offers several significant advantages, including: 1. Risk mitigation: Lenders can substantially reduce their loan default risks by gaining control over an existing contract, ensuring the ability to step in and enforce its provisions if needed. 2. Collateral diversification: The assignment allows lenders to secure the loan using an alternative form of collateral, broadening their portfolio and reducing dependency on traditional assets. 3. Pre-established terms: The assigned contract often contains pre-negotiated terms, minimizing uncertainties associated with creating new agreements. Types of Fairfax, Virginia Assignment of Contract as Security for Loan: 1. Mortgage Assignment: In real estate transactions, lenders can assign a mortgage as security for a loan, offering protection and collateralizing the borrowed funds. 2. Receivables Assignment: Lenders may secure a loan by assigning accounts receivable or future income streams, ensuring repayment through the borrower's expected collections. 3. Equipment or Asset Assignment: This type of assignment allows lenders to secure a loan by gaining control over specific equipment or assets explicitly identified in the assigned contract. Conclusion: The Fairfax, Virginia Assignment of Contract as Security for Loan is a vital legal instrument enabling lenders to secure their loans by gaining the rights and benefits associated with an existing contract. Understanding the various types of assignments available, such as mortgage assignments, receivables assignments, and equipment or asset assignments, can greatly inform borrowers and lenders engaged in financial transactions in Fairfax, Virginia.

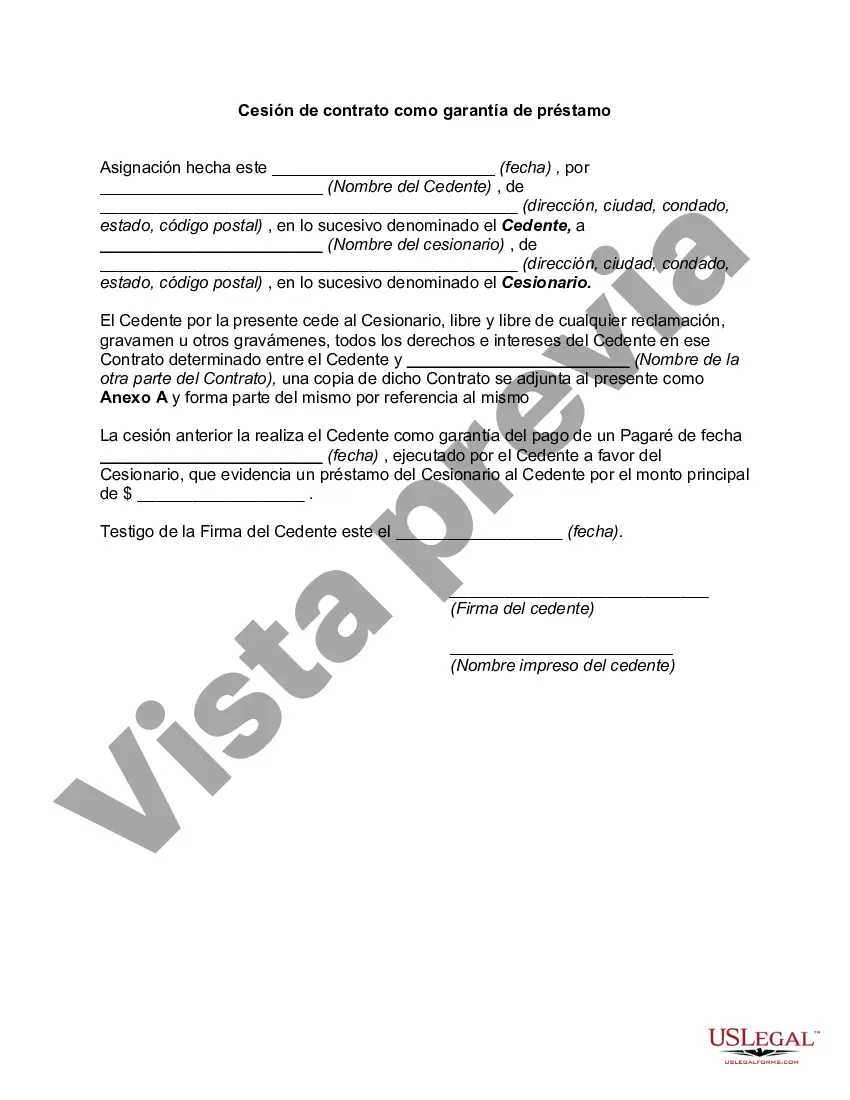

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Cesión de contrato como garantía de préstamo - Assignment of Contract as Security for Loan

Description

How to fill out Fairfax Virginia Cesión De Contrato Como Garantía De Préstamo?

Creating documents, like Fairfax Assignment of Contract as Security for Loan, to manage your legal affairs is a tough and time-consumming process. Many cases require an attorney’s participation, which also makes this task not really affordable. However, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents created for a variety of cases and life circumstances. We make sure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Fairfax Assignment of Contract as Security for Loan form. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before getting Fairfax Assignment of Contract as Security for Loan:

- Ensure that your template is compliant with your state/county since the regulations for creating legal documents may vary from one state another.

- Learn more about the form by previewing it or reading a quick description. If the Fairfax Assignment of Contract as Security for Loan isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin using our service and get the form.

- Everything looks great on your end? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is ready to go. You can try and download it.

It’s an easy task to find and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!