Kings New York Assignment of Contract as Security for Loan is a legal agreement used in the context of borrowing funds, where a contract is assigned as collateral to secure the repayment of the loan. This specific type of contract is commonly utilized in the state of New York, ensuring a legally binding document that benefits both the lender and borrower. The assignment of contract as security for a loan involves the transfer of a contract's rights, obligations, and benefits from the original party (known as the assignor) to the loan provider (known as the assignee). This arrangement guarantees that in case of default or non-payment of the loan, the lender gains the right to enforce the contract and seek appropriate remedies. The Kings New York Assignment of Contract as Security for Loan comes in various forms, depending on the specific circumstances and requirements of the parties involved. These may include: 1. Real Estate Assignment of Contract as Security for Loan: This form of assignment is commonly used when a loan is secured by a contract related to real estate, such as a mortgage or lease agreement. The assignee gains a security interest in the property, allowing them to foreclose or sell it to recover the funds in case of default. 2. Business Assignment of Contract as Security for Loan: In certain cases, a business contract may be assigned to secure a loan. This type of assignment is typically used when a company wants to borrow funds, using their existing contracts, such as client agreements or purchase orders, as collateral. 3. Personal Assignment of Contract as Security for Loan: This category involves individuals assigning their personal contracts to secure a loan, such as contracts related to employment, royalties, intellectual property rights, or inheritance. This type of assignment provides lenders with added security and reassurance. Overall, a Kings New York Assignment of Contract as Security for Loan serves as a crucial legal mechanism that protects both lenders and borrowers. It provides lenders with a measure of security by allowing them to enforce the assigned contract should the borrower default, while borrowers can benefit from potentially accessing lower interest rates and more favorable loan terms due to the added security provided by the assignment of contract.

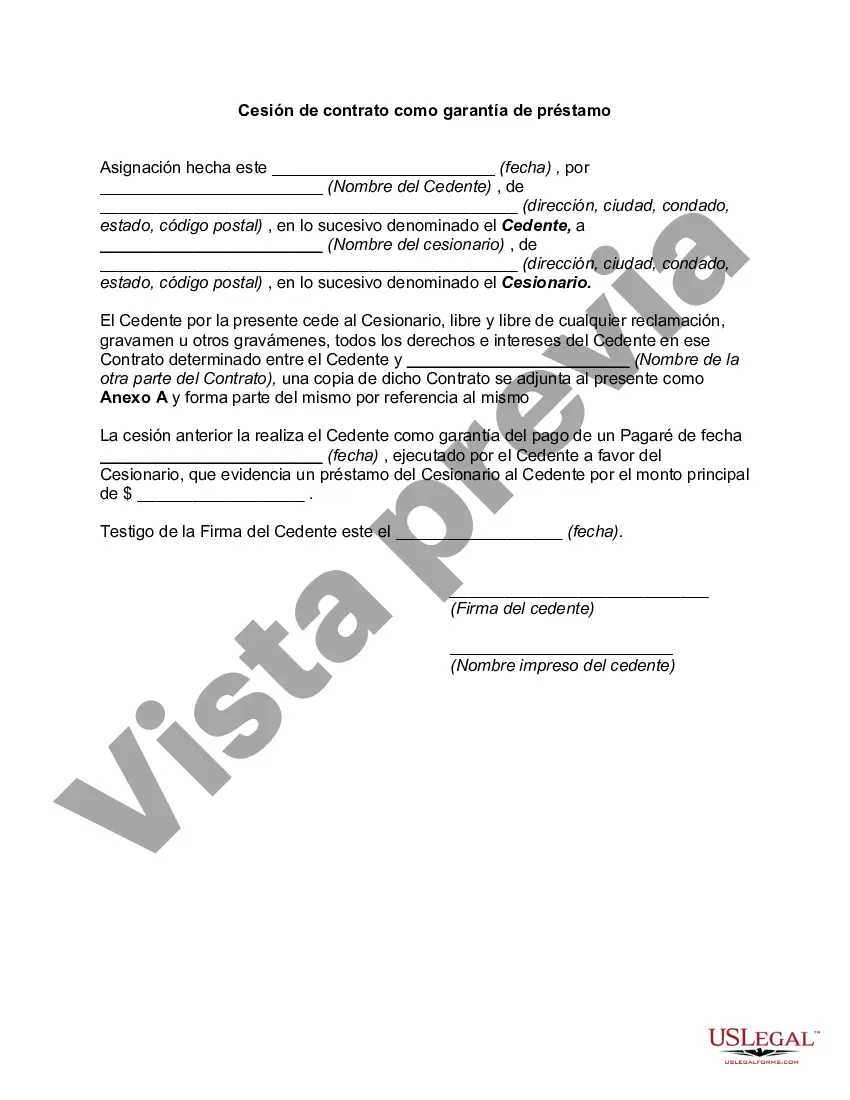

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Cesión de contrato como garantía de préstamo - Assignment of Contract as Security for Loan

Description

How to fill out Kings New York Cesión De Contrato Como Garantía De Préstamo?

If you need to find a trustworthy legal form supplier to find the Kings Assignment of Contract as Security for Loan, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can search from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of supporting resources, and dedicated support make it simple to get and complete various paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply select to look for or browse Kings Assignment of Contract as Security for Loan, either by a keyword or by the state/county the form is created for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Kings Assignment of Contract as Security for Loan template and check the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be instantly ready for download once the payment is processed. Now you can complete the form.

Handling your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less pricey and more reasonably priced. Create your first business, arrange your advance care planning, draft a real estate agreement, or complete the Kings Assignment of Contract as Security for Loan - all from the comfort of your home.

Join US Legal Forms now!